The FDIC’s Got 63 Problems, and These Banks Are Them

There are now 63 financial institutions on the FDIC’s Problem Bank List

- The FDIC recently updated its Problem Bank List, which currently includes 63 U.S. financial institutions selected for special monitoring.

- So far in 2024, only one financial institution has failed, following five such failures in 2023.

- The financial sector reported robust earnings in Q1, but that performance was attributable to cost-cutting measures and improved trading results.

Data from the economy and the financial sector continue to confound analysts. Last month, manufacturing activity in the United States appeared to slow, while activity in the services sector expanded, presenting a contradictory picture.

This divergence makes it challenging to predict the future of the U.S. economy. However, one critical development from Q1 is more straightforward: 63 financial institutions are now on the Federal Deposit Insurance Corp. (FDIC) Problem Bank List.

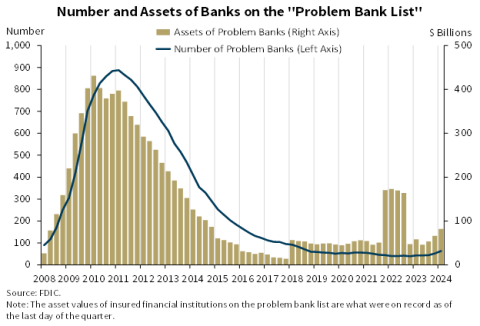

The list confidentially tracks American financial institutions facing significant financial difficulties. While the names of these banks are not publicly disclosed, the FDIC releases the total number of problem banks and their combined assets quarterly, as highlighted below.

Putting problem banks in context

The existence of 63 problematic U.S. banks might sound like a lot. And if each of the 63 banks went under, that would be a bearish development. But those 63 banks represent just 1.4% of the 4,568 banks the FDIC monitors.

Moreover, during Q4 of 2023, 52 banks were already on this list, so only 11 additional “problems” were added to the list during the first three months of 2024.

Looking back at recent history, the most significant years for bank failures in the United States were during the 2008-2009 Financial Crisis. From the beginning of 2008 through the end of 2011, 414 banks failed—roughly 100 per year, on average.

So far in 2024, only one bank has failed—Republic First Bancorp (FRBK)—which was shuttered by regulators at the end of February. Last year, five total banks failed, including the infamous Silicon Valley Bank (SIVBQ)

Bank failures are rare

Over the last decade, bank failures have been relatively rare. Since 2014, the largest number of banks to fail in a single year was 8 (2015 and 2017). From that perspective, 63 bank failures would represent a considerable number—and would ratchet up stress in the financial system.

But there is no guarantee that even one of these banks will go under in 2024. Recent data from the financial sector indicates that financial companies are doing better than most other market sectors, at least in terms of earnings.

Q1 earnings data from the financial sector were strong, but there’s a catch

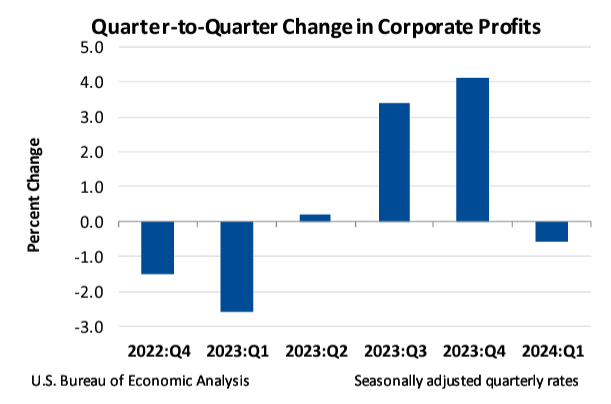

Despite the addition of 11 banks to the Problem Bank List, earnings results in the financial sector during Q1 were generally strong. According to the U.S. Bureau of Economic Analysis (BEA), profits at financial companies domiciled in the United States increased by 16.1% in Q1, after increasing only 1.3% in the previous quarter.

These results look robust when one considers that the balance of the corporate sector (e.g. all nonfinancial companies) experienced a decline in profitability. For the nonfinancial group, profits declined by 4.7% in Q1, significantly worse than the previous quarter, when profits increased by 5.9%.

Including both sets of results (financial and nonfinancial companies), overall corporate profits decreased by about 0.6% quarter over quarter, as illustrated below.

The U.S. Bureau of Economic Analysis (BEA) includes results from the entire corporate sector—from small private businesses to large publicly-traded multinational corporations. Moreover, BEA adjusts the earnings to account for changes in inventory valuation and capital consumption to better gauge income from current production activities.

In contrast, most headline figures in the financial news cite the earnings of the S&P 500 when referring to corporate earnings season. That means the BEA figures provide a more complete picture of earnings performance, compared to the narrower view of the S&P 500. The S&P 500 is composed of the largest and best-known publicly traded companies in the United States.

Notably, the BEA figures indicated that the overall corporate sector saw a decline in profits of approximately 0.6% (on average) compared to the previous quarter. In comparison, the S&P 500 saw profits increase by 5.9% during Q1 2024, according to FactSet. This reflects a divergence in the fortunes of the country’s upper-echelon companies, compared to the entirety of the corporate sector.

Circling back to the financial industry, it’s important to note that the increase in profitability wasn’t necessarily linked to increased earnings from operations. Instead, the financial sector appears to have benefited from cost-cutting measures and improved trading results. Specifically, operating costs declined by $22.5 billion, while income from activities like trading went up by $10.3 billion, according to BEA.

Final takeaways

The data paints a mixed picture. For example, there’s no guarantee that the cost savings observed in the financial sector during Q1 will extend into Q2. And the same goes for the outsized trading results. As such, it’s difficult to predict how the earnings of the financial sector will fare in Q2.

Moreover, the overall decline in corporate earnings, as documented by the BEA, is concerning. If that trend continues, deteriorating corporate profitability could eventually appear in the financial sector, potentially representing a fresh headwind.

And any tightening of financial conditions—including a potential recession—would put further stress on the 63 institutions on the FDIC’s Problem Bank List. Investors and traders may want to follow this list closely for potential additions when the FDIC releases an update in Q2.

If this problem were to escalate, it could represent a significant tail risk for the financial markets. To learn more about defending against risks in the market—including tail risk—readers can check out this installment of Options Jive on the tastylive financial network.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.