VinFast (VFS): Big Potential, But …

By 2026, VinFast (VFS) is expected to produce hundreds of thousands of electric vehicles (EVs) on an annual basis, but it’s not yet clear how the company will fund those ambitious plans

- Shares of VinFast (VFS) have ranged between $5/share and $93/share since the stock first debuted on the Nasdaq in August of 2023.

- At present, the stock trades for about $6.50/share, which implies a valuation of roughly $15 billion.

- By 2026, VinFast hopes to be producing hundreds of thousands of vehicles annually.

After a tumultuous ride, shares of VinFast (VFS) have been stuck in neutral for the last several months.

For investors and traders who purchased VinFast’s stock at higher levels, that’s probably a disappointing development. Last August, shares of VinFast debuted on the Nasdaq as a result of a SPAC (special purpose acquisition company) merger.

At that time, the company was worth roughly $23 billion and traded at roughly $10/share. Since then, however, VinFast shares have traded between roughly $5/share and $93/share, which means the company has been valued as highly as $210 billion at its peak, and $11 billion at its nadir.

Today, VinFast shares trade for roughly $6.50/share, with a valuation of around $15 billion. That’s 93% lower than the stock’s 52-week high, and about 30% above the 52-week low. Based on the dramatic slide in the company’s stock price, one might think that VinFast’s future potential was looking grim.

Digging a bit deeper, however, it appears that the company’s shares were targeted by speculators. In that regard, the recent correction in prices looks more attributable to the departure of fast money, as opposed to a material deterioration in the company’s future prospects.

That said, the future potential of VinFast remains somewhat of a mystery, and the stock carries a significant amount of risk, especially at the current valuation.

What is VinFast?

Founded in 2017, VinFast is a manufacturer of electric vehicles (EVs) and is a part of the Vietnamese conglomerate known as Vingroup. VinGroup was founded in 1993, and has grown rapidly to become one of Vietnam’s largest private enterprises.

VinFast was originally headquartered in Vietnam, but moved its headquarters to Singapore in 2022. The move was likely driven by management’s desire to raise the company’s international profile.

Last year, the company successfully combined with Black Spade Capital as part of a SPAC merger. The merger was finalized on Aug. 14, 2023 at a value of $23 billion. The next day, shares of VinFast started trading on the Nasdaq Stock Market. The reception for VinFast shares in the market was extremely positive, at least initially, with the stock rising as high as $93/share within a couple weeks of the SPAC merger.

However, shares have fallen back to earth in the interim, with the stock currently trading about $6.50/share, representing a valuation of roughly $15 billion. That valuation is about 35% lower than the company’s valuation when it merged with Black Spade Capital.

One of the major headwinds for the stock appears to stem from its need to raise capital. Normally, this process involves the issuance of new stock, which effectively dilutes the existing shares, and makes them less valuable. With more shares outstanding, each individual share represents a smaller percentage of ownership in the company.

Like most vehicle manufacturers, VinFast ultimately hopes to produce and sell enough vehicles to generate a consistent annual profit. However, in order to achieve that goal, the company’s vehicles must be in demand, and VinFast must be able to produce the necessary level of production to satisfy that demand.

Economies of scale

Manufacturers like VinFast need to attain economies of scale which help push down the average cost to build a single vehicle. As production volumes increase, the fixed costs associated with manufacturing, such as facility maintenance, equipment and tooling, can be spread over a larger number of units. This results in lower per-unit fixed costs, which contributes to a reduced average cost of production.

Once attained, higher levels of production typically trigger additional efficiencies and benefits. For example, process efficiencies, negotiating power and the ability to competitively price one’s products. In Q3 of 2022, VinFast delivered around 3,000 battery-electric vehicles (BEVs) to customers.

However, by Q3 of 2023, that figure had jumped to 10,000. By 2026, VinFast hopes to be producing hundreds of thousands of vehicles annually.

Achieving that level of success will depend heavily on VinFast’s ability to finance and operate its manufacturing facilities. The company is currently building a manufacturing plant in the United States, located in Chatham County, North Carolina. The estimated cost of that facility is about $4 billion. The plant is expected to open in early 2026 with the capacity to produce 150,000 BEVs annually.

In addition to the future U.S. facility, VinFast also owns and operates a large EV manufacturing facility in Vietnam. VinFast claims its Vietnamese plant will eventually have the capacity to produce about 1 million BEVs annually. However, it hasn’t revealed how much capital that might require, or when that might realistically occur.

The big questions, therefore, relate to the potential demand for VinFast’s offerings, and the company’s ability to fund its ambitious expansion plans. One also wonders where VinFast will get the capital necessary to fund their planned expansion, and how those capital raising activities might impact the value of the company’s underlying shares.

Valuation analysis

Valuing a new entrant in the emerging EV sector can be tricky, and that’s especially true with VinFast.

In April of last year, the Chairman of Vingroup Pham Nhat Vuong donated approximately $1.5 billion to VinFast. That’s a wonderful development for the company, and certainly increases its chances of becoming a successful going concern.

Vuong already owns more than 95% of VinFast, so while the $1.5 billion donation didn’t directly increase his stake in the company, it obviously boosts his chances of eventually making a huge return on his original investment. If VinFast is one day valued at $100 billion or more, Vuong will book a windfall from that donation in the form of his existing stake.

On the other hand, the donation also raises additional questions. Was the donation required because VinFast couldn’t raise the necessary capital from traditional sources? Or did Vuong make the donation so he wouldn’t have to reduce his percentage of ownership in the company? Along those lines, one wonders if Vuong would be willing to make future donations of a similar magnitude?

