Why U.S. Sanctions Play a Key Role in the Global Market for Crude Oil

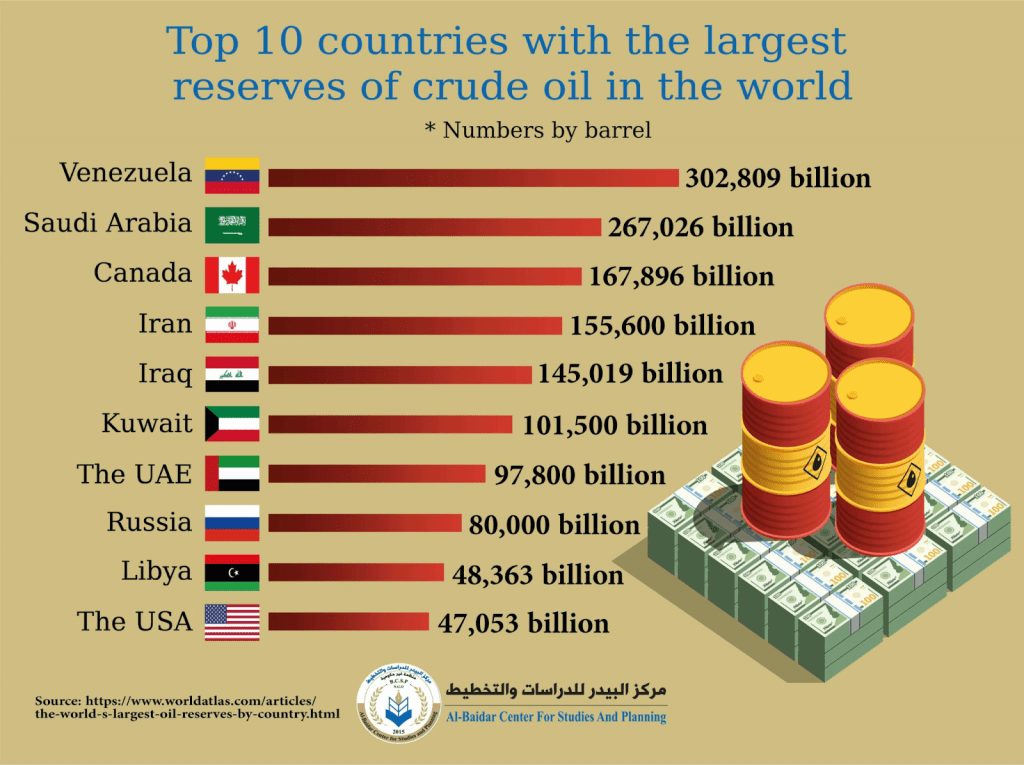

The U.S. government currently maintains oil-related sanctions against Iran, Russia and Venezuela, which together account for nearly 35% of the world’s proven oil reserves

Prior to the start of the war in Ukraine in 2022, the United States government had sanctioned two countries with some of the largest reserves of crude oil on earth.

However, after the Russian Federation expanded its war with Ukraine, the American government added one of the world’s largest annual oil producers to the list, as well.

Today, that means nearly 35% of the world’s proven oil reserves now fall under U.S. sanctions, which effectively represents an oil embargo on those countries. That reality was underscored recently by Frank Giustra, a Canadian billionaire, who estimated that U.S. sanctions may even cover as much as 40% of total proven oil reserves.

Earlier in June, Guistra told The Intercept, “Did you know, by the way, that 40 percent of the world’s oil reserves are under [U.S.] sanctions? Venezuela, Iran, and Russia? Forty percent are under sanctions.”

Iran, Russia and Venezuela rank among the top ten countries with the largest concentrations of proven oil reserves, and are currently prohibited from exporting crude oil to the U.S., and many other parts of the world.

Of course, reserves are one thing, while actual production is another.

Last year, Iran and Venezuela together produced roughly four million barrels of oil per day (on average), which represented only about 5% of daily global output.

However, Russia produced more than 10 million barrels of oil per day last year, which represents about 13% of daily global production. That means Russia exercises more influence over the global oil market than Iran and Venezuela—even though both of the latter countries have substantial proven reserves.

Taken all together, one can see why the oil market reacted so dramatically when Russia expanded its war with Ukraine, because it was clear the conflict would further disrupt the global oil market.

Last year, crude oil surged above $120/barrel as concerns over potential supply shortages stoked panic-buying around the world.

However, that elevated price environment didn’t last long and crude oil retraced back below $100/barrel in fall of 2022, and has since then dwindled all the way back down to around $70/barrel.

