Why Q1 Earnings Season is So Important for the Regional Banks

The continued slide in shares of New York Community Bancorp (NYCB) shows the regional banking crisis isn’t yet resolved

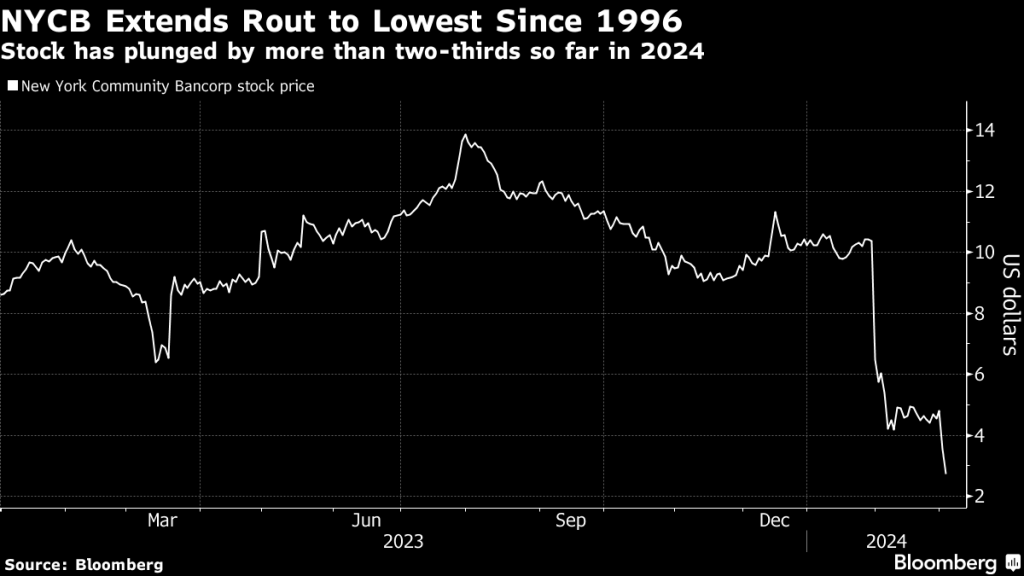

- Shares of New York Community Bancorp (NYCB) are down roughly 70% year-to-date, illustrating that the problems in the regional banking sector aren’t yet resolved.

- With Q1 earnings season starting on April 12, the regional banks will therefore be a key focus.

- If loan performance linked to the embattled commercial real estate sector continues to deteriorate, then shares of regional banks like Citizens Financial Group (CFG) could be in for a reckoning.

The year 2024 is a critical year for the commercial real estate sector, and more broadly, the regional banking sector.

Both of these sectors have been on watch since Silicon Valley Bank (SIVBQ) went bust last spring. And based on the recent slide in the shares of New York Community Bancorp (NYCB), a potential regional banking crisis is still brewing. Year-to-date, shares of NYCB are down nearly 70%, as illustrated below.

Against that backdrop, the forthcoming Q1 earnings season is setting up as “must see TV” for the regional banks. If the financial health of the commercial real estate sector has deteriorated markedly in recent months, any new blemishes are certain to show up in the Q1 earnings reports of the banks holding those loans.

Aside from top-line earnings, some key figures to keep an eye on during Q1 earnings season include net interest income (NII) and loan loss reserves.

Net interest income represents the difference between the interest earned from loans and the interest paid out on deposits. When a bank runs into financial difficulties, the bleeding often starts here.

In addition to net interest income, investors and traders can also watch net interest margin (NIM), which is calculated by dividing net interest income by the interest-earning assets.

Net interest margin basically reports a bank’s ability to generate net interest income from its interest-earning portfolio. For example, in its most recent earnings report, Citizens Financial Group (CFG) reported that its NIM would be approximately 2.85% in 2024, as compared to 3.1% last year.

Looking beyond net interest income/margin, another key statistic to follow in the forthcoming earnings season is loan loss reserves. Loan loss reserves are the funds set aside by financial institutions to cover potential losses from problem loans.

In difficult operating environments, banks typically raise their loan loss reserves to account for increased defaults. Analysts track this statistic extremely closely, because rapidly rising loan loss reserves are generally viewed as an ominous red flag.

In Q4 of last year, Citizens Financial reported $171 million in loan loss reserves, which was about $40 million higher than the same period 12 months ago. For the upcoming earnings season, analysts will be watching the regional banks closely to see if net interest and loan loss figures trend in the wrong direction.

Office property exposure of particular interest during Q1 earnings season

The Q1 earnings season is set to take off on April 12, when some of the country’s largest banks are scheduled to announce their most recent financial results. Of particular interest this earnings season will be performance in the office niche of the broader commercial real estate sector. The office niche was especially hard-hit by the pandemic, due to the work-from-home trend.

At this time, one of the primary concerns is that credit defaults will spike, which would threaten the stability of the banks holding those loans.

