Intel’s Revamped Foundry Division is a Rising Threat to Taiwan Semiconductor

Intel’s revamped foundry division wants to take on industry leader Taiwan Semiconductor—and appears to be making progress

- Intel reorganized its foundry division and is working hard to improve its capability to produce the world’s most advanced semiconductors.

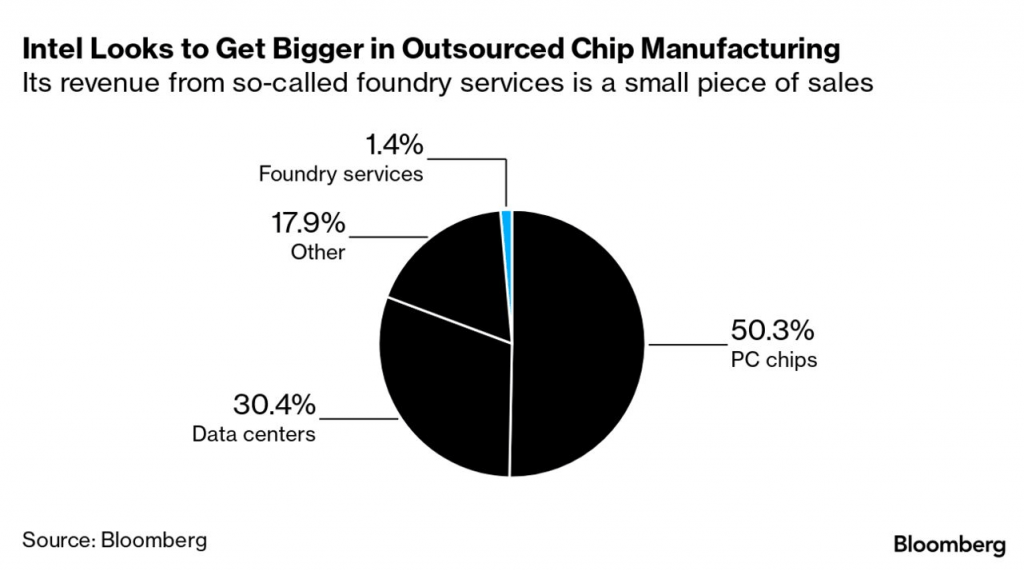

- The reorganized division has been renamed “Intel Foundry,” and will be available as a contract manufacturer, much like Taiwan Semiconductor.

- Shares of Intel have pulled back by 35% for the year to date and may look attractive to investors and traders bullish on the company’s potential.

In early May, Luckbox covered the new Gaudi 3 graphics processing unit (GPU) from Intel (INTL), designed to compete with Nvidia’s (NVDA) enterprise-focused GPUs.

However, Intel’s ambitions are much grander than just designing top-notch GPUs. The company also plans to manufacture them.

Several years ago, Intel reorganized and rebranded its foundry business as part of its broader IDM 2.0 strategy. Through this initiative, Intel intends to rejuvenate its manufacturing capabilities and competitiveness in the semiconductor industry.