Today, concerns over the slowing global economy have overtaken sentiment in the oil market, and pushed last year’s supply concerns to the back burner.

But if the global economy were to get back on track, sentiment could easily shift, which could boost prices. Especially with American sanctions on Iran, Russia and Venezuela still in place.

Moreover, any additional supply shocks—whether they be geopolitical in nature or weather-related—could also be constructive for oil prices. That might help explain why the U.S. is currently considering a comprehensive rollback of Venezuela’s oil-related sanctions.

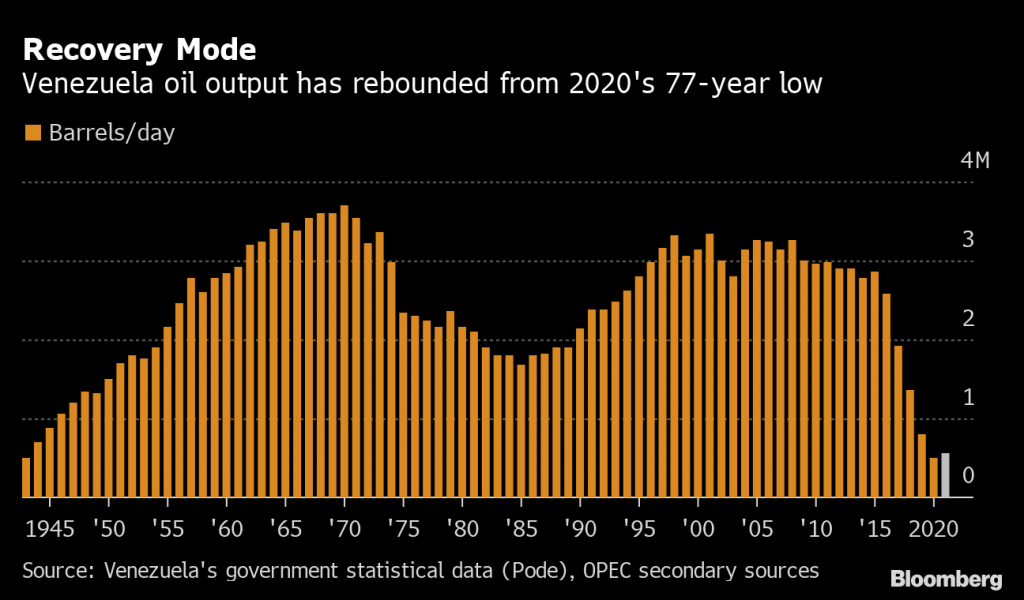

Last year, Venezuela only produced about 700K barrels per day of crude oil, but as recently as 2017, the country was pumping out upwards of 2 million barrels per day.

That data suggests that with assistance from the U.S. energy sector, Venezuela could ramp up production in relatively short order, and provide a buffer to the global market in the event of a future supply shock.

Oil sanctions against Iran and Russia

At present, the oil sanctions against Venezuela probably have the best chance of being rolled back, as compared to the current sanctions levied against Iran and Russia.

Russia can easily be struck off the list because the current administration in Washington D.C. is closely allied with the government of Ukraine—along with most of western Europe and a diverse coalition of other countries from around the world.

For this reason, the current energy sanctions against Russia—which include a complete ban on the import of Russian oil, gas and coal—won’t likely be retracted anytime soon.

Along those lines, the sanctions against the Iranian government, including sanctions against the Iranian oil industry, are equally ironclad.

The U.S. first sanctioned Iran in 1979, after a group of radical students seized the American embassy in Tehran and held some of the embassy workers hostage. A new series of sanctions was applied to Iran in 2006 and were designed to force the country to abandon its goal of building a nuclear weapon.

