First Solar (FSLR): Where Tariffs, Subsidies and AI Collide

New tariffs levied against China could benefit American manufacturers of solar cells, but there are drawbacks as well

- New tariffs imposed on Chinese solar cells are set to enhance the competitiveness of U.S. manufacturers.

- Since the tariffs were first announced in mid-May, shares of First Solar surged by about 35%.

- However, the tariffs may not ultimately benefit consumers, as they could increase the cost of residential and commercial solar installations.

When the United States unveiled new tariffs against China last month, electric vehicles (EVs) captured much of the spotlight.

However, an equally significant, yet less publicized, shift is occurring in the solar industry. The Biden administration’s recent decision to impose a 50% import duty on Chinese solar cells—doubling the previous rate—is set to reshape the solar market in the United States.

Certain companies are poised to benefit from the new tariffs. For instance, First Solar (FSLR) shares rose approximately 35% since the announcement in mid-May, reflecting optimism about the company’s enhanced competitive position.

However, the solar sector’s complexity means tariffs are not universally positive news. Chinese solar cells, known for their affordability, now face significantly higher costs due to the increased tariffs. This hike is likely to be passed on to consumers, making solar installations more expensive and potentially dampening demand. Consequently, the fortunes of various niches within the solar industry have sharply diverged in 2024.

