Trump Media, Part 1: Risk Abounds in This Highly Volatile Listing

Shares in the Trump Media & Technology Group appear to be setting up for a potential binary move in the wake of the 2024 presidential election

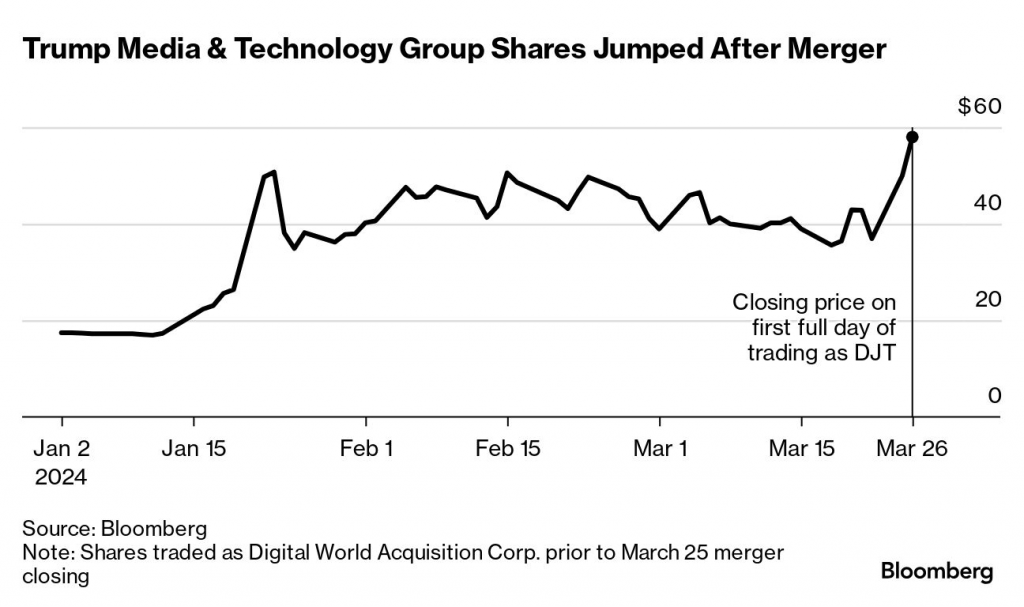

- After debuting on the Nasdaq on March 26 via a SPAC merger, shares of the Trump Media & Technology Group (DJT) have traded in extremely volatile fashion.

- The 2024 presidential election appears to be set up to be a possible binary event for DJT.

- Limited liquidity in DJT could exacerbate any potential gap move, which amplifies the potential risks in this listing during the near future.

Meme stocks fell out of favor in recent months, but the IPO of Reddit (RDDT) and the trading debut of Trump Media & Technology Group (DJT) appear to have boosted the fortunes of this unique sector.

The latter company is majority-owned by former President Donald Trump, who owns a 57% stake in DJT, according to The Wall Street Journal. Last year, the company reported about $4 million in total revenue, and generated a net loss of about $58 million. And somewhat astoundingly, the current market capitalization of DJT is about $6 billion.

Investopedia says a meme stock is one that has “gained viral popularity due to heightened social sentiment,” as opposed to more traditional measures of value, like earnings and revenue. Its valuation qualifies Trump Media as a meme stock. On their own, the underlying financials of the company don’t justify its lofty valuation.

