Education Technology Plays

Edtech companies are increasing access to online education. But does that make their stock a good investment?

The tech industry has truly redefined education. In fact, companies such as Chegg (CHGG), Duolingo (DUOL), Coursera (COUR) and Udemy (UDMY) have made a wide breadth of educational resources accessible to consumers from every demographic. But are these assets reliable as investment vehicles?

It’s difficult to form long-term expectations for these consumer-facing education companies because many of them, namely Duolingo, Coursera and Udemy, have been publicly traded only since 2021. But, an analysis of the past few months can give us an idea of how their short-term performance compares with other tech companies, the tech sector (XLK) and the broader S&P 500 (SPY).

However, the market has been far from ideal since 2021, and only time will reveal the long-term potential of these education-focused tech companies as investments.

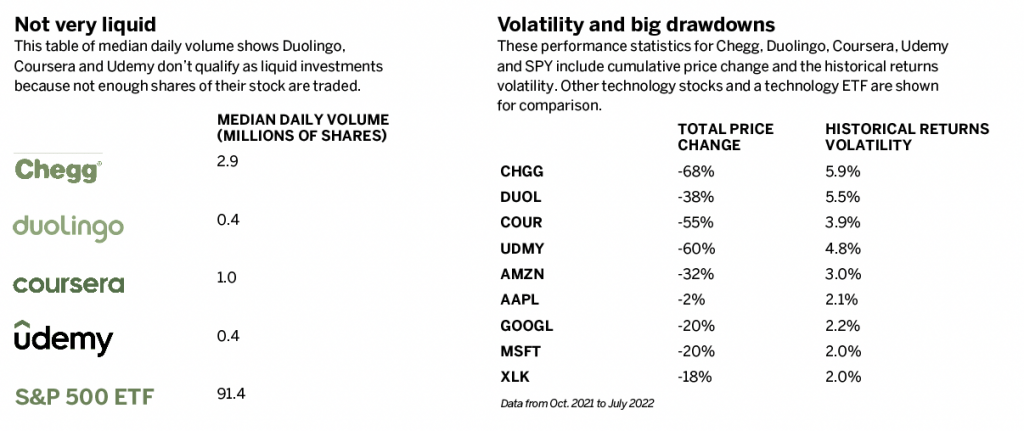

The first major factor limiting the tradability of these stocks is liquidity because many of these companies, with the exception of Chegg, are new to the public market. A liquid instrument generally has well over 1 million shares traded daily, and the table titled Not very liquid shows the median daily volume for these assets is either near or below that threshold, indicating a degree of liquidity risk.

The performance statistics in the table labeled Volatility and big drawdowns also indicate these stocks have experienced significant loss of value since 2021 and have had a more volatile run than some more-established tech companies, the tech sector and the overall market.

While it’s still too early to draw conclusions about the long-term viability of these assets, the short-term statistics indicate significant risks for passive investors. However, the options market presents notable opportunity.

Options traders should be mindful of the liquidity risk, but these education-focused tech companies still have tradable options markets, particularly Chegg and Coursera, but also Duolingo and Udemy to a lesser extent.

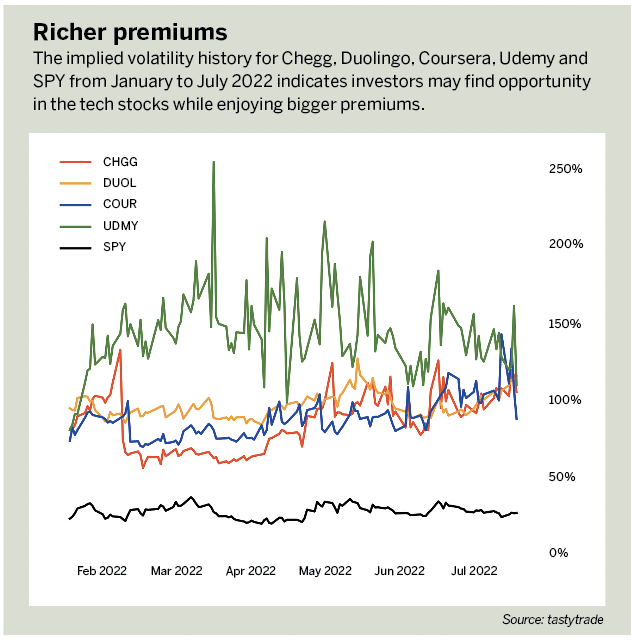

Options traders may find these underlyings attractive because they have significantly higher implied volatilities and larger premiums than SPY.

This is shown in the chart titled Richer premiums. Options traders may cope with liquidity risk by, for example, keeping positions wide (i.e., sticking to high probability of profit trades) and by keeping position sizes small so the capital at risk is minimized.

Readers can find more details on structuring options trades and sizing positions in The Unlucky Investor’s Guide to Options Trading.

Julia Spina, a member of the tastytrade research team and author of The Unlucky Investor’s Guide to Options Trading, holds degrees in engineering physics and applied mathematics and a master’s in physics.

@financephoton