Trump’s Panama Canal Controversy: High Tolls, Tariffs and Trade Wars

Trump’s Panama Canal talk stirs the pot, but his proposed tariffs could really stir the markets

- The Panama Canal has become a political flashpoint, but Trump’s proposed tariffs pose the real threat to global trade.

- While control of the canal appears unlikely to change, tariffs could disrupt the global economy, especially seaborne trade.

- The marine shipping sector stands to lose revenue and profitability if the tariffs go into effect.

Last week, President-elect Donald Trump suggested reestablishing U.S. control of the Panama Canal, a vital passage for global shipping. Combined with his remarks about acquiring Greenland, the rhetoric raises deeper questions about America’s role in shaping critical international infrastructure. While his comments on the Panama Canal have generated headlines, the real focus should be on the potential effect of his other trade policies—especially the looming tariffs—which stand to reshape the global economy.

Tariffs, especially those aimed at China, could disrupt key trade routes, increase costs and ultimately depress trade. And for the marine shipping sector, which is already grappling with climate-related issues and geopolitical tensions, tariffs could become a new headwind. The real question isn’t what Trump can do about Panama’s tolls—it’s how his broader economic agenda will reverberate through the global economy.

Panama Canal: the latest political flashpoint

Trump has stirred debate by publicly questioning the future control of the Panama Canal and the potential acquisition of Greenland by the United States. His remarks appear particularly noteworthy because of the complexities in the marine shipping industry and the reduced availability of rare earth elements—resources Greenland holds in material quantities. Trump’s comments on the canal seem especially striking, given the waterway’s key role in marine shipping and the 1999 treaty that transferred sovereign control over it to Panama.

The catalyst for Trump’s remarks about the canal appears to be the rising cost of tolls, which he perceives as price gouging. In public statements, he denounced the “ridiculous” charges, arguing they strain the U.S.-Panama relationship, considering the historical generosity of the U.S. in funding the canal’s construction and operation. Trump threatened the U.S. would take control of the canal if Panama fails to address the issue. American control would ensure security and prevent foreign influence—particularly from China, which has become active in the region.

The Panama Canal is crucial for global shipping, providing a shortcut between the Atlantic and Pacific Oceans and significantly reducing shipping time. The U.S. has been a heavy user of the canal, and Trump’s recent remarks reflect both national security concerns and economic interests. With Panama set to increase fees starting Jan. 1, the president-elect’s call for action could be viewed as part of a broader debate about pressure facing global trade, particularly in light of recent volatility in the global shipping sector.

This issue also aligns with broader conversations about U.S. foreign policy and its strategy for controlling critical global infrastructure. With the U.S. facing geopolitical and climate-related challenges, particularly in regions like Panama and the Middle East, Trump’s comments reignite debates over America’s role in global trade and shipping routes. Notably, the Suez Canal, a vital trade passage, has required the protection of sovereign militaries because of increasing security risks. That includes Operation Prosperity Guardian, a U.S.-led coalition that protects commercial shipments through the Red Sea and Suez Canal.

Seaborne trade: compounding challenges weigh on sector

Global shipping has become a focal point in recent years as a series of challenges altered its dynamics. These disruptions began when COVID-19 led to widespread bottlenecks, port congestion and elevated shipping costs. As the pandemic receded, the situation took on new complexities, notably the intensification of the war in Ukraine, which further strained global supply chains. In addition, climate-related issues, such as the drought in Panama and tensions in the Middle East, have compounded these difficulties.

The Panama Canal, a vital shipping artery, has been hit hard by climate challenges. The prolonged drought in Panama has caused water levels to drop, forcing the canal authority to reduce the number of ships allowed to pass through. As a result, ships are forced to wait longer for their passage, which not only delays deliveries but also increases the cost of passage. These higher costs have prompted some shipping companies to explore alternative routes, adding time and expense to their journeys. Rerouting adds both logistical headaches and increases costs. The latter are borne in part by end-users (e.g. American consumers).

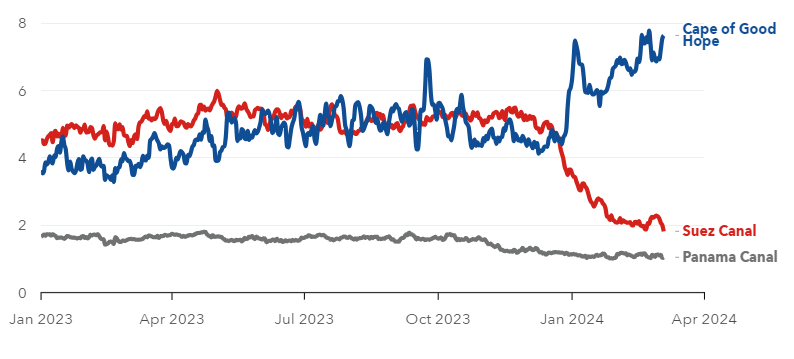

Meanwhile, the Suez Canal has been beset by its own set of problems. Geopolitical instability, particularly attacks from Houthi rebels in the Red Sea, has disrupted shipping. That’s led ship operators to reroute their vessels around the Cape of Good Hope, resulting in not only longer voyages but also higher freight rates because of the extra fuel and time required. This disruption has negatively affected Suez Canal revenue, which has declined by more than $2 billion, compared to the previous year.

While the Panama Canal has adapted somewhat by raising tolls to offset the revenue decline caused by fewer transits, the Suez Canal has faced a sharp decline in daily trade volume (illustrated above), which has resulted in lower revenue. These disruptions have added stress to the already burdened shipping industry, which has escalated lobbying efforts in Washington and may have triggered Trump’s recent statements about the Panama Canal.

