Learning from Past Currency Crises: Signs Point to Potential Stock Market Recovery

Disruptions in global currency markets are common, but major market upheavals are rare

- The recent stock market correction in the United States appears to have been amplified by a sudden reversal in the dollar/yen exchange rate.

- Shake-ups in the global currency markets are relatively common, so the sudden appreciation of the Japanese yen doesn’t qualify as a black swan event—at least not at this stage.

- Historical data indicates severe economic contractions and full-blown financial crises have had a far greater affect on stock market valuations than we’ve seen from previous currency shake-ups.

The recent stock market correction in the United States is still unfolding, and it will take time to understand its implications. But early indications suggest a sudden appreciation in the value of the Japanese yen may have played a significant role in causing the drop in stock prices.

For context, the yen had been on a steady decline against the dollar since mid-2020. This trend was not unique to the yen; other major currencies, including the Chinese yuan, have also depreciated against the dollar in recent years.

But in early July, the abrupt reversal in the yen caught many market participants off guard, contributing to the broader financial turbulence observed in early August. This incident serves as a stark reminder of how interconnected and sensitive global markets are to significant fluctuations in the global currency market.

However, this incident also serves as a reminder that currency shake-ups aren’t typically that earth-shattering, especially when compared to severe recessions and full-blown financial crises.

The unwinding of the yen “carry trade”

The recent market turbulence can be traced back to a significant shift in Japanese monetary policy. In early July, the Japanese Central Bank decided to raise interest rates and abandon its long-standing negative interest rate policy (NIRP). With the United States holding its rates steady, the shift in Japanese monetary policy bolstered the yen vis-a-vis the dollar.

This shift in the yen’s value had far-reaching implications for global financial markets. Many investors had been engaging in the “carry trade,” borrowing in yen at low interest rates and investing the capital in higher-yielding assets elsewhere. And when the yen appreciated in value, this strategy was disrupted, forcing investors to unwind their positions—ultimately contributing to increased market volatility.

Overall, the extent to which the situation in Japan contributed to the recent sell-off remains unclear. It’s also uncertain whether the carry trade has been fully unwound.

However, the recent correction in the U.S. stock market can also be attributed, at least in part, to overextended valuations. Additionally, heightened concern about a potential recession have dampened expectations for corporate earnings, further weighing on stock prices.

We need more time to assess the recent sell-off and understand its origins. But previous disruptions in global currency markets haven’t necessarily represented a long-term risk to the stock market, at least not compared to sharp economic contractions, such as recessions and depressions.

Historical parallels: lessons from the Russian ruble crisi

Looking back at history, we see several clear examples of disruptions to the currency markets triggering increased volatility in the broader financial markets. However, as detailed below, the U.S. stock market always recovered and then proceeded to march higher.

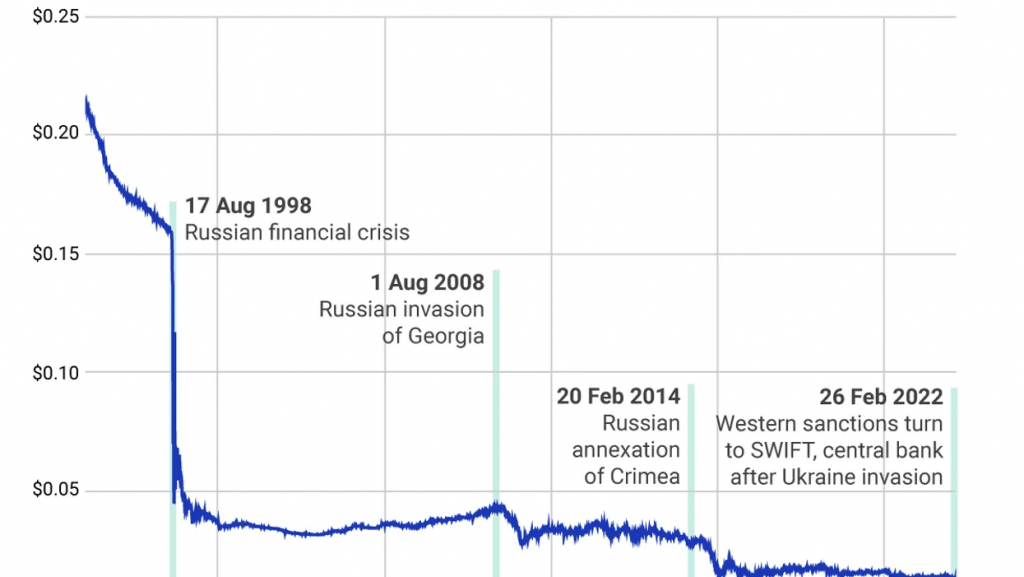

One well-known case involved the Russian ruble. In 1998, Russia faced a severe financial crisis. A sharp decline in commodity prices, particularly oil—a significant source of revenue for the country—strained the economy. Simultaneously, the country was burdened with a huge national debt. These factors combined to undermine confidence in the government’s ability to maintain the ruble’s fixed exchange rate.

