China Woes May Sink the Yuan

Look for a breakout over a pivotal resistance point

That China is all but destined to overtake the United States as the global economic leader has been received wisdom for market-watchers for quite a long time now. This narrative envisions the resurgent East Asian giant in the same challenger role that the North American powerhouse took up when it displaced the U.K. from pole position.

To be sure, China’s ascent has been impressive. In the past 14 years alone—starting in 2007 at the onset of the housing crisis that would trigger the Great Recession in 2008, setting the stage for much of the current economic order worldwide—the gap between Chinese and U.S. GDP shrank by a staggering 78%.

Looked at another way, the U.S. lead narrowed to just $686 billion as of the second quarter of 2021. That’s a mere 14% of total output, which registered at $4.84 trillion in the same period. Economists expect Chinese growth to outpace that of the United States by an average of 2.4% through 2023, shrinking this gap further.

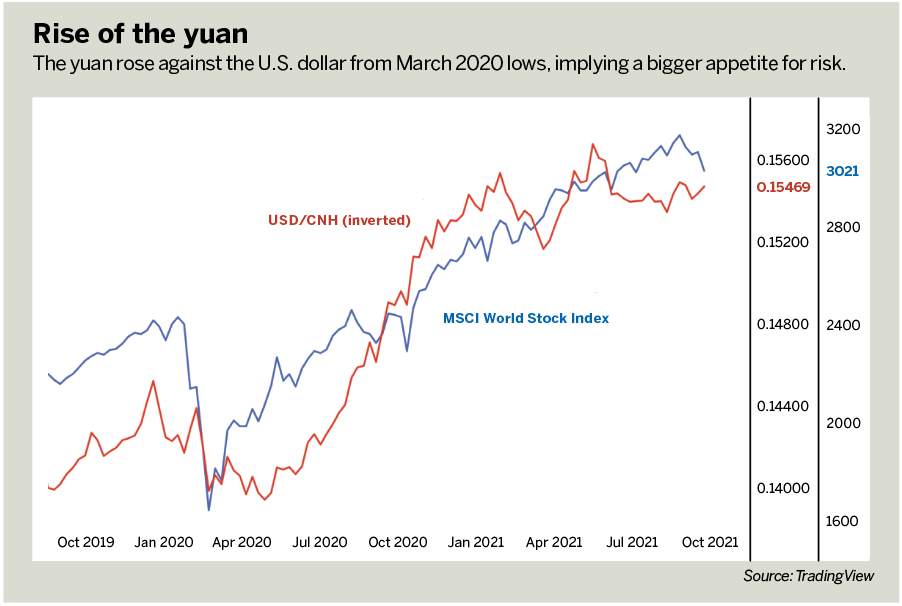

The market-wide recovery from the lows set at the onset of the COVID-19 outbreak belies this narrative. The yuan rose against the U.S. dollar alongside the rebound in the MSCI World Stock Index from March 2020 lows, indicating that improvement in risk appetite is consistent with a preference for the supposedly growth-geared Chinese unit.

Slower growth in China

A change of course over the near and longer term may be afoot. Official and private-sector PMI surveys agree that the post-COVID recovery in Chinese growth peaked in November 2020. Performance has deteriorated since then, with a steady slowdown inching toward a contraction in manufacturing- and service-sector activity in August.

The downturn has put pressure on financial stability. Credit spreads began to deteriorate rapidly in June. They are now nearly back to the strained funding conditions of March 2020, just as the worst of the pandemic struck. That property giant Evergrande suddenly seemed to be on the verge of default in September is a case in point.

Economic troubles have come alongside a sterner posture from Beijing. A thaw in U.S.-China relations does not seem to have materialized during the Biden administration after a tense four years under the leadership of Donald Trump. Friction with Europe, Japan and Australia continues to simmer.

