Another Regional Bank Just Failed, Here’s What You Need to Know

After the latest bank failure, government regulators may need to help ease the stress in the financial system

- In the first bank failure of 2024, Republic First Bancorp went under on April 26.

- The Pennsylvania Department of Banking and Securities shuttered the bank and sold it to Fulton Financial at an FDIC auction.

- In response to the latest bank failure, federal regulators should consider reinstating the Transaction Account Guarantee (TAG) Program and the Bank Term Funding Program (BTFP) to help alleviate stress in the financial system and to head off another potential banking crisis.

Not long ago, Luckbox predicted another shoe could drop in the regional banking sector during Q1 earnings season, and that’s exactly what’s come to pass.

On April 26, Republic First Bancorp (FRBK) officially went under. Last Friday, Pennsylvania state banking regulators shuttered Republic First’s operations. The institution was subsequently packaged and sold to Fulton Financial (FULT) via a Federal Deposit Insurance Corporation (FDIC) auction.

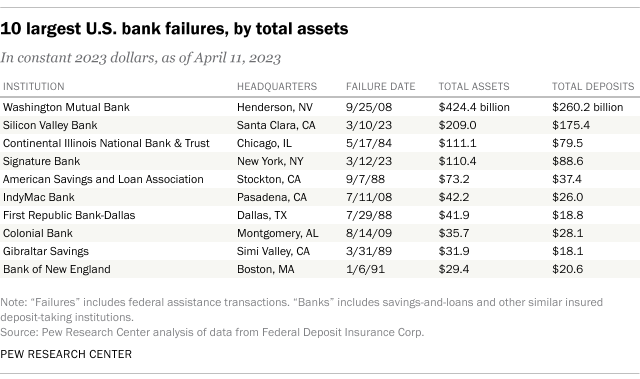

Here’s the good news. Republic First is much smaller than the banks that failed last year. At the time of its failure, Republic First had around $6 billion in assets, while Silicon Valley Bank (SIVBQ) had closer to $200 billion in assets when it went defunct last spring. Moreover, Republic First represents the first bank failure of 2024, after five total bank failures last year, including SIVBQ.

The other good news is that it appears all of the depositors at Republic First will be made whole. The FDIC indicated its insurance fund would cover a $667 million shortfall that fell outside the parameters of the FRBK-FULT takeover transaction. All of Republic First’s 32 branches in Pennsylvania, New Jersey and New York were expected to reopen by April 29 under the new Fulton umbrella.

The Republic First failure was far less surprising than the bank failures observed last year. FRBK stock was delisted by the Nasdaq in August 2023 and had been trading for under $0.10/share on the over-the-counter (OTC) market. After the failure, FRBK dipped to about a penny a share.

