Aussie Dollar Not Finished Falling

The U.S. dollar backtracked in July as the Federal Reserve tempered expectations for when it would begin to reduce stimulus. The markets had seemingly over-extrapolated after the Fed brought forward its projected rate hike timeline at the June policy meeting. That change introduced 50 basis points in tightening in 2023 that were previously absent from official forecasts. Traders understandably judged that this might mean a sooner start to the process of incrementally tapering back QE asset purchases to zero. Policymakers curbed the markets’ enthusiasm somewhat in July, asserting that progress toward the start of tapering had been made but remains insufficient. The dollar slid, registering a loss of more than 2% against an average of major currencies. The Australian dollar struggled to participate, ending up flat over the same period.

Struggling despite soft dollar

The Aussie’s lackluster performance seems all the more confounding considering a would-be supportive turn at the Reserve Bank of Australia. It lapped the Fed in early July, announcing the first reduction in its asset-buying program since the start of the COVID-19 outbreak. Officials reiterated the plan at their August meeting.

A glaring disconnect between incoming news and the response from price action is oftentimes a potent indicator of direction. In this case, the Aussie dollar’s inability to capitalize even as Fed and RBA actions pushed the relative monetary policy balance in its favor seems to reflect acute underlying weakness.

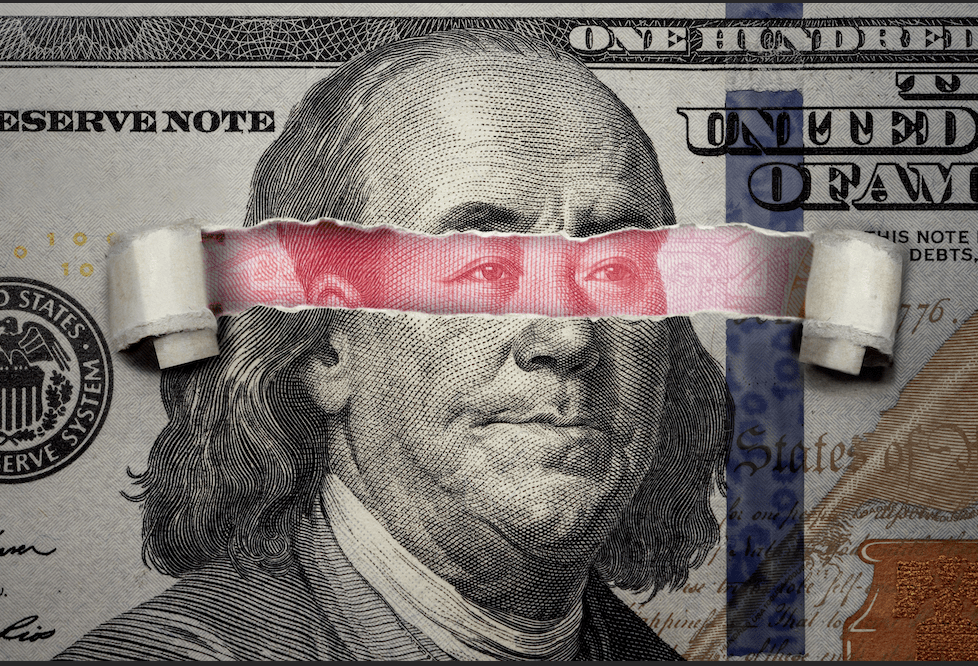

Delta woes and China’s zeal

Two driving forces are in play. First is the spread of the potent Delta variant of COVID-19 as large swaths of the Asia-Pacific region struggle to boost vaccination rates. That triggered new lockdowns, including in Australia. The second is turmoil in Chinese equity markets. The benchmark CSI 300 mainland stock index and Hong Kong’s equivalent Hang Seng Index gauge faced heavy selling as Beijing turned the regulatory screws on capital. Tech giant Alibaba was fined $2.8 billion amid an anti-monopoly campaign. Profit-making was forbidden for ed-tech companies. China is Australia’s largest trade partner, making the latter country highly sensitive to the economic fortunes of the former. Capital flight from Chinese markets amid worries about regulatory uncertainty then echoed in the Aussie.

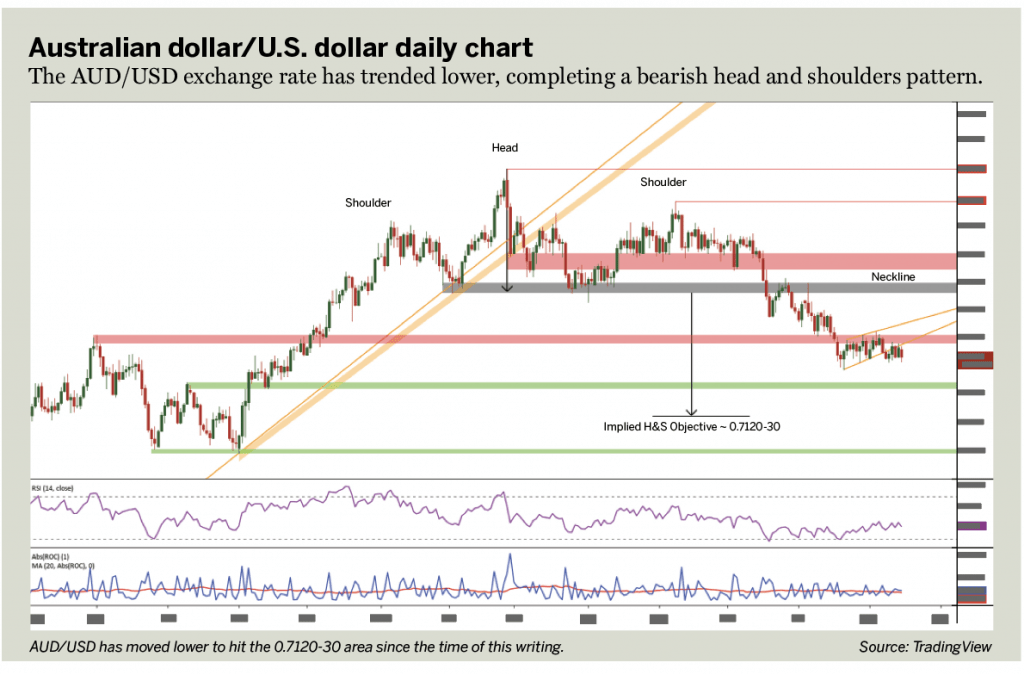

The Australian dollar/U.S. dollar exchange rate has trended lower recently, completing a bearish head and shoulders (H&S) chart formation. The setup implies a downward extension into the 0.7120-30 area. Idling through late July seems to have produced a flag continuation pattern, which may speak to downward resumption ahead.

Initially, technical confirmation on a daily close below the flag’s lower boundary seems to expose support just above the 0.72 figure, with a break below that putting the H&S objective in view. Reclaiming a foothold above 0.74 would probably signal that near-term liquidation has been neutralized. Testing nearby 0.76 could follow from there.

Ilya Spivak is head of Greater Asia at DailyFX, the research and analysis arm of retail trading platform IG. @ilyaspivak