Money Over Mind

Making—or losing—money in prediction markets can change beliefs. But how does that work?

Stock and options traders are continually trying to predict the future. After all, every market decision boils down to the same question: “Will this or won’t this make money?”

But not all markets are created equal.

Investors and economists have had hundreds of years to study markets like the New York Stock Exchange, which was established in 1792. Other markets, such as event-contract prediction markets, are still in their infancy.

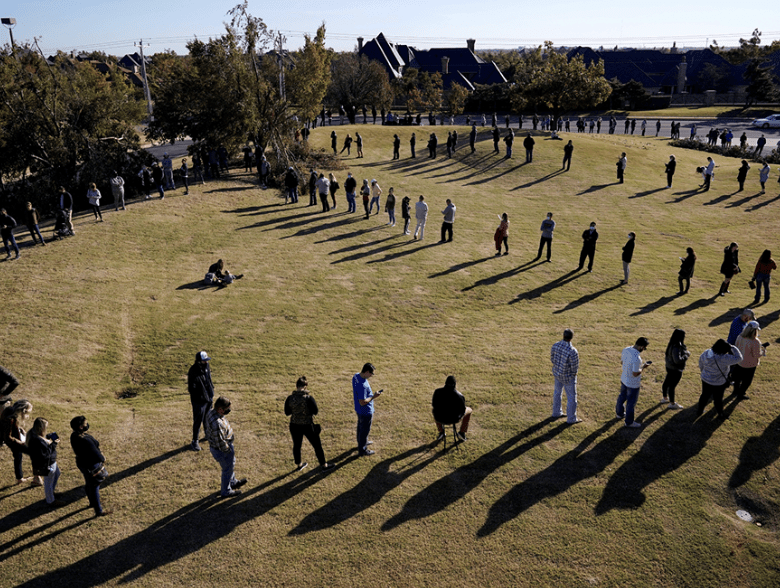

It was only last July that Kalshi, the first-ever federally regulated events exchange, opened its virtual doors for a public beta. Users are already trading hundreds of thousands of shares in its largest-volume markets, each share representing somebody’s expectation for the outcome of a future event.

With more-established prediction market platforms, such as PredictIt, it’s not uncommon for trading volume in a number of markets to surpass millions of shares.

That was more than enough to catch the attention of Moran Cerf, a neuroscientist and business professor at Northwestern University. He and his team decided to construct a prediction market for a research project—not to learn what the markets do, but instead to find out what could be done with the markets. In practice, the project accomplished a bit of both.

“We thought that we can use technology to change people’s minds,” Cerf told Luckbox. “It’s hard for the human brain to think about the future, and we thought that using technology we can make it easier for us to transport ourselves to the future and imagine it better.”

They picked the topic of climate change and recruited self-described believers and skeptics. The point was to see if participating in a climate-themed prediction market would shift beliefs because the market would serve as a non-partisan arbiter of truth.

Following the experiment, some did change their beliefs, but not merely because they participated. Participants shifted toward stronger concern about climate change proportional to the amount of money they won, regardless of whether they were believers or skeptics.

“The nuance is that giving you a stock that’s contrary to your beliefs that constantly makes money does change your mind,” Cerf said. “When you constantly get feedback that your stocks that go against your beliefs are making money, you get feedback that says your beliefs are not aligned with reality and it would have been more financially rewarding for you to have the other beliefs.”

Then, gradually, you shift your beliefs without realizing it—even if your identity doesn’t change. Climate skeptics who began acting more like believers still identified as skeptics, Cerf said, “So I think the shift is not complete—it is in practice, but not in theory.”

The experiment was repeated focusing on sports instead of climate change, and the results suggested that fandom is not as closely tied to one’s identity as environmental beliefs. It’s easier to accept a favorite team losing a game than being wrong about ideological principles.

But for prediction markets to change beliefs, Cerf said, participants must accept a common arbiter of truth.

“It only works if when you lose, you accept that you lost, and if you win, you accept that you won,” he said. “And in this game, you entered knowing the rules, and you got an outcome that’s like going to trial. The jury says ‘yes’ or ‘no.’”

Prediction Markets

Augur was developed by Forecast Foundation as a global no-limit decentralized prediction market platform built on the ethereum blockchain. Betfair, a London-based online gambling company, operates the world’s largest online betting exchange and hosts prediction markets on domestic and international politics.

Kalshi, a new federalla regulated prediction market based in the United States, began its beta in July 2021 with markets based on COVID-19, climate, politics and pop culture.

Nadex (North American Derivatives Exchange) is a regulated financial exchange, specializes in short-term binary options and spreads. It recently introduced a suite of prediction markets for forecasting economic events.

Polymarket, a prediction market platform built on the Polygon blockchain, uses USD Coin (USDC), a cryptocurrency stablecoin, to make trades.

PredictIt, a New Zealand-based prediction market, was launched as a research project in 2014 with a no-action letter from the Commodity Futures Trading Commission. It emphasizes politically themed markets.

