Expect a Rising Dollar if Inflation Sticks

With price growth exceeding expectations, could stimulus withdrawal be in sight?

In the April issue of Luckbox, this column argued that inflation may prove stickier than the “transitory” blip envisioned by the Federal Reserve, citing a sharp rise in transport costs along frayed supply chains. At that time, the central bank’s official projections saw no interest rate increases on the menu through 2023.

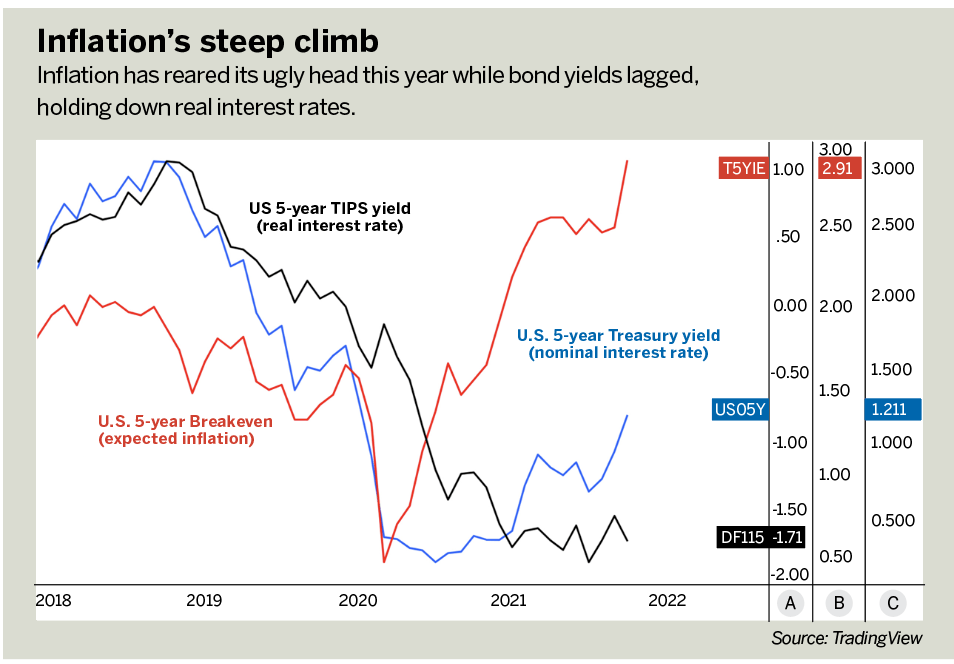

Policymakers have since changed their tune, acknowledgaing in June that price growth has exceeded expectations and advising markets to be ready for the start of stimulus withdrawal by year-end. That helped arrest a precipitous decline in real interest rates and the dollar from the COVID-19 panic peaks in March 2020.

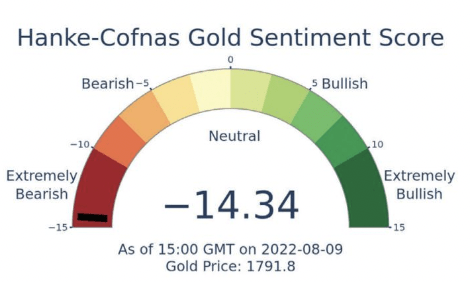

The greenback has attempted a cautious advance against this backdrop, trading up close to 7% by late September before a modest pullback. Real yields have languished, however, pinned in a narrow range near the lows of the year. That’s because the rise in priced-in inflation expectations has outpaced the rebound in nominal rates.

Hot prices

It appears that markets expect Fed officials to fall behind the curve on tightening, letting prices run hot. But a mismatch between investors’ expected path for the oncoming rate hike cycle and that of the Fed itself may force some rethinking.