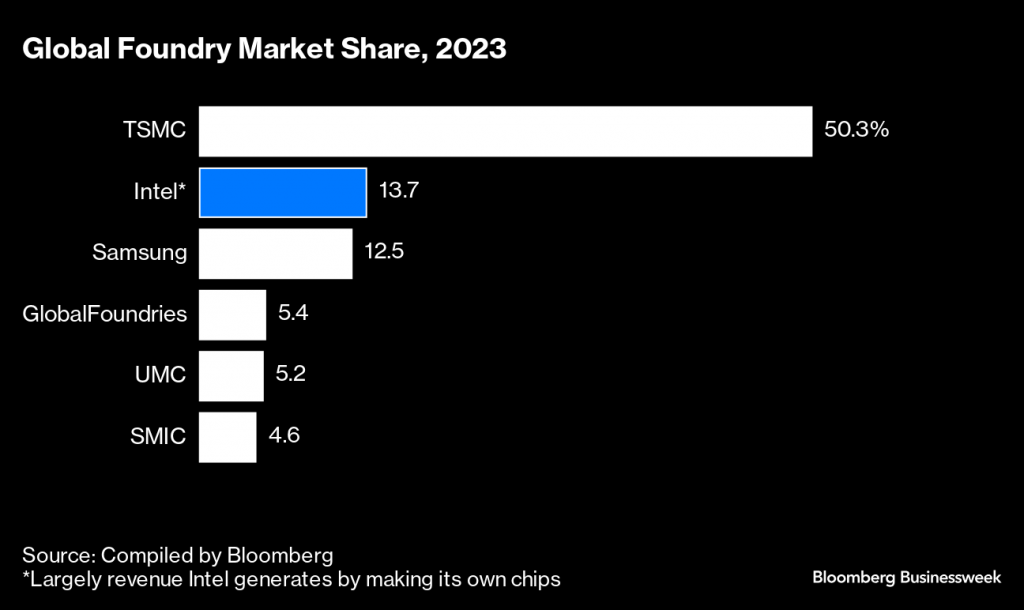

This move marked a significant pivot for Intel, as the company is enhancing its in-house production capabilities and expanding its ability to serve external customers. This puts Intel in direct competition with contract foundries like Taiwan Semiconductor (TSM) and Samsung Foundry (SSNLF).

The new foundry division—Intel Foundry—is a fully autonomous business unit within Intel. It has a strong focus on delivering advanced process and packaging technologies and a broad intellectual property (IP) portfolio. Intel strategically positioned the initiative to capitalize on the growing demand for semiconductor manufacturing outside of Asia. This reflects the need for a more geographically diversified supply chain in the semiconductor industry.

Intel’s expansion plan takes flight

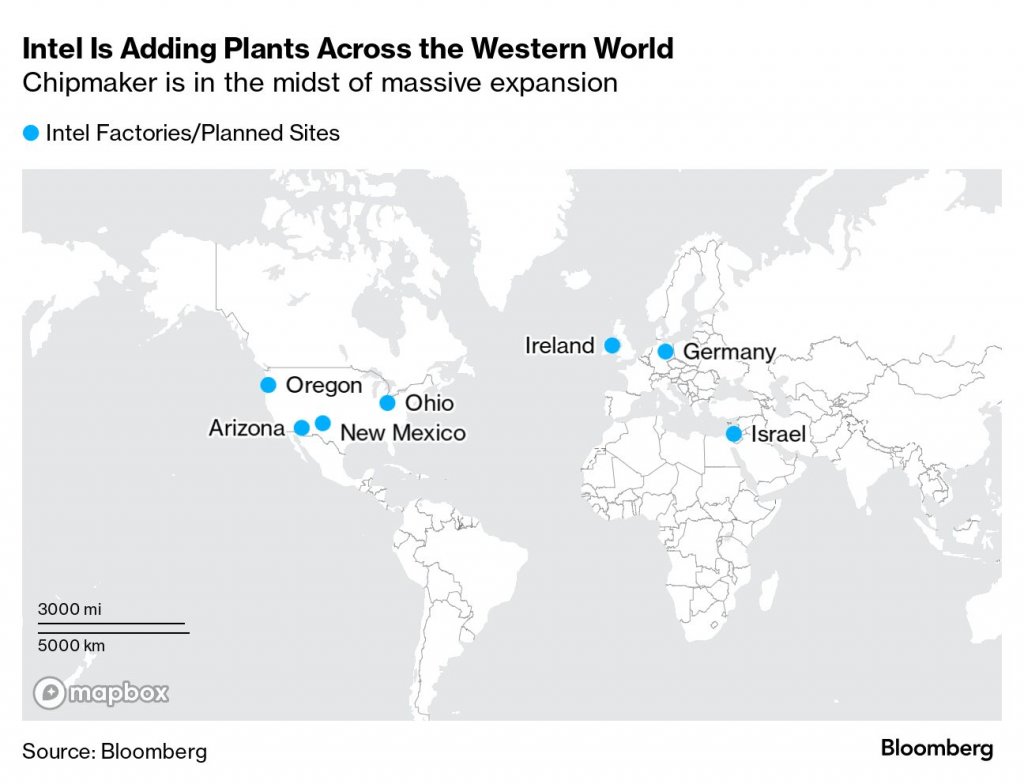

As part of this strategy, Intel has announced substantial new investments in North America, primarily centered in Arizona, New Mexico, Ohio, and Oregon.

