Why I Just Bought More Gold Bullion

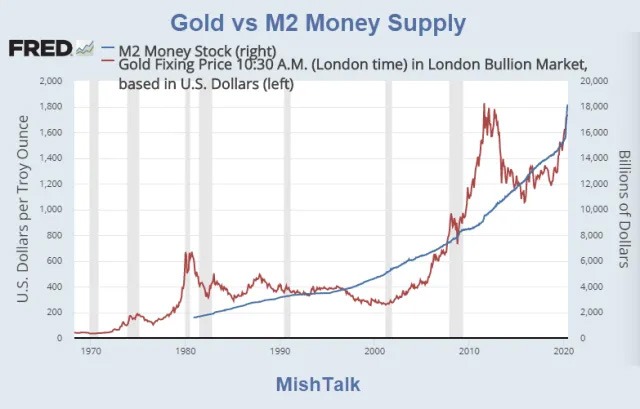

They're debasing the currency—and monetary inflation is rising with liquidity

In 2012, Peter Schiff of Euro Pacific Capital predicted on CNBC that a reckless Federal Reserve would be responsible for runaway gold prices breaking toward $5,000.

It didn’t happen. Gold collapsed from 2011 price highs after the government raised the debt ceiling, and the Fed continued its unprecedented quantitative easing.

Schiff would eventually be half-correct—the price of an ounce of gold recently topped $2,500. But the Dow Jones was a much better hedge against monetary inflation over the last decade.

Still, 12 years later, with gold breaking out this year, Schiff’s taking a victory lap.

“Gold is up almost 30% so far this year,” he said this week. “Another all-time record high today, getting close to 2,700 in the spot market. This is the best year that gold has had since 1979. A key difference between now and 1979? That was the end of the gold bull market. And in 1980, Paul Volcker raised interest rates up to 20%.”

From a macro perspective, it takes time for big, bold predictions like this to play out. But current conditions differ radically from the days when he was trying to be first over the wall on aggressive gold predictions.

We’ve seen a commitment to currency debasement over the last three years that’s radically different from the Obama and Trump years. That’s why you can and should be convinced of gold’s bright future.

It now appears the Federal Reserve is following the Bank of England’s example and giving up on inflation while trying to keep the economy afloat.

We’re “inflating” away our debt while taking on trillions in new debt at elevated prices. We’re also experiencing radical monetization and outright manipulation of the 10-year bond, or the world’s risk-free rate.

That’s spurred a lot of interest in gold and for all the right reasons.

Bill Bonner recently talked about “Inflation Forever.”

It’s because the price of gold has a solid relationship with the size of the money supply. What’s different about today is the radical shift in where credit originates.

The Fed has kept rates higher and also tapered its balance sheet. I’ve heard over and over again that monetary policy was tight and that the “money supply” or the M2 is falling.

But that’s where modern economists are lost. The M2 hasn’t mattered since July 1993. That month, then-Fed chair Alan Greenspan told Congress about the instability in the velocity of M2—the rate at which money circulates in the economy.

He explained that it was useless in setting monetary policy. He noted that financial innovation, deregulation and changes in the banking system changes contributed to the decoupling of M2 from the broader economy.

So, what else was decoupling? How about the shadow banking system, which helped fuel the long-term capital management crisis in 1997 and has been the overwhelming source of monetary organization in the last two years, adding trillions of liquidity globally since October 2022?

But now that the Fed has cut interest rates, the U.S. money supply will likely start creeping higher again. All while monetary inflation continues globally.

So, I’m buying gold again at $2,650. It’s not just because of shadow banks and the Fed. I’m losing faith in the purchasing power of the U.S. dollar more than ever before.

They can tell me the consumer price index (CPI) is just 3%. But I know just from looking at the Chapwood index, the true measure of prices, that inflation is much higher than the official tally.

With more debasement likely in China and a commitment to expansion of debt in the West, I’m happy to take on more of the shiny stuff for my own peace of mind. Of course, there’s much more to my argument and that centers on the concept of money.

What is money?

Money is traditionally believed to serve three main purposes:

- Medium of Exchange: It can be used to facilitate transactions.

- Store of Value: It preserves its value over time.

- Unit of Account: It provides a standard measure of value.

Gold met all these criteria back in the 19th century when many countries were on the gold standard, which linked paper currency directly to a specific amount of gold. That made gold “real money.”

