Robust September Jobs Report Eases Recession Fears in 2024

The labor market continues to expand

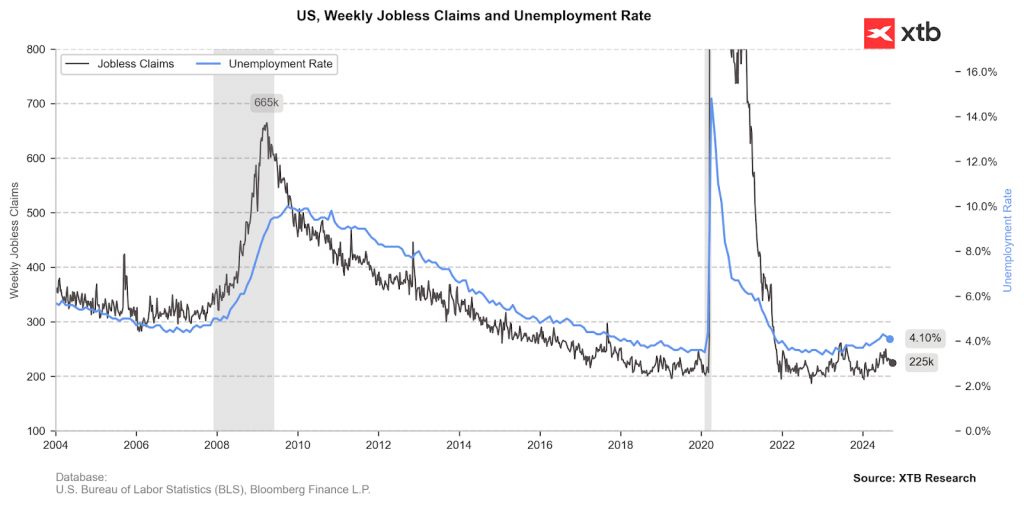

- The labor market remains robust, with the September jobs report showing unemployment at 4.1%, defying expectations amid higher interest rates.

- A recession now appears unlikely in the near term because strong job growth in September and steady economic activity suggest the economy will continue to expand into 2025.

- Government spending has supported job growth and economic stability, but the resulting $1.9 trillion budget deficit in 2024 raises concern about the nation’s long-term fiscal health.

Any doubts about the strength of the U.S. labor market were quickly dispelled Oct. 4, when the September jobs report shattered expectations. The Bureau of Labor Statistics revealed that the U.S. economy added 254,000 jobs in September, far surpassing the anticipated 150,000. The report also showed the unemployment rate ticked down to 4.1%, a 0.1% improvement from the previous month.

The surprise in September’s jobs numbers comes at a time when many economists and analysts were expecting the labor market to slow, largely because of elevated interest rates. But Friday’s report eased those concerns—at least for now.

Strong job market complicates Fed’s rate decisions

The labor market remains a focal point because it’s a key factor in the Federal Reserve’s decisions on interest-rate policy. The Fed operates with a dual mandate: managing inflation and promoting maximum employment. When inflation surged to record highs in 2022, the Fed responded with aggressive rate hikes. The challenge is that higher interest rates typically act as a headwind for businesses, often leading to layoffs or hiring freezes as companies adjust to higher borrowing costs.

Thus far, however, higher interest rates haven’t dampened the labor market to the extent many had anticipated. Some have pointed to the lagging effect of rate hikes, noting that it usually takes several months for the economy to respond fully to tighter monetary policy.

Yet, as time passes, that delayed reaction looks increasingly unlikely. Instead, the economy seems more resilient than expected. With unemployment at 4.1% in September, the rate remains at the lower end of its historical range (illustrated below), underscoring the continued strength of the labor market.

One closely watched indicator, the Sahm Rule, had hinted at a potential slowdown in hiring. But the strong September jobs report seems to ease that concern, at least for now. Hiring has been so strong in early autumn that the interest rates futures market now expects a 25-basis-point cut at the Fed’s next meeting on Nov. 6-7, instead of a 50-basis-point cut.

Fear of recession put on hold

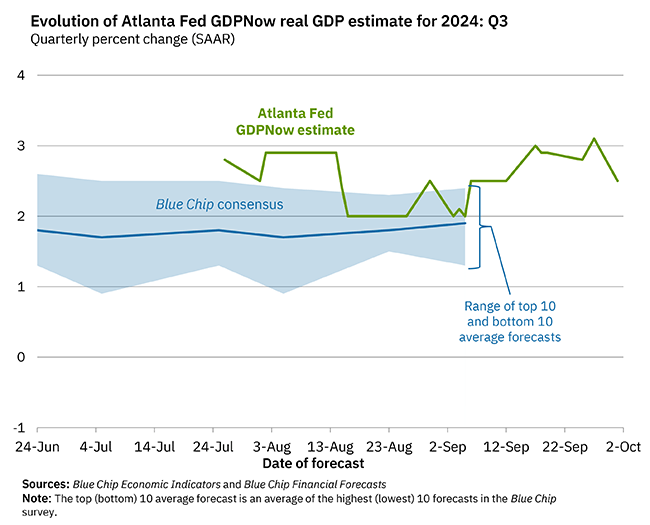

In addition to a solid labor market, economic activity remains robust. For investors, one of the biggest fears is the onset of a recession. Historically, they’ve been kryptonite for stock market valuations, often resulting in significant downward pressure on prices.

