The AI Stock Nobody Talks About

In the frenzy surrounding AI stocks like Nvidia and C3.ai, investors may neglect one of the foremost companies in agricultural automation

An employee of an agriculture startup could hardly contain his excitement as he described the upcoming harvest season to a small group of co-workers gathered in a Chicago Loop dive bar.

It seems there was a lot of “new paint” on his family’s corn and soybean farm in downstate Illinois. But exactly what was he talking about? Even agribusiness majors who didn’t grow up using “choring” as a verb might not know the phrase.

Yet, understanding “new paint” can be vital for investors who want to reap a bumper crop of cash from artificial intelligence in the agricultural sector.

Buy, hold and own forever

AI has been the craze since late last year. But the valuations of AI stocks like C3.ai (AI) and Nvidia (NVDA) make no sense to anyone who’s ever performed even basic securities analysis.

How can anyone keep a straight face when justifying C3.ai’s valuation?

After its recent earnings report, C3.ai traded at 12 times sales. That’s down from nearly 17x sales at the height of the 2023 rally, but it’s still an outrageous valuation.

A valuation of 12 times sales means the company must return every penny of revenue (not profits … but sales) to investors for 12 years to justify its valuation. So, the company theoretically can’t pay its staff, taxes, or research and development expenses. Every penny goes to investors.

Nvidia’s even worse. It trades at 110 times earnings (down from 215x) and 35 times sales. That’s 35 years of revenue forked over to investors. Insane, right?

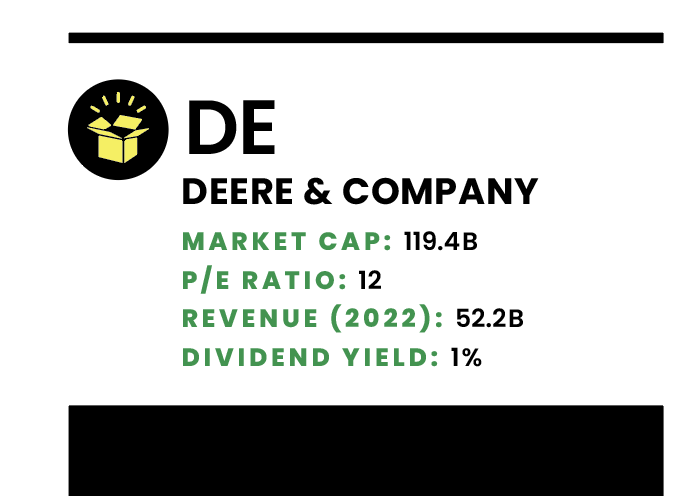

Now, take the case of a heavy machinery maker like Deere & Co. (DE), of John Deere tractor fame. The company trades at just 12.2 times earnings and less than two times revenue.

And Deere happens to be the best stock of the three to tap the enormous profit potential in AI.

Why? New paint, of course.

New paint, bigger profits

Deere’s been around since 1837. For years, the company has marketed under the classic tagline “Nothing runs like a Deere.” It manufactures heavy construction equipment, forest machines, diesel engines, lawn equipment and drive chains.

But ask my farmer friend in Champaign, Illinois, and he’ll tell you Deere makes the “best damn farm equipment” in the world. Deere owns the lion’s share of farm machinery revenue with tractors, combines, backhoes and more.

For decades, Deere has also quietly worked to become one of the top artificial intelligence companies in the world—and few analysts paid close attention. Almost no one realized Deere’s “secret sauce” was automation, advanced analytics and AI applications.

It began investing heavily in robotics and automation back in the 1990s. On Nov. 2, 1999, the company purchased GPS startup NavCon. The goal: to develop satellite-directed guidance systems for tractors.

In 1999, it formed GreenStar, a GPS for precision agriculture that brought positional accuracy down to a question of centimeters. Previous guidance systems were off by meters. GreenStar enabled farmers to accurately map and position key field operations like planting, pesticide application and harvesting.

A lot of the ag-tech advancements agronomists are perfecting these days at the Agricultural Innovation Center at the University of California, Davis started at Deere’s offices before the dot-com bubble.

Deere also established AutoTrac years later. It enabled farmers to steer tractors, combines and other equipment on an automated path.

Plenty of investors sit on their machines during harvesting and planting … guided by GPS and Autotrac. While they’re getting farm work done, they’re also buying calls and puts or trading stocks during the day.

These advances have not only helped establish Deere as a force for innovation but have also boosted its sales and set them apart from rivals.

The company’s technology will help feed the world’s burgeoning population over the next 30 years. By 2050, the planet is expected to be home to 10 billion people, increasing global food demand by 50%.

Technology will have to help provide sustenance to the masses despite having less available land and fewer skilled workers. That’s why AI is the new frontier.

Deere advancements in AI

In recent years, Deere has delved into machine-learning algorithms to optimize its machines’ performance and improve decision-making in its tech. Early AI-guided systems enabled tractors to manage tight turns and carve straight rows for crops. However, they required a human in the cab to avoid mud puddles, bypass obstacles or move to the next task.

Now, the company has introduced a powerful line of driverless tractors. AI-driven machines can drive to a field and manage tasks like seeding without a farmer’s help. This is the definition of “set it and forget it” farming.

This constitutes a key development because the job of farming isn’t only about planting, growing, feeding and harvesting. A farmer’s life is comparable to that of a hedge fund manager. The job is part weatherman, financier, supply chain expert, poker player, plant scientist and more.

The less time farmers spend in the fields, the more time they can devote to management. And that’s where the importance of predictive analytics lies.

Predictive AI will be a core driver for agriculture and will maximize the profitability of farm operations.

The variables in farm operation are nearly limitless—soil moisture, weather, weed distribution, pest infestation, crop growth patterns, crop selection, root growth and depth, soil fertility, satellite images, crop yield estimates, topography, irrigation metrics, and even farm financial reports.

AI will help farmers make informed decisions that take all of these variables into account. It can help engage in automated harvesting and sorting of crops, identify weed growth and provide real-time recommendations on when to allocate resources, including water, fertilizer and pesticide.

Deere’s AI-powered Operations Center and MyOperations offer farmers real-time insight, probability assessments and custom recommendations to optimize their business.

This ain’t Old Macdonald’s farm.

AI optimized

Artificial intelligence won’t be limited to the machines on the family farm.

There’s the ability to monitor livestock in real time, manage farm animal health, optimize supply chains, calculate inventory levels and even maximize hedging strategies when selling commodities to buyers across the value chain.

AI is not just about computer chips, ChatGPT and automated imagery. It’s a deflationary, time-saving phenomenon that will optimize operations and boost profit across many industries.

You don’t need to speculate on unprofitable AI stocks. Deere is a real company with a rich history of AI advances. While investors chase unprofitable AI, Deere trades at a surprisingly reasonable valuation with decades of dominance ahead.

Subscribe for free at getluckbox.com.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.