Biotech-Pharma Trade: Buying Opportunities on the Horizon

Despite positive performance in the broader stock market, the biotechnology and pharmaceutical sectors have been struggling in 2023

- The biotechnology and pharmaceutical sectors have been under pressure in 2023, with the Invesco Pharmaceuticals ETF (PJP) down 9% and the iShares Biotechnology ETF (IBB) down 6%.

- Elevated interest rates have weighed on the two sectors, but the forthcoming prescription drugs negotiations with Medicare represent a significant headwind.

- The two sectors could remain under pressure into 2024, but could rebound dramatically if a Republican wins the White House.

Not so long ago, the biotechnology and pharmaceutical sectors were some of the consistent top-performers in the stock market.

For example, from 1996 to 2016, the biotech and pharma sectors delivered 12% and 9% compound annual growth rates (CAGR), respectively, according to data compiled by McKinsey & Company. During that same period, the S&P 500 delivered a CAGR of 8%.

Of late, however, performance in these two sectors has been far less attractive. During the last five years, the Invesco Pharmaceuticals ETF (PJP) is up only 1%, whereas the iShares Biotechnology ETF (IBB) is up only 5%. In comparison, the SPDR S&P 500 ETF Trust (SPY) has rallied by 48% over the last five years.

That same divergent trend has held steady in 2023. So far this year, PJP is down 9%, while IBB is down 6%. In comparison, the S&P 500 is up more than 11%

It’s difficult to ascertain exactly why these two sectors have underperformed in the last five years as compared to the 20 years prior. However, more recently, there appear to be two primary headwinds for the biotech and pharma sectors.

The first is elevated interest rates. Biotech companies live on the promise of future revenues, and therefore rely heavily on debt to fund their expensive R&D operations. In that regard, higher rates increase the cost of financing, and reduce expected cash flows—in the present and future.

Due to their large size, pharmaceutical companies are somewhat better insulated from higher interest rates. That said, benchmark rates in the U.S. are now trading at multi-decade highs, which means evenly highly capitalized companies with stable cash flows are feeling the pinch from this new environment.

