Nebius Group: Another Nvidia-Backed AI Contender

It severed ties with Russia and reinvented itself for the European GPU services

- Nebius Group, emerging from the legacy of Yandex, has redefined itself as a European-focused AI infrastructure contender, backed by strategic investors, including Nvidia.

- The company plans to invest more than $1 billion to expand its GPU-powered data centers throughout Europe, aiming to capture a growing and underserved market.

- Nebius represents a compelling opportunity, but a surging valuation and sky-high expectations magnify the risk tied to a company navigating a challenging transformation.

As demand surges for AI infrastructure, Nebius Group (NBIS) is positioning itself as a contender in the sector. Rising from the ashes of Yandex’s storied past—a company once hailed as the “Google of Russia”—Nebius is redefining itself with a bold new vision. With its Russian roots now severed, the company has reinvented itself as a bold contender in AI infrastructure, seeking to dominate the European market for GPU computing services.

But Nebius is more than just the new kid on the AI block. At its helm is Arkady Volozh, a visionary leader who helped build Yandex into a multibillion-dollar enterprise. With a team of seasoned engineers, cutting-edge technology and strategic backing from industry giants like Nvidia (NVDA), Nebius has positioned itself to deliver the infrastructure essential for the next generation of AI development.

Where did Nebius come from, and how does it plan to reshape the AI landscape? And perhaps most importantly, what is a reasonable fair value for the company amid this ambitious transformation? We explore these topics below.

From Yandex to Nebius, the AI pivot

Nebius Group, formerly the Russian tech giant Yandex, has undergone a remarkable transformation. Following the divestiture of its Russian operations, Nebius has redefined itself as a standalone entity with ambitions to lead in AI infrastructure. This pivot aligns the company with the rapidly expanding market for GPU computing power, fueled by the growing demand for advanced AI capabilities.

The story of Nebius goes back to Arkady Volozh, the co-founder of Yandex, often referred to as the “Google of Russia.” Under Volozh’s leadership, Yandex grew into a multibillion-dollar internet powerhouse offering a wide range of services including search, e-commerce, maps and self-driving technology. At its height in late 2021, Yandex achieved a market capitalization exceeding $30 billion. However, the geopolitical repercussions of the Russia-Ukraine conflict in early 2022 resulted in sanctions that suspended Yandex’s trading on the Nasdaq. To address these challenges, the company made the strategic decision to divest its Russian operations.

The sale of Yandex’s Russian business, completed earlier this year, left the Dutch-registered holding company with the rest of the company’s non-Russian assets, including a Finnish data center and AI cloud platform, along with subsidiaries like the autonomous vehicle division Avride and the edtech platform TripleTen. With these assets, the company rebranded as Nebius, and signaled it was pivoting toward the burgeoning AI infrastructure market.

Nebius, headquartered in the Netherlands, has positioned the European market as its primary focus, aligning with the region’s growing demand for AI infrastructure. The company has announced plans to invest approximately $1 billion by mid-2025 to expand its operations across the continent. This initiative includes the launch of a GPU cluster in Paris, one of the first in Europe to feature Nvidia H200 Tensor Core GPUs. Additionally, Nebius plans to triple the capacity of its data center in Finland, aiming to accommodate up to 60,000 GPUs to support the need for AI computing power.

This strategic focus on Europe is widely regarded as a savvy move, given that the region’s AI infrastructure development has lagged behind that of the United States. By addressing this gap, Nebius is well-positioned to capitalize on a fast-growing market. Plus, the European AI landscape is attracting other players, including FlexAI, a French startup founded in 2023, which has raised $30 million in seed funding to provide AI computing power.

Nebius’s infrastructure expansion and focus on innovation are part of a broader strategy to establish a dominant presence in the European market. Leveraging its advanced technical expertise and existing assets, the company aims to deliver cutting-edge solutions to enterprises and developers.

Competitive advantages: leadership, talent and strategic partnerships

Nebius brings a range of competitive advantages that position it as a formidable player in the AI infrastructure market. Founder and CEO Arkady Volozh is a seasoned entrepreneur who built it into a tech giant. With decades of experience leading transformative tech projects, Volozh’s leadership provides both credibility and a clear strategic vision. His track record in building and operating large-scale infrastructure projects is a cornerstone for Nebius’s ambitions and helps fuel the market’s confidence the company can achieve its goals.

One of Nebius’s standout strengths is its deep technical expertise and talent pool. Approximately 400 engineers at the company specialize in AI infrastructure, supported by a broader team of 1,300 employees, many of whom came over from Yandex. This team brings decades of experience in building world-class technology systems, enabling Nebius to rapidly develop its proprietary full-stack infrastructure. The company’s AI-native GPU cloud, tailored to manage the full machine learning lifecycle, demonstrates this accumulated expertise, and establishes Nebius as a leader in delivering cutting-edge.

Nebius also benefits from long-standing relationships in the industry, most notably with Nvidia. As one of Nvidia’s largest European clients during the Yandex era, Nebius leveraged that partnership to deploy state-of-the-art GPU clusters. This relationship proved instrumental during Nebius’s recent $700 million private placement, as Nvidia elected to directly invest in Nebius. This strategic financing, conducted at a small premium to the stock’s trading price, not only underscores investor confidence, but also provides the capital necessary to accelerate infrastructure expansion across Europe and the U.S.