How Predictive Are Prediction Markets?

Kalshi’s co-founder discusses what she’s learned about the exchange’s forecasting power since it launched last summer

hen Tarek Mansour and I started Kalshi, we had a vision of an “everything market,” an exchange where people could hedge, forecast and trade on the things they were talking about. Forecasting was always an important part of the vision: Both of us had read the classics from Philip Tetlock and Robin Hanson, and one of us had done research in forecasting using statistics and machine learning.

We dove deeper into the literature on forecasting, reading papers from economists, such as Justin Wolfers and Eric Zitzewitz, that showed why prediction markets were theoretically optimal information aggregators, and psychology papers that showed how the markets could fail.

In the process of building the exchange, we used every shred of this acquired knowledge to choose the order book model, design the fee structure and craft the trading mechanics—all with an eye toward maximizing the forecasting power of our markets.

Let’s take an example market category, COVID-19, and see how it has performed in the wild.

One of the most interesting COVID-19 markets is one that hasn’t yet settled: VOHC-001. This market asks if the CDC will identify a “variant of high consequence” (VOHC) by March 1, 2022. Vaccines and therapeutics are ineffective against VOHCs, and no variant has yet been labeled one. The Delta variant, for instance, is a “variant of concern,” which is one tier below.

From the market’s launch on Sept. 6 to the time of this writing, traders have indicated that the probability of a VOHC emerging is at least 20%. Already, this is notable because predictions from news media, politicians and even scientists have been—and continue to be—far more optimistic about the continued usefulness of vaccines and COVID prevention measures.

A spike appeared in the “YES” probability on Nov. 25. What changed? That was the day South Africa reported news of the new, highly transmissible Omicron variant. There wasn’t much information about the variant at the time, except that the World Health Organization quickly labeled it a “variant of concern.” Traders drove yes-side prices up to 50%.

In the days after, media reports questioned the new virus’s transmissibility and lethality, causing the probability of “YES” to swing rapidly before eventually settling around 40%. By early December, as even more was learned about Omicron, the probability was back within the mid-20% range.

The market is still predicting a higher probability of a VOHC than is reported in the news or suggested by scientists. What does this mean? Prediction markets can produce very different and more frequently updated forecasts than other sources.

Kalshi has another series of markets, called VAXX, forecasting the number of vaccinated Americans. The underlying data source is published daily by the Centers for Disease Control, and it’s updated with a one-day lag.

VAXX markets were structured to fit a weekly schedule, which means that if the market is functioning properly, it will become more determined over time as the possible variation in the weekly number is reduced by the trickle of daily data points.

Over the weekly markets’ lifetimes, prediction error drops significantly as the market nears resolution, suggesting the markets responded extremely quickly to new information and updated probabilities without succumbing to narratives or biases prevalent in other sources.

COVID-19 is just one example, but the rest of Kalshi’s markets work the same way. They’re constantly updating, taking into account new information and providing facts-first forecasts.

Our experience with Kalshi has reaffirmed our belief in the power of prediction markets, and we’re excited to share this powerful tool with the world.

Luana Lopes Lara co-founded Kalshi, the first-ever federally regulated events-contract prediction market.

@luanalopeslara2

Binary Options: The Original Predictive Markets

Investors can derive valuable market forecasts from binary options. To learn more, Luckbox spoke with Travis McGhee, CEO of Nadex, a binary options exchange pending acquistion by crypto.com.