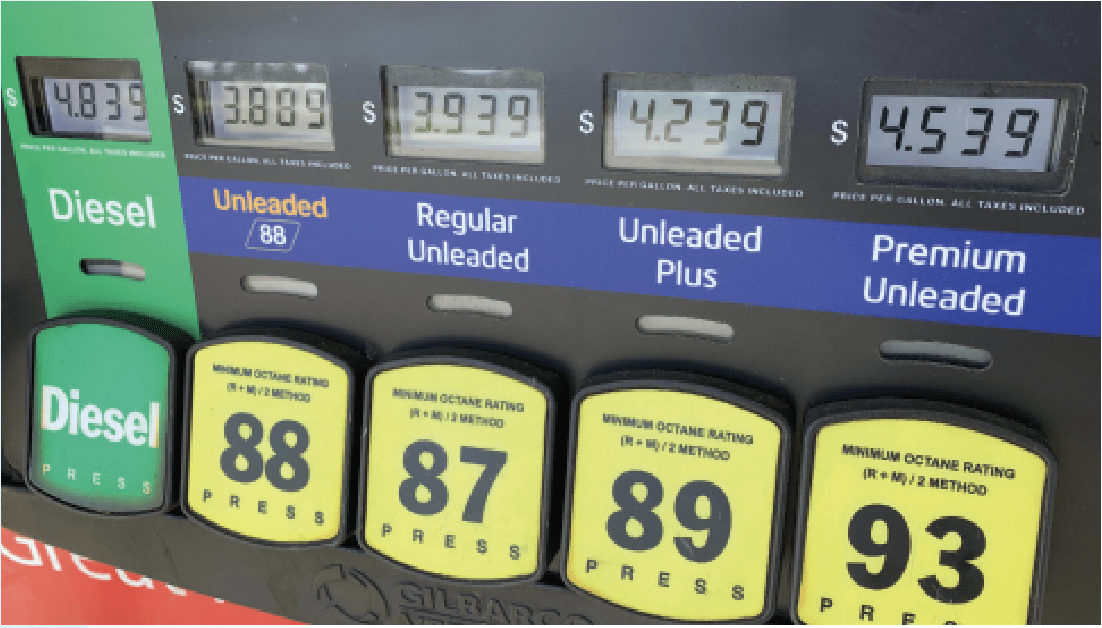

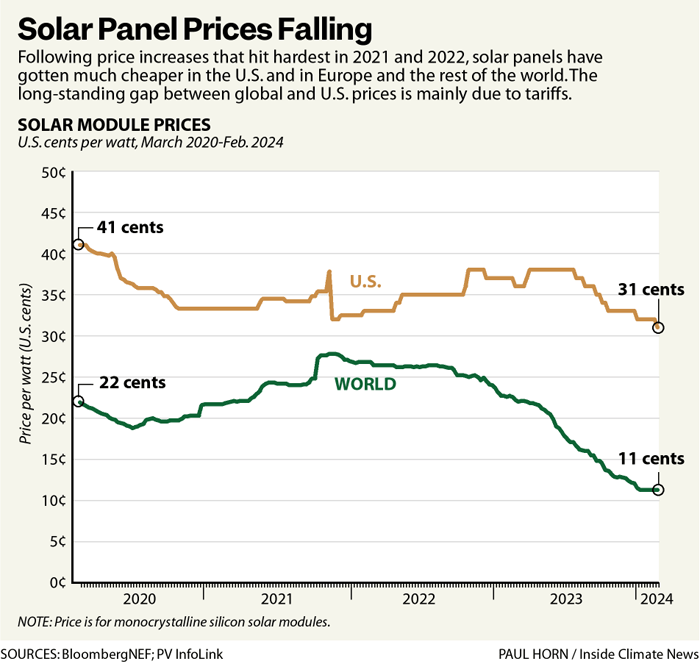

Solar modules manufactured in China reportedly cost between 9 cents and 11 cents per watt, while in the United States, that cost jumps to around 30 cents per watt (illustrated below). That forced many American manufacturers to sell their products at breakeven prices or even at a loss to stay competitive.

The recent tariffs on imported solar cells are therefore a notable change for companies like First Solar. The company will almost certainly be able to increase its revenues by charging higher prices, because of the tariffs.

Possible reduction in demand

Importantly, however, higher prices inevitably trickle down to the end consumer. That means the tariffs could result in reduced demand for solar panels.

This reality probably helps explain why shares of Sunrun (RUN) have fallen by 30% so far in 2024. As a leading provider of photovoltaic systems and battery energy storage products for residential customers, Sunrun is especially exposed to the adverse impact of the tariffs.

Compounding the issue, many residential customers rely on loans to finance their solar systems. With interest rates at record highs, the cost of financing these projects has also soared. The increased tariffs, which effectively raise the prices of solar systems, further strain the financial feasibility for consumers.

This challenging economic environment underscores the difficulties companies like Sunrun face, as the latest developments in the solar industry create significant hurdles for the business and its customers.

U.S. government subsidies provide a boost to First Solar

Looking beyond the tariff issue, another pivotal development in the solar sector in 2024 has been the impact of U.S. government subsidies.

Central to this narrative is the Inflation Reduction Act, which offers substantial incentives and support to the domestic solar industry. The act extends and enhances the Investment Tax Credit (ITC) and Production Tax Credit (PTC) for renewable energy projects, creating a stable financial environment that encourages consumers and businesses to invest in solar energy.

For solar cell manufacturers, these incentives are designed to lower production costs and foster technological innovation. For example, by reducing the industry’s reliance on international supply chains, the act is intended to improve the competitiveness of American manufacturers. This financial support is also expected to attract further investment, spurring job creation and economic growth within the manufacturing segment.

Since the law took effect last year, solar manufacturing capacity has expanded dramatically. Between the existing capacity and the announced plans for new capacity, U.S. manufacturers are poised to produce 125 gigawatts of solar panels per annum, as compared to the 7 gigawatts produced in 2022. This remarkable growth underscores the transformative impact of the Inflation Reduction Act, positioning U.S. solar manufacturers like First Solar to thrive in a rapidly evolving market environment.

Along those lines, The Wall Street Journal reported that First Solar could reap nearly $710 million in total benefits from the federal incentives and subsidies during calendar year 2024. And according to information included in that same report, that figure could balloon to as much as $10 billion over the next decade.

Importantly, First Solar has been using government benefits and incentives to build out its manufacturing capacity in the U.S., which was the precise goal of the legislation. Last summer, First Solar announced it would build a new solar panel manufacturing facility in Louisiana and then broke ground on that project in September. This will be the company’s fifth solar manufacturing plant in the United States. First Solar also operates facilities in India, Malaysia and Vietnam.

