Trading Bitcoin Without Bitcoin

Retail investors can obtain long exposure to cryptocurrencies without establishing a digital wallet and linking it to a crypto exchange

The crypto market has had a turbulent run in 2022. Major cryptocurrencies, such as bitcoin and ether, are down nearly 50% since January, compounded with a slew of bankruptcies at major decentralized finance companies, including Three Arrows Capital, Voyager Digital and Celsius Network.

While the immediate future of crypto remains unclear, this recent turbulence and potential “bottoming out” of the crypto sector has left some investors interested in bullish exposure to this emerging market.

Retail investors can obtain long exposure to cryptocurrencies in a number of ways, many of them more convenient and potentially less risky than the traditional route of establishing a digital wallet and linking it to a crypto exchange.

Besides custodial wallets for crypto trading, several traditional retail platforms also offer publicly traded stocks and exchange-traded funds (ETFs) that are correlated to major cryptocurrencies.

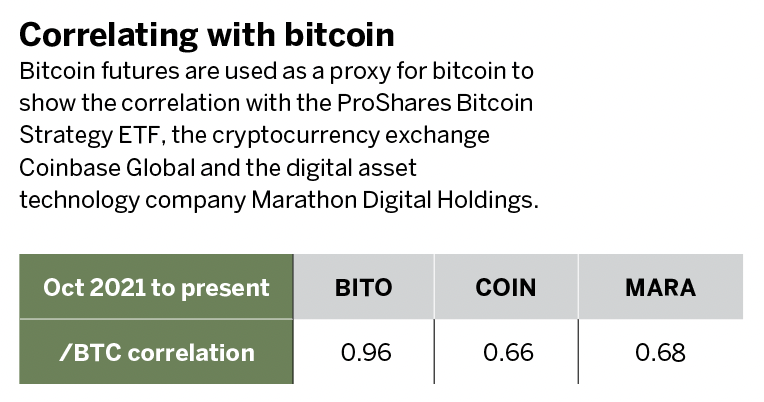

Examples include the ProShares Bitcoin Strategy ETF (BITO), the cryptocurrency exchange Coinbase Global Inc. (COIN), and the digital asset technology company Marathon Digital Holdings (MARA), whose correlations to bitcoin are shown in the table Correlating with bitcoin.

Let’s focus on how to obtain synthetic exposure to bitcoin using ProShares Bitcoin Strategy ETF options, which are available on several retail platforms. Options are appealing to more advanced investors because they’re leveraged instruments, meaning they have the potential to gain or lose much more than the equivalent unleveraged instrument, such as shares of stock.

When used responsibly, the capital efficiency of leverage is a powerful tool that enables traders to achieve the same risk-return exposure as a stock position with significantly less capital.

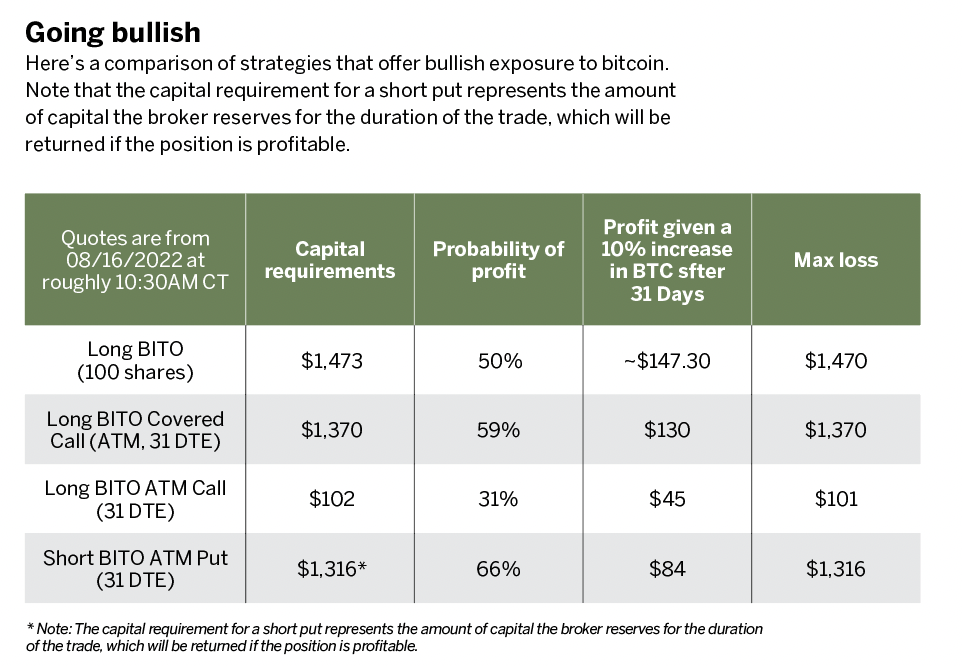

Some strategies with bullish directional assumptions also have the potential to profit even if the underlying price is unchanged. For this example, let’s compare the following strategies that offer bullish exposure to bitcoin.

•Long BITO (100 Shares): Purchase 100 shares of the bitcoin ETF (worth roughly .062 BTC).

•Long BITO Covered Call: Purchase 100 shares of the bitcoin ETF and sell one ATM call option against those shares, which reduces the capital requirements of the shares over time and generates a small profit if the underlying is unchanged.

•Long BITO ATM Call: Purchase one ATM call option on 100 shares of the bitcoin ETF, which is less expensive than purchasing 100 shares outright.

• Short BITO ATM Put: Sell one ATM put option on 100 shares of bitcoin ETF, which carries more risk than purchasing shares but also has the potential to profit if the underlying is relatively unchanged.

Compared with buying BITO shares, the covered call and short put require comparable amounts of capital upfront but may also profit if the underlying remains relatively sideways. In the event bitcoin has a strong rally, the covered call accumulates 88% as much profit as the BITO shares while requiring 7% less capital.

The long call is the least likely to profit, but in the event of a strong bitcoin rally it generates roughly 30% as much profit as the BITO shares while requiring 93% less capital.

The appropriate strategy ultimately depends on the preferred amount of capital at risk, the profit goals and the strength of directional assumption. For a strong bullish directional assumption and low capital preferences, the long call may be more appropriate. For a more moderate bullish directional assumption and higher capital preferences, the short put may be preferable.

Julia Spina, a member of the tastytrade research team and author of The Unlucky Investor’s Guide to Options Trading, holds degrees in engineering physics and applied mathematics and a master’s in physics.

@financephoton