Databricks IPO: An AI Heavyweight with Nvidia’s Seal of Approval

Data has been likened to gold in the new era of generative AI, which is one reason a potential Databricks IPO is so highly anticipated on Wall Street.

- Databricks, a market leader in enterprise data, could conduct an initial public offering (IPO) in the coming months.

- Last September, Databricks raised $500 million in new capital, which implied a company valuation of approximately $43 billion.

- Databricks recently launched its own large language model (LLM) for generative AI, known as “DBRX,” which may also allude to the company’s potential IPO ticker symbol.

Hype and hyperbole often dominate the IPO market, but in the case of Databricks, the excitement appears warranted.

Databricks hasn’t yet announced a target date for its initial public offering (IPO), but it could very well occur in the next several months. That’s because the IPO market usually slows down ahead of major elections, which means most 2024 IPOs will happen before August, or after mid-November.

Timing is a critical factor for IPOs. That’s because most companies prefer to debut their public listings during bull markets. These environments are typically characterized by investor optimism, which can fuel added enthusiasm and interest in the IPO market.

In the case of Databricks, however, one could argue that enthusiasm will be red-lining even if sentiment in the broader financial markets isn’t fiercely bullish. As an established leader in artificial intelligence (AI), Databricks is in an enviable position. Considering the current AI-fueled euphoria (some might say hysteria) on Wall Street, Databricks stands to cash in handsomely on a potential IPO.

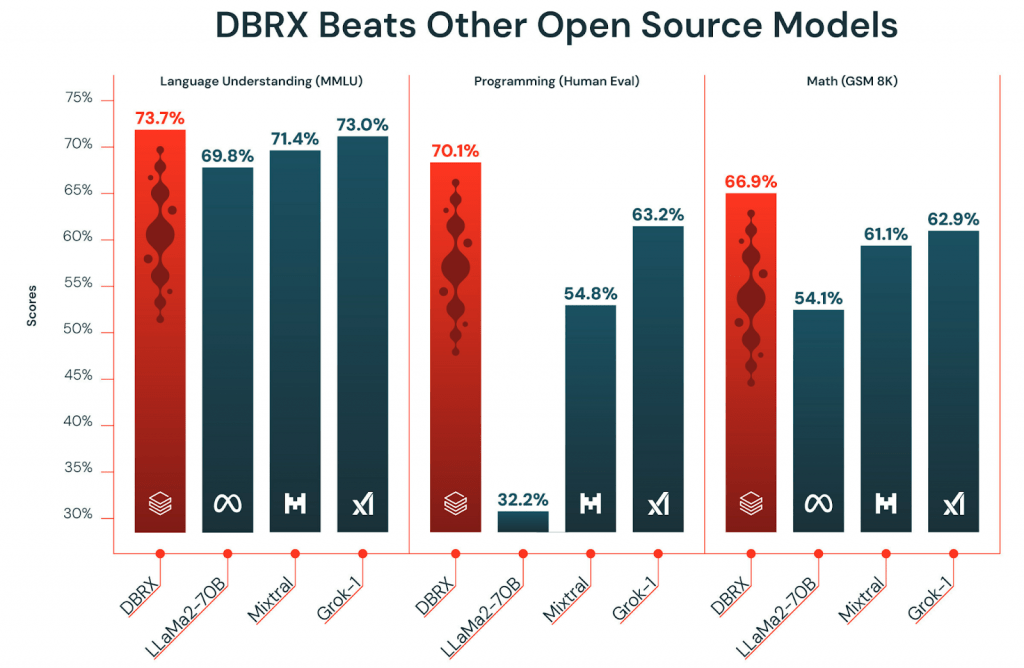

As its name implies, Databricks specializes in storing, securing, organizing and analyzing data. What’s even more interesting about Databricks is that it’s not only a data warehousing and analytics company, but also a cutting-edge AI researcher. Last month, Databricks debuted its own proprietary large language model (LLM), known as DBRX.

Competitive differentiators at Databricks

The year 2023 proved to be a seminal year for Databricks. The company’s revenue grew by 50%, and the company also raised an additional $500 million in fresh capital, which pushed its implied valuation to roughly $43 billion.