Today, most economies use fiat money—currencies that aren’t backed by physical commodities but instead by government decree. Here’s the problem: I don’t have much faith left in the people managing the decree.

Today, gold is no longer used as a medium of exchange or a unit of account, but it remains a store of value. Its value as a global exchange—in the event of real problems—is illustrated by one of the most eye-opening monetary presentations in currency history.

Remember the Winklevoss brothers?

Cameron and Tyler Winklevoss have maintained Mark Zuckerberg ripped off their HarvardConnection idea and converted it into The Facebook. Well, they did OK in the end. Besides receiving a big check from Facebook, they formed Gemini and became cryptocurrency evangelicals.

I don’t trust bitcoin as a long-term asset because it’s worthless without electricity or cell phone connections—and I know the government would love to shut it down. But, gold and silver have a special place, and it’s because of the Winklevoss brothers.

Ten years ago this November, the brothers gave a speech at the Money20/20 conference titled “Money is Broken: Its Future is Not.” Their core argument was that money is a technology critical to facilitating transactions.

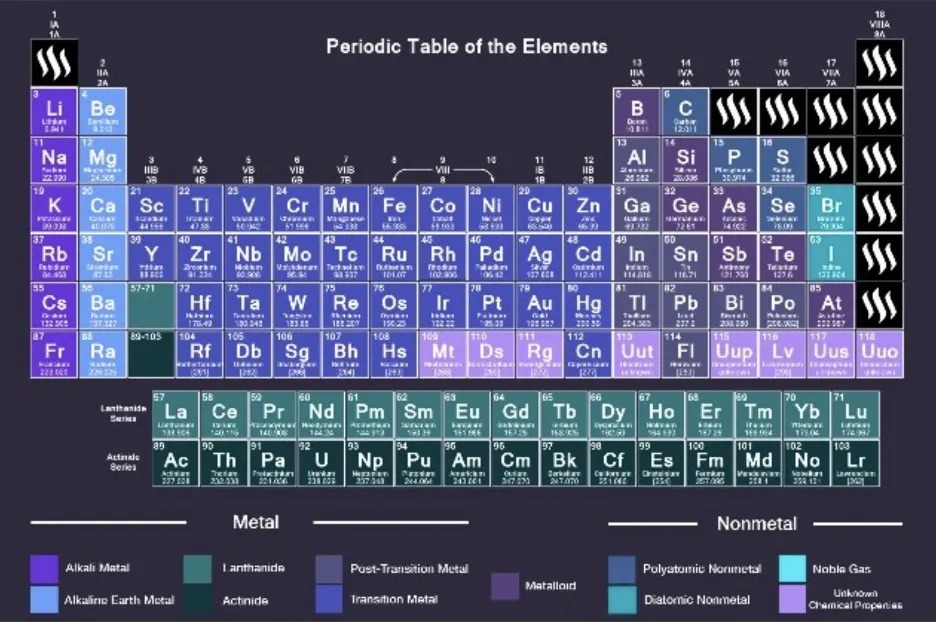

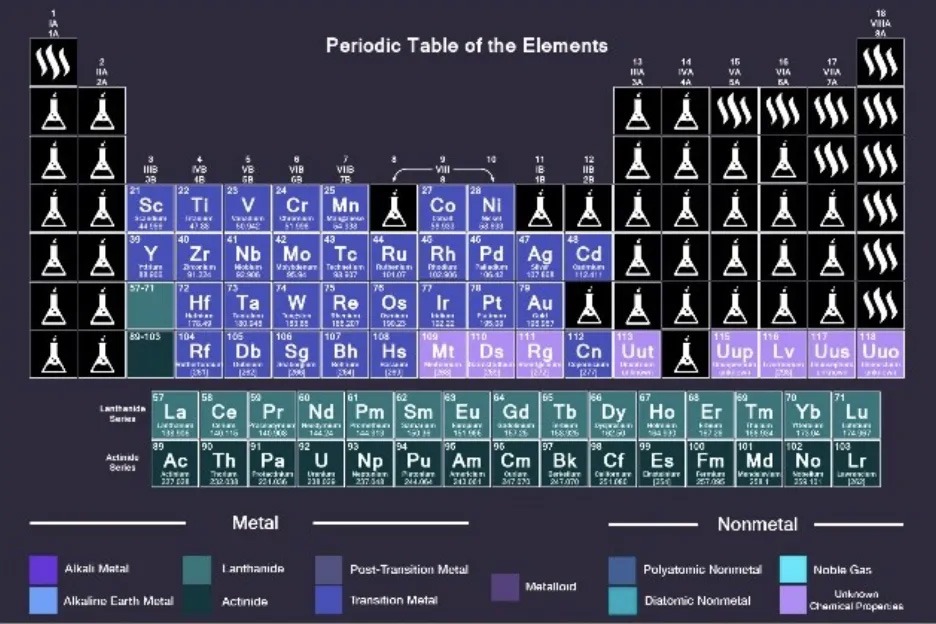

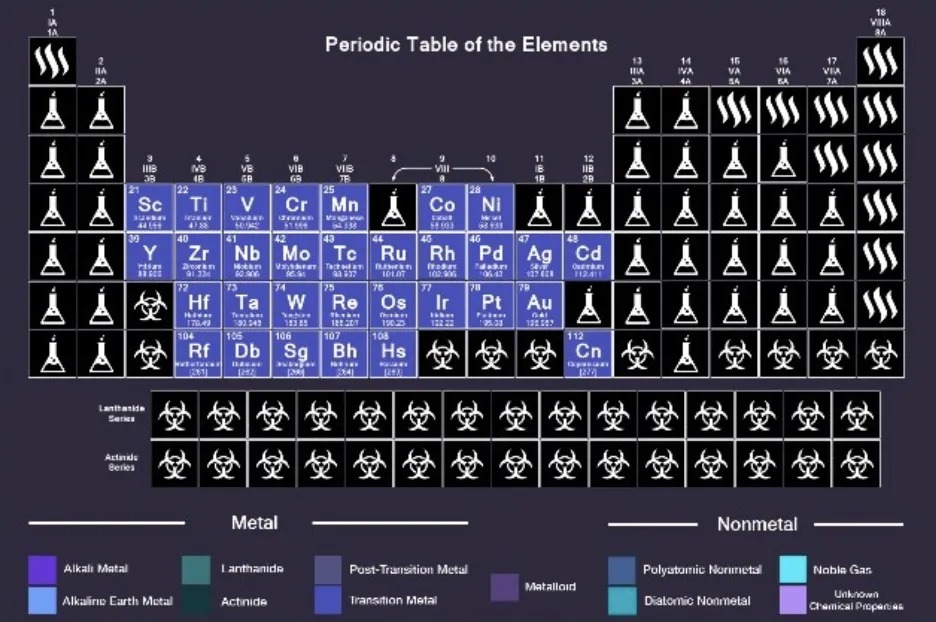

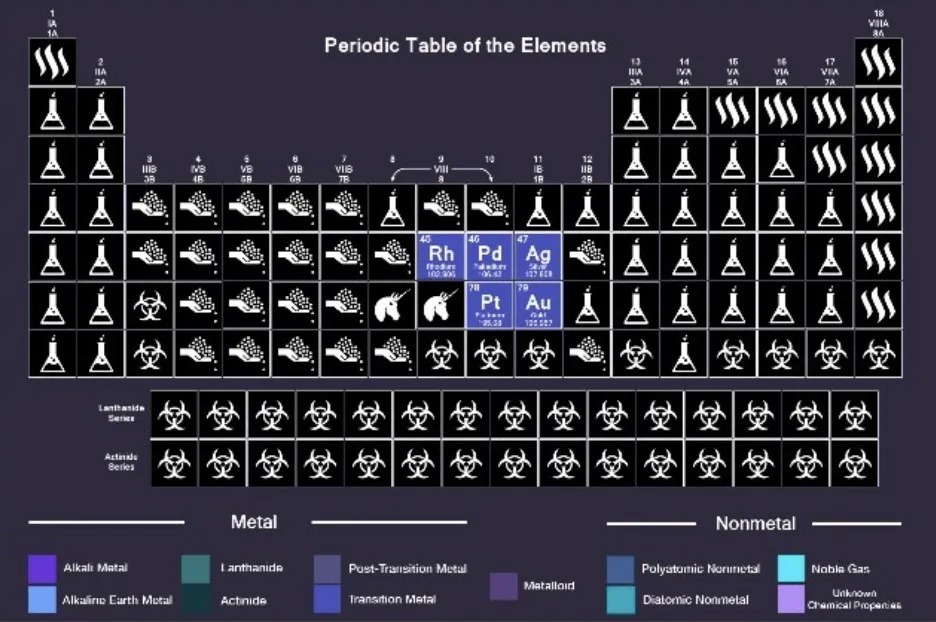

They said that long before the fiat system evolved, money was limited to a middle-school understanding of science.They broke out a poster of the periodic table of elements and said “these are your options for money” in a world where finite materials could serve as tools for transactions and ways to store your wealth.