In Focus: Q1 aernings at New York Community Bancorp

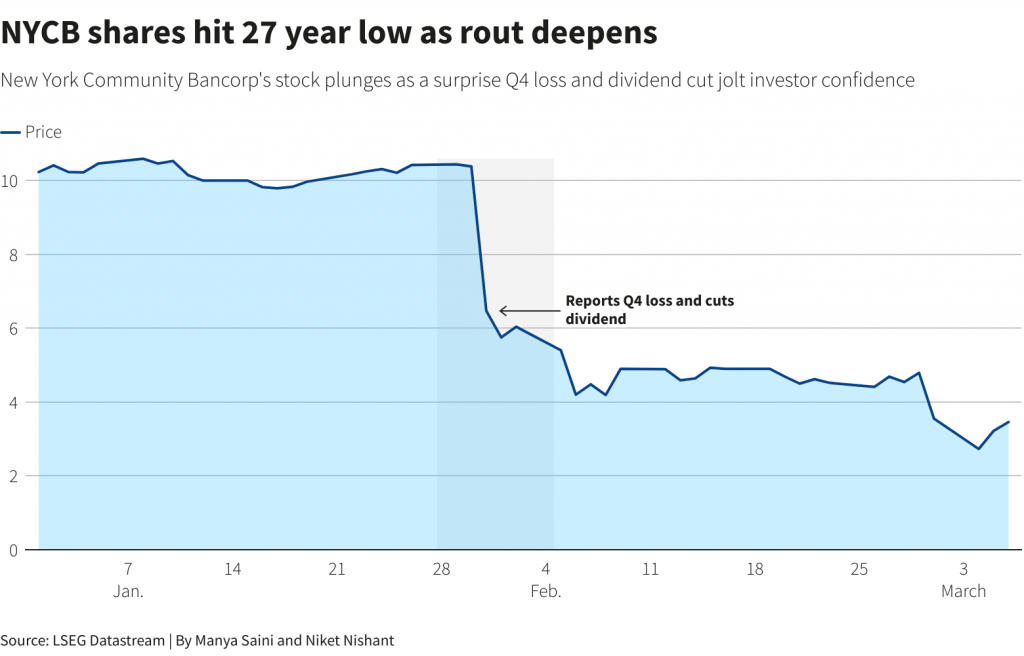

The most troubling part is of course the future unknowns—the first bank failure of 2024 will undoubtedly raise anxieties that additional financial institutions could follow suit. One regional bank that’s seen its fortunes fall this year is New York Community Bancorp (NYCB). Shares of NYCB are down roughly 70% year-to-date, and probably won’t be buoyed by recent developments at Republic First.

Somewhat ominously, New York Community Bancorp is expected to announce its Q1 earnings report as soon as this week. And when that report is released, it will undoubtedly be closely scrutinized by analysts for red flags. According to Morningstar, New York Community Bancorp will report a loss of roughly $0.26/share for Q1 2024. However, an analyst at Citibank—Ben Gerlinger—thinks the results will surprise to the downside, closer to a loss of $0.56/share.

One key difference between Republic First and New York Community Bancorp is that the latter secured funding from an investor group to shore up its balance sheet. In early March, New York Community Bancorp raised about $1 billion in fresh capital. Republic First had also been negotiating with investors regarding a potential capital injection, but it didn’t materialize, and the bank is now defunct.

Looking at the broader regional banking sector, some additional warning signs have emerged during the ongoing Q1 earnings season. Earlier this month, both US Bancorp (USB) and Citizens Financial Group (CFG) reported their quarterly net income had fallen compared to the same period last year—by 24% and 38%, respectively.

On top of falling profits, both banks said net interest income (NII) had also fallen. At USB net interest income fell by about 14%, while CFG saw a decline of around 12%. Net interest income is a key profitability indicator, and represents the difference between the interest earned from loans and the interest paid out on deposits. When banks run into financial difficulties, declining net interest income is often an early indicator.

Underscoring the depth of the problems in the sector, three other banks also reported significant declines in profitability in Q1 2024 compared to Q1 2023. For example, Ally Financial (ALLY), Comerica (CMA) and KeyCorp (KEY) all experienced drops in net income—56%, 59% and 34%, respectively.

Reinstate the transaction account guarantee (TAG)?

If the situation worsens, regulators might take steps to head off a broader crisis. One could argue proactive measures might be prudent.

At least that’s the advice of Sheila Bair, a former chair of the FDIC. Appearing recently on CNBC’s Fast Money, Bair expressed concern over the state of the regional banking sector, saying “I think some of them are still overly reliant on industry deposits, have a lot of concentrated commercial real estate exposure, and then I think the larger picture really is the potential instability of their uninsured deposits even for the healthy ones if we have another bank failure.”

To head off problems, Bair suggested Congress reinstate the FDIC’s transaction account guarantee authority. Established during the 2008-2009 financial crisis, the FDIC’s transaction account guarantee (TAG) program was designed to help ensure businesses, local governments and nonprofit organizations could maintain their operations by guaranteeing the full amount in their checking accounts, regardless of the balance, thereby encouraging them to keep their funds inside financial institutions.

TAG was part of the federal government’s broader strategy to stabilize the financial system, and was intended to limit sudden withdrawals from banks, which would have undoubtedly exacerbated the crisis. Envisioned as a temporary and extraordinary measure, the TAG program was extended but eventually expired at the end of 2012.

One can see how the restoration of this program could inject fresh optimism into the financial system, and help ease the anxieties of depositors.

Reinstatement of the bank term funding program?

On top of reinstating TAG, federal regulators might also consider reviving the bank term funding program (BTFP).

The Federal Reserve introduced BTFP in March of 2023 in response to the Silicon Valley Bank failure. This program was designed to bolster confidence in the banking sector by providing banks, credit unions, and other eligible entities with the ability to take out loans against high-quality securities.

