Buy the Dip: The Strategy That Keeps Paying Dividends

A look at the stocks that soared and sunk in August’s market turmoil

- The stock market has once again staged a strong rebound following a surge in volatility, continuing a pattern observed frequently in recent years (aka “buy the dip”).

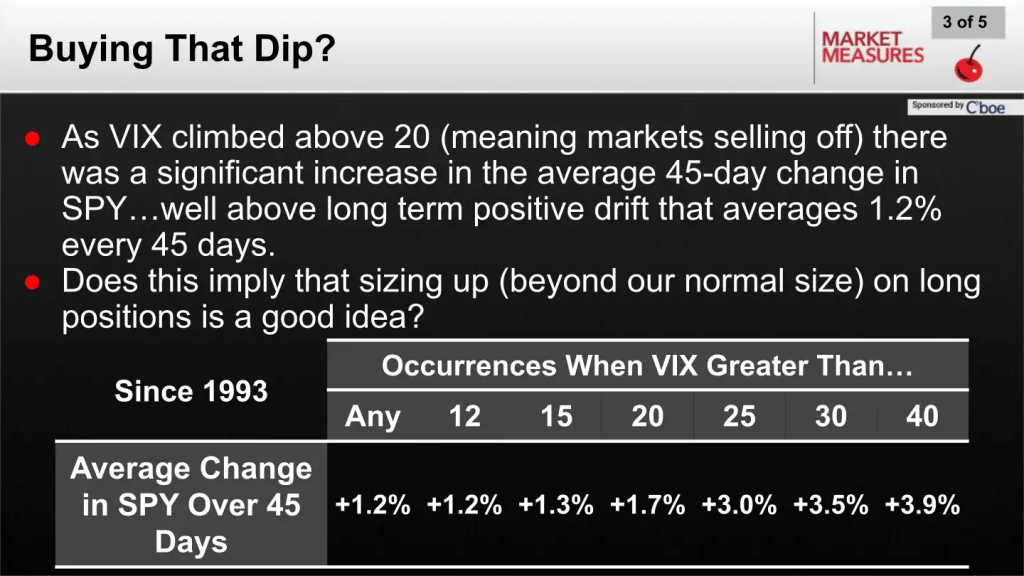

- According to research by the tastylive financial network, rebounds tend to be more pronounced when the CBOE Volatility Index (VIX) surpasses its long-term average of approximately 19.

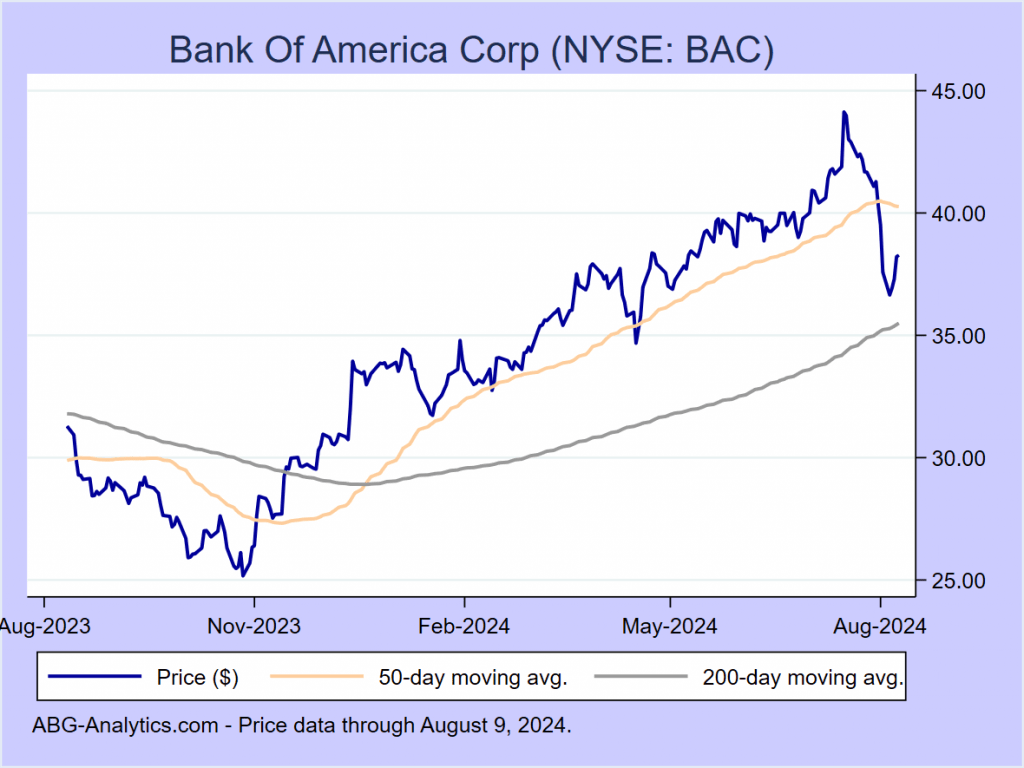

- Despite the recovery, some stocks didn’t escape the turbulence unscathed. Bank of America was a notable casualty.