Of course, 11 elements were gas—so hydrogen, helium and others were out.

Other elements were corrosive or poison, and lithium is not something you want to have sitting around.

Other elements were radioactive, so you had to eliminate them.

And then there’s the final issue: What is readily available?

There aren’t many solid metals that are neither corrosive nor radioactive. In fact, there are only five: platinum, palladium, rhodium, silver … and gold.

Rhodium and palladium weren’t discovered until about 140 years ago and are extremely rare. Turning platinum into coins is really hard, given its melting point is 3,215 degrees Fahrenheit.

Gold and silver were the only two things left and became logical forms of storage and exchange. That wa zs a pretty good deduction on the part of the Winklevi.

Buying more gold

Gold won’t do me much good in a revolution. Bullets and green beans are the go-to purchases when facing a reckoning.

But gold would do much better than paper money, which is already leveraged to the hilt because of the nature of the Fed’s Fractional Reserve System (there’s not as much money in circulation as money counted in banking accounts). That’s how the Fed could flood the financial markets in 2020, preventing bank runs.

If we’re going to overhaul our monetary system, my bet would be on gold’s 5,000 years of history, and because it has held its purchasing power.

I’m again repositioning my portfolio on gold and rebalancing toward the portfolio I’ve discussed in the past: betting on more monetary inflation. Just bear in mind that monetary inflation is defined as an increase in the money supply, not higher prices.

Anyway, I’ve made two large purchases of gold and silver in my lifetime. The first came after the crash in the wake of the debt ceiling crisis in 2014 when it was priced around $1,300 and ounce. The second was in late 2022, when it hit $1,650.

I’m buying into strength again, and I wouldn’t regret any pullback right now. I’m just increasing my allocation level—adding to my position.

Plus, I don’t think gold is in a bubble. This year’s rally is just the natural course and continued bastardization of fiat currency and the stumbling toward a serious monetary crisis that starts in the early 2030s when Medicare becomes insolvent.

I don’t see good things on the horizon, and more monetary inflation is coming. No one is coming to save us. And Washington treats us as expendable—little more than votes at best, and “meat with eyes” at worst.

So, we do what we always do. Focus on ourselves. That’s why I’m giving you a free survival guide for coping with monetary inflation.

Recall Michael Howell has projected a doubling of the global liquidity base every decade or so, which would take us from about $175 trillion today to $350 trillion in the mid-2030s. It’s inevitable.

Your fiat currency’s value will continue to erode and they will keep printing to stop a revolution. Don’t cling to a broken currency like the citizens of Germany, Venezuela or Argentina.

Nothing’s patriotic about holding onto something that erodes in value. And remember the Fed’s system is based on perpetual bailouts. I’ve been studying this a long time, and it appears that people are finally waking up.

It’s why gold will head much higher, especially with central banks loading up on more of it. This is big news for producing nations that can take advantage of higher prices and even hoard gold f they desire.

My preferred gold investment

So, how do I buy gold? I prefer ounces of physical gold. I have something of last resort to throw at the Zombies. I prefer an asset I can see and touch, even if it’s a mile away in a safe deposit box or buried somewhere requiring a treasure map to find it (kidding).

If you don’t want to buy physical gold, I advocate for the Sprott Physical Gold Trust (NYSEARCA: PHYS.) PHYS is a closed-end fund that invests and holds physical gold bullion. It’s managed by Sprott Asset Management, a company focused on precious metals and alternative investments.

The trust holds physical gold bullion in secure storage. Yes, the gold is not a paper claim or derivative but actual gold bars stored in a vault.

Before you ask, I’ll tell you I don’t like investing in junior miners or anything whose shares can be diluted or whose balance sheet is overrun with debt. With gold, I don’t want to invest in anything that isn’t directly tied to the commodity itself, including “good” management.

This is one of the few exceptions to emphasizing operations and the balance sheet. I want direct investment in gold and silver as commodities—nothing more, nothing less.

Garrett Baldwin is an economist at Marketwise, author of Postcards from the Republic on Substack, and a disappointed Orioles fan.