KWEB: Playing a Potential Rebound in the Chinese Stock Market

The CSI 300 index in China recently dropped to a 4.5-year low, but a rebound in the Chinese economy could push stock valuations higher in 2024

- Chinese stocks have slumped to their lowest levels of the year, with the iShares China Large-Cap ETF (FXI) recently hitting a fresh 52-week low.

- Idiosyncratic risks remain elevated in China, which is why investors and traders bullish on Chinese stocks may want to focus on ETFs as opposed to single stocks.

- KWEB and CQQQ look especially attractive at this time, due to their heavy exposure to the Chinese tech sector, and their impressive performance during previous stock market rebounds.

Chinese stocks have been out of favor in 2023, but that type of trend is often music to the ears of contrarians and value investors. Investors and traders from these two groups often look past short-term trends to identify value-based opportunities that can benefit from shifting perceptions in the financial markets.

Along those lines, one of the most highly followed China-focused ETFs—the iShares China Large-Cap ETF (FXI)—just hit a fresh 52-week low, and is currently trading about $24/share.

Mirroring the FXI, the tech-heavy KraneShares CSI China Internet ETF (KWEB) is also trading at the lower end of its 52-week range. Shares of KWEB are currently trading about $27, and have ranged between $24 and $36 per share during the last 52 weeks.

The Chinese stock market has been under pressure in 2023 due to a variety of headwinds in the Chinese economy. The most immediate challenges are weakening economic growth, a slowdown in the Chinese real estate market and an ongoing corporate regulatory crackdown.

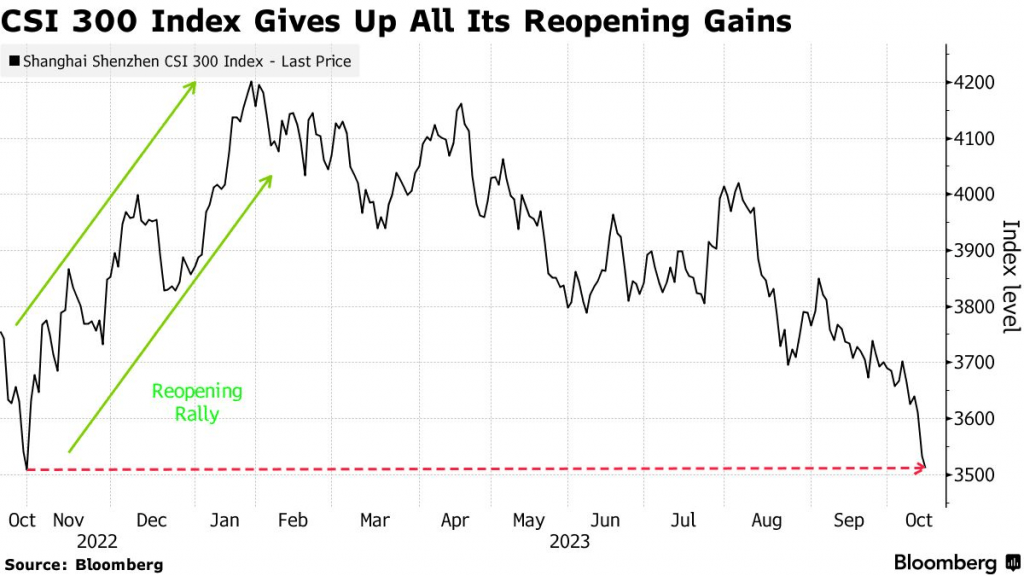

China’s CSI 300 index recently slumped to a 4.5-year low and has now given up all of its gains from earlier this year. Chinese stocks staged a rally at the end of 2022 based on optimism over a post-COVID rebound, but weren’t able to sustain the positive momentum, as illustrated below.

Importantly, it’s not just the absolute share prices of Chinese-focused equities that have slumped in recent months. According to MSCI data, Chinese stocks are trading at roughly 10 times 12-month forward earnings, which is well below the 10-year average of 11.30.

Moreover, the valuations of Chinese stocks relative to other major international markets are also sitting at depressed levels. So far in 2023, the Shanghai Composite index is down 3%, while the S&P 500 in the United States is up roughly 20% and the Nikkei 225 in Japan is up nearly 30%.

That divergence has served to temporarily expand the gap between the valuations of Chinese stocks as compared to American stocks. The latter have always traded at a richer valuation than the former, but as of now, the gap is at a multi-year extreme. Stocks in the U.S. currently trade with a 12-month forward earnings multiple of closer to 20.

That means relative to 12-month forward earnings, U.S. stocks are valued at roughly twice that of their Chinese counterparts (20 vs. 10). Historically, the gap between those two countries’ earnings multiples has been as narrow as 5 points, as opposed to the current gap of 10 points.

