COVID-19 Redux?

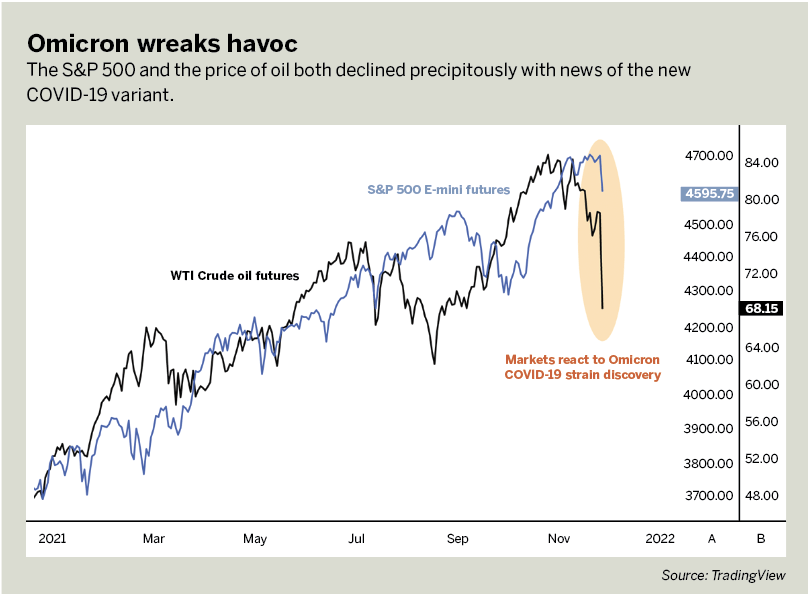

News of the Omicron variant made markets plunge, but the mutated virus might buttress the dollar

In the second half of 2021, investors worried about inflation and speculated on how the Federal Reserve would respond. Meanwhile, the Fed tried to allay fears of rising prices—insisting gains were merely “transitory” side effects of the COVID-19 pandemic—even as it pivoted to step up stimulus withdrawal.

The matter seemed mostly settled as the holidays drew near. Market pricing of the expected rate hike path, as reflected in Fed Funds futures, evolved over the fourth quarter to match the Federal Open Market Committee’s September forecast of about 180 basis points in rate increases through 2024. Jerome Powell was renominated as chair, signaling continuity.

But the backdrop changed suddenly as markets wound down for Thanksgiving. The World Health Organization warned that the new Omicron variant of COVID-19 was spreading across the globe, and a slew of countries promptly imposed travel restrictions.

Investors rushed for the exits at the prospect of another broad-based shutdown. The bellwether S&P 500 stock index, a benchmark for overall market sentiment, plunged 2.2% to record its largest one-day decline in nine months. Crude oil prices shed an eye-watering 13%.

At press time, it appears that Omicron may not warrant such alarm or could perhaps have demanded even more forceful liquidation. Scientists didn’t know how effective existing vaccines would be against the mutated virus, and a U.K. health official warned that they would “almost certainly” prove less potent.

Stagflation risk

However the Omicron saga unfolds, the episode highlights the increasing risk of stagflation. Reimposing barriers on cross-border economic activity would limit growth, and supply chain disruptions would push prices upward.

How the Fed’s policy calculus might evolve to achieve the dual mandate of price stability and maximum employment would seem to call for divergent actions. Uncertainty about the response would probably stoke volatility and cool the appetite for risk.

This seems likely to put a premium on liquidity for two reasons. First, liquidity and volatility tend to be inversely related: Price action in assets that are more widely traded tends to be less jittery when all else is equal. Second, greater liquidity confers maneuverability, making risk easier to manage amid difficult market conditions.

The rising dollar

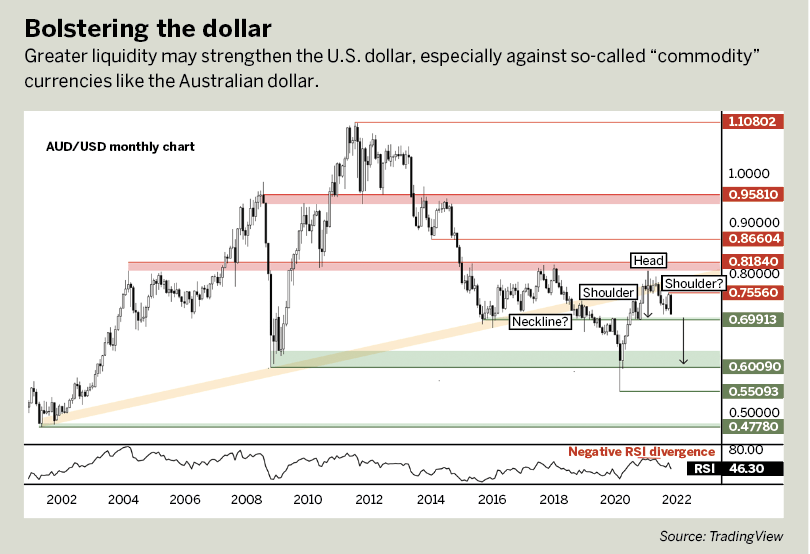

Liquidity probably bodes well for the dollar, especially against pro-cyclical so-called “commodity” currencies like the Australian dollar. The monthly chart of the Australian dollar/U.S. dollar exchange rate hints that a major top—with implications for deep losses in the coming weeks and months—might be taking shape.

Prices appear to be carving out a bearish head-and-shoulders (H&S) technical pattern after retesting support-turned-resistance at a 20-year rising trend line, as well as a price inflection zone approximated in the 0.80-0.82 region. Confirming the setup seems to call for a close under “neckline” support just below the 0.70 figure.

If prices manage a breach, the H&S formation would imply a measured downside objective within the support region, marking the crisis bottoms from 2008 amid the financial crisis and 2020 at the onset of the COVID-19 outbreak. That’s anchored at the 0.60 handle. Invalidating the setup would begin with a close back above 0.7556.

Ilya Spivak is head strategist for Asia-Pacific markets at DailyFX, the research and analysis arm of retail trading platform IG. @ilyaspivak