If AI doesn’t take your job, it’ll change it. A lot.

By James Melton

The new reality will favor those able and willing to collaborate effectively with AI

AI is here. How soon it transforms the economy depends on how fast the technology advances. But experts agree the transition to the “jobs of tomorrow” is already underway.

In late 2022, ChatGPT, an AI chatbot developed by San Francisco-based OpenAI, introduced the public to the potential of generative artificial intelligence. That’s the kind of AI engineers can train to generate new outputs, like sonnets, graphics or awkwardly written term papers.

Soon, experts say generative and other forms of AI will create millions of jobs and destroy millions of others. If forecasts prove correct, we’re facing an economic realignment as intense as the...

Topics

-

Argentina’s Economic Success: Can U.S. Learn from Milei’s Reforms?

|The U.S. faces tough fiscal choices, and Argentina’s bold reforms may provide a blueprint. -

Trump’s Panama Canal Controversy: High Tolls, Tariffs and Trade Wars

|Trump’s Panama Canal talk stirs the pot, but his proposed tariffs could really stir the markets -

Quantum Computing Is the Future—Here’s How to Invest

|From science fiction to reality—quantum computing is poised to emerge as the next big thing in tech. Why QTUM Is Your Ticket to the Future -

Will RFK Jr. Transform the Way America Makes and Sells Food?

|Politics may change the recipe for success in the food industry. Here are some potential winners and losers. -

GLP-1, the FDA and RFK-J Take on the Food Biz

By Ed McKinley

|Junk food manufacturers and restaurant owners are trying to adjust to three looming challenges -

Mark Zuckerberg 2.0: Superficial Makeover or Profound Change of Heart?

By Ed McKinley

|The billionaire CEO of Meta Platforms is shedding his dour image. We ask why. -

What Would Chris Wright’s Confirmation Mean for Nuclear Power?

By Ed McKinley

|The nominee for secretary of energy owns stock worth $40 million in an oil and gas services company -

What Higher Tariffs Would Mean for Markets and Consumers

|Stiff proposed import duties could raise prices and might even foment trade wars -

This Bubble’s Not in Trouble: Why the 2024 Bull Run Isn’t Ready to Quit

|From AI to tax cuts—here's why this rally might be just getting started -

How Much Do Moats Matter?

By Ed McKinley

|While Buffett and Musk disagree, a company’s value can reside in its surrounding protective barrier -

Will America Issue a Central Bank Digital Currency?

By Ed McKinley

|Reactions to CBDC range from indifference to alarm -

CoreWeave: Poised to Transform AI

|CoreWeave, a Nvidia-backed pioneer of cloud services for artificial intelligence, is preparing for an IPO -

How Much Does the U.S. Really Spend on NATO and Foreign Aid?

By Ed McKinley

|The U.S. is paying less than you might think to defend Europe, and NATO members are stepping up their contributions -

