Battered by Tariffs, Poised for Rebound: The Snapback Potential of Nike, RH and Five Below

The market’s pain could be your gain—especially in the consumer discretionary sector

- Trump’s latest tariffs have weighed heavily on consumer discretionary stocks, such as Nike, Restoration Hardware and Five Below.

- The category is likely to rebound at some point, especially if the tariffs are rolled back or consumer confidence strengthens.

- These three stocks offer a prime opportunity to profit from volatility because their stock prices are sensitive to tariff news.

Three companies buffeted by the Trump administration’s tariffs are poised to surge when the storm clears. Let’s examine the reasons why Nike (NKE), Restoration Hardware (RH) and Five Below (FIVE) look like compelling snapback plays.

These players in the consumer discretionary sector offer opportunites to capitalize on volatility in the short term. For anyone who thrive on market swings, these three stocks could potentially become cash cows. Every twist in the tariff narrative—whether it’s an unexpected escalation or a surprise rollback—could catalyze a big move (up or down) for shares in these companies. And that’s where the real magic happens. Whether you’re trading the stocks or playing the options game, these three are set to serve as lightning rods for breaking news in the global trade war.

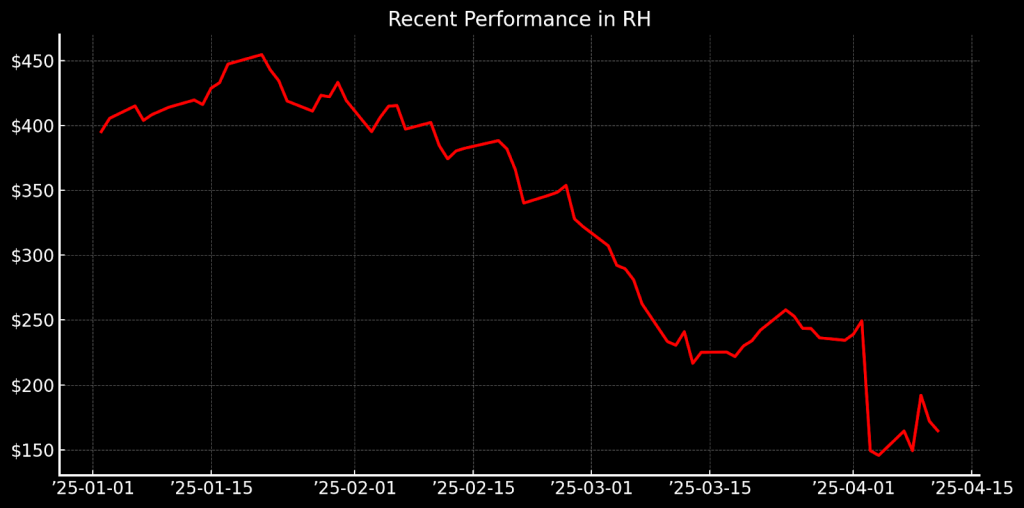

Disappointing earnings at Restoration Hardware

Restoration Hardware (RH), a leader in luxury home furnishings, has seen its stock take a dramatic hit recently, down more than 30% since the start of April and closer to 50% over the last six months. This steep decline came on the heels of a disappointing earnings report on April 3 and the announcement of new tariffs by the Trump administration. The combination of these two factors caused RH’s stock to plummet, marking its worst day on the market in the company’s history.

CEO Gary Friedman’s reaction during the earnings call spoke volumes, acknowledging the negative impact of both the tariffs and the company’s underwhelming financial results. The luxury retailer, which sources a significant portion of its products from Asia, is particularly vulnerable to the impact of the new tariffs, especially the sharp increases on imports from countries like Vietnam, Taiwan and China.

RH operates in a cyclical industry, with its fortunes tied closely to the health of the housing market and consumer spending. The company’s product offerings—which include high-end furniture and décor—is aimed at affluent consumers and relies on a strong housing market. In recent months, however, the company has faced significant challenges: The housing market is cooling and interest rates are rising. These problems were compounded by the announcement of tariffs, which directly affected the cost structure of the company. While it has performed well during periods of market strength, particularly in the post-pandemic era, the current market is now more uncertain, and this has raised concern about the company’s near-term prospects.

Despite these difficulties, RH is making strides toward execuring its long-term strategy, including expanding its physical presence with new galleries and making money from its real estate. There’s strong demand for its luxury offerings, with a 21% increase in demand in the fourth quarter. However, the company’s weak revenue guidance for the upcoming quarter reflects the challenges of high-end retailing, which is why the stock price has crumbled. From a valuation perspective, RH’s P/E ratio of 45.4 is still well above the sector median of 16.7, which suggests the stock is still priced at a premium despite its recent struggles. On the other hand, the price-to-sales (P/S) ratio of 0.90 is only slightly above the sector average of 0.80, suggesting the stock is more reasonably priced on a revenue basis.

