Trump Media Part 2: How Traders Can Approach this Meme Stock

Here is what to consider when evaluating the value of Trump Media & Technology Group

- The 2024 election—and other forthcoming developments—are expected to heavily influence the underlying value of the Trump Media & Technology Group (DJT)

- The election is so critical to the prospects of the company that it represents a “binary event” for the stock.

- To track risk in DJT, market participants can follow implied volatility, as well as the “expected move” for key events.

The recent debut of the Trump Media & Technology Group (DJT) via a SPAC merger has created a highly volatile listing in the stock market. Extreme volatility can sometimes lead to attractive trading opportunities, but not without a substantial degree of risk.

As we noted in another blog post Trump Media investors must keep in mind that the stock could be subject to a binary move in November, if not before. Here, we outline how market participants can track risk in DJT, so they can better evaluate potential risks and rewards in this listing.

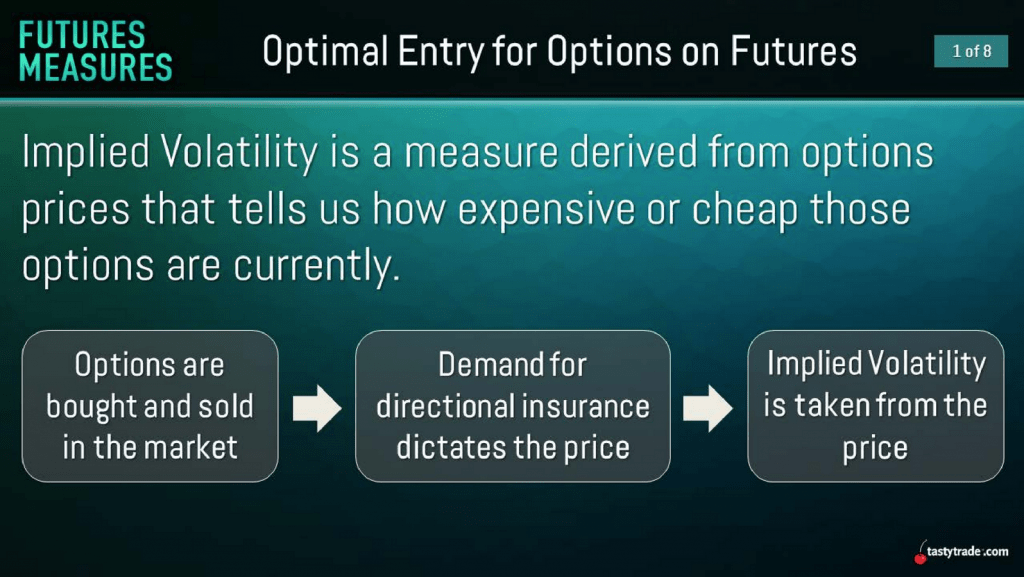

To track ongoing risk in shares of DJT, investors and traders utilize implied volatility in the associated options market. However, market participants can also track expectations for a potential binary event using an options concept known as “expected move.”

Tracking implied volatility in DJT

To track the value of options prices, one of the best metrics to follow is implied volatility. Implied volatility reflects the future expectations for movement in the associated underlying.

The best thing about implied volatility is that it can be tracked over time. For example, over the last 52 weeks, implied volatility in hypothetical stock XYZ might have ranged between 30 and 80. That context provides important insight into the options prices of XYZ. When implied volatility in XYZ is 80, that suggests that options prices are relatively high, and potentially expensive.

On the other hand, if implied volatility in XYZ is closer to 30, that would indicate that options prices in XYZ were relatively low, and potentially inexpensive. Implied volatility is historically mean reverting, which means low levels tend to trend higher (toward the long-term average), while elevated levels tend to trend lower.

To quickly ascertain the volatility picture in an underlying security, investors and traders can use metrics such as implied volatility rank (IV rank or IVR). IV rank reports the current level of implied volatility in an underlying relative to the last 52 weeks of data, and is expressed as a value between 0% and 100%

Using the previous example, the 52-week range in hypothetical underlying XYZ was between 30 and 80. So if implied volatility were 30, that would represent an IV rank of 0%, because 30 is the lowest level of implied volatility observed over the last 52 weeks. Along those lines, if implied volatility was trading 80, then IV rank would be 100%.

As one can see, higher levels of IV rank indicate that options prices in an underlying security are relatively expensive, especially as compared to the last 52 weeks of data. And if IV rank is 0-20%, that might infer that implied volatility in each underlying was relatively low. Options traders often use this data to help with trading decisions, whether that be selling expensive options, or buying inexpensive options.

The one complication with DJT is that the SPAC merger with Digital World Acquisition Corp. occurred very recently (March 25). That means there isn’t a lot of data to rely upon to determine whether implied volatility in DJT is high or low (e.g. expensive or cheap) currently.

On the other hand, implied volatility in DJT is high on an absolute basis. And that’s a valuable insight because it indicates that options market participants believe there is a high likelihood of extreme movement in this underlying security. The fact that implied volatility is elevated on an absolute basis also dovetails well with the possibility of a binary move in DJT.

