Going Ape: AMC is Issuing Preferred Equity Units to Shareholders. Now What?

Winter may have arrived early in the cryptocurrency sector (aka crypto winter), but the summer trade in so-called “meme stocks” remains hot.

In the wake of Q2 earnings season, some of the best-known meme stocks—including AMC Entertainment (AMC) and Bed Bath & Beyond (BBBY)—have spiked dramatically. This month alone, AMC is up over 60%, while shares in BBBY are up more than 80%.

There was even a new entrant to the category, as a little-known company from Hong Kong saw its American-listed shares climb from roughly $75/share in late July to more than $2,000/share in early August. Shares in AMTD Digital (HKD) have since retraced back down to about $200/share.

While each of the meme stocks has its own unique narrative, the recent run in AMC shares appears to be at least partially attributable to a surprise dividend announcement. However, AMC will not be paying out a cash dividend, but instead preferred stock.

The award has been couched as a reward to loyal shareholders of AMC’s common shares, but also represents an ingenuitive piece of financial engineering. More on that later…

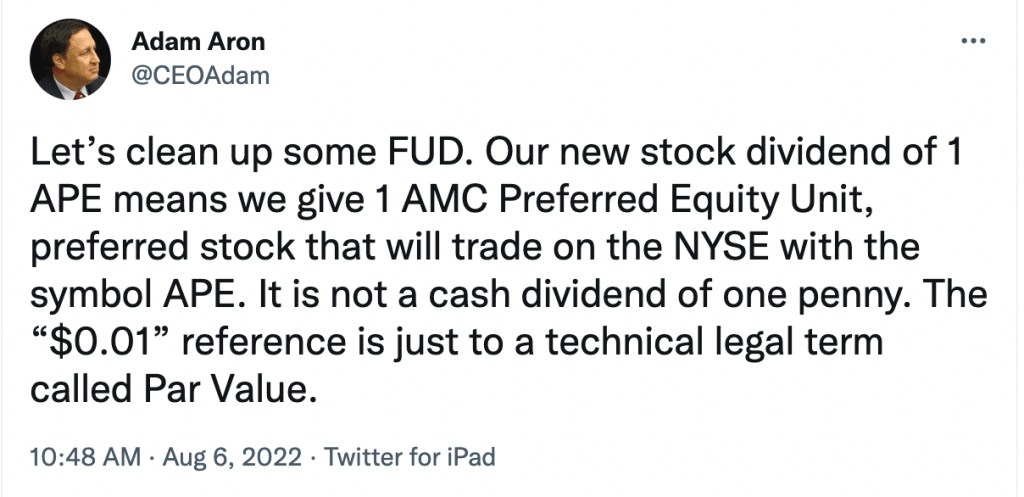

Per the announcement, AMC is creating a new preferred stock called AMC Preferred Equity Units under the associated ticker APE—a nod to some of AMC’s retail shareholders, especially those that hail from the Reddit investing/trading world who refer to themselves as “apes.”

The preferred dividend will be paid on a 1-to-1 basis, which means that every common share currently in circulation will be awarded one preferred share. Currently, there are roughly 517 million shares of AMC common stock outstanding. APE shares will have their own separate listing on the NYSE, and will confer the same voting rights as one share of AMC common stock.

As of now, it’s expected that anyone owning AMC shares at the close of business on Aug. 15 will receive the preferred stock dividend. APE shares will then be paid out by the end of the business day on Friday, Aug. 19. NYSE-listed APE shares are then expected to start trading publicly on Monday, Aug. 22.

What’s interesting about the announcement is that the preferred stock dividend also appears to represent a workaround of sorts for AMC—thus, the ingenuitive financial engineering. The problem for AMC is that the company has been selling common stock to raise capital, and had essentially run out of common shares to sell, at least not without shareholder approval to issue new common shares.

However, in 2021, AMC’s plan to issue additional common stock was met with disapproval from shareholders, and the company elected to table the proposition. That is, until this announcement about the preferred stock dividend.

The thing is, preferred shares can ultimately be converted to common shares—if existing shareholders agree to such a plan. That essentially means that the APE dividend represents a revival of the company’s previous capital-raising plan, albeit in a more discreet (some might say covert) fashion.

Therefore, the company has created a new method of tapping the capital markets without technically creating new shares of AMC. Reports suggest there’s another 4.5 billion shares of preferred equity units that have already been approved—in addition to the 500+ million that are set to be awarded as a dividend.

The question now is whether this surreptitious approach will ultimately be supported by shareholders over the long run. At the end of the day, the move does appear to strengthen AMC’s balance sheet, which in turn theoretically improves shareholder value.

Considering that AMC already enjoys widespread support from its retail investor base, it’s likely that APE shares will receive a warm welcome in the market on Aug. 22. However, it’s a little harder to predict how the shares will fare months, and even years, down the line.

Investors and traders may also want to note that increased interest in the meme stocks has pushed up associated options prices, which is typically measured via implied volatility. In recent trading, implied volatility rank has increased to 76% in AMC, and 84% in BBBY, indicating that implied volatility is at the higher end of its 52-week range in these two tickers.

To learn more about trading options using implied volatility rank, check out this installment of Best Practices on the tastytrade financial network.