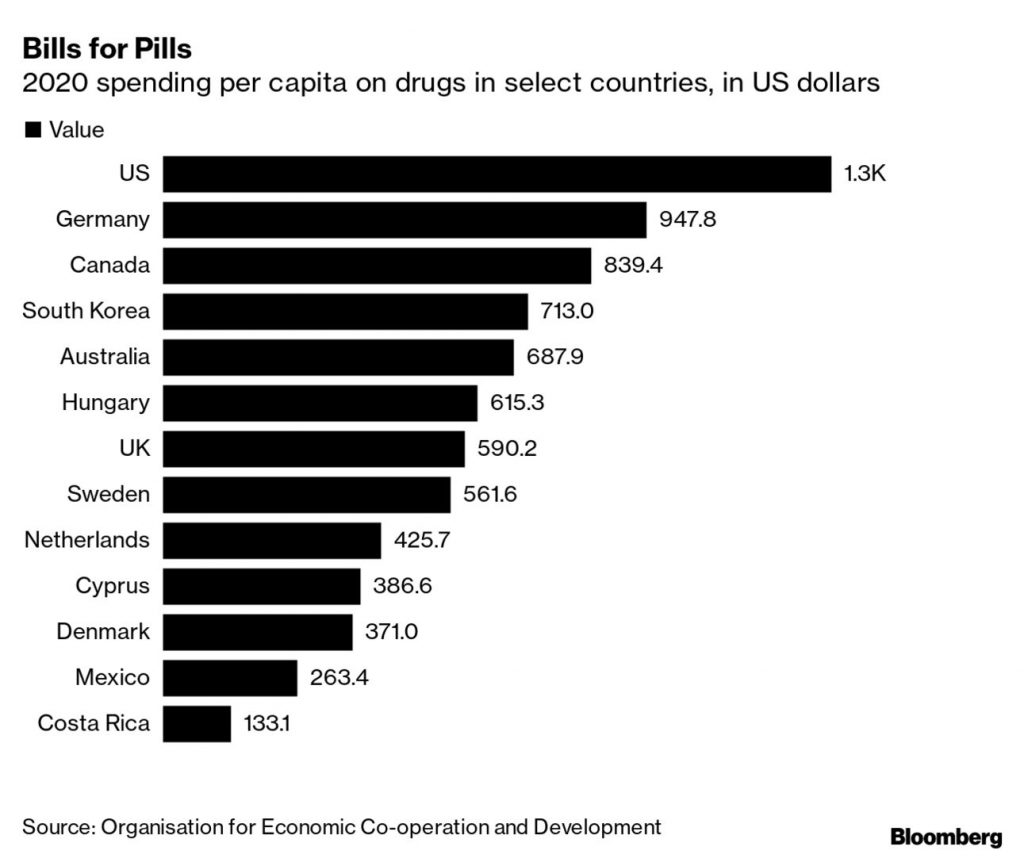

Moreover, the pharmaceutical industry is also facing a potential erosion in its pricing power, as well as decreased revenue/profitability potential due to the U.S. government’s plan to start negotiating prescription drug prices. The government’s goal is to reduce the country’s annual expenditures on prescription drugs, which are the highest in the world.

Drug check

Currently, there are 10 prescription drugs that are expected to be discounted starting in 2026, which is expected to save the U.S. government nearly $100 billion over the next decade. The drugs include well-known treatments for cancer, diabetes, and heart disease, as highlighted in the list below:

- Eliquis: used to prevent blood clotting, made by Bristol-Myers Squibb (BMY)

- Enbrel: used to treat rheumatoid arthritis, made by Amgen (AMGN)

- Entresto: used to treat cardiovascular conditions, made by Novartis (NVS)

- Farxiga: used to treat type type 2 diabetes, made by AstraZeneca (AZN)

- Fiasp/NovoLog: used to treat diabetes, made by Novo Nordisk (NVO)

- Imbruvica: used to treat blood cancers, made by AbbVie (ABBV)

- Januvia: used to treat diabetes, made by Merck (MRK)

- Jardiance: used to treat diabetes, made by Boehringer Ingelheim

- Stelara: used to treat Crohn’s disease, made by Johnson & Johnson (JNJ)

- Xarelto: used to prevent blood clotting, made by Johnson & Johnson (JNJ)

Medicare’s new ability to negotiate prescription drug prices stems from a legislative change made as part of the 2022 Inflation Reduction Act.

Starting this autumn, the Centers for Medicare & Medicaid Services (CMS) will engage in price negotiations with the manufacturers of those 10 drugs. These lengthy negotiations aren’t expected to conclude until August of 2024, after which the agreed-upon prices will be officially published on September 1, 2024.

The new discounted prices will go into effect on Jan. 1, 2026. After that, the CMS can negotiate 15 new drugs in both 2027 and 2028, and then 20 starting in 2029, and beyond.

Not surprisingly, the savings to the U.S. government will be substantial, which means the impact on the biotech and pharma industries will also be significant. According to one estimate from the University of Chicago, the Medicare price discounts could eventually eat into about 8% of the pharmaceutical industry’s total annual revenue.

This particular challenge probably helps explain why these sectors have lagged the broader market so far in 2023. Speaking to the current climate in the biotech and pharma industries, the CEO of ABioX—Jeff Jonas—highlighted that “Uncertainty never benefits innovation or investment.”

Top-Performers in the Biotech and Pharma Sectors in 2023

Despite the headwinds in the biotech and pharma sectors, there have been some outperformers.

When filtering for companies that earn at least $2 billion in annual revenues, the top year-to-date performers in the biotech and pharma sectors include:

- Oscar Health (OSCR), +124%

- Amneal Pharmaceuticals (AMRX), +84%

- West Pharmaceutical Services (WST), +59%

- Eli Lilly (LLY), +48%

- Exact Sciences (EXAS), +34%

- Novo Nordisk (NVO), +31%

- Vertex Pharmaceuticals (VRTX), +24%

- GE HealthCare Technologies (GEHC), +20%

- Zoetis (ZTS), +17%

- Regeneron Pharmaceuticals (REGN), +15%

Notably, none of the companies involved in the forthcoming price negotiations with the U.S. government are included in the above list. Interestingly, however, two of the world’s largest pharmaceutical companies are highlighted above—Eli Lilly and Novo Nordisk.

Along those lines, one of the key themes in 2023 has been outperformance in companies that produce weight-loss treatments—particularly those tailored toward patients with type 2 diabetes.

