Luckbox Leans in with Tracy Shuchart

On America’s energy security, the intermediate-term outlook for oil prices and the specific

Tracy Shuchart began her career in finance at the Chicago Board of Trade as a futures and options broker. She then moved on to manage trade desks on the trading floor in both the agriculture and bond rooms where her firm served both as an executing broker and market strategist for global hedge funds and international banks. She currently is a partner and the Global Energy and Materials Strategist at Intelligence Quarterly, as well an energy and materials portfolio manager for a family office.energy stocks that she owns today.

What’s the future of fossil fuels in the U.S.?

It’s going to take longer to transition than most people think—fossil fuels will be around for a while. That said, we started shutting down coal power stations in the 2010s. And now, all of those have been transferred to natural gas, which is a perfect transition fuel because it is very clean-burning and we have a lot of it. As far as renewables are concerned, I know everybody really wants to get there quickly. However, we’re just not logistically ready. If we all wanted to drive electric vehicles tomorrow, we would literally crash the grid. We just don’t have the power there to support that. What needs to be done in the United States is to completely tear down the energy grid and start over, but nobody wants to pay for that because that’s literally trillions of dollars and it’s going to be a very slow process. So, don’t think you’re getting rid of fossil fuels anytime within the next 20 years.

What do you mean By ‘tear down the energy grid’?

We have a very aging grid. Europe has the same problem. The U.K. has the same problem. And then we’ve been adding wind and solar—new technology—onto the old technology. It’s akin to having an old website and wanting to upgrade it, but you just put all the new code on top of old code. They expect it to run flawlessly. So what we need to do is start from scratch if we want to be able to handle this transition.

What forms of alternative energy should America pursue?

There’s always wind and solar. But with wind and solar, we’re going to need a lot of fossil fuels just to produce those products. I mean, you need a ton of steel, you need a ton of copper, cobalt and magnesium. For solar panels, you need a ton of plastic, a ton of resin and a ton of rare-earth metals. And to mine all of this, we’re going to need a lot of fossil fuels.

We need to pursue nuclear power. Unfortunately for most people, Chernobyl and Fukushima come to mind. Granted, we have a lot of older reactors, but we also have a lot of new reactors.

We also need to be making batteries more efficient.

The U.S. recently released 180 million barrels of oil. How will that affect the market?

It’s actually 160 million barrels. Twenty million of them were already planned for release. That’s about a million barrels a day.

Aside from the Strategic Petroleum Reserve release being a horrendous decision and a threat to national energy security, especially during a war and sanctions, this is merely a Band-Aid and a flimsy one at that. It does not solve the overall structural supply deficit in the market in the years to come.

In addition, this slows shale growth as it discourages E&Ps from drilling more, which is what actually needs to be done. It also creates potential logistical bottlenecks, as we have never had a release this large, creating congestion on the Gulf Coast further exacerbating the problem. This, in turn, could cause oil companies to actually have to scale back production, creating a doom loop.

What about the allegation that the E&Ps aren’t drilling? They’re sitting on 9,000 oil drilling permits.

You can’t just turn on wells—it’s not that easy. There’s typically six to 12 months of lead time, and that’s not even considering the problems the industry is facing right now. They’re facing labor shortages. They’re facing supply chain problems. It’s almost impossible to get steel pipe right now. In addition, it’s not that easy to pull rigs out of the yard and put them to work. If we begin taxing or penalizing permits, E&Ps will just abandon the wells and their leases, which means they won’t be available when they’re actually needed or when we want to turn them on again.

Do you approve of the Biden administration’s energy policy?

I think it’s completely disastrous. When Congress is talking about “oil companies making so much money,” they’re demonizing an industry that has been completely beaten up.

What voice would you remove from the nation’s energy discussions?

It feels like nobody in the Department of Energy is an energy expert anymore. This is not a Republican or Democrat thing. It doesn’t really matter. You have Republicans and Democrats there, so I’m not making a statement. I think that we need to have better-qualified people in the DOE.

Is there evidence of price gouging?

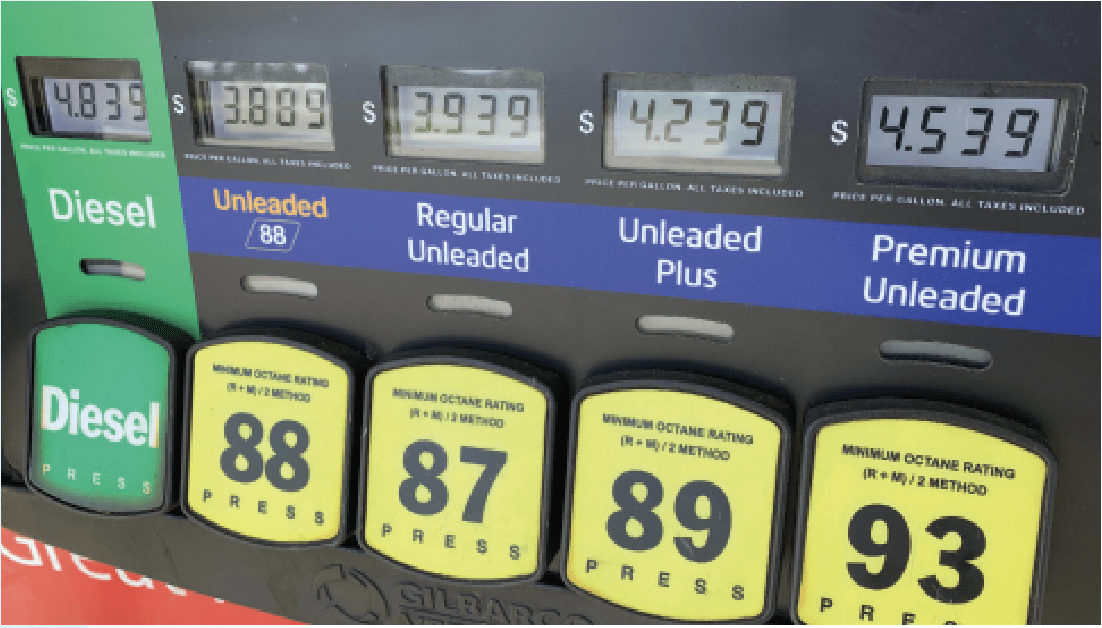

Several administrations have gone after the oil industry on this. It’s not unique to this particular administration. It’s a global market that sets global prices—oil companies do not set oil prices. It’s a global trading market. So, it’s not the oil companies’ fault.