The Russian government was ultimately forced to devalue the ruble, which led to a loss of confidence among investors, both domestic and international. The stock market plunged, and Russia defaulted on its debt, causing shockwaves across global financial markets. This crisis underscored the vulnerability of emerging markets to sudden shifts in investor sentiment and contributed to increased volatility and financial instability worldwide.

The example of the Russian ruble may parallel the current situation with the yen. Back in 1998, the shake-up in global currency markets triggered a 19% intra-year correction in the S&P 500. However, by the end of 1998, the S&P 500 had recovered and posted a 28.6% return for the year.

The Asian Financial Crisis in 1997 resulted in a somewhat similar outcome. Back then, the Thai government depleted its foreign currency reserves and could no longer support the baht’s fixed exchange rate. Consequently, the government was forced to float the baht, causing the currency to crash in value. That led to massive devaluations and financial turmoil across East Asia, and the broader world.

During the Asian crisis, the S&P 500 also experienced a pullback of 10%, but it eventually recovered and finished the year with a total return of 33%.

There’s certainly no guarantee 2024 will follow the same script. But if a recession doesn’t materialize in the second half of the year, the U.S. stock market could easily finish in positive territory, as observed in 1997 and 1998.

Recessions have weighed more heavily on the stock market

While disruptions in the currency market can trigger significant volatility, severe contractions in the U.S. economy have historically been most strongly correlated with sharp corrections in the stock market.

The last major U.S. recession, which occurred in 2008 and 2009, serves as a prime example. During 2008, the S&P 500 plummeted as much as 48% and ended the year with a 37% net decline. In 2009, the index initially fell by 27%, but later recovered to achieve a 26% total return by year-end.

A similar situation played out when the U.S. battled recession at the turn of the century. Back in 2001 and 2002, the S&P 500 saw drawdowns of 30% and 34%, respectively. And because of the significance of the economic headwinds, the S&P 500 finished net negative in both of those years (-12%, -22%).

Those examples underscore how the economic landscape will probably shape the stock market’s direction during the last two quarters of 2024. Should the economy dramatically weaken, stock market valuations are likely to decline. However, if the economy proves resilient, the stock market is likely to finish on a strong footing.

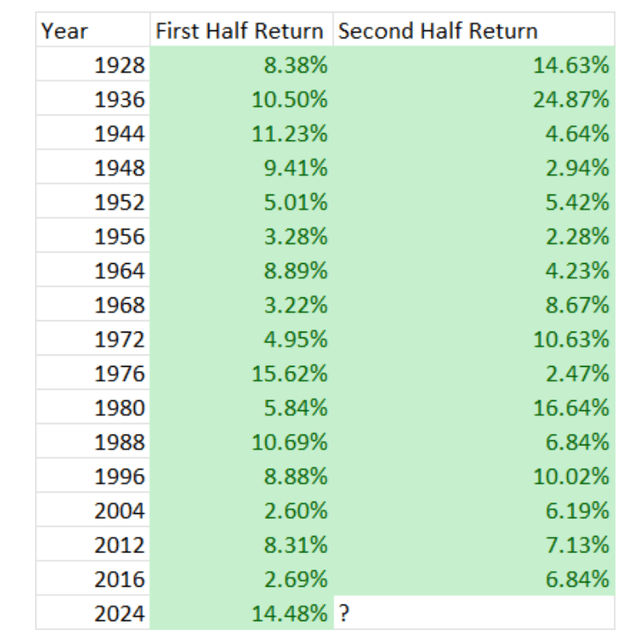

Along those lines, historical data indicates that when the stock market performs well during the first half of a presidential election year, it usually continues to outperform during the second half. On 16 previous occasions when the stock market rallied in the first half of a presidential election year, it continued to rally in the second half, as highlighted below., according to research by Andrew McElroy, chief analyst at Matrixtrade and author of the ebook Fractal Market Mastery.

Of course, history doesn’t always repeat itself, and if a recession sets in during the coming months, then 2024 could become an exception to the previous “rule.”

Regardless, the financial markets will almost certainly see increased volatility for the foreseeable future. Autumn is fast approaching, and September/October are traditionally the most volatile months on the calendar.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

To learn more about trading the global currency markets, readers can check out this installment of Hear Me Out on the tastylive financial network.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.