As of early April, implied volatility ranges between 100% and 200% across the regular monthly expirations in the DJT options market. For the front month options, which expire on April 19, tastytrade data indicates that DJT implied volatility is roughly 160%, which indicates options market participants expect DJT to trade between roughly $30 and $50 over the next couple of weeks.

Of course, the actual move in DJT could vary greatly from those expectations. Shares of DJT currently trade for about $40/share.

Tracking potential binary events in DJT using “expected move”

In addition to assessing whether options prices are high or low using implied volatility, investors and traders can also utilize the options market to track the potential for a binary move.

This concept is typically referred to as “expected move, ” which is often utilized for corporate earnings announcements. But the expected move calculation can also be valuable when tracking and trading binary events.

At a high level, the expected move is derived from the options market, and provides insight into the market’s expectation for the amount a stock will move during a particular event. This may be expressed in absolute dollar terms, or as a percentage of the stock’s total value.

One quick “back of the envelope” method to estimate the expected move is to simply add together the value of the at-the-money call and put. This approach is especially valuable if the options are poised to expire, because that helps ensure the bulk of the value in the options is attributable to the event.

For example, imagine that DJT is trading $40/share on November 4, the day before the election. On that day, the weekly options market (expiring November 8) shows that the $40-strike call in DJT is trading $10.00, and the $40-strike put is also trading $10.00

To calculate the expected move for the election-related binary event, one would simply add together the value of at-the-money calls and puts. This value is commonly referred to as an options straddle, which is an oft-used options trading strategy. In this hypothetical scenario, the value of the straddle would be $20 ($10.00 + $10.00). That implies that the market is expecting shares of DJT to move up or down $20 based on the outcome of the election.

In percentage terms, $20 also represents 50% of the value of DJT shares ($20/$40 = 50%). So, in this case, the expected percent move would be 50%.

As one can see, these figures provide valuable insight into the market’s expectation for the event. It’s important to note, however, that the expected move represents the market’s expectation for a binary event.

The actual move could end up being much smaller or larger than the market’s expectation. In the previous example, the expected move is 50%, but the underlying stock could move by 5%, 25%, or even 100%.

Importantly, traders can utilize a variety of approaches to calculate expected move. This approach is a very handy “back of the envelope” approach for options that are nearing expiration. However, some options market participants have their own unique method of calculating expected move.

At tastylive, for example, the preferred calculation involves taking 85% of the at-the-money (ATM) straddle on the day before the event. Using the previous example, that calculation would equate to an expected move of $17.00 ($20 x 85% = $17.00).

Importantly, it’s a lot more complicated to project the expected move for an event that is weeks—or months—away. That’s because the value of longer-dated options are priced not only for that specific event, but also for any other potential developments that might occur in the interim. For a volatile stock like DJT, that could potentially encompass a string of significant developments.

For example, what if one of Trump’s various court cases were to settle in a favorable or unfavorable manner? That type of news could catalyze a significant move in the underlying shares of DJT, as well. Along those lines, one can’t overlook the fact that the Trump Media & Technology Group will be reporting quarterly earnings in 2024, which will also likely impact perceptions of the company’s value.

Moreover, Trump could decide to liquidate his stake in the company after the lockup period ends. Based on a six-month lockup, which means Trump will be free to do so before the November election. Under that scenario, shares of DJT could be overwhelmed by negative sentiment.

Volatility and risk are the watchwords in DJT

Investors and traders holding an existing position in Trump Media—or considering a new position—should be aware that this stock may be subject to extreme volatility in the coming weeks and months.

That expectation is based not only on past performance in shares of DJT, but also the sky-high implied volatility observed in the DJT options market.

Moreover, the risks in this listing are further amplified by the fact that the stock trades with limited liquidity and is “hard to borrow.” The latter means shares are hard to locate for the purposes of short selling. The net effect of these factors is that the options market for DJT is skewed heavily to the downside.

Volatility skew refers to the distribution of implied volatility across different strike prices in each expiration period. Normally, skew is biased negatively, meaning downside puts are typically more expensive than upside calls. This occurs because downside puts typically enjoy strong demand due to their key role in hedging against corrections.

In the case of DJT, the options market is skewed extremely negatively, meaning the downside puts are significantly more expensive than the upside calls. One reason for that heavy downside bias is undoubtedly attributable to the fact that DJT’s market capitalization is much higher than the valuation implied by its underlying financials. The fact that the shares are hard to borrow is another reason for the extreme steepness in skew.

Going forward, investors and traders can use the options market to glean additional insights about shifting perceptions of risk in Trump Media. When the 2024 presidential election finally rolls around, it will be interesting to see where the underlying stock is trading, and where the options straddle is priced the day before the election.

Investors and traders should keep in mind that any position in DJT—whether focused in the underlying stock or the associated options—should be considered extremely risky and highly speculative.

To learn more about binary events and associated expected moves, readers can check out this installment of From Theory to Practice on the tastylive financial network. Additionally, this episode of The Skinny on Options Math also provides valuable perspective on binary events.

To follow everything moving the markets, including the options and futures markets, readers can tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.