What France’s Election Means for Global Credit Spreads

In the summer of 2024, political uncertainty in Europe is becoming a key focus on Wall Street

- Political uncertainty in France appears to have spooked global credit markets.

- In the United States, the spread between government and corporate yields climbed to its highest level in three months.

- Known as a “credit spread,” this gauge of market risk reflects the difference in yields between two sets of bonds, typically government vs. corporate bonds.

When financial markets become volatile, most active investors monitor the Chicago Board Options Exchange’s (CBOE) Volatility Index (VIX) to gauge market “fear.” However, other indicators, such as credit spreads, also provide valuable insight into the broader risk environment.

A credit spread measures the difference in yields between two bonds. For example, a common method compares the yield on government bonds, like those issued by the United States, to the yield on corporate bonds. Government bonds are considered low-risk, with a minimal chance of default. In contrast, corporate bonds carry higher risk, reflected in higher yields.

Evaluating credit spreads helps investors understand the relative risk in financial markets, offering a critical perspective beyond traditional volatility measures. When bond investors and traders get nervous, the yields on corporate bonds typically rise, as market participants lighten exposure to this asset class.

And as most are aware, bond prices and bond yields share a strong, inverse relationship—meaning that as bond prices fall, yields typically rise, and vice versa. That’s why the divestment of corporate bonds (i.e. selling pressure) usually leads to lower prices and higher yields.

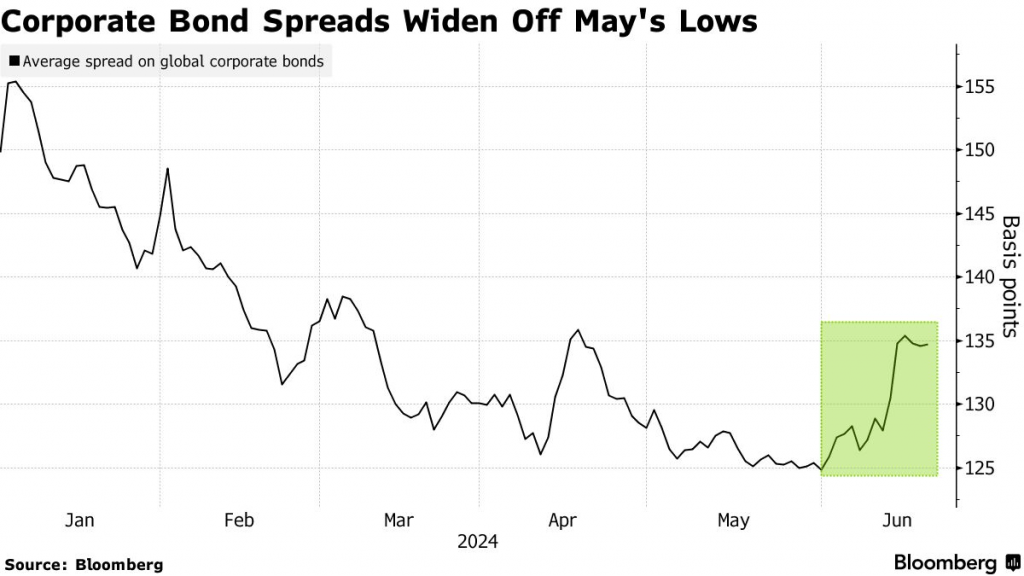

As of late June 2024, credit spreads are in the news because there’s been some subtle, but notable, shifts in the global bond markets. According to Reuters, the spread between government and corporate yields in the U.S. recently climbed to its highest level in three months, indicating that anxieties have ramped up slightly in Q2, as illustrated below.

This shift appears to stem from political uncertainty in the European Union—particularly in France. Importantly, shifts in credit spreads have at times represented the “canary in the coal mine,” preceding disruptions in the global financial system.

Political and fiscal uncertainty in France

France may not have the largest economy in the world, but as a G7 member, it plays a significant role in global affairs. And this summer, France has garnered extensive media coverage because of the country’s upcoming elections, which could trigger significant political changes.

Starting June 30, French citizens will engage in a two-part general election. In the first round, voters choose from a broad range of candidates. If no candidate secures a majority, a second round then features the top two candidates from first vote. This runoff system ensures the final elected candidate has a clear mandate from the majority of voters.

In 2024, the stakes are particularly high for the French elections. Recent polling suggests the current centrist leadership of President Emmanuel Macron could be replaced by a far-right coalition. This shift would mark a significant change in France’s political landscape, potentially impacting the entire European Union. Dramatic changes could transform fiscal management, immigration and trade.

The far-right Rassemblement National party leads the polls, with the left-leaning New Popular Front in second place. These elections are seen as a critical referendum on Macron’s presidency and a pivotal moment for France and Europe.

