Strong Economic Data Pushes Expected Rate Cut to Q3

The bond rally might have to wait until late in the year

- The U.S. manufacturing sector unexpectedly rebounded in March, underscoring recent strength in the underlying economy.

- Strength in manufacturing—alongside another robust labor report—has reduced the likelihood of a near-term rate cut.

- The interest rate futures market currently indicates that the Federal Reserve won’t cut rates until Q3.

Last year, most market pundits expected the Federal Reserve to cut rates during the first quarter of 2024. Then, those same pundits claimed the Fed was certain to cut rates by June 2024. Now, expectations appear to have shifted once again—the first rate cut isn’t expected to arrive until early Q3, or even Q4, of this year.

So, what’s changed? A better question might be what hasn’t. The underlying U.S. economy remains strong, the labor market remains tight, and most recently, the manufacturing sector experienced an unexpected rebound in activity.

On top of all that, the inflation problem hasn’t been fully resolved. And as most recall, rampant inflation was the main reason the Fed started raising rates in the first place. Sugar prices recently hit record highs, while the cost of a dozen eggs has also been rising. And with crude oil prices rallying, gasoline prices are also trending back toward uncomfortably high levels.

No rush to cut rates

Importantly, the Fed has consistently said it would cut rates when economic conditions warranted such a move. And based on economic data, prevailing conditions don’t appear to warrant an easing of monetary policy, at least not right now. Underscoring that reality, Fed governor Chris Waller recently told the Economic Club of New York there’s “no rush to begin cutting interest rates.”

On the other hand, if some key leading economic indicators fall off a cliff in April or May, then a June rate cut could quickly be put back on the table. But for now, it’s a safer bet to assume the first cut will arrive in July or August.

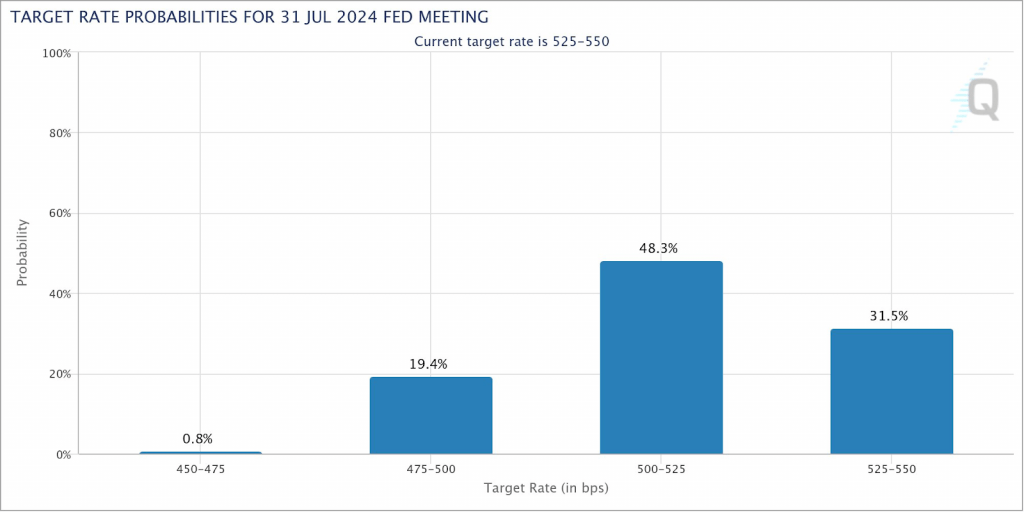

Not surprisingly, the interest rates market appears to agree—according to current expectations, the chance of a June rate cut has dipped below 50%. Previously, the likelihood of a June rate cut was closer to 90%. Now, those bets have shifted to July, with the rates market currently indicating about a 70% chance that the federal funds rate will drop below its current range of 5.25-5.50% after the Fed’s July policy meeting on July 30-31, as illustrated below.

All things considered, the rally in the bond market—which many expected would take flight in early 2024—has been delayed until late summer, or early fall. Interest rates and bond prices share a strong inverse correlation, which means a cut in benchmark rates would theoretically represent an incremental positive for the bond market.

Unfortunately, bond prices have taken cues from the economic indicators and have steadily retraced in recent months. Last year, government bond ETFs such as the iShares 20+ Year Treasury Bond ETF (TLT) rallied on expectations that the Fed would cut rates in Q1 2024. But as hopes for a rate cut dissipated, so did the rally in TLT. Year-to-date, TLT is down roughly 7%, giving back a large chunk of its gains observed during Q4 or last year.

Rebounding manufacturing activity dampens hopes for a June rate cut

One key reason for the recent shift in rate cut expectations was the surprise rebound in U.S. manufacturing activity in March. According to data compiled by The Institute for Supply Management (ISM), the Purchasing Managers’ Index (PMI) unexpectedly surged to 50.3 last month, which was well above consensus expectations. A PMI reading above 50 is generally viewed as expansionary.