These aren’t easy questions to answer, and in that regard, the donation muddles the finances and future prospects of VinFast, making it harder to ascertain a proper valuation for the company.

Limited visibility into the company’s future earnings

Looking at the company’s high-level financials, VinFast generated revenues of about $700 million in 2021 and $633 million in 2022. During the first three quarters of 2023, VinFast collected roughly $755 million in revenues, which implies that total fiscal year 2023 revenue will clock in somewhere north of $1 billion. In 2024, consensus estimates suggest that VinFast will pull in roughly $1.4 billion in revenue.

Based on those figures, VinFast produced a strong revenue growth rate of 57% in 2023. That follows with the company’s fast-rising EV sales numbers, which are expected to be in the range of 40,000-50,000 vehicles in 2023. That represents a 70-100% increase from the number of EVs sold in 2022.

Unfortunately, the company hasn’t provided a clear projection for EV sales in 2024 or 2025, which makes it extremely difficult to forecast the company’s revenues in those years. Considering that the new American manufacturing plant is expected to come online at the end of 2025, some analysts have projected that VinFast’s revenues could climb as high as $5.5-7 billion by 2026.

While those estimates may prove correct, it’s entirely possible that VinFast’s revenues fall well short of those expectations, because it’s difficult to anticipate if the new manufacturing capacity will come online as expected, and it’s even more difficult to forecast whether or not consumers will gravitate toward the company’s offerings.

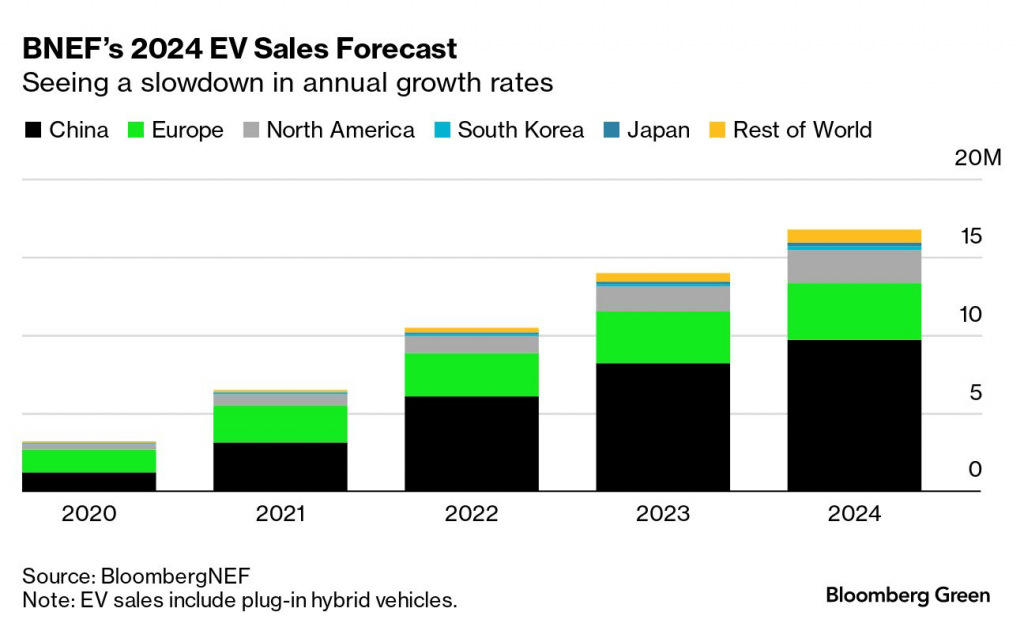

The EV sector has become increasingly competitive due to a slew of new entrants in the sector.

Last year, a report compiled by CarGurus indicated that EVs were sitting on dealer lots for an estimated 82 days, as compared to 64 days for traditional gas-powered vehicles.

Overall, global sales of EVs continues to grow at a rapid pace. However, rising inventories of EVs have forced many manufacturers to discount their prices. With most EV manufacturers continuing to ramp up production, it’s hard to predict whether VinFast’s added capacity will face a saturated market when it finally arrives in 2026.

Ascertain a proper valuation

It’s difficult to predict whether VinFast’s EV offerings will be in demand. Not only because it’s hard to predict VinFast’s unique curb appeal, but also because it’s hard to predict the state of the global economy in 2026. Based on this long list of unknowns, it’s extremely difficult to project—at least with a high degree of confidence—VinFast’s potential revenues in the coming years.

Moreover, VinFast’s mountain of annual expenses don’t appear to be going anywhere. The company lost around $2 billion in 2022 and is expected to lose another $2 billion in 2023. In 2024 and 2025, total losses should be on par with those levels, if not higher.

By 2026, VinFast should see dramatic improvements to its bottom line, as expenses linked to the current expansion plan decline, and increased production capacity contributes to higher revenues—assuming the company can successfully sell those vehicles.

Due to the murkiness of VinFast’s near-term financials, it’s almost impossible to ascertain a proper valuation for the company using a traditional discounted cash flow (DCF) analysis. As such, it’s worthwhile examining the company from the perspective of a comparative company analysis (CCA).

Luckbox will delve deeper into VinFast and bring you a very comprehensive CCA to help you better understand where this company’s potential for profits stands.

Look for Part 2 of this story tomorrow, Jan. 17: CCA: VinFast vs. Rivian.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

Want more insights on EVs? Subscribe to Luckbox magazine for free at getluckbox.com. The upcoming Spring issue is all about EVs and the auto industry.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.