Illustrating the risk associated with the election, the primary benchmark for the French stock market—the CAC 40—corrected by almost 10% between May 15 and June 15. Moreover, the euro has seen increased volatility and has been weakening in value against the U.S. dollar since the start of June. These developments underscore the uncertainty associated with the upcoming elections.

The election results could influence France’s stance on key EU policies, potentially leading to shifts in the union’s overall direction. For example, the prospect of a far-right government raises concerns about more protectionist economic policies, stricter immigration controls and a potential re-evaluation of France’s commitments to EU agreements. Investors are closely monitoring these developments, because the outcome could have far-reaching consequences for not only France, but the broader European Union.

Considering the situation in France, it’s no great surprise that credit spreads have also been shifting in Europe.

More context on credit spreads

Not long ago, the gap between the yields on French 10-year yields vs. German 10-year yields climbed to its highest point since 2017, reflecting investor preference for the relative stability offered by German bonds.

Similarly, the yields on lower rated Portuguese bonds have also performed better than their French equivalents, of late. Interestingly, credit spreads have also widened in the United States, likely underscoring the integrated nature of the modern, global economy.

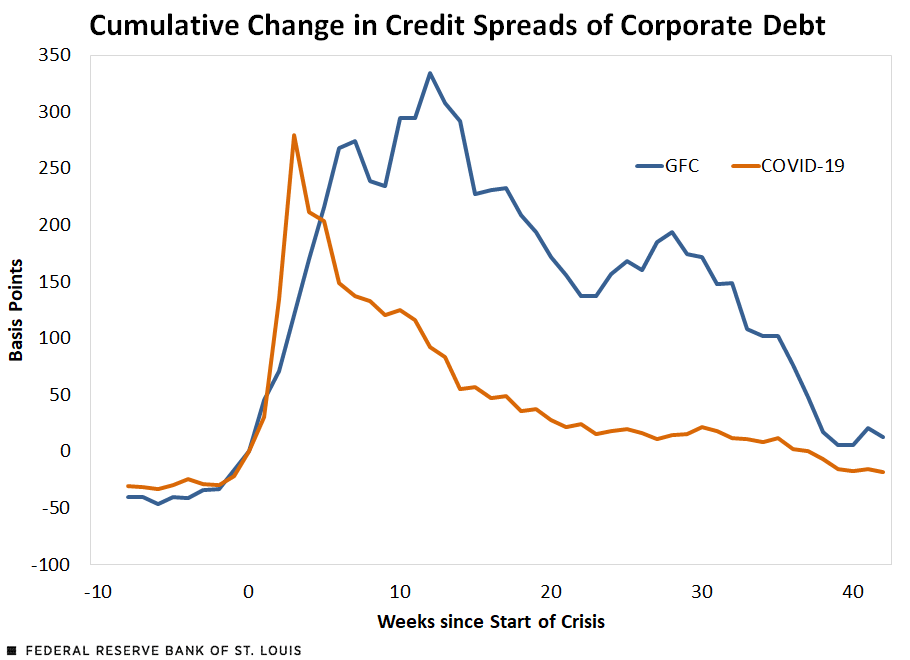

However, credit spreads have not yet entered crisis territory—far from it. In 2008 and 2009, credit spreads in the United States widened to some of the most extreme levels on record amid the broader global financial crisis (GFC). Credit spreads also ballooned during the COVID-19 pandemic, as illustrated below.

As shown above, credit spreads widened significantly during both the GFC and the COVID-19 pandemic.

However, as observed above, credit spreads remained inflated longer during the GFC as compared to the COVID-19 pandemic. That was likely because of the swift action of global central banks in 2020 to loosen monetary policy—a valuable lesson that many central bankers learned during the 2008-2009 crisis.

The above chart also helps to drive home how credit spreads can serve as a key indicator of risk in the financial markets. Because as indicated on the X-axis—weeks since the start of the crisis—the spread between safer government bonds and riskier corporate bonds ballooned almost immediately. In contrast, it took many months—in the case of the GFC—for the VIX to peak and the major stock indices to bottom.

These historical precedents illustrate the importance of credit spreads in the global financial system show why active investors should closely follow this gauge of market risk.

Currently, the spread between the yields on the U.S. 10-year Treasury bond and BBB-rated corporate debt is roughly 1.35%, or 135 basis points (illustrated in the earlier graphic). In a crisis, that spread would likely widen to between 250 and 300 basis points, as observed in 2008 and 2020.

Investors and traders should note that much like volatility, yields on government and corporate bonds can be traded. To learn more about trading the bond universe, readers can check out this installment of Splash Into Futures on the tastylive financial network.

(Note: In the options universe, a “credit spread” also refers to a trading strategy that results in a net credit to the account, as opposed to a net debit. This is different from the one discussed in this article, which focuses on credit risk in the global bond/interest rates markets).

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.