Trading U.S. Interest Rates Ahead of Fed Meeting

The U.S. yield curve shifted dramatically during the height of the banking crisis in Q2, but has since reverted.

After a last-minute agreement to suspend the debt limit through 2025, the risk of a U.S. sovereign default is, for now, off the table.

While that’s a positive for the financial markets, the resolution of the debt ceiling issue brings some of the other key 2023 market narratives back in focus on Wall Street.

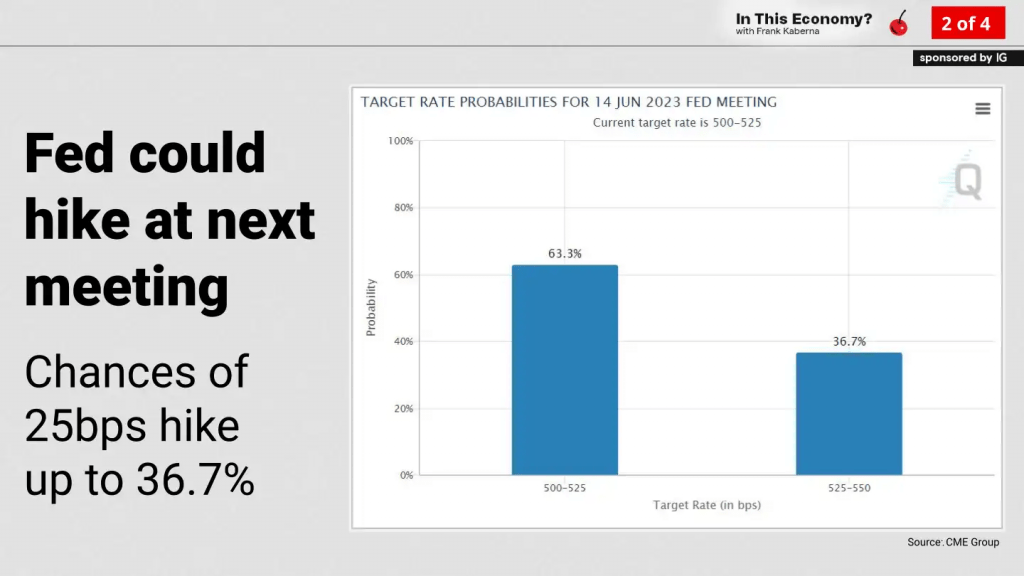

For example, the next Federal Reserve meeting is scheduled for June 13-14. At present, the market believes there’s about a 35% chance the Fed will raise rates by another quarter percentage point.

The Fed has been steadily hiking short-term interest rates since early 2022, and most pundits believe that the Fed is in the late innings of the current rate-hike cycle.

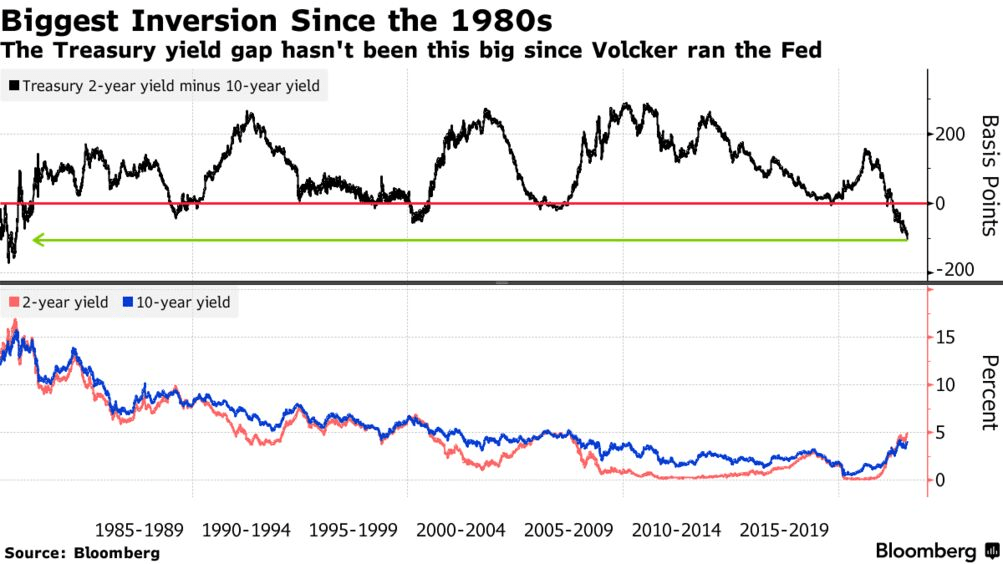

Moreover, the yield curve has been inverted since July of last year. However, the severity of that inversion has shifted between then and now, and at times, dramatically. The 2023 banking crisis was especially disruptive to the U.S. yield curve.

