Options Spreads: Your Essential Introduction to Trading Straddles, Strangles, Verticals & Calendars

Options spreads involve two or more different positions, and can be deployed to fit a wide range of strategic approaches, market outlooks and risk profiles.

Options are extremely dynamic securities and can be a great complement to single stocks and ETFs.

Moreover, options trading has exploded in recent years, which means that options markets are deeper and more liquid than ever before.

Many investors and traders have traded so-called “naked options,” like a long put or a short call. And depending on one’s outlook and risk profile, a naked option may represent a good choice.

However, options can also be traded in “spreads,” which are comprised of two or more options positions, which together constitute a specific strategy.

For example, an investor or trader that believes a stock might sit still—or trade sideways—for the foreseeable future might sell an options straddle or strangle.

In addition to straddles and strangles, there are several other common options spreads that investors and traders often utilize in the options market. Some of the most frequently utilized spreads include calendar spreads (intermediate-level traders) and vertical spreads (advanced-level traders).

Additional information on each of these spreads in highlighted below.

Straddle and Strangle Options Spreads (beginner)

A straddle involves an at-the-money (ATM) call and put with the same expiration date. When the call and put are sold simultaneously, the associated position is referred to as a “short straddle,” and when both options are purchased, it’s referred to as a “long straddle.”

A strangle, on the other hand, is similar to a straddle, except that this spread involves out-of-the-money (OTM) options instead of at-the-money options. To deploy a short strangle, a trader simply sells an OTM call and an OTM put with the same expiration date.

Alternatively, a long strangle involves purchasing an OTM call and an OTM put with the same expiration date.

Most options trades are executed in equal proportion—meaning the same number of contracts are traded on each leg of the trade. For a straddle, that means one would sell the same number of call contracts as put contracts.

As with most short options positions, short straddles and strangles perform best when the underlying sits still, and the options expire worthless. On the other hand, long straddles and strangles perform best when the underlying makes a big move in one direction or the other, which causes a sharp spike in the value of the call or put option in the spread.

As such, straddles and strangles may be suitable for investors and traders that expect an underlying to sit still (a short straddle or strangle), or for those that expect a big move in the underlying, but aren’t sure which direction the underlying will move (a long straddle or strangle).

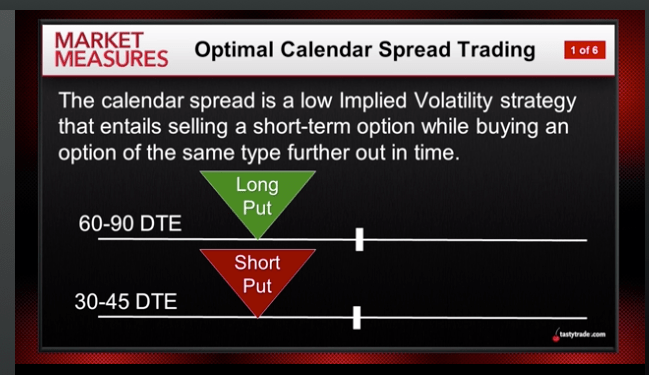

Calendar Options Spreads (intermediate)

Unlike vertical spreads, calendar spreads (aka time spreads) are usually deployed when an investor or trader expects that volatility will increase or decrease at some point in the future.

A calendar spread is executed by buying and selling options with the same strike price, but different expirations. When executed for a debit, the position entails selling the closer month option, in favor of purchasing an out-month option.

Debit calendar spreads are theoretically bullish volatility, because after the near-term option rolls off (i.e. expires), the position is left with only the long premium position. If volatility then expands, the position wins.

On the other hand, a credit calendar spread is executed in opposite fashion, by buying the closer month option, and selling the out-month option. Credit calendars are theoretically bearish volatility, because after the near-term option rolls off, the position is left with only the short premium position. If volatility then drops, the position wins.

Investors and traders should be aware that significant risk is associated with credit calendars, because of the exposure related to the naked short option after the long option expires.

For this reason, most investors and traders focus on debit calendars, when they are bullish on volatility.

Debit calendar spreads perform optimally when the underlying hovers close to, or right on, the strike of the near-month short option. In this scenario, the premium from that short option bleeds off, and funnels straight into the trader’s wallet.

On the other hand, if the underlying makes a big unexpected move in either direction, the most a debit calendar spread can lose is the amount of premium paid to establish the position (the net debit). In this regard, the debit calendar spread is a defined risk position.

Alternatively, a credit calendar spead is theoretically an undefined risk position, because of the naked short option that exists after the near-month option rolls off. The fact that credit calendar spreads are theoretically exposed to unlimited risk is another reason that many investors and traders avoid this structure.

Vertical Options Spreads (advanced)

The terms “debit” and “credit” are often used when trading option spreads, even though such positions usually involve both the purchase and sale of two (or more) different options. In this usage, debit or credit refers to the net result of the combined position.

For example, “credit spreads” refer to positions in which the investor/trader collects premium when taking into account the net cost of the spread, whereas “debit spreads” refer to positions in which the trader outlays premium when taking into account the net cost of the spread.