Importantly, this was the first PMI reading above 50 since September of 2022, which was why it was such a surprising (and notable) development. With interest rates currently hovering at multi-decade highs, most economists hadn’t expected manufacturing activity to increase in the near-term. In fact, an increase in manufacturing wasn’t expected to materialize until sometime after the Fed cut rates.

On top of that, the most recent U.S. labor report also indicated that the underlying U.S. economy remains strong. The Bureau of Labor Statistics reported on April 5 that U.S. employers created 303,000 new jobs last month—50% higher than the forecast. Moreover, the report indicated that the historically low unemployment rate in the U.S. had edged even lower in March, falling to 3.8%. Analyzed in a vacuum, these figures suggest the economy is strengthening, not losing steam.

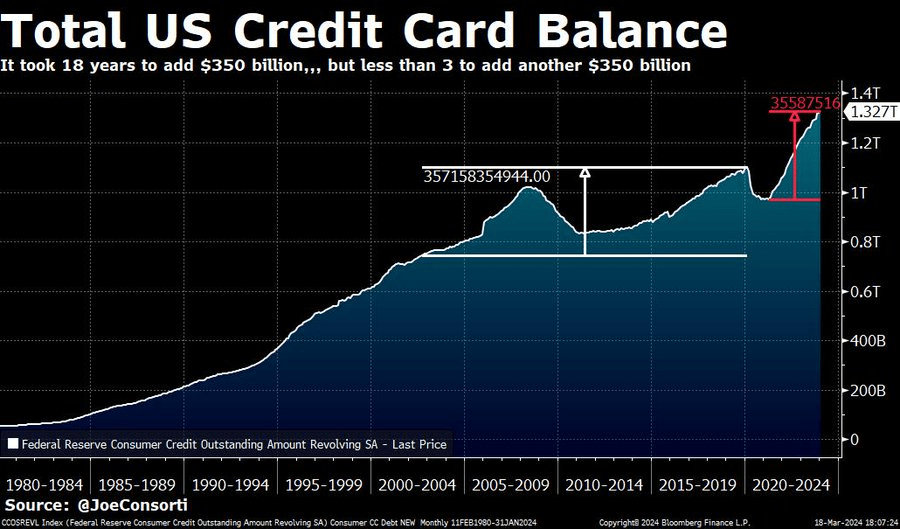

But some other data suggest things aren’t as rosy as they seem. According to recent reports, credit card balances in the U.S. are now above $1.3 trillion, a new all-time high.

Supplementing incomes with plastic

Rising credit card debit is rarely a good sign, and it appears that many Americans are leaning on plastic to compensate for rising prices. According to Mark Zandi—the chief economist at Moody’s Analytics—Americans have used credit card debt “to supplement their incomes to maintain their purchasing power.” Not surprisingly, credit card delinquencies have also surged, and recently eclipsed the levels observed immediately before the pandemic.

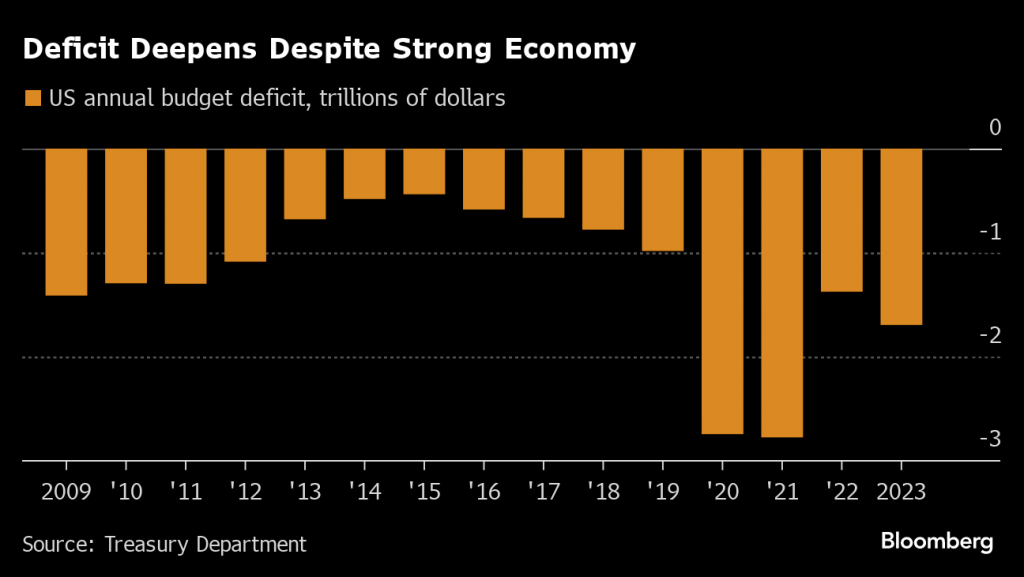

Alarmingly, U.S. consumers aren’t the only ones relying on credit—the U.S. federal government has also been relying on debt to maintain its current level of spending. And record-high government spending has undoubtedly helped the underlying economy avoid recession. As illustrated below, the annual U.S. government budget deficit has shrunk since the pandemic years, but remains alarmingly high.

