Fiscal Stimulus, Inflation and the Dollar’s Next Move

The recovery from the depths of the COVID-19-induced recession has gathered meaningful momentum. In fact, global manufacturing and services are growing at their fastest pace in more than six years, according to the Purchasing Managers’ Index (PMI) survey data from JPMorgan and Markit Economics. The upswell has come thanks to an unprecedented flood of fiscal and monetary stimulus as well as the hope that the spread of vaccinations will unleash pent-up demand.

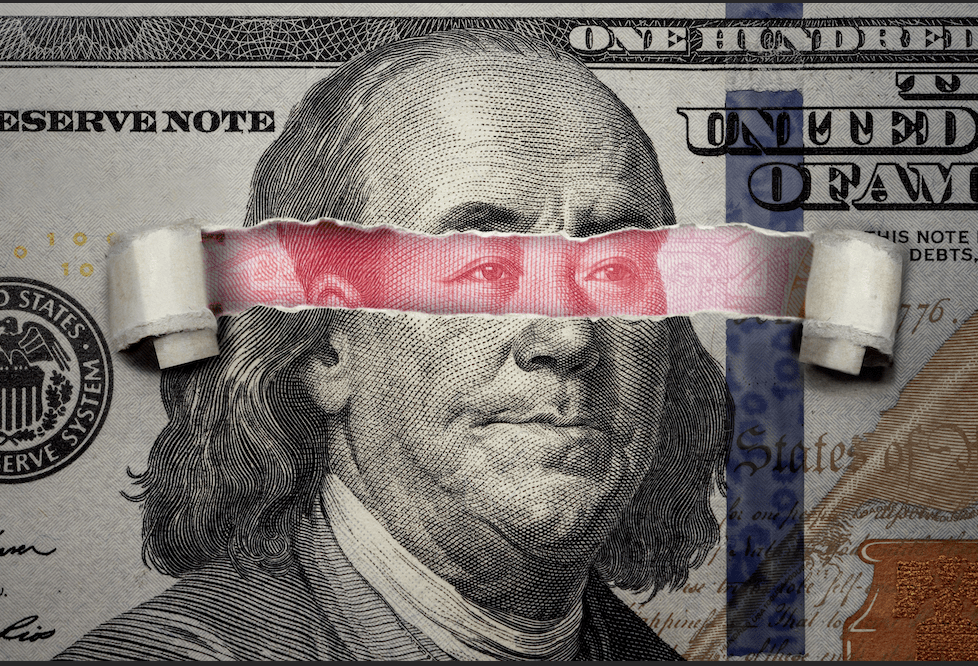

Frayed global supply chains are already struggling to keep up with such spirited growth, and pre-COVID-19 economic policies aren’t helping. The Trump administration’s nationalist approach to trade relations had challenged the smooth function of the deeply interconnected international commercial order—driving global growth to a six-year low—when the pandemic struck. Global lockdowns that followed compounded the problem. Not surprisingly, that bid up costs.

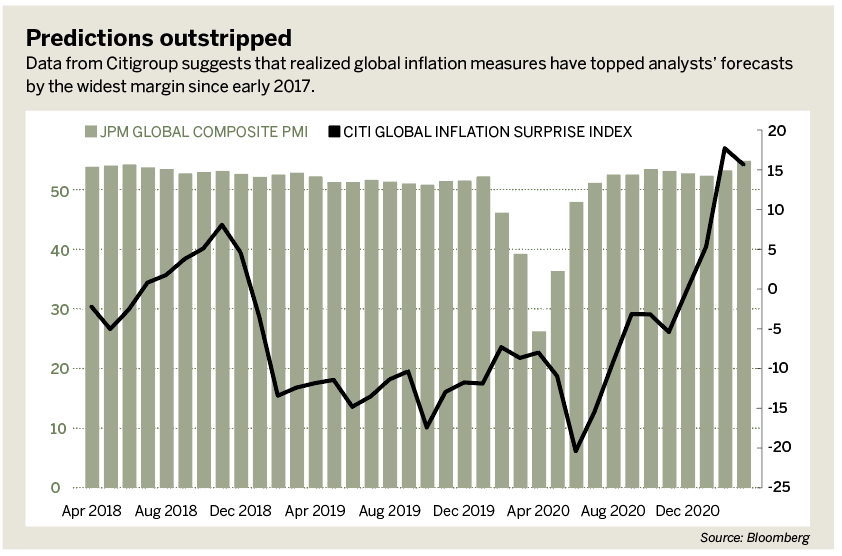

Now, price pressures are being amplified by uneven economic reopening and still-elevated trade barriers, which continue to gum up key trade linkages like the one between the United States and China. Indeed, PMI reporting confirms that input costs are rising at the quickest pace in more than 12 years. Separately, data from Citigroup suggests that realized global inflation measures have topped analysts’ forecasts by the widest margin since early 2017.

Federal Reserve officials have been quick to dismiss worries about runaway price growth, arguing that elevated readings now are mostly due to rapid disinflation in 2020 and reflect base effects instead of a genuinely lasting pickup. That makes some sense: Prices plunged as COVID-19 containment efforts spread but have since recovered, which will cosmetically overstate the current year-on-year inflation measures that economists and traders follow.