If perceptions were to shift in favor of the Chinese market, the current gap could consequently narrow from 10 points to five points, which would require an appreciation in the value of Chinese stocks, a depreciation in the value of U.S. stocks, or a combination of both.

Taken all together, the aforementioned figures indicate that Chinese stocks are trading at depressed levels in comparison to their own historical valuations, and also relative to their global peers.

Some investors and traders likely view the current situation as an opportunity—especially those bullish on a near-term rebound in Chinese economic growth.

Analysts at Goldman Sachs appear to count among those optimists that think better times lie ahead for the Chinese economy, as well as the Chinese financial markets. Goldman recently predicted that the Chinese CSI 300 index will appreciate by roughly 15% next year. That forecast is underpinned by an expectation that Chinese corporate earnings will increase by as much as 10% in 2024.

For that to occur, China’s economic growth will undoubtedly need to rebound. Based on recent data out of the Middle Kingdom, that’s a real possibility. In early November, the International Monetary Fund (IMF) announced that the Chinese economy would grow at a rate of about 5.4% in 2023, which was an upside revision from the IMF’s previous forecast of 5%.

If that positive trend continues, Chinese stocks could easily become the new darling of the international financial markets in 2024, with a Chinese economic rebound driving fresh optimism in the Chinese stock market.

Why China-Focused ETFs Represent a Better Value Proposition Than Single Stocks

Looking beyond weakness in the Chinese economy, one of the biggest headwinds for the Chinese financial markets over the last several years has been the government’s ongoing regulatory crackdown.

The current bout of increased corporate scrutiny started back in November of 2020 when Chinese regulators stepped in at the last minute to block the initial public offering (IPO) of Ant Financial. Since that time, the regulatory net has steadily expanded—reeling in the education technology sector, the e-commerce sector, and the online gaming sector, among others.

One of the early concerns was the usage of Chinese consumer data, as well as the security of that data. However, regulators have since broadened their net, and have been cracking down on skyrocketing education costs, addictive gaming behavior and excessive risk-taking in the financial industry.

As many probably recall, the former executive chairman of Alibaba (BABA) Jack Ma was one of the first to run afoul of Chinese regulators. Back in October of 2020, Ma gave a speech at an annual forum organized by the People’s Bank of China and criticized the work of Chinese regulators in the financial industry, suggesting that they were too cautious and risk-averse. Ma implied that this approach was throttling innovation in the country.

Not long after that speech, the Chinese government stepped in to block the initial public offering (IPO) of Ant Group. At the time, Ant Group was China’s largest fintech conglomerate, and a close affiliate of Alibaba. Around that same time, Ma disappeared from the public eye, and some hypothesized he had been detained by government authorities.

Ma did eventually resurface, but in a greatly reduced role. He has no official role at Alibaba, and no control over Ant Group. Ma accepted an honorary professorship at Hong Kong University and recently announced that he had launched a new venture known as “Hangzhou Ma’s Kitchen Food,” which will focus on pre-packaged foods.

Interestingly, Alibaba announced it was breaking up into six separate business units back in spring of 2023, shortly after Ma made his first public appearance back in Hangzhou—the same city where Ma originally founded Alibaba back in 1999.

Since Ma’s ill-advised speech in October of 2020, shares of Alibaba have dropped by a jaw- dropping 76%, cratering from $310/share all the way down to $73/share. This situation illustrates quite clearly how idiosyncratic risks (stock specific risks) are elevated in China at this time.

Underscoring that reality, a previous Chinese government probe of Didi Global (DIDIY) resulted in a voluntary delisting of the company’s shares from the New York Stock Exchange. Shares of Didi continue to trade over-the-counter (OTC) in the U.S. under the ticker DIDIY.

No one knows for sure when the current regulatory crackdown will end, but for the time being, that means any single stock in China is potentially vulnerable to an ill-fated inquisition by the government. For this reason, investors and traders bullish on the Chinese market may want to focus their attention on exchange-traded funds (ETFs), as opposed to single stocks.

ETFs are inherently less risky than single stocks because they typically invest in a large number of companies, as opposed to concentrating on a single holding. This approach diversifies risk across multiple assets and reduces the impact of underperformance in a single asset.

Fortunately, when it comes to Chinese ETFs, there’s a large list to choose from. That’s to be expected, considering that China possesses the second-largest economy on the planet, and also the second-largest stock market in terms of total market capitalization.

