Pelosi’s New NVDA Disclosure Reignites Congressional Trading Conundrum

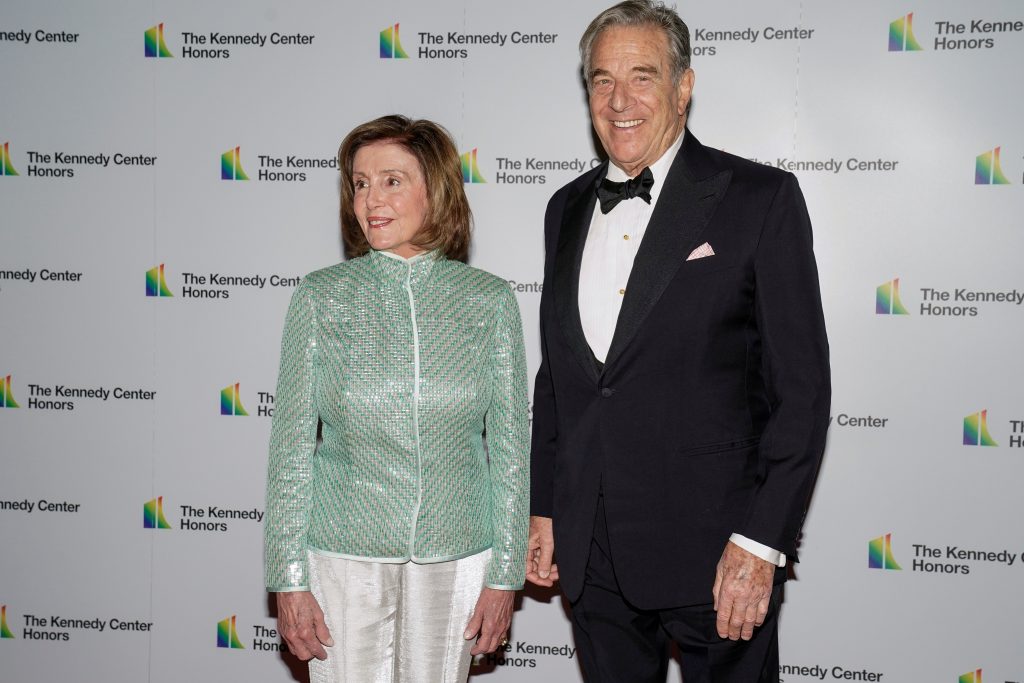

A recent Senate financial disclosure revealed that Paul and Nancy Pelosi recently exercised an existing NVDA call position—converting it into long stock ahead of an upcoming vote on the CHIPS Act in Congress

Tech investors received a boost of confidence in mid-July when fresh financial disclosures from Congress revealed that Nancy Pelosi’s family had seemingly taken on a new bullish position in Nvidia (NVDA)—one of the country’s best-known chip makers.

Nancy Pelosi is the Speaker of the House of Representatives in Congress, which helps explain why trading activity in her family’s account is so closely followed by the investing/trading community.

Interestingly, many headlines focusing on this disclosure are couching the Pelosi NVDA position as “new,” but in actuality, this was a pre-existing bullish position in NVDA that started out as long calls, and was merely transformed into a long stock position via the exercise of those calls.

So a more appropriate headline for this particular situation might be that the Pelosi family “remains bullish on NVDA” after exercising an existing long call position.

It should be further noted that Pelosi’s husband—Paul Pelosi—was the one attributed with the call exercise, not Nancy herself. The same Senate financial disclosure also noted that Paul Pelosi had sold 10,000 shares of Visa (V) on June 21, and closed a long call position in Apple (AAPL).

The Pelosi disclosure was especially interesting because Congress could pass the CHIPS Act as soon as next week. This legislation would funnel roughly $52 billion in subsidies and investment tax credits to help bolster the production of semiconductors on U.S. soil. NVDA—along with many other domestic chip makers—stands to benefit if the CHIPS Act is enacted.

Investing and trading activity by members of Congress has come under the microscope in recent years because political activists have likened such activity to “insider trading.” Insider trading refers to the illegal practice of using confidential information to one’s own personal advantage through a position in the financial markets.

Critics have long argued that members of Congress are privy to critical/sensitive information in their role as public servants, and that they should be forbidden from using that information for personal gain in the financial markets.