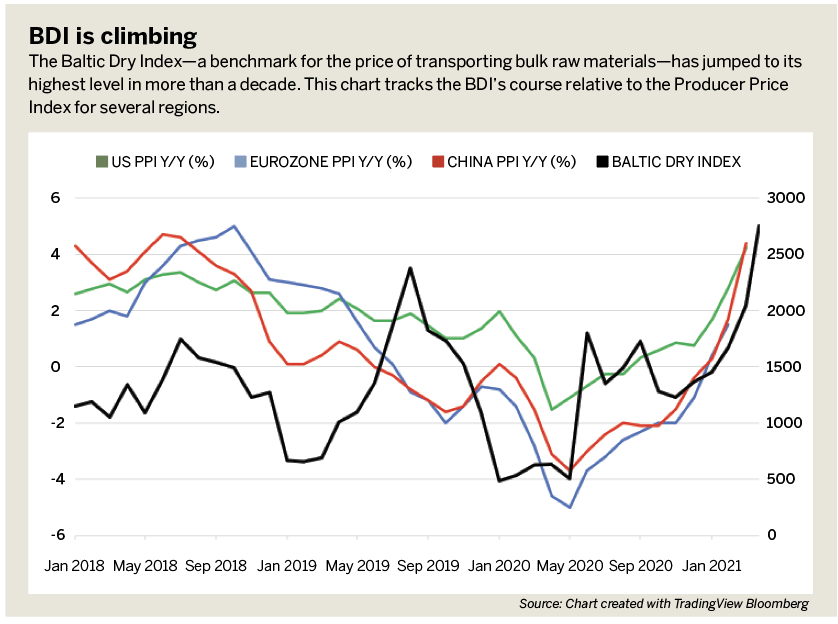

But that’s only part of the story. Trouble along global supply chains is palpably on display in elevated shipping costs. The Baltic Dry Index (BDI)—a benchmark for the price of transporting bulk raw materials like coal and steel on merchant ships across more than 20 international routes—has jumped to its highest level in more than a decade. Tellingly, the shipping costs at Amazon grew by an eye-watering 253% from early 2018 to the end of 2020 (revenue still grew by an impressive 117% over this period).

An element of base-effect amplification is almost certainly present in current economic growth rates, with a period of downward normalization to follow. However, the present overclocking of the business cycle probably has room to continue before this happens. The Biden administration seems determined to keep the fiscal pedal to the metal with a plan to spend over $2 trillion on infrastructure. That’s likely to keep prices pushing upward.

Against this backdrop, the Federal Reserve’s dismissive posture now might mean policymakers will be forced to tighten in a hurry as the reflationary drive proves stickier than anticipated. Worryingly, that may come just as peaking growth rates finally convince the central bank to come in off the sidelines. Speedy tightening could thus be unintentionally overlaid with the onset of natural regression in the business cycle.

This bodes doubly well for the U.S. dollar. First, speculation about the onset of a hawkish policy reversal will probably begin to lift the currency well before Fed action actually materializes. The markets previewed such a move in March. Next, when growth sags and risk appetite deflates, the greenback’s unrivaled liquidity is likely to attract haven-seeking as capital preservation supplants returns in the minds of investors.

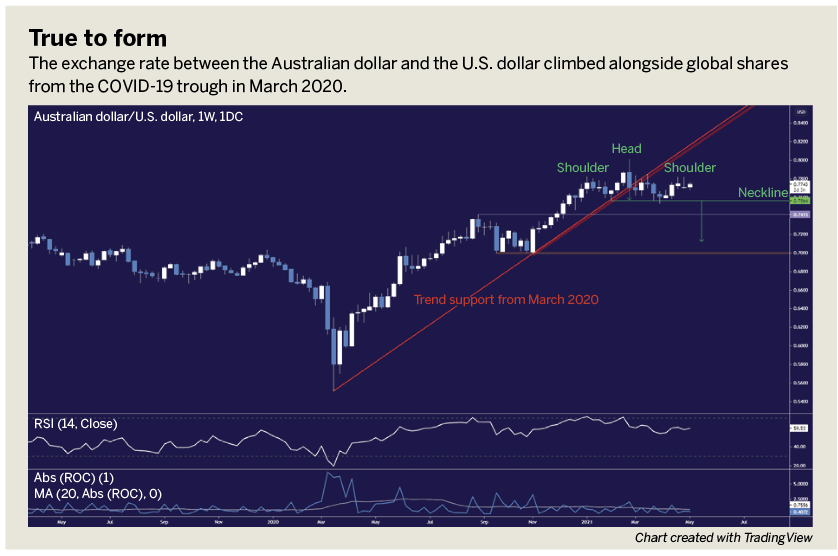

The sentiment-sensitive Australian dollar seems like a natural foil for its U.S. counterpart in this scenario. True to form, the Australian dollar to U.S. dollar exchange rate climbed alongside global shares from the COVID-19 trough in March 2020. That rally may now be fading: Prices have broken the series of higher highs and lows defining the advance and a bearish head-and-shoulders chart pattern appears to be forming. Confirmation on a break of 0.7564 may precede a drop below 0.72.

Ilya Spivak is head strategist for Asia-Pacific markets at DailyFX, the research and analysis arm of retail trading platform IG. @ilyaspivak