Post-pandemic Reset

Stock in companies specializing in home entertainment and home offices appreciated during the pandemic but stumbled as the world reopened

he COVID-19 pandemic devastated global economies in early 2020, but by sheer happenstance, a handful of companies were perfectly positioned to benefit from worldwide lockdowns.

Driven largely by a massive shift in consumer spending preferences, stock prices for companies such as Netflix (NFLX), Amazon (AMZN), Zoom Video Communications (ZM) and Peloton Interactive (PTON) thrived in the midst of widespread economic turbulence throughout 2020.

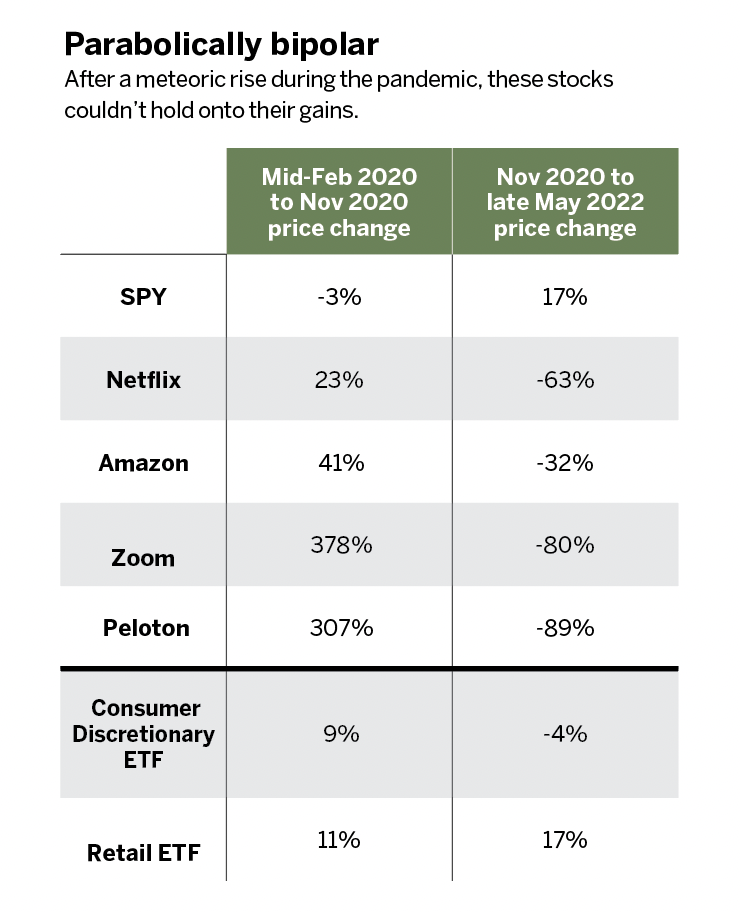

From mid-February 2020 (just before lockdowns began in the United States) until November of that year (just before COVID-19 vaccines became available), those stocks dramatically outpaced the S&P 500. However, as shown in Parabolically bipolar (right), much of the edge the companies had during the onset of the pandemic diminished. Once the dust settled, economies began reopening and competitors had an opportunity to adapt.

Although global lockdowns contributed to the exceptional growth of all four of those stocks, the sell-off points vary significantly. Zoom began to depreciate in November 2020 and Peloton in February 2021.

Even though lockdowns have eased since late 2020, Amazon and Netflix continued to perform well until 2022. Caught in a slew of sell-offs across U.S. markets, Amazon sold off by 14% following its earnings announcement in April 2022, and Netflix sold off by 22% and 35% following earnings reports in January 2022 and April 2022, respectively.

Those sell-offs occurred for a variety of reasons beyond the retreat from the great indoors, such as inflation and supply chain disruptions in the case of Amazon, a saturated market in the case of Peloton, and more competition in the case of Zoom and Netflix. Those trends and their timing form a reasonable narrative for the past two years, but that’s in 20/20 hindsight.

The core investments of a portfolio should offer somewhat dependable expectations of risk and reward. Investors can accomplish that by focusing capital on assets tied to broader markets and sectors, while reserving only a small fraction of the portfolio for aggressive growth stocks.

For example, attempting to capitalize on consumer spending trends by picking single stocks is sensitive to timing, assuming the prediction is even correct in the first place. Consumer spending exchange-traded funds (ETFs), such as XLY (SPDR Consumer Discretionary ETF) or XRT (SPDR S&P Retail ETF), track consumer spending as a broader market and are less volatile overall and less sensitive to timing and cyclic trends.

These characteristics are demonstrated in Parabolically bipolar, which compares how those ETFs performed against the single stocks during mid- and post-lockdown. The primary takeaway is that market trends are rarely black and white.

Consistently predicting market trends and their timing is incredibly difficult—if not impossible. It is not a reliable investment strategy for the majority of retail investors.

Julia Spina is a member of the tastytrade research team and author of The Unlucky Investor’s Guide to Options Trading. @financephoton