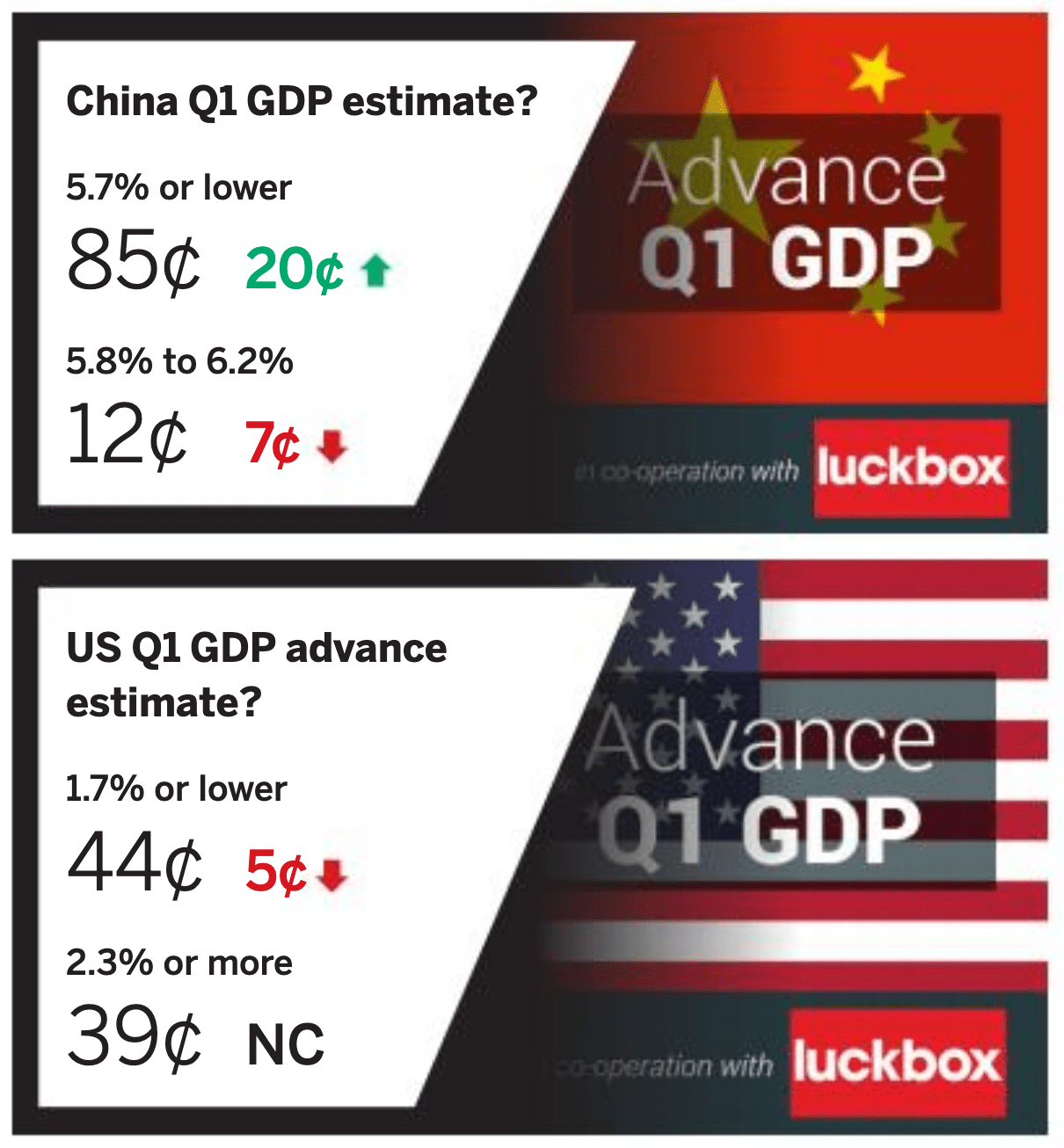

Tell us about Nadex’s new prediction markets.

We’ve recently added approximately 11 new contracts on recognizable economic events, such as retail sales, crude oil inventories and the Consumer Price Index (CPI)—to name a few. We have plans to offer more, many of which will step outside standard economic event classification. What we have seen with more retail traders entering the financial markets is that there is increased demand for access to opportunity. Ten years ago, opportunity came in the form of the S&P 500 or Apple stock. Now, traders across the globe are looking to speculate or hedge with events—both financial and non-financial—whose outcomes may directly or indirectly impact underlying financial markets.

What inspired you to launch these markets?

Funny enough, we’ve listed many of these markets at various points throughout our history. A lot of these new prediction markets are top-of-mind for world citizens and impact the global economy. So, we thought finding the right markets to fit the current macroeconomic landscape made a lot of sense. With the recent pandemic, economic downturn and ongoing recovery, we have been busy adding many markets that are debated in the news and at the dinner table around the country.

What do traders need to know before participating in these markets?

Each contract is effectively a yes-or-no (binary outcome) question. For example, “Will the next CPI release be greater than 0.9%?” Most prediction markets on Nadex have five strike prices—or price levels—to choose from. If you think the next CPI release will be greater than 0.5%, you can trade that as well. Nadex contracts provide traders with extra options and flexibility in prediction markets. These contracts typically open and are available to trade about a week before the prediction numbers are released and the contracts expire. Once they open, people can trade these markets 23 hours a day, five days a week.

Are there any contract limitations?

While the possibilities for new prediction contracts are nearly endless, Nadex, as an exchange regulated by the Commodity Futures Trading Commission, is prohibited from offering some of them. Political elections would be one of those areas where we’re prohibited from listing markets. That said, we plan to expand our offerings in the coming months to include predictions around current issues relating to crypto, pop culture, travel, the pandemic and many other interesting topics.

What makes Nadex’s prediction markets different?

Beyond prediction markets, Nadex members can also speculate on stock indexes, commodities and currencies—all from the same account they use to participate in event contracts.

What trends will these markets be able to capture?

The insights gained from these markets may be the most exciting, but also the most overlooked aspect of their value. As these markets continue to grow in popularity with people from all walks of life, we can begin to get a statistically significant indicator of the real day-to-day experience of Americans and their views on the probability of future outcomes. Additionally, because these are not just questions that may have been hastily answered on some survey but opinions and predictions backed by real money, they may arguably be a more accurate gauge of the current economic temperature.

What do you hope the future holds for Nadex’s prediction markets?

We are continuously researching and evaluating opportunities to list contracts, both in the economic realm and outside, to continue offering our members the most innovative and interesting trading opportunities available anywhere.