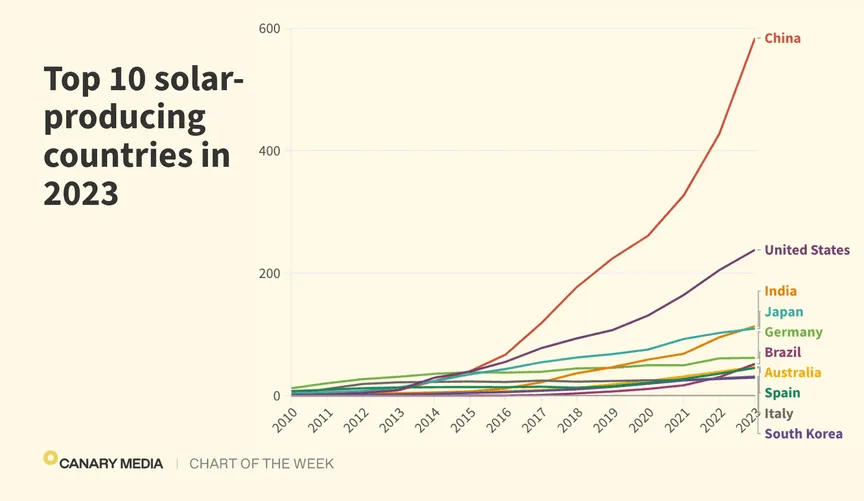

At present, the United States is the world’s second-largest producer of solar energy. But China remains the dominant player in the global solar sector, producing more than 580 terawatt-hours (TWh) of solar electricity in 2023, which was more than the next five countries combined. During that same year, the United States produced 238 TWh, as illustrated below.

The Biden administration recently extended the solar tariffs to some other countries in southeast Asia, to help ensure that China doesn’t try to circumvent the duties by routing their production through neighboring countries. The new countries include Cambodia, Malaysia, Thailand and Vietnam.

First Solar’s unique “thin film” manufacturing approach

For most solar panel manufacturers, the process begins with the production (or acquisition) of solar cells, which are the fundamental building blocks for solar panels.

Solar cells, typically made from crystalline silicon, are interconnected to form a solar module. Producers then encapsulate the interconnected cells for protection, frame them for structural support and test them for quality and performance. This assembly process transforms individual solar cells into complete solar panels, which are then ready for installation and use in generating solar power.

First Solar, however, uses a thin-film cadmium telluride (CdTe) technology instead of traditional crystalline silicon. According to this process, CdTe is deposited onto glass to form solar cells. In turn, the solar cells are encapsulated and integrated into a complete solar panel.

First Solar’s production process is highly integrated, meaning they handle both the creation of the thin-film solar cells and the assembly of these cells into complete solar panels on the same manufacturing line.

Competitive impact in the U.S.

Considering this context, it’s easier to see how increased tariffs on imported solar cells might affect the competitive landscape in the U.S. solar industry. For example, the tariffs could be disruptive for companies that don’t produce solar cells and import them from abroad. In those cases, the increased cost of raw materials will likely force them to raise their prices.

On the other hand, domestic producers that don’t require foreign solar cells—such as First Solar—are expected to benefit, because the price of solar cells (on average) should increase in the American market, providing the opportunity for increased revenues and profits. That undoubtedly helps explain why shares of First Solar have increased by roughly 35% since the tariffs were announced. First Solar stock has rallied by about 55% in 2024.

In contrast, shares of Sunrun are down about 30% year-to-date. Sunrun sells solar systems primarily to residential customers and doesn’t produce solar cells. As a result of the tariffs, the end cost to Sunrun’s customers will almost certainly rise, which could stifle demand, especially with interest rates (e.g. financing costs) at record highs. Taken together, these developments help explain why shares of Sunrun have faltered in 2024.

Final takeaways

Importantly, this divergence in stock performance—FSLR vs. RUN, for example—helps explain why the Invesco Solar ETF (TAN) has underperformed in 2024.

Both First Solar and Sunrun are top-10 holdings in TAN. And due to diverging stock performance in the sector, TAN is down 11% on the year. That drop happened despite the huge gains in FSLR, representing the single largest holding in TAN.

In 2024, picking the right narrative has been a key to success when it comes to investing in the solar sector. In addition to the tariffs and subsidies, First Solar also appears to be benefiting from the recent AI narrative. Much like the utilities sector, analysts expect First Solar to benefit from increased demand for electricity from AI-focused data centers.

Wall Street expects the positive tailwinds for First Solar to persist. Goldman Sachs recently raised its price target on First Solar to $302/share, up from $268/share, and reiterated its buy rating on the stock.

According to The Wall Street Journal, 38 analysts follow First Solar, with 31 rating the shares “buy” or “overweight” and seven rating shares a “hold.” Currently, no analysts rate shares of FSLR “underweight” or “sell.” The average price target for FSLR is $265 per share. First Solar currently trades for about $267 per share.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.