Intel intends the facilities to support both its internet needs and those of its foundry customers. This illustrates Intel’s strong commitment to becoming a major player in the global foundry market, which is valued at upwards of $115 billion annually and is expected to double by 2032.

As they say, however, “Rome wasn’t built in a day,” and it will take time for Intel to match (or even supplant) an industry leader like Taiwan Semi. Intel, for example, lost a reported $7 billion on its foundry business in 2023. To get its chip designs and manufacturing capabilities adequate, Intel has been pouring money into its research and development budget.

Last year, Intel’s R&D budget was around $16 billion, in comparison to around $9 billion for Nvidia (NVDA) and $6 billion for Advanced Micro Devices (AMD).

While $7 billion may seem like a substantial loss, it’s important to remember that Intel knew it would need billions of dollars to rejuvenate its semiconductor manufacturing unit. Building and developing chip manufacturing facilities is a capital-intensive endeavor, as evidenced by Taiwan Semi, which plans to invest upwards of $65 billion to bring its new U.S. plants online.

Scaling up requires not only significant capital but also expertise, and Intel certainly has the latter. Intel is already one of the world’s largest semiconductor manufacturers, but it is now striving to become the most sophisticated.

Intel’s strategic “5 Nodes in 4 Years” (5N4Y) plan

When it comes to manufacturing advanced chips, one of the most important metrics relates to “nodes.” Process technology nodes describe the smallest features that can be manufactured on a semiconductor chip. For instance, a 7-nanometer (nm) node indicates that the smallest features on the chip are approximately 7 nm in size.

However, it’s important to note that this naming convention doesn’t always directly correspond to the specific dimensions of a given chip. Different manufacturers emphasize various aspects of the chip design and manufacturing process. As a result, a “7 nm” chip from Samsung isn’t necessarily directly comparable to a “7 nm” chip from Intel, even if the smallest features are of similar dimensions.

Intel’s foundry unit is currently pursuing a strategic development plan known as “5 Nodes in 4 Years” (5N4Y). Each node represents a new generation of semiconductor manufacturing technology. Generally, this involves incremental reductions in feature sizes, allowing for more transistors to be packed onto a single chip. These advancements typically lead to improved performance, optimized energy consumption, and reduced average cost per transistor.

Intel foundry’s near-term goals are in sight

In early March, Intel Foundry hosted its inaugural “Direct Connect” event in San Jose, California. At this gathering, Intel revealed it made meaningful progress on its goal to modernize its semiconductor manufacturing capabilities.

The company expects to implement its 18A process node by the end of 2024. This process node features a 1.8 nm fabrication process, a significant advancement for Intel. For context, Taiwan Semiconductor currently offers 3 nm manufacturing capabilities.

Intel Foundry believes that it will officially surpass Taiwan Semi as the world’s most advanced manufacturer of semiconductors at some point in late 2024 or early 2025. And it plans to hold onto that lead with its planned 14A process node. The latter features a 1.4 nm manufacturing capability. Intel has said that with the introduction of the 18A, the company also expects to extend its lead as the world’s second-largest foundry by revenue.

Intel signed up some heavy-hitting customers for the 18A process node. Earlier this year, Intel announced that Microsoft (MSFT) will lean on Intel to produce some of its most advanced chips starting around 2025. Other notable customers of the Intel Foundry include Amazon (AMZN), MediaTek and Qualcomm (QCOM).

ASML’s (ASML) “High-NA EUV” (high-numerical aperture extreme ultraviolet) lithography system enables the 14A process node. Intel was one of the first companies in the world to take delivery of these machines, which helps explain why it is now potentially positioned to leapfrog Taiwan Semi.