Of the 22 analysts covering RH, 13 rate the shares “buy” or “overweight.” The average analyst price target is roughly $275 per share, significantly higher than the stock’s current price of about $170. While it isn’t cheap on a P/E basis, we do like the stock’s snapback potential if a deal is struck with China—or if the tariffs are abandoned altogether. Over the longer term, however, the company’s valuation will depend heavily on the performance of the U.S. economy. If a recession materializes and the housing market weakens, shares could face further downside. In instances like this, it can be prudent to use dollar cost averaging, when opening a new position (or adding to an existing one).

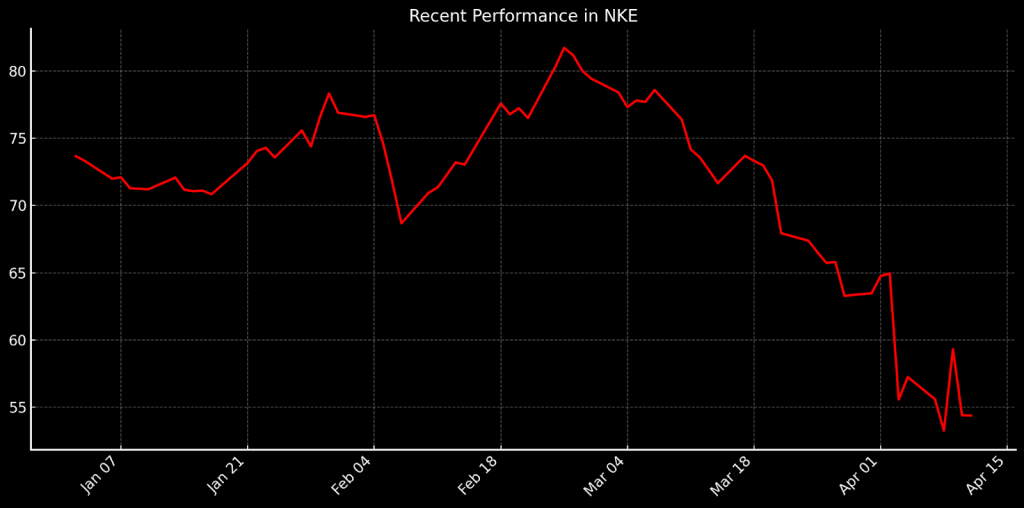

Consumer confidence and Vietnam tariffs are concerns at Nike

Nike, a global leader in athletic footwear and apparel, has been under pressure recently, with its stock down roughly 25% over the past month, including a sharp 15% drop on April 3 following the announcement of new tariffs. The company has been grappling with multiple challenges, including a slowdown in consumer confidence, challenges in its China market and rising U.S. tariffs that are sure to pressure its margins. Nike’s guidance for the current fiscal quarter reflects these challenges, with the company expecting sales to decline in the “low teens” and gross margins to fall 4% to 5% as it works through excess inventory.

Nike has been facing a shift in consumer behavior, with demand slowing in key markets. In China, sales fell by 17% in the most recent quarter. The company is also grappling with rising tariffs on goods imported from China, but even more concerning was the new 46% tariff on imports from Vietnam (since reduced to 10% during the 90-day pause). Nike uses 130 factories in Vietnam, relying on hundreds of thousands of workers, and the tariffs on this critical manufacturing hub present a serious risk to its cost structure.

Despite these struggles, Nike remains committed to its long-term strategy, which includes reigniting innovation in its product lines, expanding partnerships and reaching new consumer segments, particularly women. The success of new product releases like the Pegasus Premium and collaborations with influencers such as Kim Kardashian demonstrate the company’s continuing efforts to stay relevant in a competitive market.

From a valuation perspective, Nike’s P/E ratio of 18.0 slightly exceeds the sector median of 16.8, indicating the stock is modestly overvalued compared to its peers. However, its price-to-sales (P/S) ratio of 1.7 is more than double the sector average of 0.8, and its price-to-book (P/B) ratio of 5.7 significantly outpaces the sector’s 1.8, suggesting investors are still paying a premium for Nike’s growth potential, despite the sell-off.

Analysts remain divided on the stock’s near-term outlook, with 18 of 41 analysts rating it as a “hold” and a consensus price target of $78—well above its current price of $57. This mixed sentiment signals that while fundamentals are facing pressure, there is still optimism for a potential rebound, especially if external factors like tariffs are alleviated or consumer sentiment improves.

Much like Restoration Hardware, we view Nike as a strong candidate for a snap-back play if tariffs are rolled back because the stock holds considerable upside potential if cost pressures ease. However, if the stock continues its downward trajectory, it could become a compelling long-term play. Its enduring brand strength and market leadership position it well for sustained growth, even amid the current challenges.

