Prime Numbers

Despite surprisingly strong recent earnings, stock in Amazon (AMZN) has softened over the past nine months after surging in the early months of COVID-19. The company faces tough comparisons against calendar year 2020 because many brick-and-mortar retailers closed during the pandemic and consumers switched to e-commerce amid a national lockdown. Deeper analysis of the company’s first-quarter results suggests the stock should continue to outperform.

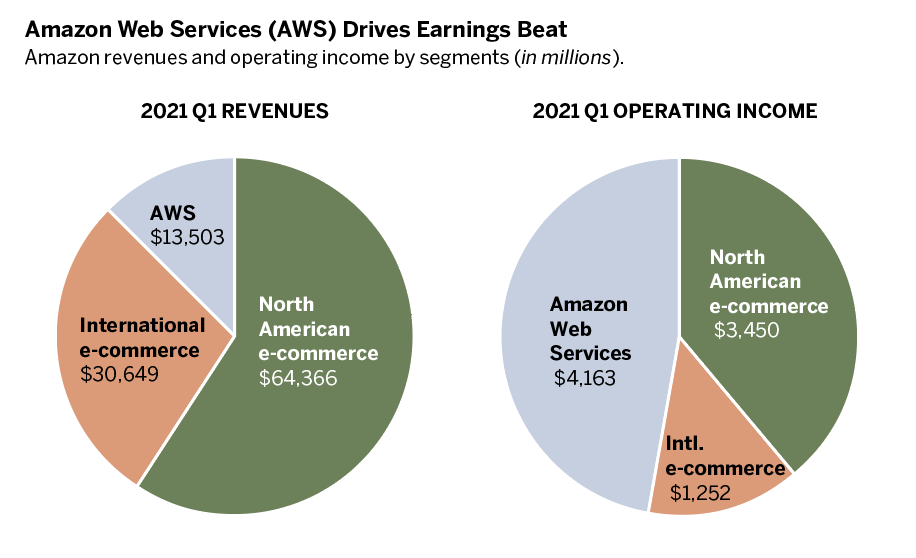

Amazon’s cloud-computing and software as a service (SaaS) segment, Amazon Web Services (AWS), drives the company’s free cash flow and is key to the long-term performance of the company’s stock.

AWS benefits from a first-mover advantage in the cloud-services business, with a multi-year head start against the competition. Relentless innovation at AWS has also helped it maintain a sizable market-share advantage.

Only two companies have the scale, expertise and operating leverage to compete with AWS in the cloud business, namely Microsoft (MSFT), via its Azure segment, and Alphabet (GOOGL), through Google Cloud Services. But neither has been able to close the gap and catch up with AWS’s leading market share.

The consensus among market research firms puts AWS’s market share at or above 30%, with Microsoft and Google trailing far behind with roughly 20% and 7%, respectively. Both companies have focused heavily on growing their cloud businesses during the past five or more years, yet their heavy capital investment and attempts to take share from AWS have been largely unsuccessful.

Since its inception, AWS has been a cash cow, supporting Amazon’s rapid expansion of the e-commerce business domestically and abroad. In the first quarter of this year, AWS’s outperformance illustrates the strong moat it enjoys in this high-growth, highly profitable segment.

AWS’s sales growth accelerated in the first quarter, with quarter-on-quarter growth of 6% (relative to Q4 2020) and year-on-year growth of 32%, bucking the trend of decelerating growth at its competitors Microsoft and Google.

AWS saw strength across the board during the first quarter, with management reporting growth in new contracts with small-to-medium-sized businesses, in addition to new contracts with several large enterprise customers.

AWS sales typically rise in the fourth quarter, making quarter-to-quarter comparisons in Q1 seasonally weak. But in 2021, AWS quarter-on-quarter dollar sales almost tripled (at $761 million) versus the first quarters of 2020 ($265 million) and 2019 ($266 million), respectively. Finally, the AWS backlog continues to grow, up 55% year-on-year, outpacing the growth in Q1 reported revenue.

Advertising revenues also drive Amazon’s cash earnings, posting a third consecutive quarter of accelerating growth, up 73% in Q1 of this year, against an impressive 68% year-on-year growth in the fourth quarter of 2020.

For the reasons highlighted here, weakness of late in Amazon stock represents a buying opportunity. The company’s true value is best approximated with a sum-of-the-parts valuation, given its diverse operations. SaaS businesses command trading multiple orders of magnitude larger than companies in the retail or e-commerce businesses (e.g., Autodesk (ADSK) trades at 54x trailing 12 months earnings per share (TTM EPS), while Walmart (WMT) sports a multiple of roughly 30x TTM EPS).

Comparing 2021 Q1 revenues to operating income (see below), it makes sense to value Amazon Web Services and Amazon’s direct advertising revenues separately from its e-commerce retail operations. Applying a 20x multiple to the JP Morgan 2022 AWS estimate of earnings before interest, taxes and amortization (EBITDA) ($38 billion), a December 2021 price target of $4,600 is firmly within reach.

Emma Muhleman works as a long/short equity analyst specializing in forensic accounting at Ascend Investment Management. @emma_cfa