At present, Taiwan Semi boasts customers such as Advanced Micro Devices (AMD), Apple (AAPL), Nvidia (NVDA) and STMicroelectronics (STM). However, there’s no guarantee those customers will stick exclusively with Taiwan Semi forever. Some may seek to diversify their supply chains by adding additional suppliers (e.g. Intel).

However, according to Tom’s Hardware, Intel won’t collect meaningful revenues from its most advanced manufacturing technology until 2026. That’s largely due to the size and scale of semiconductor manufacturing projects, which require years of lead time.

Building plants is one thing, generating revenue is another

While Intel’s progress has been steady, the company has run into some obstacles. The Register reported in mid-April that Intel’s foundry expansion plans are taking longer and are more expensive than originally expected.

But those headwinds probably won’t stop Intel from achieving its manufacturing goals. Intel enjoys significant support from the U.S. government. It recently secured $20 billion from the Creating Helpful Incentives to Produce Semiconductors and Science Act (aka the “CHIPS and Science Act”). The fact that Intel will be manufacturing advanced chips on U.S. soil is a huge differentiator.

By offering advanced semiconductor manufacturing in North America, many global semiconductor companies will be able to diversify a portion of their production outside of Asia (primarily South Korea and Taiwan), while also providing the U.S. government with strategic access to the world’s most advanced chips.

Building U.S.-based capacity will bolster national security and contribute to a more resilient and diversified global supply chain. Due in large part to Intel’s expansion plans, it’s now expected that the chip manufacturing capacity of the United States will triple by 2032, according to a new report from the Semiconductor Industry Association and the Boston Consulting Group.

Looking ahead, the biggest obstacle for Intel will probably be convincing other major chip designers—such as Nvidia and AMD—to contract with Intel Foundry. Having the necessary facilities is one thing, but assuring their potential customers that they can deliver the same level of quality is another. This will undoubtedly take time, and most customers will probably only utilize Intel Foundry for smaller, experimental orders, especially early on.

Playing the long game with shares of Intel

Performance in Intel’s stock certainly appears to suggest that investors and traders remain skeptical that Intel can achieve all its goals. As covered in a recent Luckbox post, Intel intends not only to manufacture the world’s most advanced chips but also to design them.

Despite those lofty goals, shares of Intel have suffered in 2024, and are down 37% so far in 2024. That’s especially concerning given that shares in Nvidia and Taiwan Semi have rallied considerably in 2024—87% and 41%, respectively. Importantly, the slide in Intel’s shares did coincide with a pullback in the broader market indexes in early April, but the indexes have since recovered, while Intel’s shares have not.

In hindsight, it appears that Intel’s April 25 earnings report may have spooked some investors, particularly the $7 billion loss in the foundry division. But the company expects its foundry division to start breaking even by 2026 or 2027, and it has already booked $15 billion in new business. Moreover, the company expects 30% non-GAAP operating margins from its foundry division by 2030.

Ultimately, it will all come down to the sales figures. If Intel can generate new interest in the company’s revamped foundry division, then the existing forecasts for the company’s future earnings are likely too conservative. And if that favorable scenario unfolds, Intel’s valuation should climb considerably higher from where it stands today—a mere $130 billion.

Unlike many of the other high-flying technology companies with exposure to AI, Intel’s 12-month trailing price/earnings ratio is mostly in line with the industry average. Moreover, Intel’s stock is trading well below the average analyst price target of roughly $40 per share. Intel shares currently trade for closer to $30 per share.

For those bullish on Intel’s future potential as both a chip designer and manufacturer, the current pullback in Intel stock may therefore represent an attractive opportunity.

At the end of the day, Intel has considerable experience designing and manufacturing advanced chips, but those have traditionally been CPUs and processors integrated with graphics (integrated CPU/GPU) for the PC market. When Intel has enough confidence in its foundry division that it produces its own discrete GPUs in house (e.g. the Gaudi chipset series), that will likely be a pivotal moment in the company’s history.

And when that day finally arrives, it’ll be much harder for skeptics to discount Intel’s potential.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.