What is your price forecast for oil?

I think we could easily see $150+ oil over the next year. What we have to watch right now is how many Russian barrels will be taken off the market. With Iran, even if we had a deal tomorrow, it’s still not enough to fill the gap. Then we have the problem of where everybody’s going with the gas stimulus. Every country has announced a gas stimulus, and several states have. The federal government really hasn’t announced a program yet, but what that does is create more demand. If you’re giving everybody gas credits or checks or subsidies, there are a lot of ways you can go about doing it. But all that means is that as price goes higher, you’re not creating demand destruction, you’re creating demand construction.

Other than your macro, intermediate-term outlook for higher oil prices, what specific opportunities do you see in the energy sector?

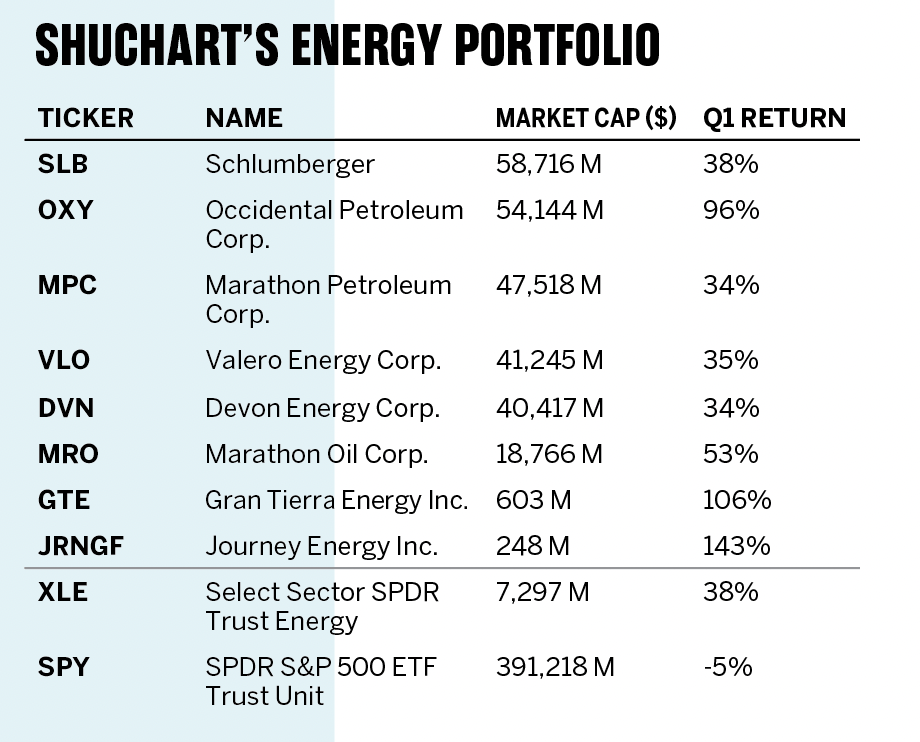

I’m not really keen on the majors. That said, I think there’s a lot of opportunity in the small-cap and the mid-tiers in the United States and in Canada right now.

Name names?

Devon Energy (DVN) has been one of my favorites. I like Gran Tierra Energy (GTE), and I like Journey Energy (JRNGF). I like Occidental Petroleum (OXY). These are long-term trades. And I like Schlumberger (SLB), I like the services if the government lets these guys start producing more. I prefer SLB over Baker Hughes (BKR).

What aspect of energy policy should change?

We need to get seriously realistic. All these green energy goals are nice and fantastic. But nobody has a plan to get there. We’re going to spend all this money, and what did they say? ‘Well, just buy an electric vehicle and you can save $900 a year’? Yeah, but not everybody has $55,000 to buy an electric vehicle. And how is that saving you $900? Which car payment are you on? These are not real solutions.

Any final thoughts?

Oil and gas are still very investable right now and over the next five to seven years. We came from the lowest of the low. Some of these stocks were $2 and $3. Oh, I like Marathon Oil (MRO), too. And then if you want to look at refiners, which are very interesting, I especially like Marathon Petroleum (MPC) and Valero Energy (VLO) because they’re looking into renewable diesel.

Thank you, Tracy.

If you could remove one group or voice from the discussion of energy policy in the United States, who would it be?

The American Gas Association. Coal is uncompetitive. Electric vehicles are inevitable and far superior. The remaining big fight is with gas and fracking. The AGA is an insidious lobbying organization that is well-funded and uses bad data and worse analysis to justify itself. Koch brothers might be the other answer.

—Saul Griffith

Anti-nuclear environmentalists. We need nuclear energy as a stepping stone to carbon-free renewables if we’re going to achieve the dual goals of energy security and national security.

—Christopher Vecchio

John Kerry. The man flies around on a private jet and justifies his massive carbon footprint by insisting that he must travel and speak to win the battle against climate change. People like Kerry live in a bubble and don’t understand how their hypocrisy damages their support.

—Garrett Baldwin