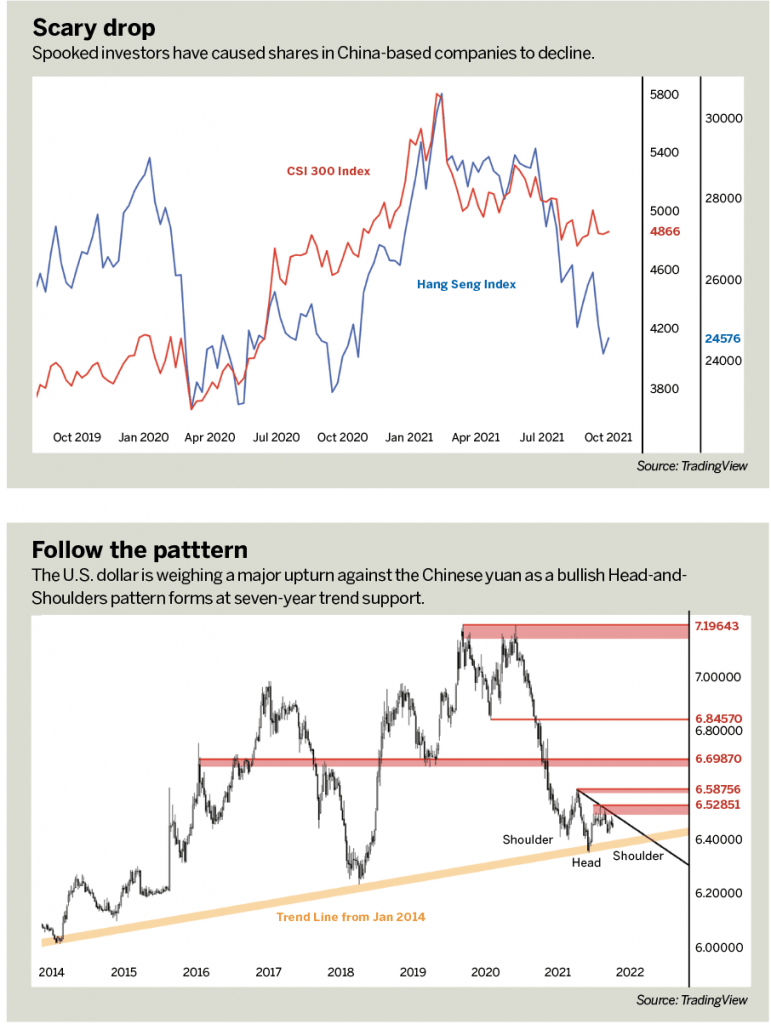

Meanwhile, Chinese officials have taken a pointedly harder regulatory line, moving with particular zeal to clip the wings of ascendant technology companies and their high-profile bosses. That along with a seemingly tightening mainland grip on Hong Kong has spooked investors and local shares have duly dropped.

Political change in China?

It’s inconvenient for China’s policymakers that the world has hit COVID’s economic soft patch just as the Federal Reserve begins to reduce expansive monetary stimulus. That portends a global upshift in borrowing costs in the coming two to three years. Vast parts of a massive fiscal backstop for the COVID-struck economy are also about to expire.

That reflects relative U.S. economic strength. While activity growth has slowed since peaking in May 2021, the pace of nonfarm expansion remains well above the recent average. It also amounts to stronger headwinds for China’s economy just as it can ill afford them.

In the immediate term, the allure of greener pastures on the growth front and heightened worries about heavier regulation may cause a reversal of capital flows in favor of the greenback at the expense of the yuan. From a longer-term perspective, how the People’s Republic meets this moment may prove pivotal.

Broadly speaking, China’s prosperity in recent years has reflected its greater openness to and parallel embrace by Western-dominated international institutions and financial markets. If Beijing continues to turn inward in response to current difficulties, a larger exodus of assets geared to the East Asian giant’s fortunes may follow.

Trading USD/CNH

One way to trade this narrative may be via an upturn in the U.S. dollar/Chinese yuan renminbi (USD/CNH), the United States unit’s pairing against the free-floating “offshore” version of the Chinese yuan (as opposed to CNY, the heavily managed “onshore” expression of China’s currency). Prices may be bottoming as a bullish head-and-shoulders pattern emerges at trend support dating back to early 2014.

Overcoming initial swing-high resistance at 6.5285 and 6.5876 may amount to confirmation of reversal, setting the stage for a push higher to challenge the inflection zone capped near the 6.70 figure. This has been a pivotal barrier since 2015, with a break above it conjuring visions of long-lasting USD appreciation.

Ilya Spivak is head strategist for Asia-Pacific markets at DailyFX, the research and analysis arm of retail trading platform IG. @ilyaspivak