As a reminder, the yield curve depicts U.S. interest rates over time—short term, medium term and long term. And when the yield curve is upward-sloping over time, that generally implies that the underlying economy is healthy.

On the other hand, when long-term rates drop below short-term rates, that implies the market is expecting the Federal Reserve to lower benchmark interest rates at some point in the future. The Fed usually cuts interest rates to accommodate the economy when it hits a rough patch.

When the yield curve is aligned in this fashion, it’s referred to as an inverted yield curve.

That’s precisely how the yield curve is currently shaped. The yield on the 2-year U.S. Treasury bond is 4.60%, while the yield on the longer-dated 10-year U.S. Treasury bond is 3.75%.

Impact of the banking crisis on the yield curve

The yield curve first inverted in July 2022 and has remained inverted through today. However, the severity of the inversion has shifted over time.

For example, between July 2022 and February 2023, the inversion between the 2-year Treasury yield and the 10-year Treasury yield steepened to such an extreme degree that it was setting multi-decade records.

By early March 2023, the spread between the “2s and 10s” had stretched to over 100 basis points.

There’s no telling what might have happened to the yield curve after it hit that historic extreme because the sudden implosion of Silicon Valley Bank (SIVBQ) threw the interest rates markets into chaos.

In the wake of the Silicon Valley Bank failure, investors and traders flocked to government bonds, which triggered a tumultuous shift in the yield curve.

During those harrowing days, the yield on the 2-year Treasury bond slumped from above 5% all the way down to 3.75%, while the yield on the 10-year Treasury bond dropped from above 4% to about 3.30%.

These moves had a dramatic impact on the overall yield curve, because the inversion between the 2s and 10s shrunk from over 100 basis points (5.00% – 4.00% = 1.00%) down to about 45 basis points (3.75% – 3.30% = 0.45%).

In the financial markets, that type of transformation is referred to as a “flattening,” because the two yields (2s and 10s) moved closer together. That extreme shift in the curve was due to growing expectations that the Fed would be forced to drop rates earlier than expected, in order to help stave off another financial crisis.

But those expectations haven’t been realized. In recent weeks, concerns over the banking crisis have dissipated. As a result, the shape of the yield curve has reverted back toward what was observed in early March—before Silicon Valley Bank went bust.

Over the last several weeks, the 2-year Treasury yield has rebounded to 4.60%, while the 10-year Treasury yield has rallied back to 3.75%. The steep inversion between the two yields has also reappeared.

The current spread between the 2s and 10s is 85 basis points (4.60% – 3.75% = 0.85%), which is within shouting distance of the 100 basis point spread observed in early March.

The yield curve appears to have reverted to its previous shape because of reduced expectations for a Fed rate cut in 2023.

Amid the height of the banking crisis in Q2, the interest rates market was implying that the Fed would cut rates by a full percentage point at some point in the second half of 2023. However, those expectations have been steadily winnowed down. The market now thinks the Fed will cut rates by a quarter-percentage point at most in 2023.

At present, the Fed’s target range for the federal funds rate is 5%-5.25%, indicating the market is expecting benchmark rates to remain at current levels—or slightly below—through the end of the year.

That’s eerily similar to what the interest rates market was projecting back in early March, before the onset of the banking crisis.

Interestingly, those expectations also go together well with previous guidance from the Federal Reserve. Fed leaders have previously indicated they won’t cut rates until 2024, at the earliest.

Going forward, that suggests movement in the yield curve will depend heavily on whether or not the banking crisis remains contained. If it does, it’s likely the sharp inversion in the yield curve will persist.

But if the banking crisis intensifies, or dominos, then the yield curve could shift dramatically, indicating that the Fed could cut rates much earlier than expected. Under that scenario, it’s likely that a recession could materialize shortly after.

To monitor this situation going forward, keep a close eye on the spread between the 2-year and 10-year Treasury yields.

For more background on the current interest rates environment, check out this episode of In This Economy on the tastylive financial network. To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.