Highlighted below are some of China-focused ETFs listed in the U.S. with the largest amount of assets under management (sorted by year-to-date return, best to worst):

- Invesco Golden Dragon China ETF (PGJ), -12%

- Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR), -15%

- Global X MSCI China Consumer Discretionary ETF (CHIQ), -16%

- Franklin FTSE China ETF (FLCH), -16%

- iShares MSCI China A ETF (CNYA), -16%

- SPDR S&P China ETF (GXC), -16%

- KraneShares CSI China Internet ETF (KWEB), -16%

- iShares MSCI China ETF (MCHI), -17%

- iShares China Large-Cap ETF (FXI), -18%

- KraneShares Bosera MSCI China A 50 Connect Index ETF (KBA), -20%

- KraneShares MSCI China Clean Technology Index ETF (KGRN), -20%

- KraneShares SSE Star Market 50 Index ETF (KSTR), -21%

- Invesco China Technology ETF (CQQQ), -21%

- WisdomTree China ex-State-Owned Enterprises Fund (CXSE), -24%

- iShares MSCI China Small-Cap ETF (ECNS), -28%

Why KWEB and CQQQ Stand Out Among China-Focused ETFs

If the Chinese economy rebounds in 2024, and fresh optimism spills over into Chinese stocks, the entire market will undoubtedly benefit from improved sentiment. After all, a rising tide floats all boats.

However, certain niches will undoubtedly perform better than others. Considering recent outperformance in the U.S. tech sector, one could argue that Chinese tech stocks represent one of the most attractive segments of the broader Chinese stock market.

When it comes to the Chinese tech sector, these stocks are not only the highest-capitalized Chinese issues, but they also enjoy the highest degree of name recognition. Both of those are attractive qualities when it comes to a market rebound, as investors and traders tend to gravitate toward stocks they know, and those that trade with robust liquidity.

Much like the broader market, the Chinese tech sector is lagging well behind its global peers when it comes to associated valuations. According to analysts at Jeffries, the average valuation of Chinese tech companies is 14x forward price earnings, as compared to a forward price earnings of closer to 22x for their global peers.

As a result of these depressed valuations, Morningstar recently noted that “a handful of high-quality Chinese stocks are now deeply undervalued, including tech and e-commerce giant Alibaba (BABA) and entertainment and social media conglomerate Tencent (TCEHY).”

In that same research note, Morningstar also highlighted Baidu (BIDU) and JD.com (JD) in their list of “5 Undervalued Chinese Stocks.” Along those same lines, a recent analysis by Nasdaq suggested that Alibaba and JD.com were among the “3 most undervalued Chinese stocks.”

Importantly, the KraneShares CSI China Internet ETF (KWEB) counts most of the aforementioned Chinese tech stocks among its top ten holdings, as highlighted below (sorted by percent weighting):

- PDD Holdings (PDD), 10.43%

- Alibaba (BABA), 9.06%

- Tencent (TCEHY), 8.80%

- Meituan (MPNGF), 7.46%

- NetEase (NTES), 5.13%

- Baidu (BIDU), 4.95%

- Full Truck Alliance (YMM), 4.12%

- Trip.com (TCOM), 3.95%

- Kanzhun (BZ), 3.83%

- KE Holdings (BEKE), 3.81%

KWEB offers investors and traders diversified exposure to the Chinese tech sector. Should the Chinese stock market rebound in the coming months, KWEB will undoubtedly participate in that rally, while limiting exposure to idiosyncratic risks associated with the blow-up of a single company.

Along with KWEB, the Invesco China Technology ETF (CQQQ) also offers diversified exposure to the Chinese tech sector, albeit with slightly different holdings.

In contrast to KWEB, CQQQ does not count Alibaba or NetEase among its top ten holdings. Instead, Tencent, PDD Holdings and Baudi account for three of the ETF’s top four holdings, together representing about 25% of the total invested capital.

When Chinese stocks staged a rally at the end of last year on optimism over the post-COVID recovery, KWEB rallied by about 47% between Oct. 28, 2022 and Jan. 27, 2023, climbing from $19/share all the way to $36/share. During that same period, CQQQ rallied by about 60%, climbing from $32/share to $51/share.

Whenever Chinese stocks do come back into favor, it’s virtually assured these two well-diversified ETFs will outperform once again. The big outstanding question is when exactly that might happen. That’s more difficult to predict, but Goldman Sachs is currently projecting that a rebound will unfold at some point in 2024.

On top of that, there are 32 analysts that currently cover KWEB, and 31 of them rate KWEB shares a buy or hold, as compared to only one analyst that rates KWEB a sell. The average analyst price target for KWEB is $38/share, which is about 40% higher than where KWEB shares trade today.

The nice thing is that unlike U.S. tech stocks, Chinese tech stocks are already trading at depressed levels. That means the risks to the downside are arguably reduced in Chinese stocks and ETFs, as compared to their U.S. counterparts.

For all of the above reasons, KWEB and CQQQ offer a compelling value proposition for those bullish on the longer-term prospects of the Chinese economy.

To follow everything moving the markets, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.