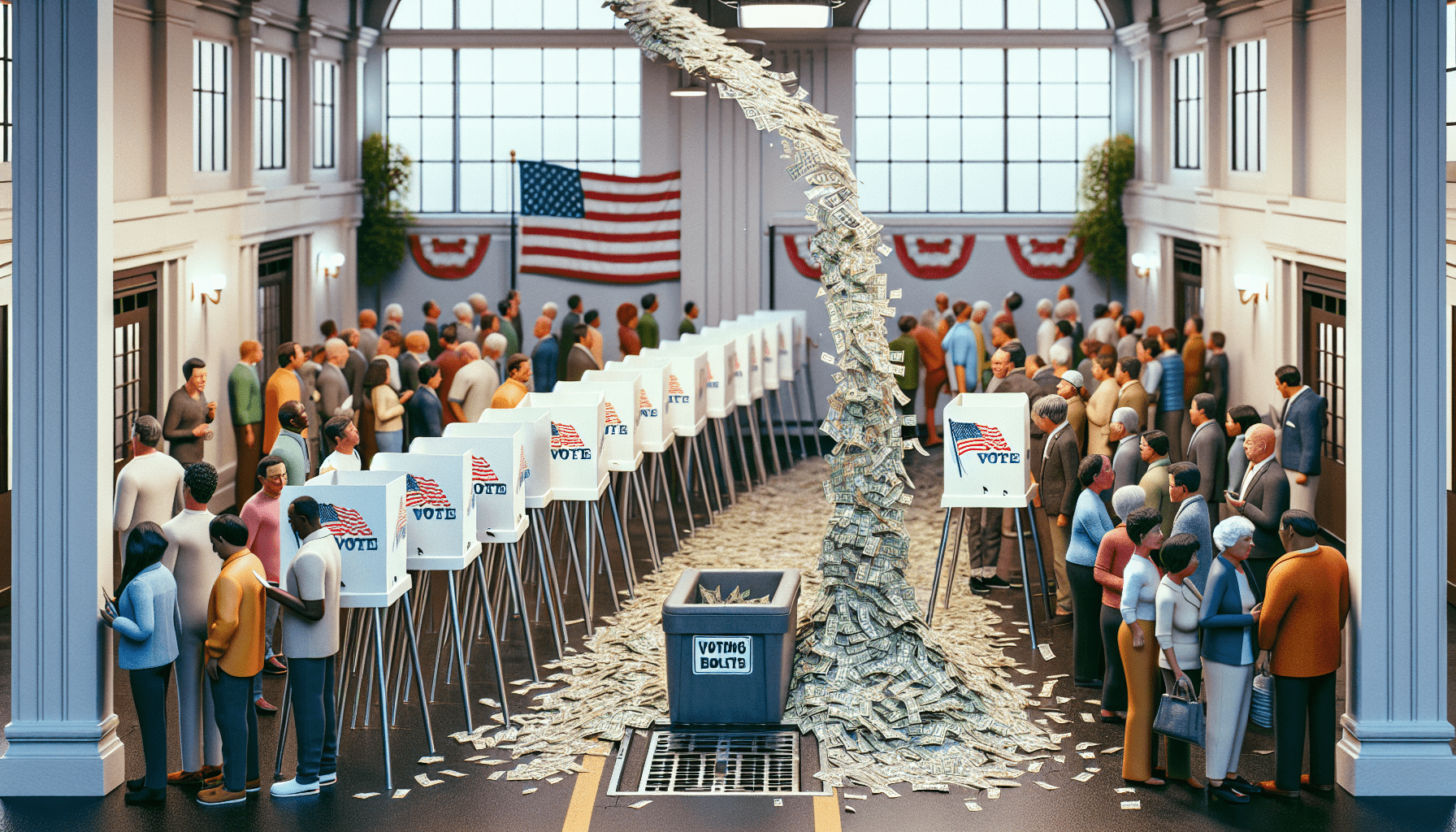

$4.4 Billion Has Been Spent on This Election

By Ed McKinley

|Everybody follows presidential fundraising, but who knows where all that cash goes? -

An All-Star Panel Wades Into the Election Prediction Market Trading Pits

By Jeff Joseph

|Mark Cuban, Robert Cahaly, and others joined Luckbox’s Jeff Joseph to look several days into the future without the advantage of a crystal ball -

What’s Driving Luckbox Readers to the Voting Booth?

|Our most recent survey reveals the political thinking of our favorite group of investors -