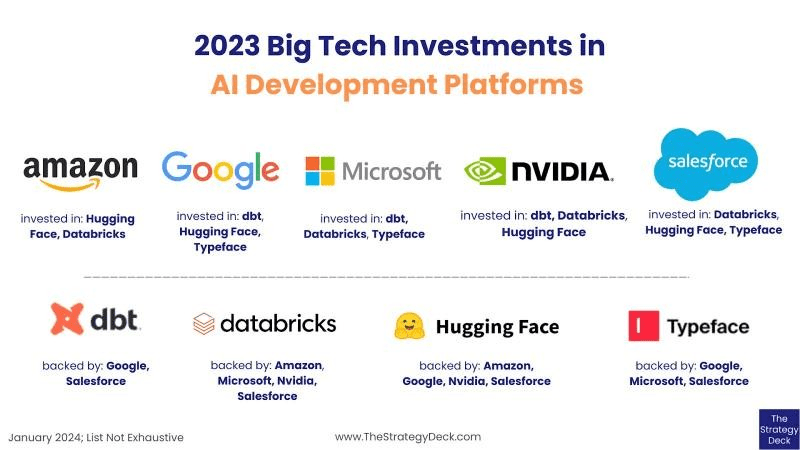

Additionally, Databricks acquired AI-specialist MosaicML for $1.3 billion. Databricks was already a major player in machine learning with its Lakehouse suite of data organization and analytics software. But the addition of the Mosaic platform has enhanced its ability to provide AI software to its data-centric customer base.

Using the Mosaic-powered Data Intelligence platform, Databricks clients can customize their own AI models and use them to organize, analyze and query their stored data. Additionally, Databricks offers LakehouseIQ, which is an LLM-based enterprise search tool that provides “smart” answers to employee queries.

An open-source LLM model

Beyond the tools, the new DBRX system could make Databricks a major player in the emerging large language model sector. Databricks’ platform is unique because unlike OpenAI’s ChatGPT and Google’s Gemini, DBRX is an open-source model.

According to Databricks, the open-source nature of DBRX should enable companies around the world to “cost-effectively build, train, and serve their own custom LLMs.”

This is an important distinction, because closed-source and open-source platforms offer hugely different value propositions. With an open-source platform, anyone can inspect, modify or distribute the source code. As a result, open-source platforms are often viewed as more collaborative and tend to attract a large base of diverse developers. This can help speed up development and adoption of the model and help optimize it.

In contrast, the closed-source nature of the ChatGPT and Gemini models means they are more restrictive, and outsiders can’t modify or distribute them. While closed-source platforms provide proprietary advantages and control over intellectual property, they often lack transparency and collaborative potential, which can throttle innovation and adoption.

Obviously, Databricks is hoping to gain added traction and awareness of the DBRX platform using the open-source approach. But the company can also offer the use of DBRX directly to its customers. And in conjunction with the MosaicML platform, this could be an enticing proposition.

The MosaicML platform is designed to help improve large language models, which means Databricks customers can use it in concert with DBRX to customize bespoke LLMs to their unique business needs.

Latest capital infusion and Nvidia investment

Last fall, Databricks conducted a capital-raising round that valued the company at roughly $43 billion. That development was billed not only as a strategic opportunity for new investors, but also a pre-IPO financing round.

This implies that the company won’t seek additional funding in the capital markets until its IPO. Notably, Nvidia (NVDA) invested in the company during the capital round, which speaks favorably to the company’s potential.

Commenting on his company’s new stake in Databricks, Nvidia founder and CEO—Jensen Huang—said, “Databricks is doing incredible work with Nvidia technology to accelerate data processing and generative AI models.” Huang added, “Databricks has not only pioneered the Lakehouse category with a world-class team and product, but it is now also at the forefront of Generative AI for the enterprise.”

Considering Nvidia’s leading position in the artificial intelligence sector, those words carry significant weight, and provide important context on Databricks’ current position in the data-focused software-as-a-service (SaaS) sector. Underscoring the company’s dominant position is the fact that it maintains an 80% gross margin on its subscription products. And, as highlighted previously, Databricks grew its annual revenues at a rate of 50% last year.

Growth at Snowflake

Databricks’ closest competitor—Snowflake (SNOW)—has also been growing its revenue at a rapid pace, reporting a 41% revenue-growth rate in 2023.

