Traders Should Know Their Options

Gamblers eventually lose to the house, but investors can come out ahead in the markets

The house always wins. This cautionary quote is certainly true but doesn’t tell the entire story.

From table limits to payout odds, every game in a casino is designed to give the house a statistical edge. The casino may take large, infrequent losses at the slot machines or small, frequent losses at the blackjack table. But if patrons play long enough, the house will inevitably turn a profit.

Casinos rely on this principle as the foundation of their business model: People can either bet against the house and hope luck favors them or be the house and have probability on their side.

Unlike casinos, where the odds are fixed against the players, liquid financial markets offer a dynamic level playing field with more room to strategize. However, successful traders don’t rely on luck.

Traders’ long-term success depends on their ability to use readily available tools, strategies and information to gain a consistent statistical edge.

What’s more, the markets are becoming increasingly accessible to the average person, as online and commission-free trading have become industry standards.

Investors choose from almost unlimited strategies, and options play an interesting role.

Options are financial contracts that give the holder the right to buy or sell an asset on or before a future date. They have tunable risk-reward profiles, enabling investors to select the reliable probability of profit, max loss and max profit of a position and potentially profit in any market conditions—bullish, bearish or neutral.

Investors can use these versatile instruments to hedge risk and diversify a portfolio. Or options can be structured to give more risk-tolerant traders a probabilistic edge.

Besides being customizable for specific risk-reward preferences, options are tradable with accounts of nearly any size because they’re leveraged instruments. In the world of options, leverage refers to the ability to gain or lose more than the initial investment.

Investors may pay $100 for an option and make $200 by the end of the trade, or they may make $100 by selling an option and lose $200 by the end of the trade.

Leverage may seem unappealing because of the risk, but it’s not inherently dangerous. Still, when leverage is misused, it can wreak financial havoc.

But when used responsibly, the capital efficiency of leverage becomes a powerful tool. It enables investors to put up significantly less capital but still achieve the same risk-return exposure as a stock position.

There’s no free lunch in the market. A leveraged instrument with a 70% chance of profiting must come with some trade-off in increased risk. The risk may even be undefined in some cases.

That’s why the core principle of sustainable options trading is risk management. Just as casinos control the size of jackpot payouts by limiting the maximum amount a player can bet, options traders should limit the size of their positions to control their exposure to potential losses.

And just as casinos diversify risk across different games with different odds, strategy diversification is essential to the long-term success of an options portfolio.

Beyond the potential downside risk of options, other factors can make them unattractive to investors. Unlike equities, which are passive instruments, options require a more active trading approach because of their volatile nature and time sensitivity.

Depending on the choice of strategies, investors should monitor options portfolios daily or at least once every two weeks.

Options trading also has a fairly steep learning curve and requires a stronger knowledge of math compared to trading stocks. Although the mathematics of options can become complicated and burdensome, investors can often make trading decisions with a selection of indicators and intuitive, back-of-the-envelope calculations.

Julia Spina, a member of the tastytrade research team and author of The Unlucky Investor’s Guide to Options Trading, holds degrees in engineering physics and applied mathematics and a master’s in physics.

@financephoton

Excerpted with permission from the publisher, Wiley, from The Unlucky Investor’s Guide to Options Trading

by Julia Spina and Anton Kulikov. Copyright © 2021. All rights reserved. This book is available wherever books are sold and at tastytrade.com/investorsguide.

Trade School

A short strangle—a neutral strategy consisting of a short out-the-money (OTM) put and a short OTM call—is a high-probability of profit (POP) trade that profits from time and volatility decay instead of large directional moves.

In other words, this strategy profits regardless of whether the market trends moderately upward, downward or sideways, and potential profits are highest during high-volatility conditions, when investors can sell the call and put contracts for larger premiums.

These strategies are probabilistically likely to profit but are undefined risk, meaning they can result in rare but significant losses.

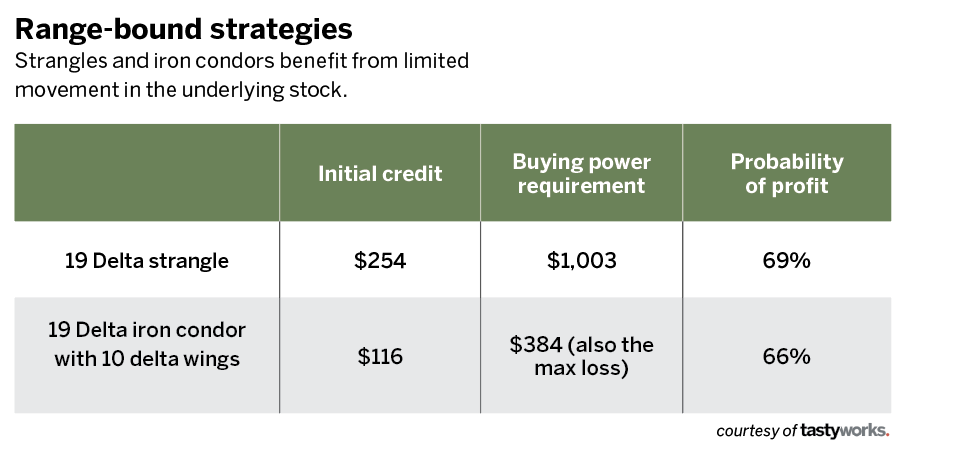

An example of a short strangle with a high volatility underlying, Alphabet (GOOGL), is shown in “Range-bound strategies.”

The strangle shown in the table will be profitable if the price of Alphabet, trading at $95.44 at press time, stays between approximately $90 and $112.50 by Jan. 20.

Also included are quotes for an Alphabet iron condor, a defined-risk neutral strategy which may be more suitable for volatile, single-company stocks because it’s less likely to profit (lower POP) but also carries much less tail risk.

Like the strangle, the iron condor will profit if the price of GOOGL stays between $90 and $112.50 by Jan. 20. But unlike the strangle, the maximum loss of the Alphabet iron condor is capped at $384.