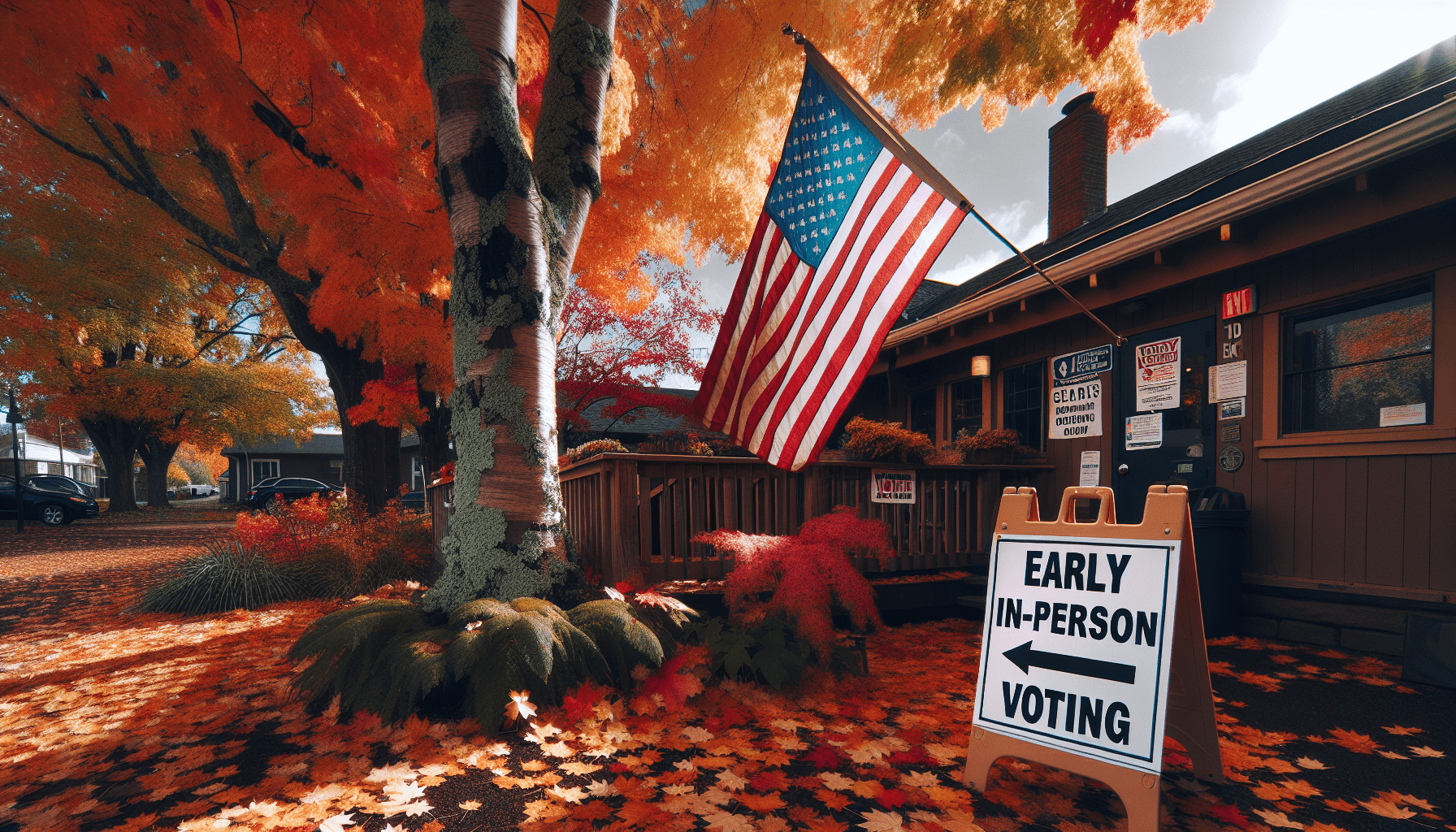

Predicting the Unpredictable: Early Voting, Swing States and the Road to 270

|With early voting trends pointing to fresh records, the result of the 2024 presidential election will likely be once again decided by a handful of key swing states. -

Alex Karp: Meet the Self-Described Freak Leading the S&P 500’s Newest Member

By Ed McKinley

|The Palantir Technologies CEO does things his way—and it works -

What’s Driving the Price of Gold?

By Ed McKinley

|The upward pressure has resulted from economic uncertainty, stockpiling by central banks and wars raging on two continents. But will the trend remain intact? -

Why I Just Bought More Gold Bullion

|They're debasing the currency—and monetary inflation is rising with liquidity