What DJT does and it has performed

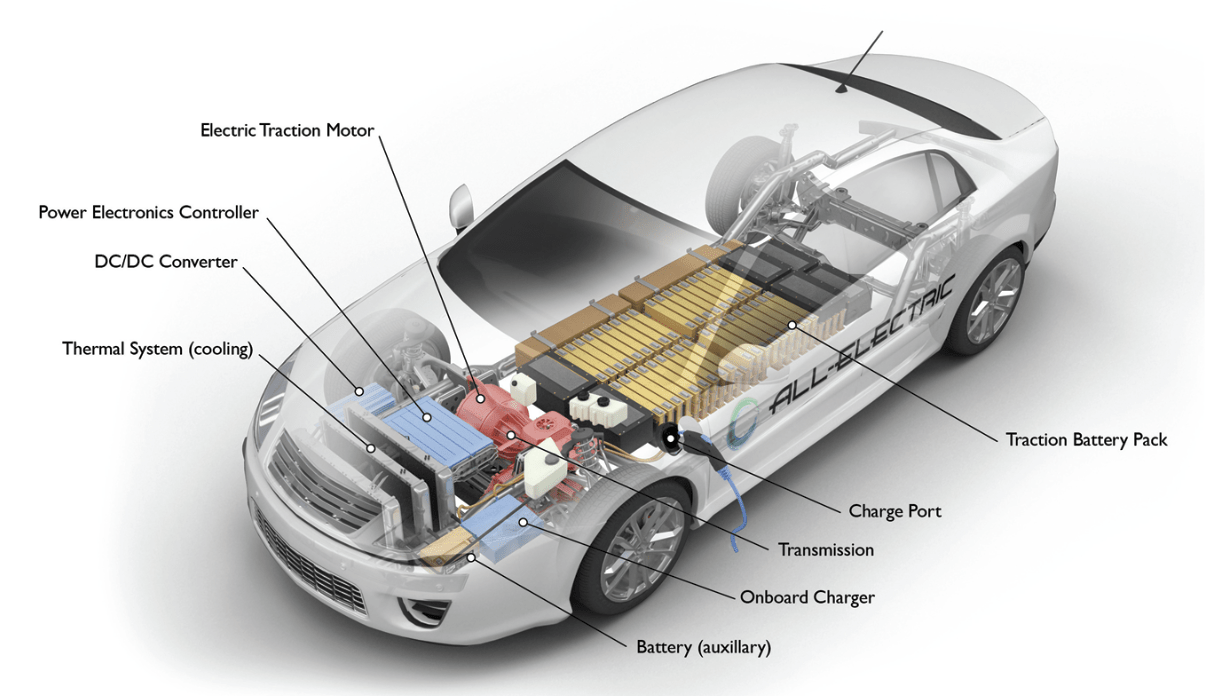

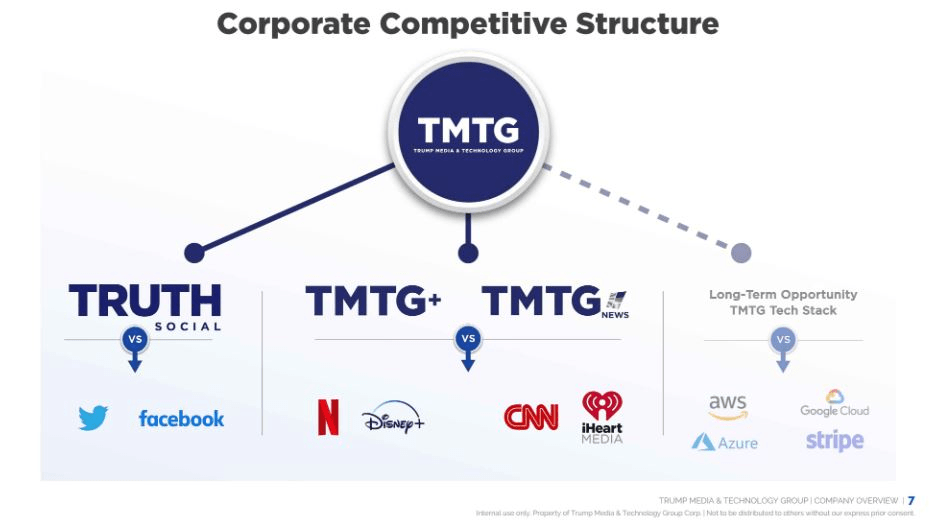

Trump Media’s primary asset is Truth Social—a social media platform that’s been likened to Twitter (aka “X”) and Facebook—owned by Meta (META). Trump Media debuted recently on the Nasdaq after it merged with the special purpose acquisition company (SPAC) Digital World Acquisition Corp. on March 25. As part of the merger, the ticker symbol for the combined entity changed from DWAC to DJT.

