How Flutter Entertainment (FLUT) is Cashing In on America’s Sports Betting Boom

Together, Flutter and DraftKings control 70% of the burgeoning American sports betting market

- Flutter Entertainment, the parent company of FanDuel, reported strong earnings for Q2 2024, signaling robust growth in the U.S. market.

- FanDuel and DraftKings, dominate U.S. online sports betting, with the two companies controlling approximately 70% of the market.

- With football and basketball historically the most popular sports for American bettors, the upcoming NFL and NBA seasons are poised to drive increased betting activity, positioning Flutter for continued success.

Betting on sports online has altered the entertainment landscape in the six years since it became legal in some states. In 2023 alone, Americans wagered an astonishing $120 billion on sporting events.

The companies enabling this betting frenzy—particularly online sportsbooks—are thriving. Aggressive marketing campaigns have propelled several digital gambling platforms into the public consciousness, with two giants, DraftKings (DKNG) and FanDuel, leading the pack. FanDuel serves as the U.S. arm of Flutter Entertainment (FLUT), a global behemoth in gaming.

Together, DraftKings and FanDuel dominate nearly 70% of the U.S. online sports gambling market, which is typically measured by net gaming revenue (NGR). Trailing them in third place is BetMGM, a division of MGM Resorts International (MGM), which also commands a significant portion of the market.

So far in 2024, investors appear to favor FanDuel’s prospects over those of DraftKings. Flutter Entertainment’s stock has surged nearly 20% this year, reflecting growing confidence among its investor base. In contrast, DraftKings shares have managed only a modest 2% gain year-to-date.

BetMGM’s performance is harder to isolate in the broader MGM Resorts portfolio, but it’s evident the parent company has faced challenges. Shares are down nearly 14% over the same period.

FanDuel’s ascent fuels growth at Flutter

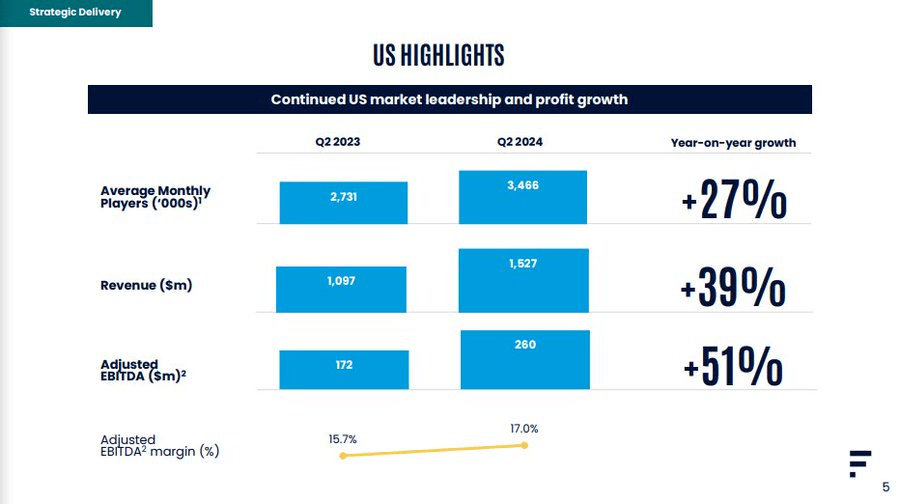

On Aug. 13, 2024, Flutter Entertainment, the parent company of FanDuel, reported stellar performance for the second quarter, underscoring its dominance in the rapidly expanding U.S. sports betting market.

Flutter’s global revenues surged by 20% year-over-year, reaching $3.61 billion—well above the consensus estimate of $3.4 billion. This strong top-line growth was matched by an impressive bottom line, with adjusted earnings per share (EPS) coming in at $2.61, significantly surpassing FactSet’s forecast of $1.47.

The driving force behind these results was the U.S. market, where FanDuel continues to expand at an extraordinary pace. In Q2, FanDuel commanded 51% of the net gaming revenue (NGR) in the U.S., cementing its position as the leading sportsbook in the nation.

Additional data sheds further light on the company’s impressive growth trajectory in the U.S. market. In Q2, Flutter’s U.S. revenues soared by 39% compared to the same quarter last year, while FanDuel’s average monthly user base grew by about 27%. These figures demonstrate FanDuel’s increasing appeal to American sports bettors, and its ability to convert this engagement into substantial revenue.

In a bid to align more closely with its fastest-growing market, Flutter Entertainment made a strategic decision earlier this year to shift its primary listing to the New York Stock Exchange and relocate its headquarters from Ireland to New York. These moves not only raised the profile of the company’s stock but also positioned it to navigate the competitive U.S. landscape, further solidifying its foothold in a crucial market.

The market has responded favorably, with Flutter’s stock up nearly 20% year-to-date, a clear indication investors have confidence in the company’s prospects.