This topic has been in focus during the last couple of years after disclosures revealed that some members of Congress used information from pandemic-related briefings to reposition their accounts in early 2020.

One high-profile example involved Senator Richard Burr, who was the chair of the Senate Intelligence Committee in 2020 when the COVID-19 pandemic first took hold in the United States. Senate financial disclosures revealed that an investment account linked to Burr had liquidated millions in stock holdings from January 21 to February 13 of 2020, just before a pandemic-fueled stock market correction took hold in the U.S. markets.

Senator Burr has maintained that his decision to liquidate was linked to “public news reports,” despite the fact that the Senate Intelligence Committee held a closed-door briefing on the coronavirus on January 24. The U.S. Justice Department opened an investigation into Burr’s trading activities later in 2020, but ultimately elected not to file charges.

Recently, former Georgia Republican Senators Kelly Loeffler and David Perdue were both investigated for alleged insider trading in 2020. Moreover, dozens of current lawmakers have been cited for failing to disclose trades on time.

In the case of Paul Pelosi and the recent NVDA disclosure, it’s a bit harder to connect the dots when it comes to nefarious intent. The Pelosi family already held a bullish position in NVDA, and merely transformed that position from long calls to long stock at a time when the stock is down nearly 50% on the year.

Status of Current Legislative Efforts to Ban Congressional Trading

Currently, trading and investment activity by members of Congress is primarily governed by the 2012 STOCK Act.

This legislation bars members of Congress from using nonpublic information they receive as part of their job to turn a personal profit. The STOCK Act therefore makes it clear that members of Congress are subject to Rule 10b-5 insider trading prohibitions.

This legislation also mandates that members of Congress disclose any financial transactions within 45 days of execution.

Realistically, however, the STOCK Act has fallen well short of its intended mandate. To date, not a single member of Congress has been prosecuted under the STOCK Act.

Critics argue that it’s often too difficult to prove that the nonpublic information was acquired from the member’s role in office, as was likely the case in the instance of Senator Richard Burr. The definition of “nonpublic” has also become more blurred, due to the increased availability of information in the modern age.

For these reasons, there’s been a fresh push to completely ban members of Congress—as well as senior staff and close family—from trading individual stocks altogether. Whether these efforts ultimately develop into effective and comprehensive legislation is another question entirely.

The Ban Conflicted Trading Act, introduced in the House, would theoretically prohibit lawmakers and senior staff from owning or trading individual stocks, as well as from serving on corporate boards. This legislation was proposed by a bipartisan group in the House of Representatives.

Alternatively, the TRUST in Congress Act would require members of Congress (as well as their spouses and children) to put certain investment assets into a blind trust during their service as public servants. This bill was introduced by House Representatives Abigail Spanberger and Chip Roy.

The Ban Congressional Stock Trading Act, introduced in the Senate by Jon Ossoff and Mark Kelly, is viewed as a companion bill to the TRUST in Congress Act.

For its part, the American public appears to support such measures. In a poll conducted by Data for Progress earlier this year, 67% of respondents expressed support for a comprehensive ban of stock trading by members of Congress.

On the other hand, there are some within the investing community that have established a niche following the trades made by members of Congress, and publishing that information for consumption by fellow investors and traders. For this group, a ban on such trading wouldn’t likely be welcome.

One player in this niche is “Iris”—a social investing platform that publishes other people’s trades. Users of Iris can elect to receive push notifications that alert the user when a new trade is disclosed by a certain individual (e.g. Nancy and Paul Pelosi).

Two databases created and operated by Tim Carambat—House Stock Watcher and Senate Stock Watcher—function in a similar fashion.

However, that certainly doesn’t mean that every investment decision made by a member of Congress guarantees a profitable result.

For example, back in March, a Congressional financial disclosure revealed that the same account managed by Paul Pelosi exercised call options on Tesla (TSLA). Such a move means that he elected to convert those calls into long stock. Year-to-date, shares in Tesla are down roughly 40%, and since March 17, Tesla shares are down 17%.

This example helps illustrate the potential pitfalls of a blanket approach that piggybacks on the investment/trading decisions of Congressional members. Much like in the real world, some members of Congress likely possess more market savvy than others.

To follow everything moving the financial markets on a daily basis, tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.