The Skinny on Zero DTE Options

These options provide volatility —but they’re risky

Zero days to expiration (0DTE) options have exploded in popularity among retail investors because they can offer volatility during otherwise calm markets and may offer cheaper alternatives to longer-term trades.

However, intense volatility makes 0DTE trades highly speculative, and investors should not consider them a reliable source of income. Traditional options risk metrics tend to break down for such short-dated contracts, and the expiration mechanics of options become much more relevant with 0DTEs, compared to longer-term options.

0DTEs considerations

If you choose to accept the risk, remember the important limitations that come with choosing the underlying security.

• Liquidity: Stick with highly liquid options that enable you to get out of a position quickly and easily.

• Settlement method: Index and futures options tend to be cash-settled (requiring cash value of options at expiration) while exchange-traded funds (ETFs) and stock options tend to be physically settled

(requiring delivery of underlying shares).

• Account size and the PDT rule: For accounts of less than $25,000, the pattern day trading rule applies to 0DTE options that are managed before they expire, except in the case of futures, forex and crypto.

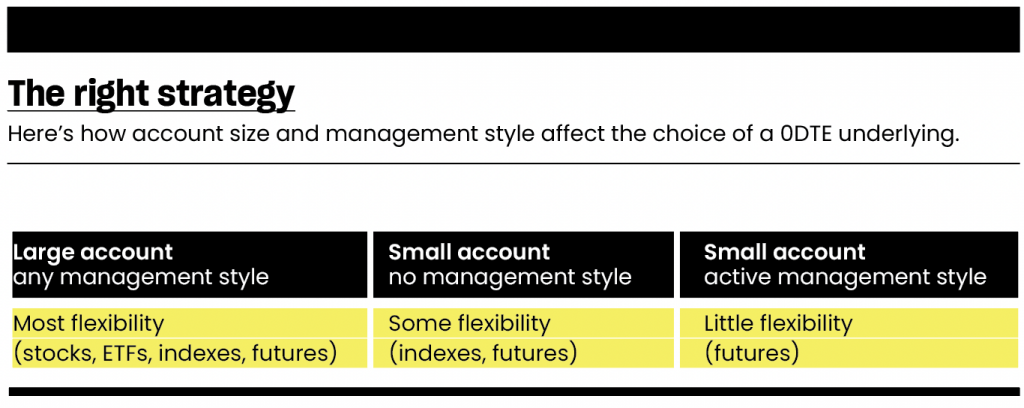

The choice of underlying is limited by liquidity and account size because small accounts may not be able to fulfill the physical delivery of the underlying security. Management style is also limited by account size, as summarized in the table below.

The most important risk management techniques for 0DTE options are position sizing and, to a lesser extent, early management. Because of their speculative nature, position sizes should be exceptionally small relative to account size.

If the choice of underlying allows for early management, risk-averse investors often close their positions at a low profit target (20%-30% or lower) and avoid holding positions past noon or for more than a few hours.

Meet Bad Trader

Internet searches for the term ‘0DTE’ peaked in 2023, according to Google Trends, and business reporters have taken notice.

Bloomberg has published articles with headlines like Day Traders Lose $358,000 Per Day Gambling on Zero-Day Options and ‘Degenerate Gambling’ in Zero-Day Options Thrills Retail Traders.

a community where conversation centers on

experimentation, speculation and calculated risk in the financial markets.

Complaints about 0DTE degeneracy have appeared on platforms like Reddit and X, but disparaging messages may not be the best way to address the phenomenon.

Let’s look back at what happened with meme-stock trading. The resulting chaos demonstrated that many less-engaged (and less-informed) investors want to trade the financial markets but are often discouraged by the scale, power and judgment of large institutional investors.

That’s why many inexperienced traders invested in GameStop (GME), AMC Entertainment (AMC) and other stocks as an act of rebellion. Many lost money because they invested without a real understanding of market nuances and risk management. In fact, the primary takeaway from meme-stock trading lunacy is that financial literacy is critical.

Enter “Bad Trader,” a new community for active investors. It was created to experiment with risk and share the inevitable blunders that come with it. Risk management techniques for 0DTE options are among the first topics featured.

The Bad Trader app, available for iOS and Android, combines social media with finance. It offers daily trading livestreams, speculation opportunities with an in-app currency, and live chat you can use to roast friends for impulsive decisions.

Bad Trader users can also watch markets, set up orders and connect directly to a broker through its engaging neon interface. This platform is the place for aspiring traders to experiment, share experiences and come to a better understanding of how to take calculated risks.

Julia Spina is the CEO of Bad Trader and author of The Unlucky Investor’s Guide to Options Trading. She holds bachelor’s degrees in engineering physics and applied mathematics and a master’s in physics. @financephoton