Is Logitech a Buy After Its Recent 25% Drop?

The company’s steady growth seems attractive in a turbulent market

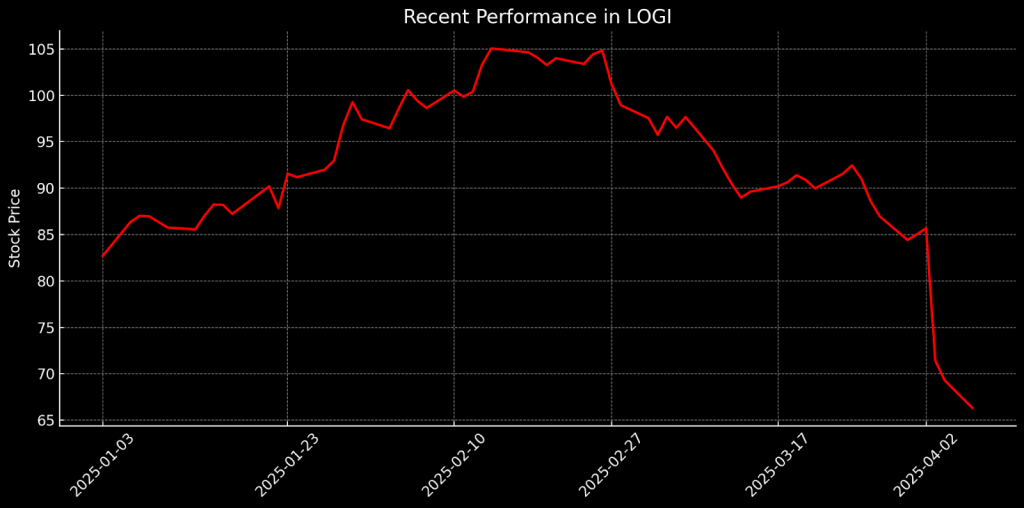

- Stock in Logitech has declined 25% in the past month, driven by the market sell-off and concern over tariffs.

- Despite the recent drop in its share price, the company remains a leader in growth areas like gaming and video collaboration.

- Logitech’s valuation has become increasingly attractive, with a P/E ratio now well below the sector median.

With the stock market dipping into bear territory, Logitech (LOGI) serves as a reminder that opportunity often emerges in times of uncertainty. The company remains a leader in gaming and video collaboration. With a robust product portfolio and a proven ability to innovate amid external challenges, it’s well-positioned to thrive, even as tech faces turbulence.

With the stock down roughly 25% in the last month, investors are confronted with a question: Is this a temporary setback, or does the decline present a compelling buying opportunity? Let’s explore how Logitech’s valuation—bolstered by strong growth in its core business—has become increasingly attractive in the wake of the tariff-induced fall in stock prices.

From gaming to AI, a global leader in peripherals

Logitech, a global leader in the design and manufacture of computer peripherals, offers a wide range of products, such as mice, keyboards, webcams and gaming peripherals. The company, founded in 1981, has expanded its presence in tech, providing innovative products for personal computing, gaming and video collaboration. It has built a strong reputation for high-quality products for consumers and businesses, becoming a go-to brand for peripherals.

In recent years, Logitech has capitalized on the booming gaming market, which now generates a considerable portion of its revenue. The company’s gaming peripherals have seen strong growth, thanks to product launches and increased demand in markets like China. At the same time, it has maintained a leading position in the video collaboration niche, benefiting from the surge in remote work and virtual meetings. By incorporating AI into its video conferencing platform, it is positioning itself as an emerging player in the enterprise market, offering advanced, integrated technology for businesses.

Beyond its traditional hardware offerings, Logitech has also ventured into software and AI-driven services. The company’s recent move into AI-powered tools, such as an AI-driven streaming assistant created in partnership with Nvidia, signals its shift toward recurring revenue streams. This strategic expansion into AI not only enhances Logitech’s product offerings but also increases the “stickiness” of its devices, embedding the company into users’ workflows and daily routines. The shift toward AI and software should unlock growth avenues in the years to come.