BTFP was conceived in response to issues stemming partly from the Fed’s decision to raise benchmark interest rates rapidly. Rising interest rates have weighted heavily on the holdings of many financial institutions, because in the bond world, interest rates are inversely correlated with prices.

The BTFP was therefore designed to provide a safety valve by offering loans against these securities, which were valued at the original face value (aka “par” value), thus precluding the need for financial institutions to hold “fire sales” in unfavorable conditions at discounted prices. So, instead of selling them for a loss, the financial institution could tap the full face value of their bond holdings, as necessary.

The BTFP was discontinued March 11 of this year. Considering the context, one can see how the reinstating it might help restore confidence in the financial system and provide the banking sector with a much-needed liquidity lifeline.

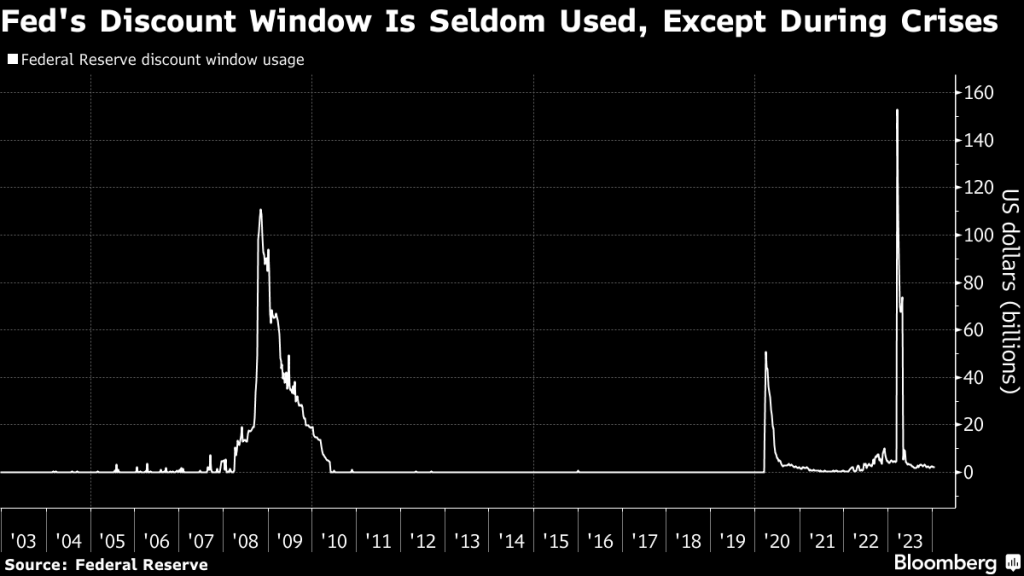

Financial institutions still have access to the Federal Reserve’s traditional “discount window,” a lending facility that banks and other financial institutions can use to borrow funds directly from the Federal Reserve, usually on a short-term basis. The discount window is intended to help banks manage their liquidity needs by providing additional funding when necessary, particularly in times of financial stress or when other sources of funding may not be available, as in the spring of 2023 (illustrated below).

The discount window plays a crucial role in the Fed’s function as a lender of last resort. However, banks are sometimes hesitant to use this facility because of the negative stigma associated with it—heavy reliance on the discount window often signals financial distress, and markets can interpret it as a sign of trouble. That can exacerbate a crisis by undermining confidence in an institution, leading to potential depositor runs and further financial instability.

Creating the BTFP was therefore viewed as a strategic complement to the discount window. But with the it no longer operating, distressed financial institutions have to rely solely on the discount window, which could amplify a potential regional banking crisis.

Final Takeaways

Reinstating the transaction account guarantee (TAG) program and the bank term funding program (BTFP)could help alleviate stress in the financial system, and potentially head off another crisis.

Looking ahead, if New York Community Bancorp’s imminent earnings report triggers more anxiety in the financial sector, it’s hard to envision how the Fed couldn’t at least consider the bringing back the two programs. But until BTFP and TAG are back, investors and traders may want to tread cautiously in this sector. That may include the adoption of a more defensive overall portfolio management approach, especially if additional bank failures materialize.

To track and trade the regional banking sector, investors and traders can use exchnge-traded funds (ETFs), such as the SPDR S&P Regional Banking ETF (KRE), the iShares U.S. Regional Banks ETF (IAT) and the Invesco KBW Regional Banking ETF (KBWR).

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.