A Bad Omen for the Market

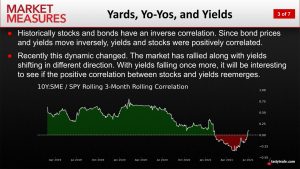

Treasury yields and stock market valuations traditionally share a positive correlation, but in 2021 that relationship seems to have broken down—at least temporarily. Here is what yields are telling us now.

One of the most riveting narratives in the markets at this time remains the dissonant chord being struck by Treasury yields and stock market valuations.

And there are several ways to easily illustrate why this topic is drawing so much attention.

For example, when the stock market tanked in early 2020 due to the onset of the coronavirus pandemic, Treasury yields likewise plummeted to record lows.

While those developments were viewed as worrisome, they were also viewed as somewhat “normal” because historically, Treasury yields and the stock market have shared a relatively strong, positive correlation.

As most are aware, when the economy enters a contraction (as seen during the pandemic), the stock market often corrects due to deteriorating fundamentals in the corporate business environment (i.e. declining earnings). Concurrently, Treasury yields also tend to fall during economic contractions, because central bankers tend to lower benchmark interest rates during these periods.

As a result, it wasn’t any great surprise to see Treasury yields crumble alongside a slumping stock market back in the spring of 2020.

Inexplicably, however, the strong correlation between stock market valuations and Treasury yields appears to have broken down in 2021.

Case in point, Treasury yields are now well off 52-week highs. The 10-year Treasury yield, one of the most-followed yields on earth, has dropped from its recent highs of roughly 1.75% in March, down to about 1.25% today. Fascinatingly, the stock market has not followed suit.

Instead of reversing course in the face of declining yields, stock market valuations have actually continued to rise—a point that was driven home clearly last week when the Dow Jones Industrial Average closed above 35,000 for the first time in history on July 23.

While there are never any guarantees in the market, most long-time market observers probably aren’t expecting this divergence to last—meaning that Treasury yields and the stock market probably won’t continue to move in opposite directions over the long haul.

Historical correlation data suggests that either Treasury yields will reverse course and start climbing back toward 52-week highs, or the stock market will pull back from all-time highs, at some point in the coming weeks. The million dollar question is when that will occur, and which one of the two indicators, yields or the stock market, will reverse course.

The chart below highlights how the traditional positive correlation between Treasury yields and the stock market broke down several months ago, and only recently started to revert back toward its long-term average.

Given their importance in everyday life, Treasury yields, and products related to them, are one of the highest volume products traded on Wall Street. However, before 2020, trading such instruments was overly complex and mostly targeted toward institutional investors.

With the introduction of the Small Treasury Yield (S10Y) by the Small Exchange, a much larger pool of market participants can now access such exposure—whether it be for speculation or hedging.

The Small Treasury Yield (S10Y) is directly tied to the percentage yield of the U.S. 10-year Treasury bond, one of the most widely followed global benchmarks for interest rates.

An investor or trader expecting interest rates to rise, reflected in rising Treasury yields, might therefore consider purchasing the S10Y. Conversely, a trader expecting interest rates to decline, might sell the S10Y.

For a detailed breakdown on the traditional relationship between yields and the stock market, readers may want to review a new episode of Market Measures on the tastytrade financial network.

To learn more about trading Treasury yields using the S10Y, readers may also want to review the following programming:

- Small Stakes: Introducing the Small Treasury Yield (S10Y)

- Small Stakes: How to Trade Interest Rate Futures

- Small Stakes: Managing Stock Risk with Bonds

For updates on everything moving the markets, readers can tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.