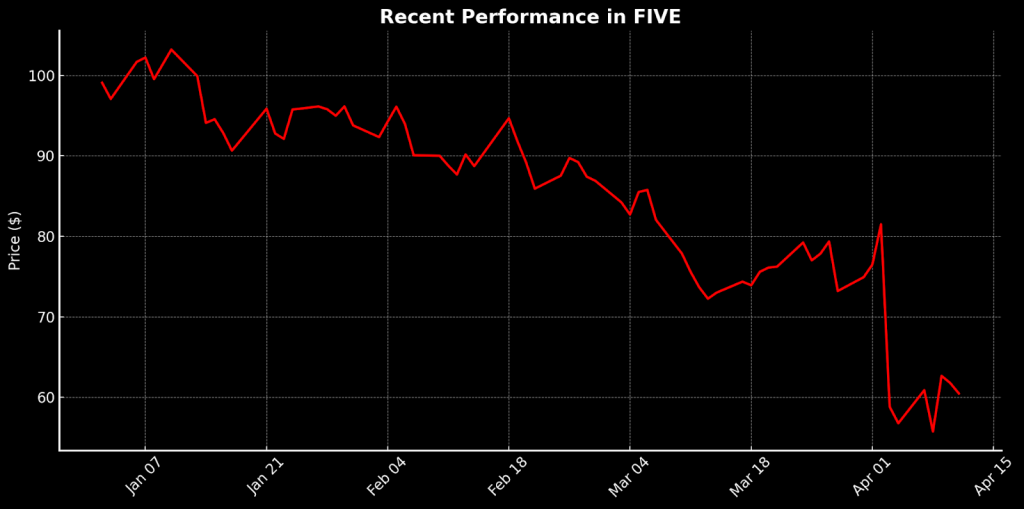

Tariffs overshadow inventory strategy at Five Below

Five Below, the discount retailer known for a wide range of products priced at $5 or less, has experienced a sharp sell-off, with its stock down more than 40% since December. This decline has been exacerbated by Trump’s announcement of new reciprocal tariffs on U.S. imports, which hit companies with global supply chains particularly hard. Tariffs on goods imported from countries like Vietnam, where the company sources many of its products, will undoubtedly raise costs and squeeze margins, adding pressure to an already challenging retail environment.

Despite these headwinds, Five Below has continued its aggressive expansion strategy, opening 227 stores in fiscal year 2024, bringing its total to nearly 1,800, with plans to open up to 150 more in the current fiscal year. However, the burden of tariffs threatens to erode profitability, especially if consumer spending continues to slow in the U.S. In the latest fiscal year, the company saw a decline in same-store sales growth (SSSG) of about 2.7% compared to the year before. And while revenue grew by about 9% last year, net income fell by 16%.

On the bright side, Five Below’s SKU rationalization strategy, which aims to streamline its product offerings by reducing the number of items it carries, is designed to boost efficiency and enhance profitability. This move could also help mitigate the impact of rising tariffs by improving its negotiating power with suppliers and enabling better cost control. By focusing on high-demand products and “product newness,” the retailer hopes to reduce costs and improve margins.

From a valuation perspective, Five Below is trading at a P/E ratio of 13.1, which is below the sector median of 16.7, suggesting the stock is undervalued relative to its peers. The P/S ratio of 0.9 is on par with the sector average, while the P/B ratio of 1.8 also mirrors the sector average. Much like Restoration Hardware and Nike, the analyst outlook for Five Below is mixed. Of the 24 analysts who cover the stock, only 10 rate the shares a “buy” or “overweight,” while 13 rate them a “hold.” That said, the average price target of those ratings is about $100 per share, which is well above the current price of $63. That gap is one reason we like this stock as a snapback play on a tariff rollback.

And even if the tariffs continue, but at a lower level, shares of Five Below may become increasingly attractive on a long-term basis. The company’s growth potential—particularly through its expansion strategy and SKU rationalization efforts—positions it well to weather macroeconomic uncertainty. And while risks remain, Five Below’s value-focused approach could provide a strong lift to the stock price when consumer confidence improves. If the stock drops below $55 per share, the long-term value will be tough to ignore.

Takeaways

The trade war has thrown consumer discretionary stocks into a state of uncertainty but also creates opportunity. Nike, Restoration Hardware and Five Below aren’t necessarily casualties of intensified tariff tensions—they’re candidates for a rebound. And if their stock prices drop further, they all deserve serious consideration as long-term buys.

On the other hand, these three stocks can also be vehicles for navigating ongoing developments in the trade war. Whether tariffs escalate or ease, Nike, Restoration Hardware and Five Below are primed to react swiftly, presenting traders with the opportunity to profit from every twist in the tale. In a world where volatility reigns, these names could provide substantial rewards for those who know when to strike. Alternatively, investors who prefer exchange-traded funds (ETFs) can consider the Consumer Discretionary Select Sector SPDR Fund (XLY) for exposure to this market sector.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.