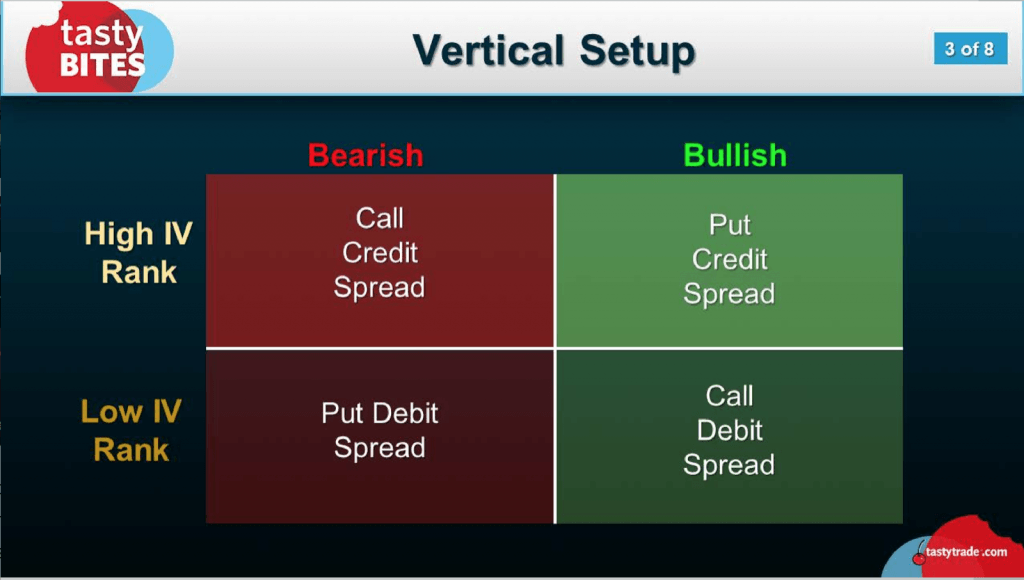

Vertical spreads are often deployed when an investor holds an opinion on not only price direction, but also volatility.

Getting down to the actual mechanics of the position, a vertical spread is constructed using one long option, and one short option. In a vertical, both options should be of the same type (two calls or two puts) and in the same expiration month, but of different strike prices.

Accordingly, a vertical consists of a long call and a short call, or a long put and a short put. Moreover, one of the options in the spread will be in-the-money (ITM), while the other will be out-of-the-money (OTM). The latter OTM option serves as the “wing” of the position.

Taking the above all together, a vertical spread can be deployed in four different ways:

- long ITM call, short OTM call (call debit, bullish)

- short ITM call, long OTM call (call credit, bearish)

- long ITM put, short OTM put (put debit, bearish)

- short ITM put, long OTM put (put credit, bullish)

The key to understanding a vertical spread is to visualize it as a naked options position, but with a “wing” deployed as a hedge to help protect the position from outsized losses. The “wing” in a vertical spread is the OTM option.

Along those lines, the wing (aka the second leg of the spread) in a vertical spread is essentially what transforms this position into a defined-risk exposure—meaning the potential maximum gains and losses of the spread are clearly defined prior to trade deployment. This can be a huge benefit to traders that are seeking to reduce the risk of unexpected losses in their portfolios.

It should be noted that the wing in a vertical can also serve to reduce potential gains—depending on what type of vertical is deployed, and what ultimately unfolds in the underlying.

Looking at a hypothetical example, imagine there’s a publicly traded technology company that is preparing to announce a new product offering. Now, let’s further assume there exists a trader who is a strong believer in the new product, and is expecting a moderately bullish move in the wake of the announcement.

Finally, let’s also assume that this trader believes the market has overlooked the potential impact of this event, and views the implied volatility in the options of ABC as “cheap.”

As mentioned at the outset of this piece, this trader essentially holds a view on both price and volatility—as opposed to a view on only one or the other. The vertical that best fits this outlook is the bullish call debit spread in the right-hand bottom corner of the graphic, which is comprised of a long ITM call and a short OTM call.

The reason this structure is particularly suitable is threefold. First, the trader will have expressed his/her bullish opinion using the long ITM call—the more elementary aspect of the position. Second, the trader will have expressed his/her opinion that volatility is cheap by purchasing option premium, also via the long ITM call.

The last piece of the puzzle is the short OTM call. This leg of the position provides a potential benefit to the trader if his/her outlook ends up being incorrect. That’s because the short OTM call provides the trader with a credit (i.e. short premium) which effectively reduces the cost of the ITM call debit (i.e. long premium).

The total “cost” of a debit vertical spread is calculated by taking the long premium less the short premium, which in sum is referred to as the total “debit.” If the event comes to pass, and underlying ABC fails to rally, or goes down in value, the trader will have saved himself/herself valuable capital via the short OTM.

The maximum potential loss from a call debit vertical spread is the total premium outlaid to establish the position. However, the maximum potential gain is also capped when employing this position structure.

The maximum potential gain from a call debit vertical spread is the difference between the two strikes, less the net debit paid for the spread. So if the distance between strikes is $5, and the net debit for the spread is $2, then the maximum potential gain would be $3 (multiplied by 100 times the number of contracts, or $3 x 100 x 1 contract = $300). The maximum potential loss in this same example is $2 x 1 contract x 100, or $200.

These numbers help illustrate that an important consideration for a trader employing this structure is that the underlying rallies dramatically, in which case the short OTM call ends up capping the potential gains from the long ITM call. That’s one reason the call debit vertical is possibly more suitable when a moderate rally is expected in the underlying, as opposed to a dramatic rally—although the position would still profit under both scenarios.

Parting Shots

Options allow investors and traders to express a wider range of strategies as compared to long or short stock/ETFs.

Whether it be a naked options position (long call, short put, etc…) or an options spread (straddle, strangle, verticle, calendar) there’s often an options strategy or approach that will fit an investor/trader’s outlook and risk profile.

To learn more about trading options spreads, readers can check out the following links on the tastylive financial network:

- Market Mindset: Strangle vs. Straddle Trade-Offs

- Options Jive: Trading Calendar Spreads

- Tasty Bites: Trading Vertical Spreads

To follow everything moving the markets in 2023, readers can tune into tastylive—weekdays from 7a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.