Federal deficit above pre-pandemic levels

As most recall, government assistance during the pandemic years was a key crutch for the economy. However, that elevated level of support has extended well beyond the pandemic years and is now entering its fifth year. As a result, the U.S. federal government is currently spending a lot more than it collects in tax revenue.

In 2024, the Congressional Budget Office (CBO) forecasts that the federal government will run a budget deficit of roughly $1.5 trillion. That’s down from the $1.7 billion budget deficit observed last year, but still well above pre-pandemic levels. And there’s simply no doubt that the current level of government spending is contributing to better-than-expected GDP growth.

Federal spending directly impacts economic activity in the U.S. because a large chunk of the government’s annual outlay ends up in the private sector, whether it be defense spending, infrastructure spending, social welfare payments (Social Security, Medicare and Medicaid) or government procurement contracts. Along those lines, estimates indicate that nearly 25% of the country’s annual GDP is tied to government spending.

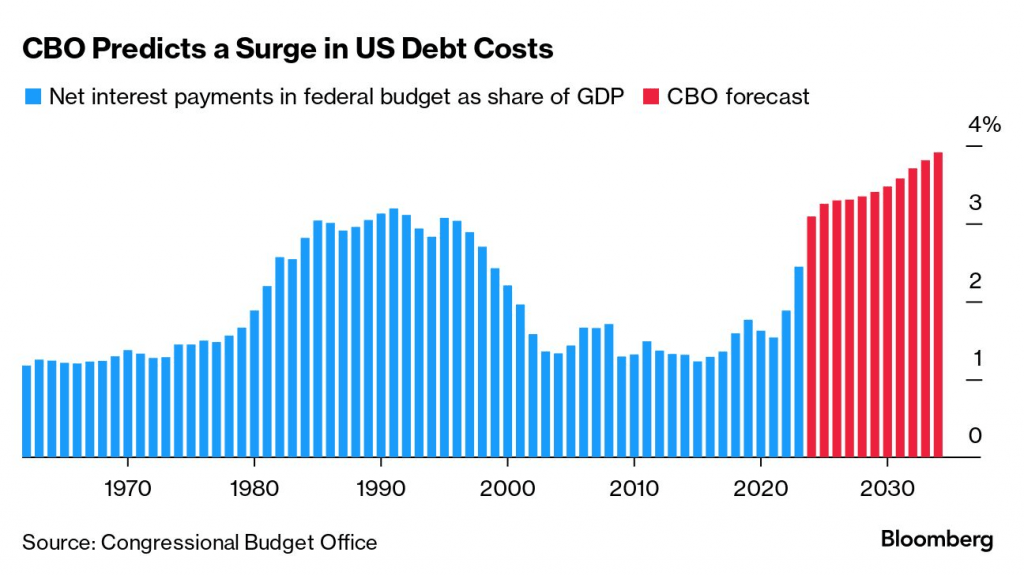

If the federal government were to suddenly balance its budget—cutting spending in line with income—the economy would lose a key source of support, and almost certainly tip into recession. From that perspective, the federal government is getting something from its investment, but not without a cost. As shown below, the interest the federal government pays to service its debt has been rising, and now represents an increasingly large percentage of annual GDP.

Federal debt costs surge

As a result of the country’s deteriorating fiscal position, two different global debt ratings agencies already downgraded the credit rating of the U.S. federal government. And with the national debt continuing to rise at an uncomfortably rapid pace, lawmakers in Washington D.C.—including both the Congress and the White House—must navigate a resolution to this increasingly critical situation. Any realistic solution is likely to necessitate a combination of spending cuts and tax increases.

Considering the deteriorating health of the American consumer, and the federal government’s calamitous fiscal position, the current economic situation in the United States doesn’t seem as attractive as the top-line figures appear to indicate. Yes, GDP growth remains robust, and the unemployment rate remains historically low. But behind the scenes, the finances of the citizens and the central government continue to weaken.

That reality makes it even harder to predict when the Federal Reserve might start cutting interest rates. Will economic activity continue to rebound, as evidenced by the recent pop in manufacturing, or will the American consumer finally succumb to the intense pressure of record-high rates? Only time will tell, but each of those scenarios would likely prompt a vastly different response from the Federal Reserve.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.