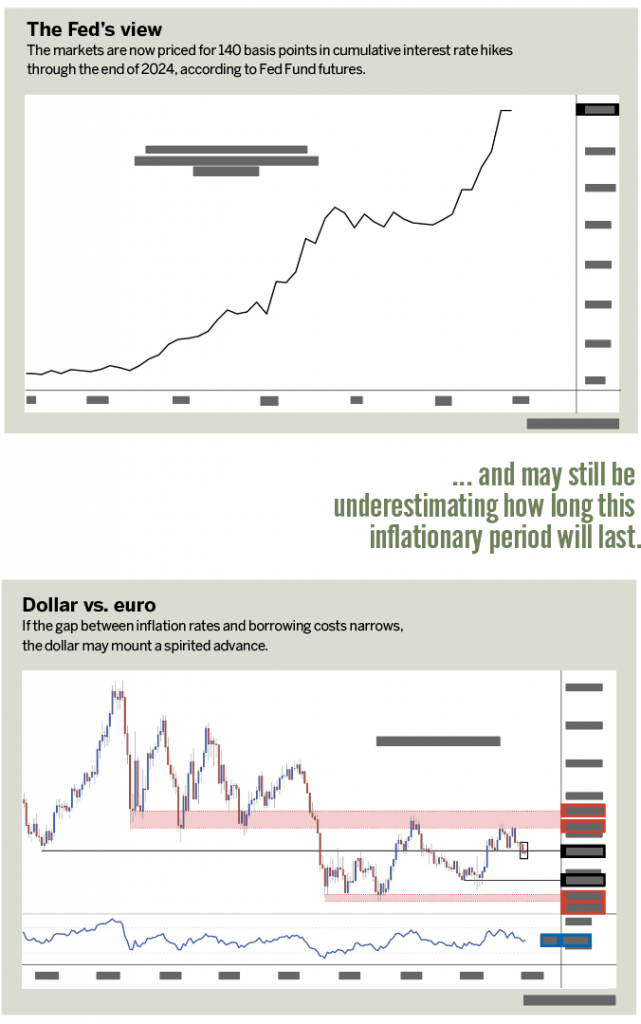

Fed Funds futures indicate that the markets are now priced for 140 basis points (bps) in cumulative interest rate hikes through the end of 2024. Because increases almost always come in increments of 25 bps and the Fed targets a range instead of a single level for the target lending rate, that could mean a policy setting of 125-150 bps in just over three years.

By contrast, Fed Chair Jerome Powell and company envisioned rates finishing 2024 in the 175-200 bps range, putting them 25-50 bps ahead when official projections were last updated in September. While that seems modest at the outset, it reflects the view of a central bank that still sees rapid reflation as short-lived.

Underestimating inflation?

The jury is out on whether the Fed is predicting the right level of inflation. The Fed is almost certainly right to expect that base effects will cool inflation somewhat as the normalization from pandemic-made extremes plays out. It also makes sense when it argues that rising vaccination rates will help even out economic reopening worldwide and improve supply chains.

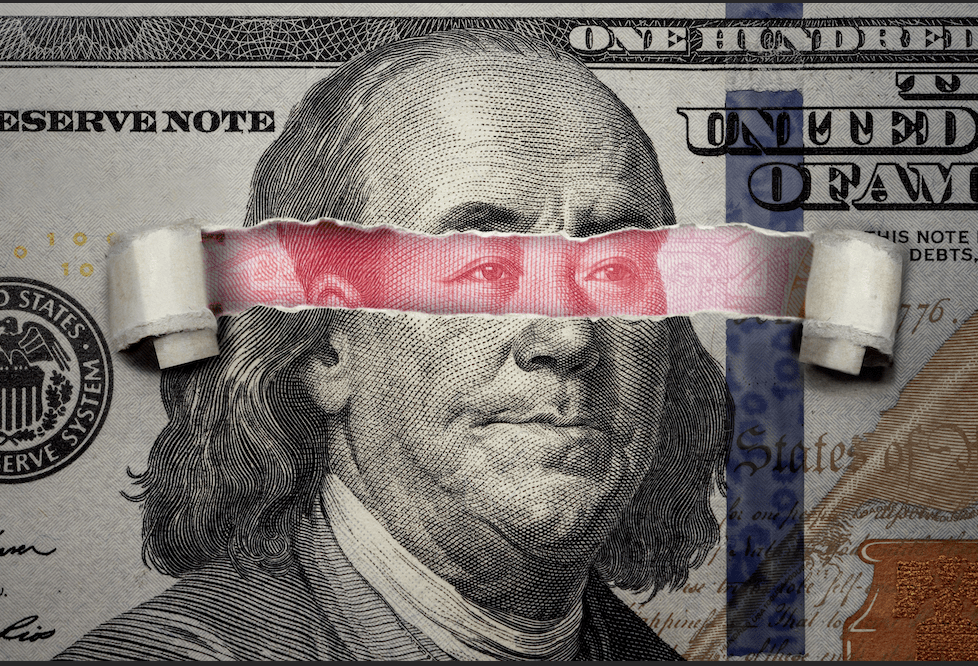

However, officials see these forces pulling inflation down from 4.2% this year to just 2.2% in 2022. That seems like a tall order given the structural inflationary influence of de-globalization. Trade barriers erected amid the trade war preceding the COVID-19 outbreak remain in place, and hardened positions on all sides suggest they will continue.

Add to this the improbability of the full reversal of price increases after consumers’ sticker shock wears off, as well as the rebalancing of terms within contracts and wage agreements being negotiated now. Taken together, this warns the Fed may still be underestimating how long this inflationary period will last.

Euro may suffer

That could mean room for further steepening in the expected rate hike path, warning that current market pricing may be lagging more than meets the eye. In fact, it may be that the slower the Fed is to curb price growth in earnest, the harder it will eventually have to slam on the brakes.

Crucially, credible speculation about such a scenario might prove sufficient to animate price action long before it could be realized. If the gap between expected inflation rates and nominal borrowing costs narrows in this context, rising real yields may animate the dollar to mount a spirited advance.

The greenback’s most liquid expression on global currency markets—its pairing against the euro—may be setting up for such a move already. Prices tellingly finished in September below 1.1639, a key monthly inflection level in play for nearly 15 years. If follow-through materializes, a drop to test below the 1.09 figure may be in the cards.

Ilya Spivak is head strategist for Asia-Pacific markets at DailyFX, the research and analysis arm of retail trading platform IG. @ilyaspivak