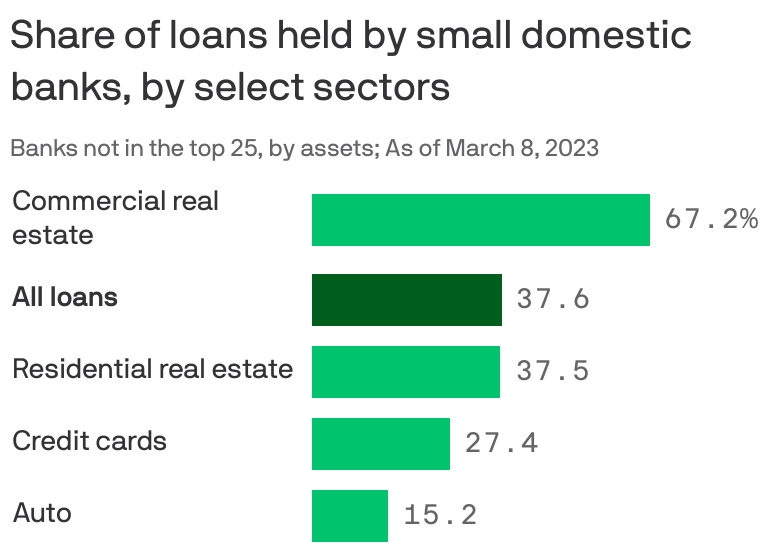

Previous research indicates that small and medium regional banks hold around 67% of the loans linked to the commercial real estate sector, as highlighted below.

Commenting on this ominous situation, the chief investment officer of Guggenheim Partners Investment Management—Anne Walsh—said recently, “the commercial real-estate pain in the office sector is just starting.”

Importantly, the forthcoming earnings season should shed valuable light on the current state of affairs in the office niche.

If the regional banks report further degradation in their commercial loan portfolios, that would likely be viewed as an incremental negative, and could trigger additional selling pressure in this sector of the stock market.

It’s also possible that the forthcoming earnings season produces another situation in which federal regulators need to bail out another financial institution.

One candidate for that worst case scenario is New York Community Bancorp (NYCB). Looking beyond New York Community Bancorp, Evercore ISI recently highlighted that four other regional banks will be closely scrutinized during Q1 earnings season, including Cullen/Frost Bankers (CFZ), Citizens Financial Group (CFG), M&T Bank (MTB) and Synovus Financial (SNV).

There’s good reason to be cautious with investments in any of these companies, but due to the bank’s significant exposure to the commercial real estate sector, Citizens Financial Group may be the least attractive of this group.

Heavy office exposure could be an issue at Citizens Financial Group (CFG)

It’s impossible to predict where the next domino may fall in the regional banking sector, but Citizens Financial Group is certainly a candidate. In January, the bank reported worse than expected earnings, and as mentioned previously, its exposure to the office niche is more significant than some of its peers.

From an earnings perspective, Citizens Financial reported earnings per share of $0.34 in Q4 of 2023, which was well short of the expectations of analysts, who forecasted earnings of closer to $0.60/share.

Moreover, the bank’s net income for Q4 was only $189 million—71% lower than the same quarter a year prior.

Revenues at Citizens Financial also dropped in Q4, but not as substantially as net income. Q4 revenue was 10% lower than the prior quarter. Importantly, however, net interest income at Citizens Financial fell from $1.70 billion a year ago, down to $1.49 billion. And as mentioned previously, the bank raised its loan loss provision by about $40 million.

Moreover, some of the potential red flags highlighted previously—slumping net interest income and rising loan loss provisions—were evident in the company’s Q4 report. If these trends continue, or god forbid accelerate, the market will undoubtedly punish shares of Citizens Financial after Q1 earnings, which is expected in mid-April.

One of the primary headwinds for Citizens Financial appears to be its hefty portfolio of office-focused commercial real estate loans. As of March 2024, the total value of Citizen Financial’s loans to the commercial real estate sector is $29 billion, representing roughly 19% of the bank’s total loan portfolio.

To account for that risk, Citizens Financial has set aside roughly 2.2% of the bank’s total loan exposure in the form of loan loss reserves.

However, Evercore ISI noted that the bank has upped that percentage to more than 10% for loan loss reserves linked to its office-focused loan portfolio. That means the bank is taking the threat of further deterioration in the office sector seriously.

Worryingly, that level of loan reserves suggests that the bank expects credit defaults to rise considerably in the foreseeable future. But even that level of loan loss provisions probably won’t be adequate in a worst-case situation.

According to stress tests conducted by the Federal Reserve, the current level of loan loss provisions at Citizens Financial would only cover about 18% of the bank’s total loan losses if the economy experiences a “severely adverse” downturn.

This example helps illustrate how dicey things could get in the regional banking sector under a worst-case scenario.

Obviously, most companies don’t prepare for the worst case scenario, because it’s hard to grow a business from a defensive posture. But foreclosure data from the commercial real estate sector suggests that recent concerns may be justified.

According to a report compiled by Attom, there were twice as many commercial real estate foreclosures in the January 2024 (635 of them) as compared January 2023 (illustrated below).

For the time being, the aforementioned information and data suggests that investors and traders may want to tread cautiously with positions exposed to regional banks, as well as the office-niche of the commercial real estate sector.

That’s not only due to stock-specific risks, like those facing Citizens Financial, but the risk that another domino could fall in the sector.

For example, if New York Community Bancorp suffers the same fate as Silicon Valley Bank, then the broader group could be in for a reckoning. And in just a couple short weeks, we’ll know a lot more about the likelihood of that reckoning, and potentially, the timing.

=In addition to aforementioned regional banks, readers can follow the Q1 earnings results of the following stocks: Comerica (CMA), Keycorp (KEY), PNC Financial (PNC), Truist Financial (TFC) and Zions Bancorporation (ZION).

And to track and trade the broader regional banking sector, investors and traders can use ETFs such as the SPDR S&P Regional Banking ETF (KRE), the iShares U.S. Regional Banks ETF (IAT) and the Invesco KBW Regional Banking ETF (KBWR).

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.