Novo Nordisk (NVO) recently became the most valuable company in Europe due to the skyrocketing demand for its weight-loss drugs Ozempic and Wegovy. Eli Lilly has likewise seen its shares charge higher in 2023 due to increased demand for its weight-loss drug Mounjaro.

According to data compiled by the Centers for Disease Control and Prevention (CDC), roughly 37 million Americans now have diabetes, with approximately 90-95% of them suffering from type 2 diabetes. Taking into account the global total, that figure balloons to 422 million.

Moreover, an estimated 40% of American adults are now rated obese, and according to the American Diabetes Association, being obese significantly increases one’s likelihood of contracting diabetes.

Due to the rising effectiveness of the aforementioned weight-loss treatments, analysts are now forecasting that the combined annual sales of these three drugs will increase to $54 billion by 2028, from $21 billion in 2023. That level of expected sales growth helps explain why Novo Nordisk and Eli Lilly have seen such impressive appreciation in their shares so far in 2023.

Small stakes

Expanding the list to include smaller biotech and pharma companies with lower annual revenues (below $2 billion annually), there’s also been some notable winners year-to-date.

For example, BridgeBio Pharma (BBIO) is up over 250% so far in 2023, due to promising test results from its cardiovascular drug Acoramidis. Some of the other top-performers with smaller market caps include Akebia Therapeutics (AKBA, +66%), Amneal Pharma (AMRX, +85%), Amphastar Pharma (AMPH, +65%), Quanterix (QTRX, +100%) and UroGen Pharma (URGN, +56%),

Another key theme in the pharma and biotech sectors has been the artificial intelligence (AI) narrative. Data plays a key role in the development of new drugs, which means AI will play a key role in the future of this industry.

Several of the stocks involved in AI-focused endeavors in the biotech and pharma sectors include Radnet (RDNT) and Schrodinger (SDGR), which are up 54% and 52% so far this year, respectively. Radnet is using AI to interpret mammograms, while Schrodinger offers AI-enhanced software that’s used in the drug development process.

Looking at the ETF universe, the biggest winners are quite telling. The top performing biotech and pharma ETF is the inverse, leveraged Direxion Daily S&P Biotech Bear 3x Shares (LABD), which is up 16% on the year.

As an inverse ETF, LABD performs best when the shares in the biotech sector are moving lower. Along those lines, the ProShares UltraShort Nasdaq Biotechnology (BIS, +13%) has also outperformed in 2023, for the same reason.

The only other biotech or pharma-focused ETF in positive territory this year is the VanEck Pharmaceutical ETF (PPH), which is up 3%. The balance of the ETFs in these two sectors are down on the year, along with the aforementioned IBB and PJP.

Outlook for Pharma and Biotech Sectors Going Forward

Despite positive returns in the S&P 500 in 2023, the biotech and pharma sectors have been moving in the opposite direction.

That divergent trend is likely attributable to the negative forces acting upon the biotech and pharma sectors—particularly the forthcoming Medicare negotiations.

Considering that those negotiations won’t end until August of next year, negative sentiment in these sectors could persist for the foreseeable future. The fact that interest rates are expected to remain “higher for longer,” is another headwind for these sectors.

Moreover, the 2024 Presidential election could end up representing a key binary event for the biotechnology and pharmaceutical sectors, because if a Democrat maintains the White House, one would think that the current plan to Medicare price negotiations will continue to move forward. But if a Republican ascends to the White House, the current plan to negotiate prescription drugs could be set aside, which could trigger a significant rally in both of these market sectors.

It should be noted, however, that the plan for Medicare to negotiate prescription drug prices is widely supported amongst the electorate, with an August 2023 survey conducted by West Health-Gallup demonstrating that 83% of respondents favor this approach.

Taken all together, the aforementioned information suggests that investors and traders may want to avoid these sectors for the time being, or focus on specific themes that currently enjoy positive momentum, such as the aforementioned weight-loss drug niche, or AI-focused firms like Radnet and Schrodinger.

That said, biotech and pharma stocks could be among the big winners in 2024 and 2025 if a Republican wins the White House. To follow everything moving the markets in 2023, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Hungry for more? The next issue of Luckbox is food-focused looking at new growth opportunities and trading ideas in food, beverage, agricultural, hospitality and grocery stocks. Not a subscriber? Subscribe for free at getluckbox.com.