Trump’s trade and national security policies provide shipping executives with a clear opening to push for policy adjustments that could ease rising costs and stabilize global trade. This shift has turned the Panama Canal, once a relatively low-profile issue, into a hot-button topic as Trump heads into his second term.

Taking back the canal, a thorny proposition

Despite Trump’s recent threat to “take back” the Panama Canal, reasserting control over this vital waterway would be extremely difficult. It would probably require a major military conflict because Panama is unlikely to cede control voluntarily. To understand this situation, let’s review the history and legal framework governing the canal today.

After the canal was completed in 1914, the U.S. controlled it for most of the 20th century, using it as a strategic and commercial asset. However, by the 1970s, the canal had become a point of contention, particularly for the Panamanian people, who viewed U.S. control as a lingering symbol of imperialism. After years of negotiation, the U.S. and Panama signed the Torrijos-Carter Treaties in 1977, which outlined a path for the U.S. to relinquish control of the canal by 1999. These treaties included provisions to ensure the canal’s neutrality, while also allowing for U.S. military intervention in the event of a threat. However, these provisions do not include any clauses that would allow the U.S. to reclaim total control of the canal.

Since the transfer in 1999, Panama has managed the canal efficiently, increasing traffic and modernizing the waterway, including a 2016 expansion to accommodate larger vessels. Trump’s suggestion to “take it back” ignores legal and diplomatic agreements in place for years. Panama’s sovereignty over the canal is enshrined in international law, and the country’s pride in controlling such a critical national asset is not something it is likely to relinquish.

Besides, Trump’s comments about “ripping off” the U.S. with increased tolls reflect a misunderstanding of the broader context. Rising shipping fees are largely attributable to the severe drought that lowered the canal’s water levels, forcing Panama to limit traffic and raise tolls to offset reduced capacity. While some shipping executives have voiced concern about the higher costs, that doesn’t provide a legal basis for the U.S. to reassert control over the canal.

If Trump does try to force a solution that benefits American interests, it could backfire, tarnishing the country’s reputation in a strategically critical region. Panama has already rejected Trump’s claims, with President José Raúl Mulino stating unequivocally that the canal belongs to Panama and will remain under Panama’s control. Additional provocations by President Trump could reopen old wounds and potentially alienate Panama, as well as other partners in Central and South America.

Tariffs vs. tolls: the real threat to seaborne trade

Elevated tolls at the Panama Canal may be a valid point of contention, but they represent only a small piece of the puzzle when it comes to the challenges facing seaborne trade. A more critical concern lies in the potential impact of Trump’s trade policies, particularly a new wave of tariffs, which threaten to exacerbate the shipping sector’s struggles.

For instance, higher tariffs—especially on Chinese imports—would directly affect export volume to the U.S., putting immense pressure on shipping companies that rely on these trade flows. The container shipping sector, deeply embedded in the U.S.-China trade corridor, stands to suffer most. And even if Trump’s hardline stance on the Panama Canal succeeds in lowering tolls, those potential savings may be overshadowed by the broader economic consequences of the tariffs.

The struggles facing the shipping industry are already evident in the financial markets, where marine shipping stocks have been overtaken by bearish sentiment. Optimism marked the beginning of 2024 for companies like Frontline (FRO), Star Bulk Carriers (SBLK) and Matson (MATX). They all posted strong early performances, but their gains have largely evaporated. Fitch Ratings expects the industry to remain “stable” in 2025, but that’s hardly a ringing endorsement, especially when it comes to investment appeal. The year-to-date returns in the marine shipping sector provide further evidence of investor caution in this space, as highlighted below (sorted by year-to-date return).

- Matson (MATX), +21%

- Euroseas (ESEA), +3%

- Overseas Shipholding (OSG), -7%

- Golden Ocean Group (GOGL), -8%

- Teekay (TK), -8%

- Safe Bulkers (SB), -10%

- SFL (SFL), -11%

- Genco Shipping (GNK), -14%

- Scorpio Tankers (STNG), -21%

- International Seaways (INSW), -23%

- Teekay Tankers (TNK), -24%

- Tidewater (TDW), -27%

- Star Bulk Carriers (SBLK), -29%

- Frontline (FRO), -30%

- EuroDry (EDRY), -40%

Uncertain outlook for seaborne trade and marine shipping

Despite the attention Trump’s jawboning on the Panama Canal have garnered, the true challenge for the shipping industry isn’t in the headlines. While Trump’s rhetoric has raised eyebrows, his administration’s influence over the canal’s operational difficulties remains limited. Instead, the real threat lies in his broader economic policies, especially tariffs that could inflict more economic impact than the high canal tolls in Panama.

The future of the marine shipping sector is intertwined with the state of global trade. If the proposed tariffs come into effect and stifle international commerce, the shipping industry could see reduced demand, squeezing growth and profits. On the flip side, if these proposed tariffs are only a negotiating threat and the global economy picks up steam, the shipping sector could be a big beneficiary.

Taking all of the above into account, the marine shipping sector is probably best viewed as a “hold” instead of a “buy.” There’s simply too much uncertainty in the sector’s near-term outlook. That said, things could change quickly. Any uptick in global economic growth, in conjunction with increased trade, could transform the sector. In the meantime, investors should focus on concrete developments, as opposed to rhetoric, when assessing the near-term fortunes of the marine shipping sector.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.