NFL kick-off, a golden opportunity for U.S. sportsbooks

With autumn approaching, excitement is mounting not only among sports fans but also in the sports gambling industry. As the NFL and NBA prepare to kick off their seasons, Flutter Entertainment and its rivals are entering a pivotal stretch.

The NFL’s 2024-2025 season kicks off on Sept. 5 with the Kansas City Chiefs hosting the Baltimore Ravens. A few weeks later, the NBA season begins, marking the start of a busy and crucial period for American sportsbooks.

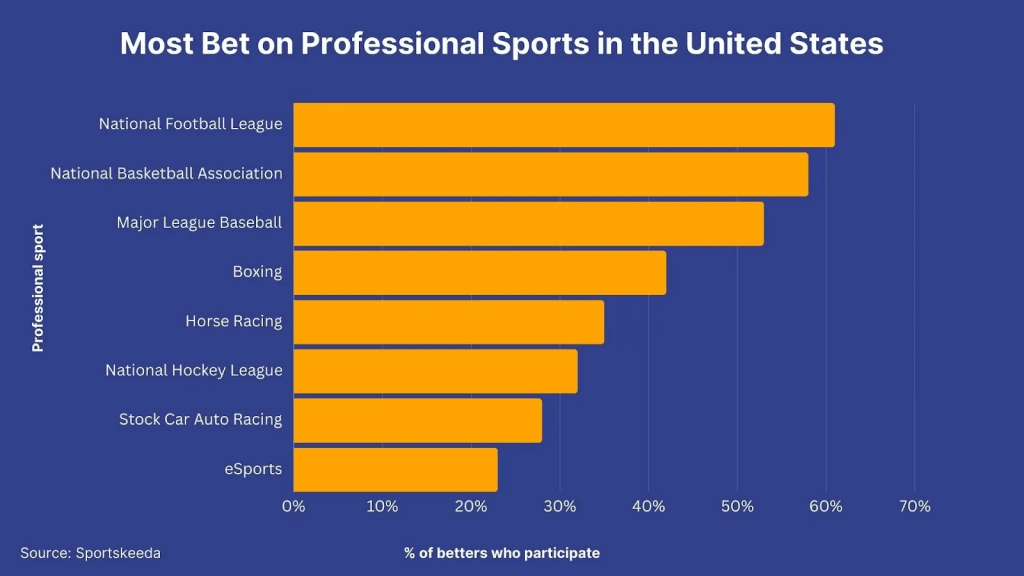

The NFL and NBA are crucial for the sports betting industry, because football and basketball are the top choices for U.S. sports bettors. The popularity of a sport is directly linked to the volume of betting it generates, according to Ryan Butler, senior analyst and editor at Covers.com. “Sports betting interest is absolutely proportional to the popularity of the sport,” Butler said. “In the U.S., it’s football, especially NFL football. It is the end-all, be-all,” Butler recently maintained to Investor’s Business Daily.

While the NFL may offer fewer games than the NBA or MLB, it remains an undeniable juggernaut in the world of sports betting. With each team playing 17 games, the NFL’s regular season delivers 272 “events,” each attracting significant wagering interest. In contrast, the NBA, with its 1,230 games spread across 32 teams is significant in terms of sheer volume.

This difference in volume creates an intriguing dynamic: The NBA commands the highest overall betting handle, driven by the sheer number of games. But when it comes to average bets per game, the NFL reigns supreme, leading with the highest average. Baseball, which ranks third among the major sports leagues, also plays a crucial role, particularly as it nears the high-stakes drama of the postseason.

And with the MLB playoffs on the horizon, the convergence of these major sports seasons creates a compelling landscape for bettors, promising a period of intense activity and engagement across all platforms.

Why flutter entertainment could be a winning bet

Companies like DraftKings and FanDuel are just now entering their most active season, especially in the U.S. market. And with nearly 40 states now offering some form of legalized sports gambling, the industry is primed for additional growth.

Flutter Entertainment, buoyed by its impressive Q2 earnings, appears well-positioned to capitalize on this momentum. Flutter’s CEO, Peter Jackson, expressed confidence in the company’s U.S. strategy during the Q2 earnings call, stating, “The returns we are seeing give us the confidence to continue driving customer acquisition in the second half, building a bigger business, which bodes well for 2025 and beyond.”

In a bold affirmation of its prospects, Flutter recently raised its revenue forecast for the U.S. market in 2024. And considering its recent successes, Flutter Entertainment is well-positioned to seize additional opportunities presented by the rapidly expanding American sports gambling industry.

As of mid-August, 24 analysts cover Flutter Entertainment (FLUT), with 18 rating the stock a “buy,” one rating it “overweight” and five rating it a “hold.” At present, none of the analysts covering FLUT rate the shares “sell” or “underweight.” Based on those 24 ratings, the average price target for FLUT is roughly $248/share. The stock recently closed trading at closer to $208 per share.

For more perspective on rise of sports gambling in America, readers can check out this installment of Truth or Skepticism on the tastylive financial network.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.