The stock market has a knack for bouncing back after chaos. And in early August, those who bought the dip were quickly rewarded as the market rebounded from its latest downturn.

However, the volatility left its scars. Bank of America (BAC), often a stalwart of stability, saw its shares plummet by roughly 21% from mid-July to early August, underscoring the fragility of even the most established financial institutions.

Meanwhile, Beyond Meat (BYND) provided a cautionary tale. On Aug. 9, shares in the plant-based protein pioneer soared over 40% in intraday trading, but those gains evaporated by the closing bell. The day’s wild ride highlighted both the potential and the peril of the current market.

Let’s delve deeper into these stories and explore the market dynamics shapimg the recent bout of volatility in the financial markets.

Dip buyers thrive again

In early August the S&P 500 took investors on a rollercoaster ride, swinging between 5,500 and 5,100, with daily moves that kept stockholders on edge. But as the dust starts to settle, one thing is becoming clear: Those who bought the dip are once again coming out on top.

“Buy the dip” (or “BTD”) is a strategy as old as the markets themselves. Investors swoop in after a price drop, betting on a quick rebound. It’s a gutsy move that banks on the idea that what goes down must come up. More often than not, it pays off—especially in the big indices.

Take gold, for instance. If its price were to drop suddenly by 10%, a wave of investors would likely rush in, seeking to capitalize on a potential bounce-back. This strategy, though inherently risky, has proven effective over time, particularly in the major stock indices.

Research by the tastylive financial network underscores the success of dip buying, especially in the S&P 500. Analyzing data from 1993 through 2022, tastylive’s findings suggest that, on average, the S&P 500 does indeed rebound following sharp selloffs—a pattern that held true in early August.

What makes this research particularly compelling is its focus on the CBOE Volatility Index (VIX), often called the market’s “fear gauge.” Historically, when the VIX rises above its average level (~19), the S&P 500’s rebounds tend to be even more pronounced.

When the VIX crosses the 20 mark, the S&P 500’s recovery over the following 45 days is typically more robust compared to when the VIX spikes but remains below 20, as illustrated below.

In the most recent bout of volatility, the VIX did indeed surge above 20, and the S&P 500 ultimately bottomed out around 5,119. Since then, the index has climbed back to 5,350, marking a 4.5% rebound—a promising move that aligns with historical trends.

However, it’s important to note that the full 45-day window has yet to pass, meaning the final outcome of this particular rebound remains unclear. Early signs, though, point to a familiar pattern taking shape.

That said, active investors should not overlook the risks accompanying these volatile conditions. As the VIX rises, the variability of returns increases, underscoring the uncertainty in the market. This correlation between risk and return is a crucial consideration for anyone navigating turbulent conditions.

Bank of America takes a 21% hit

Bank of America has been taking it on the chin lately, with its stock tumbling about 21% from July 16 to Aug. 5. For a company with a market cap hovering around $300 billion—and operating in what’s considered a stable industry—that’s a significant drop. But the decline isn’t just about market volatility.

The real blow seems to have come from Berkshire Hathaway (BRK.B). Over a 12-day stretch in late July and early August, Warren Buffett’s investment powerhouse trimmed its stake in BAC by roughly $3.8 billion. That move sent ripples through the market, and BAC’s stock price felt the impact.

This isn’t just any investor pulling back—this is Berkshire Hathaway, the investment powerhouse. With the recent sale, BAC dropped to third place in Berkshire’s portfolio, now trailing Apple (AAPL) and American Express (AXP). Even so, Berkshire still holds the largest single position in BAC, with a 12.1% stake.

Despite the recent slump, BAC shares have rebounded slightly in the last several trading days and are still up more than 10% for the year. But with Buffett and his team stepping back, the big question now is: Where does Bank of America trade from here?

Beyond Meat (BYND) surges by 40% before crashing

One of the more dramatic stories in early August was the wild ride of Beyond Meat (BYND).

At one point on Aug. 9, shares of BYND surged by an impressive 42%, rocketing from around $6.50 to over $9 per share. For a stock that’s been trading within a 52-week range of $5 to $13, that was a notable move.

But for those hoping the rally would hold, the day ended in disappointment. By the closing bell, the gains had vaporized, and the stock settled back to where it started, leaving investors wondering what had just happened.

Moreover, when trading resumed on Aug.12, Beyond Meat couldn’t maintain its momentum. Instead, the stock reversed course, slipping about $0.50 when the excitement faded as quickly as it had appeared. The stock now trades for about $5.90/share.

While Beyond Meat had released its earnings report on Aug. 7, the numbers didn’t seem to fuel either a bullish or bearish case. Instead, it looks like a whale in the options market might have sparked the sudden surge on Aug. 9, triggering a short squeeze that briefly sent the stock soaring.

Given the recent volatility, Beyond Meat is likely to stay on the radar of active traders. For more insight into the current volatility dynamics on Wall Street, readers can check out this new installment of Market Measures on the tastylive financial network.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.