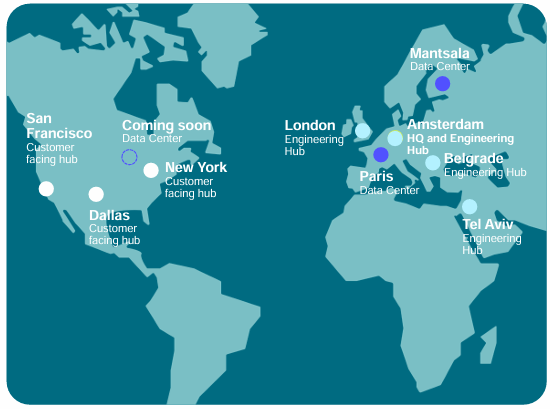

The success at raising capital is a testament to the company’s strategic vision and market potential. Nebius plans to leverage this funding to triple the capacity of its Finnish data center, launch a new GPU cluster in Kansas City and pursue additional facilities in Europe (illustrated below). With a projected annualized revenue run rate forecast of $750 million to $1 billion by the end of 2025, Nebius is set to scale rapidly and compete effectively. These competitive elements—visionary leadership, technical expertise, industry partnerships and strong capital backing—indicate Nebius’s goals are within reach.

Stock performance: the Yandex suspension and Nebius debut

Before evaluating Nebius’s potential valuation, it’s important to understand the trading history of its shares, which recently transitioned from Yandex to Nebius. The Russia-Ukraine conflict in early 2022 had immediate consequences for Yandex’s Dutch-registered holding company. Sanctions targeting Russian-affiliated entities resulted in a suspension of trading on Nasdaq, freezing shareholder activity. Then, over the next 2+ years, Yandex worked to sever its Russian ties, ultimately divesting its Russian operations entirely and rebranding as Nebius in the second half of this year.

Nebius shares resumed trading on Nasdaq in October, marking a significant milestone in the company’s transformation. Initially, the stock traded sideways as investors adopted a cautious outlook, reflecting uncertainty about Nebius’s new direction. However, the stock’s narrative shifted dramatically in early this month after the announcement of a key development.

On Dec. 2, Nebius executed a $700 million private placement at $21 per share, representing a modest premium to the stock’s recent trading levels. The capital raise, supported by prominent investors, such as Nvidia, Accel and Orbis Investments, signaled strong confidence in the company’s strategic vision. This financing valued Nebius at approximately $4.6 billion and provided the necessary capital to accelerate its ambitious AI infrastructure expansion, marking a critical turning point in the company’s evolution.

In the days following the announcement, Nebius stock surged to approximately $37 per share—a rise of nearly 76% from the private placement price. The rally elevated the company’s market capitalization to around $7.5 billion. The stock’s strong performance reflects increasing investor enthusiasm for Nebius’s vision, driven largely by Nvidia’s strategic investment, which has added credibility to this developing narrative.

Nebius valuation: base case and bullish scenarios

Assessing the valuation of Nebius Group is no straightforward task. The company is navigating a transformative journey, shedding its former identity to emerge as a specialized AI infrastructure provider. With shares trading at around $33 and a market valuation of $6.7 billion, much of Nebius’s perceived value rests on its ambitious plans for the future instead of its current fundamentals. This reliance on forward-looking growth makes valuation inherently speculative, hinging on the company’s ability to execute.

Recent assessments have sought to bring clarity to this puzzle. Two valuation analyses, using a sum-of-parts approach, estimated the combined worth of Nebius’s subsidiaries, including its centerpiece AI-focused data centers under Nebius AI. These two analyses placed a fair valuation for the company somewhere between $5.5 billion and $6.5 billion, translating to a share price range of $27 to $32. And that seems to align with recent trading patterns, as Nebius shares rallied from the low $20s after it raised capital in December to a high of $37, before dropping back to $33. This data, combined with a price-to-book ratio of 2.2—slightly above the industry average of 2—suggest Nebius’s current valuation is within the bounds of reason.

That said, the future trajectory of Nebius isn’t necessarily confined to reasonable estimates. Citron Research has outlined a more bullish scenario, projecting that Nebius could achieve a valuation as high as $12 billion, or $60 per share, based on comparisons to competitors in the AI infrastructure space. However, this outlook probably hinges on Nebius realizing its full potential.

Moreover, one can’t overlook the risks associated with the Nebius narrative. If macroeconomic conditions deteriorate—whether through a global recession, a shift in investor sentiment or a cooling of enthusiasm for AI infrastructure—Nebius’s shares could retreat toward their Dec. 2 capital raise price of $21. Such a scenario would reflect the vulnerabilities of a company that’s in the early stages of a turnaround, relying on projected revenue instead of established fundamentals.

Ultimately, Nebius’s valuation reflects the ongoing struggle between the company’s future potential, and the risk inherent in its transformation. The best-case scenario envisions the company joining the ranks of industry leaders, driven by its ability to scale GPU infrastructure and capture AI-driven revenue streams. On the other hand, investors must weigh this promise against the very real possibility of setbacks in a high-growth, volatile sector. All told, we favor the bullish case for Nebius, but would target a more conservative level of $40 per share in the near-term.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.