Like its namesake, DJT shares appear susceptible to extreme bouts of volatility. But the recent ups and downs in DJT may be child’s play compared to what lies ahead. The stock appears to be setting up for a dramatic gap move in the wake of the 2024 presidential election.

DJT rallied by 16% on March 26, immediately following the merger, and urges another 14% on March 27. However, DJT shares corrected sharply in early April, after it was revealed that the company reported its huge net loss for fiscal year 2023.

In terms of an apples-to-apples comparison, consider that X (formerly Twitter) is currently valued at about $12.5 billion. X has an active monthly user base of roughly 550 million people and is believed to have generated over $3 billion in revenue in 2023. DJT’s Truth Social, on the other hand, has an active monthly user base of around 5 million people and produced $4 million in revenues last year.

Binary event: What the election could do to DJT

If Trump wins the upcoming election, shares of DJT are likely to surge significantly higher. But if he loses, the stock will more than likely plunge in value.

In the financial markets, situations like this are typically referred to as “binary events.” Binary events occur when dramatic and significant developments trigger high magnitude moves in the underlying price of a stock, a group of stocks, or the overall market.

On an average trading day, most binary events are linked to merger-and-acquisition activity, or decisions made by the U.S. Food and Drug Administration (FDA). But binary events can also be associated with significant geopolitical developments, such as elections, wars or public health emergencies.

For example, the 9/11 terrorist attacks and the COVID-19 pandemic triggered massive moves in the financial markets. In those cases, the binary events were linked to unforeseen/unanticipated events. However, binary events can be associated with planned/scheduled events as well, such as elections, legislative votes and FDA decisions.

In the case of DJT, the date of the forthcoming binary event is already known. It’s Nov. 5, the date of the 2024 presidential election. That’s because the fortunes of the Trump Media are expected to swing in dramatic fashion based on the outcome of that election.

However, DJT also might respond if Trump suffered a significant legal setback. It’s still theoretically possible that a legal complication could prohibit Trump from appearing on the ballot or preclude him from holding public office. That’s not likely to occur before November, but it’s a risk that investors and traders in DJT need to keep in mind.

Psychological impact

If Trump wins the election, the Truth Social platform would undoubtedly experience an influx of users and advertising revenue. But most of the immediate gains would arguably be psychological in nature.

For example, euphoria linked to a potential Trump election victory is almost certain to spill over into shares of DJT. And that momentum could easily domino, creating an epic surge in the company’s valuation. This is especially pertinent for DJT because liquidity in this listing is extremely limited. On an average day, about 4 million shares change hands. In Nvidia (NVDA), more than 50 million shares are exchanged daily.

One of the primary complications is that share ownership in DJT is heavily concentrated. Trump, for example, owns roughly 78 million shares. And due to lockup agreements, insiders are prohibited from selling shares until a certain period has elapsed. The lockup period for Trump is reported to be six months, according to Reuters.

Hard to borrow

Due to these complications, shares of DJT are technically “hard to borrow,” which means it’s extremely challenging to borrow them for the purposes of short selling. Speaking to this reality, Matthew Unterman—a director at S3—recently told Reuters, “Demand is sky-high to short DJT, but any borrow supply is very scarce and extremely hard to locate.”

One can see how that situation could lend itself to a short squeeze in DJT, if Trump wins the election. In that scenario, it’s hard to predict where the shares might trade, because valuation considerations would likely be overrun by a stampede of positive sentiment. In the reverse scenario, limited liquidity could also exacerbate a potential selloff.

Considering that “going concern” issues have already been linked to the Trump Media, one can only imagine how severely the stock might correct in the wake of an election loss. If Trump loses, the Trump Media & Technology Group would probably be valued closer to its existing business fundamentals. And as highlighted previously, those aren’t pretty.

Regardless of what transpires, it’s easy to see how the result of the election will constitute a binary event for Trump Media. That said, the possibility of a tie also must be considered, whereby each candidate accumulates 269 electoral votes. It’s also possible that recounts may be necessary, which could delay the outcome. But even in these unlikely scenarios, the election will ultimately result in a winner, even if it takes longer to get there.

In another post, we discuss how to track ongoing expectations for a potential binary move in DJT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.