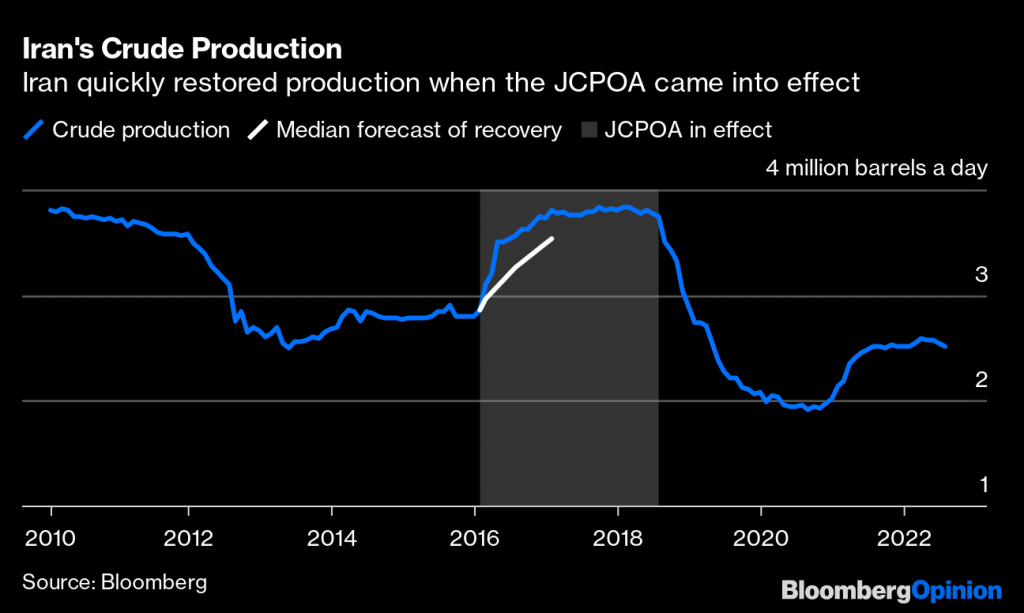

However, most of the existing sanctions on Iran were lifted from 2015 to 2018, when the Joint Comprehensive Plan of Action was adopted in October 2015. This agreement is known widely in the U.S. as the “Iran nuclear deal.” As part of this deal, Iran agreed to suspend its nuclear program in exchange for sanctions relief from the West.

Iran was able to restore a significant amount of its daily production during the life of the Iran nuclear deal, but that window didn’t last long.

The Iran nuclear deal remained in place from October 2015 until May 2018, when former President Donald Trump withdrew the U.S. from the agreement. In conjunction with that move, the U.S. government also reenacted unilateral sanctions against Iran. The sanctions prohibit all U.S. persons and entities from doing business with Iran.

Moreover, the sanctions are extraterritorial, which means non-U.S. persons and entities are also prohibited from doing business with Iran, and could be subject to punishments/sanctions for doing so.

Earlier this spring, the Biden administration announced it was no longer focused on renegotiating the aforementioned Iran nuclear deal because the talks had essentially ground to a halt, and were viewed as a wasted effort.

Instead, the U.S. government actually upped the ante against Iran in March 2023, and imposed a stiffer round of sanctions. The latest actions affect companies in other countries (such as China and Vietnam) that are purportedly helping Iran export its oil onto the world market.

Considering this backdrop, the current sanctions against the Iranian energy sector appear almost as firmly entrenched as those against Russia.

The Venezuelan gambit

Unlike the aforementioned sanctions against Iran and Russia, the United States has recently shown a willingness to potentially lift the existing sanctions against the Venezuelan oil industry.

In 2006, the U.S. government enacted a wide range of financial sanctions against Venezuelan President Nicolas Maduro and members of his administration, including a complete ban on Venezuelan oil imports.

Then, in 2017, former President Trump tightened those sanctions in hopes of triggering regime change in the country. Today, the current White House administration still maintains most of those restrictions, but they have failed to produce the intended result—Maduro remains firmly entrenched as the country’s leader.

Due to recent geopolitical developments elsewhere in the world (i.e. the Ukraine war), the U.S. government now appears to view Maduro/Venezuela as the lesser of three evils, and has reportedly made overtures to Venezuela about lifting the sanctions in exchange for political concessions from the Venezuelan government.

The American oil giant Chevron (CVX) still maintains a small presence in Venezuela, and the Biden administration has apparently offered to allow the company to ramp up its operations—if Maduro agrees to negotiate in good faith with his political opponents to help ensure free and fair elections in 2024.

The state department has asserted that the revitalization of Venezuela’s oil industry could help stabilize Venezuela’s economy, which in turn could help alleviate the ongoing humanitarian crisis that has engulfed the country.

Last November, the U.S. granted Chevron a limited license to export Venezuelan oil to the U.S., but with the caveat that any profits produced from that activity would be used to pay back U.S.-based creditors of Venezuela.

If the U.S. were to lift 100% of the oil-related sanctions against Venezuela, that development could actually weigh on prices, because it would theoretically boost the available supply of oil on the global market. It would also provide an important buffer if another supply shock were to develop elsewhere in the world.

The chart below illustrates how Venezuela could potentially transform back into a key player in the global energy market if sanctions were no longer an obstacle.

To learn more about trading the global crude oil market, check out this episode of Splash Into Futures on the tastylive financial network. To follow everything moving the markets in 2023, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.