Robust earnings and a solid 2025 outlook

Logitech posted another solid quarter for Q3 FY25, highlighting its ability to grow despite external challenges. The company reported revenue of $1.3 billion, a 6% increase in constant currency compared to the previous year. This performance was fueled largely by the continued success of its gaming products, which saw growth near pandemic-high levels. The premium Pro Gaming and MX product lines, in addition to the expansion of Logitech for Business, were important to this performance. The company also reported an improvement in non-GAAP gross margin, which increased to 43% and reflected strong operational execution and cost management.

However, Logitech is not without challenges. The company expects currency fluctuations, particularly the strengthening of the U.S. dollar, to hampe its financial performance in Q4. That could result in a 20% decline in non-GAAP EBIT year-over-year for the quarter. Additionally, a $40 million charge because of bad debt from an e-commerce payment provider added pressure to operating expenses. Despite these short-term problems, Logitech remains optimistic, raising its full-year sales guidance for FY2025 to a range of $4.5 billion to $4.6 billion, up from the previous forecast of around $4.4 billion. This upward revision shows the company’s confidence in its business momentum, particularly as gaming and enterprise segments continue to growth.

Logitech’s financial strength is evident in its robust cash generation, with $371 million in cash flow from operations in Q3, leaving the company with a healthy cash balance of $1.5 billion. The company has also been returning capital to shareholders, repurchasing $200 million worth of shares during the quarter, part of its broader plan to buy back $2 billion in shares over the next three years. This reflects the company’s strong cash position and its commitment to creating value for shareholders.

Logitech shares look compelling long-term

Shares of Logitech have dropped about 25% in the last month, largely because of the broader market sell-off and the looming uncertainty surrounding tariffs. This situation has created a potentially attractive buying opportunity for investors because the stock is now trading at compelling valuation multiples compared to the broader sector.

At a price-to-earnings (P/E) ratio of 16.4, Logitech’s valuation is well below the sector median of 23.7, suggesting the stock is undervalued relative to peers. This lower multiple may reflect investors’ caution, considering the pressures from tariffs and supply chain risk. However, this could also signal an opportunity for long-term investors because the company continues to deliver solid performance in key growth segments. The price-to-sales (P/S) ratio of 2.3 is also below the sector median of 2.4, demonstrating its relative value, especially with the strong demand in its gaming and enterprise segments.

Despite the headwinds, Logitech has shown resilience with consistent growth, including a 7% increase in Q3 FY2025 revenue and robust cash flow generation. The company’s price-to-book (P/B) ratio of 4.9, though above the sector median of 2.6, reflects its solid asset base, strong product portfolio and hoard of cash reserves. While this higher ratio can be a point of concern for value investors, it is not unusual for tech companies with expansive intellectual property and brand value like Logitech. It continues to innovate and invest in new technology, particularly AI and video collaboration.

Analyst sentiment isn’t overwhelmingly bullish, but positive signs are emerging. Of the 19 analysts covering Logitech, only five rate the stock as “buy” or “overweight,” while 12 maintain a “hold” rating. Despite that, the average price target for Logitech is around $100 per share, well above its current price of $75, suggesting analysts see considerable upside potential in the shares. Case in point, Wedbush recently upgraded shares of Logitech to “outperform” and assigned a $125 per share price target.

Takeaways

Logitech’s recent price drop has created an enticing opportunity for investors, offering a chance to buy into a tech leader at a discounted rate. Despite facing short-term difficulties, like currency fluctuations and a bad debt charge, the company’s robust financial health, strong cash flow and dominance in high-growth sectors, like gaming and enterprise services, put it in a prime position for long-term success. With its P/E ratio now significantly lower than the sector median, the company presents an attractive prospect for those seeking growth at a reasonable price—especially if concern about tariffs subsides.

That said, the primary risk to this investment opportunity is the potential onset of a recession, which could significantly affect consumer and corporate spending. A downturn in economic activity would undoubtedly affect Logitech’s financial outlook, as it would for many companies. Prospective investors should stay attuned to broader macroeconomic conditions that could influence demand for Logitech’s products and, consequently, its earnings potential.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.