However, in conjunction with Snowflake’s most recent earnings report, the company guided down expectations for the upcoming year, indicating that revenues would grow more moderately, at about 22%. As a result of that disappointing outlook, shares of Snowflake have been under pressure, and are down about 20% year-to-date.

On top of flagging financials, Snowflake also appears to be rethinking its strategic approach—ostensibly to drive further innovation at the company. In tandem with its most recent earnings report, the company announced that its CEO—Frank Slootman—would step down.

Slootman will be replaced by Sridhar Ramaswamy, who was most recently the CEO of Neeva, an AI startup that was acquired by Snowflake in 2023.

In the opinion of Ali Ghodsi, the CEO of Databricks, Slootman was forced out because Snowflake was lagging its competition in terms of AI capabilities. During an interview with Bloomberg Television, Ghodsi commented, “I think we put a lot of pressure on them, and they realized that AI is important. Snowflake was basically not doing AI whatsoever.”

The potential valuation range for the Datbricks IPO

There’s no doubt that a potential Databricks IPO is eagerly anticipated by the investment community. But because the company isn’t yet public, it’s hard to comprehensively analyze its financial position, because private companies aren’t required to release sensitive financial data. That said, Databricks has provided some nuggets of information publicly.

The most recent capital raise provides evidence that the company was worth around $43 billion last autumn.

However, the stock market has rallied significantly since that time, and companies with advanced AI capabilities have led the charge. As such, it will also be interesting to see where Databricks guides its 2024 revenues, and whether it can sustain the impressive growth rate (50%) observed last year.

Taking a conservative approach to the company’s valuation, imagine that Databricks only grew its revenues by 35% in 2024, as compared to 50% last year. Under that scenario, annual revenue at Databricks would equate to about $2.1 billion.

In comparison, Snowflake is projected to grow its 2023 revenues by about 22% this year, which implies total revenues will climb to about $3.3 billion in 2024.

Using the above figures, one can calculate a potential valuation range for Databricks using the price/sales ratio (P/S ratio). This P/S ratio compares a company’s current market capitalization to its total revenue over a specified period. To calculate the price/sales ratio, one simply divides the current market capitalization by its 12-month revenue, whether that be the trailing 12 months revenue, or the projected future 12 months revenue.

In the case of Snowflake, the company currently trades with a market capitalization of about $51 billion. The price/sales ratio is therefore calculated by dividing $51 billion by $3.3 billion (projected 2024 sales), which yields a forward price/sales ratio of about 15.4. This figure is often referred to as the “sales multiple” or “revenue multiple.”

Using the same conservative approach, one can now apply that revenue multiple to an estimated valuation for Databricks. Using the $2.1 billion revenue forecast for Databricks in 2024, one simply multiples $2.1 billion by 15.4, which equates to about $32 billion. That’s a possible low-end valuation for Databricks, using a highly conservative estimate for 2024 sales, and a close competitor’s revenue multiple.

However, one can also backwards engineer a potential valuation for the IPO using the $43 billion valuation assigned to Databricks last September.

At the time, Databricks 2023 revenue was projected at about $1.6 billion. Using those figures, the price/sales ratio for Databricks would equate to about 27 ($43 billion/$1.6 billion = 27).

Using a more aggressive valuation approach, it’s now possible to estimate the upper end of the potential IPO range. This is done by multiplying Databricks’ expected 2024 sales of $2.1 billion by 27, which equates to $57 billion.

Final takeaways

Analysis suggests that a potential IPO valuation for Databricks could range somewhere between $32 billion (ultra conservative) and $57 billion (highly optimistic). Of course, any material change to the company’s 2024 outlook could significantly impact these estimates.

For example, if 2024 sales growth outpaces the rate observed in 2024, then Databricks could achieve a valuation even higher than $57 billion. But if the company issues disappointing guidance, that figure would assuredly fall. In that scenario, the midpoint of the valuation range ($45 billion) might be more reasonable, which is on par with where the company was valued last autumn.

Other factors could impact the valuation of Databricks leading up to a potential IPO. For example, the company could release additional financial information that alters the complexion of its future potential. Either way, this offering is reminiscent of the Arm Holdings (ARM) IPO, which was warmly received on Wall Street last September.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.