However, it doesn’t appear that a recession is looming. Typically, Recessions are preceded by slowdowns in the labor market. Right now, the Federal Reserve Bank of Atlanta is forecasting relatively strong 2%-3% economic growth for Q3 2024. (Highlighted below.) This is in line with last quarter, when the U.S. economy expanded at an annualized rate of roughly 3%.

It’s unlikely a recession will occur in 2024, even if the economy slows marginally in Q4. That view is supported by signals from the corporate sector. During Q2 earnings season, there was a notable reduction in the number of companies mentioning a future recession as a potential risk. In fact, several companies with close ties to U.S. consumer spending indicated they don’t expect a recession in the near future.

One such company is Walmart (WMT), which raised its profitability outlook for 2024 as part of its Q2 earnings report. In an interview with CNBC, the company’s chief financial officer, John David Rainey, said this: “In this environment, it’s responsible or prudent to be a little bit guarded with the outlook, but we’re not projecting a recession.”

Rainey also said consumers are price-sensitive but financially healthy. “We see, among our members and customers,” he noted, “that they remain choiceful, discerning, value-seeking, focusing on things like essentials rather than discretionary items, but importantly, we don’t see any additional fraying of consumer health.”

Echoing those views, Goldman Sachs (GS) Chief Global Equity Strategist Peter Oppenheimer said he doesn’t foresee a recession in 2024. Along the same lines, Brian Moynihan, CEO of Bank of America (BAC), recently noted on CBS’s Face the Nation that “last year, this time, it was a recession. This year, we talked about now there’s no recession.”

Government spending aided COVID recovery

One reason the U.S. economy and labor market have remained resilient despite elevated interest rates is government spending. A prime example is passage of the American Rescue Plan (ARP), which injected $1.3 trillion into the economy in 2021, followed by an additional $600 billion in 2022. This massive stimulus helped stabilize the labor market, particularly in the immediate aftermath of the pandemic.

To put this effort in context, the unemployment rate dropped from 6.1% in April 2021 to 3.9% by December 2021. And a February 2022 analysis by Moody’s. The analytics firm’s model demonstrates that without the ARP unemployment would have remained above 7% throughout 2021 instead of falling below 4% by year’s end.

In comparison, the Eurozone, which allocated fiscal stimulus equivalent to only 10% of its annual GDP—compared to 25% in the U.S.—experienced a much more sluggish recovery. By December 2021, the Eurozone’s unemployment rate remained at 7.0%, while the U.S. had already made significant strides back to full employment with its 3.9% rate.

This data highlights how substantial government spending has played a vital role in fueling American economic resilience, particularly in the labor market. Without the ARP and other fiscal measures, the U.S. would likely be grappling with higher unemployment and weaker economic growth, similar to what was seen in other parts of the world, such as the Eurozone, as illustrated below.

But government spending also comes with significant costs. In 2024, the Congressional Budget Office (CBO) projects a $1.9 trillion budget deficit, which will add to the national debt, whichg now exceeds $35 trillion.

This deficit represents 7%-8%% of annual GDP, well above the 3% level considered healthy. While spending like the ARP has bolstered the labor market, the growing fiscal imbalance could eventually weigh on the U.S. economy, leading to higher borrowing costs or reduced spending in other critical areas.

Takeaways

The labor market remains remarkably resilient, with strong job creation and unemployment near historical lows. The broader economy has similarly defied expectations, continuing to grow despite elevated interest rates. However, the persistent and elevated levels of government spending pose a clear fiscal risk. With deficits projected at nearly 7% of GDP and national debt exceeding $35 trillion, the long-term consequences of such imbalances cannot be ignored.

The way forward may lie in gradually reducing federal spending as the economy stabilizes. This approach would help curb budget deficits and slow the growth of national debt without derailing the recovery. Striking this balance is essential: Maintaining economic momentum while addressing fiscal risks will be crucial for both short-term resilience and long-term sustainability. It’s an important dynamic to keep in mind ahead of the November elections.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. He is a frequent contributor to Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.