Nvidia’s Grip on AI Chips Produces Blockbuster Q1 Earnings

Nvidia (NVDA) has been one of the stock market’s top performers in 2023, and the company’s shares are skyrocketing even higher after its Q1 earnings report.

As of May 24, shares of Nvidia (NVDA) were up a jaw-dropping 113%, making it the top-performing stock in the S&P 500. However, after releasing a blockbuster earnings report on Wednesday, Nvidia’s stock is poised to shoot higher.

In after-hours trading on May 24, shares in Nvidia climbed another 25% and were last trading hands at roughly $380/share. If those gains hold on May 25, the year-to-date returns in Nvidia will spike to +165%.

Considering the extraordinary nature of those returns, it’s clear that something special is at work over at Nvidia. And it all ties back to the emerging artificial intelligence sector, which exploded in 2023 due to the growing popularity of AI chatbots like ChatGPT.

TrendForce.com reported in early March that the creator of ChatGPT—OpenAI—utilized 20,000 of Nvidia’s advanced graphics processing units (GPUs) to process AI training data in 2020, and that OpenAI may need an additional 10,000 to run ChatGPT efficiently going forward.

Those figures suggest that future growth in the AI sector will run straight through Nvidia’s headquarters in Santa Clara, California. On Wednesday, after reporting revised upward guidance for Q2, Jensen Huang, Nvidia’s CEO, said the company is planning to aggressively ramp up its inventory of AI-related processors to meet surging market demand.

Huang said of the company’s operational strategy, “Our entire data center family of products—H100, Grace CPU, Grace Hopper Superchip, NVLink, Quantum 400 InfiniBand and BlueField-3 DPU—is in production. We are significantly increasing our supply to meet surging demand for them.”

Looking at Nvidia’s Q1 numbers, the company beat comfortably on both revenue and earnings, reporting $7.19 billion in sales and $1.09/share in adjusted earnings, as compared with Wall Street’s consensus expectations of $6.52 billion and $0.92/share.

However, what really stunned the market was Nvidia’s guidance for the current quarter. In Q2, the company now expects sales of $11 billion, as compared to its previous guidance of $7.2 billion—representing a massive 52% jump in expected revenue.

That adjusted guidance was so strong that well-known securities analyst at Wedbush Matt Bryson commented in a note to clients, “I can’t remember a semiconductor/hardware company as big as Nvidia ever surprising with a guide this much higher vs. expectations in my 20 years covering technology stocks.”

The historic nature of this updated guidance may help explain why shares of Nvidia are soaring an additional 25% in the wake of Wednesday’s report. Nvidia is now the country’s largest chip maker by market capitalization, and is within striking distance of becoming the first semiconductor company to cross above $1 trillion in terms of total valuation.

Importantly, Nvidia doesn’t manufacture its own chip designs. Instead, it farms the manufacturing process out to companies like Taiwan Semiconductor Manufacturing Company (TSM), which recently announced it was bringing some of its most advanced manufacturing capabilities to a new production complex in Arizona.

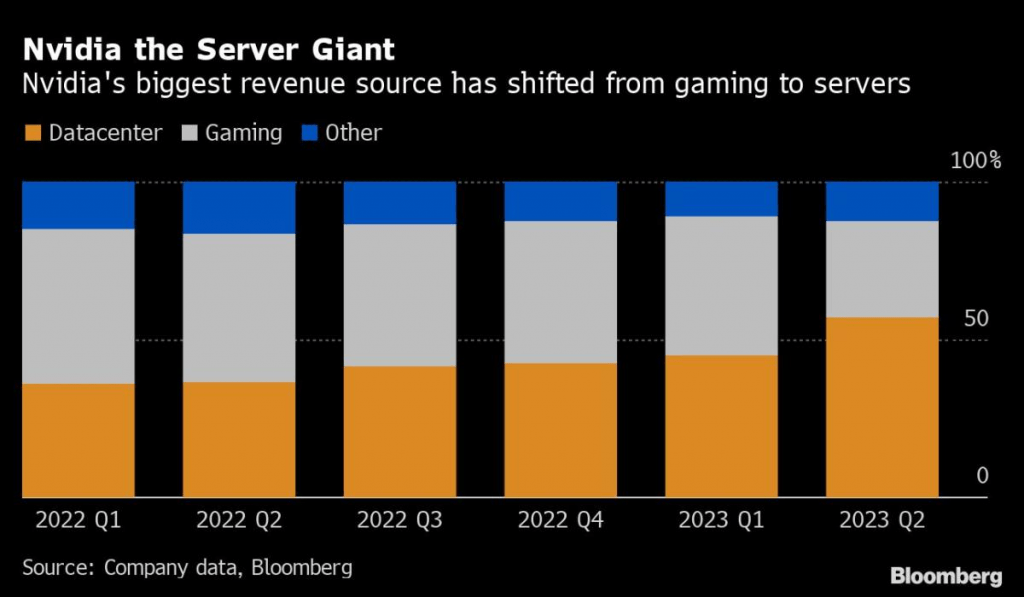

Investors and traders should also note that Nvidia’s earnings report wasn’t a slam-dunk across the board. Similar to the broader gaming industry, Nvidia experienced a drop in demand from gaming-focused customers in Q1. Last quarter, revenue from the gaming division dropped by roughly 38%, down to $2.2 billion.

However, the company expects gaming-related revenue to return to growth soon, which represents another incremental positive, and may also help boost shares of Nvidia in the wake of the earnings.

Moreover, the company has experienced sharp growth in its server business, which has offset revenue declines in the gaming sector.

Nvidia’s Q1 earnings and the AI chip sector

Even in a healthy corporate earnings environment, Nvidia’s Q1 earnings would have made waves, but that’s especially true considering the corporate earnings slowdown that’s taken hold in America.

An earnings recession is defined as two consecutive quarters of negative earnings growth, and due to negative earnings growth in Q4 2022 and now Q1 2023, that means an earnings recession has now officially developed in the U.S.

However, the news isn’t all bad. Earnings growth in Q1 2023 was on average far better than expected. Back in March, most projections estimated that earnings growth would decline by 6-7% decline in Q1.

But, the actual results have been far less grim, with earnings growth declining by only 2%. That’s an improvement from last quarter, when earnings growth declined by roughly 5%.

Circling back to Nvidia, the company’s results aren’t necessarily comparable to the broader market, because the company is so heavily exposed to the artificial intelligence sector, which is one of the hottest sectors of the market in 2023.

Nvidia also has a hold on the AI chip market. For example, in 2021, Wired reported that “nearly 70% of the top 500 supercomputers use its [Nvidia’s] GPUs.” Around that same time, Karl Freund, an analyst at Cambrian AI research, estimated that Nvidia commanded “nearly 100%” of the market for training AI algorithms.

Today, Nvidia’s tight grip on the AI chip market remains nearly as strong. In February 2023, an analysis by New Street Research estimated that Nvidia currently controls roughly 95% of the market for graphics processors that are used for machine learning.

That reality may help explain why some of Nvidia’s closest competitors in the GPU market, such as Advanced Micro Devices (AMD), reported earnings more in line with the broader corporate world, as opposed to the blockbuster results reported by Nvidia.

In sharp contrast to Nvidia, Advanced Micro Devices actually guided down its revenue expectations for the current quarter when it reported its Q1 results in early May. Advanced Micro Devices now expects revenues of $5.3 billion (less than half of Nvidia’s estimate) in Q2 2023, as compared to Wall Street’s previous expectation of $5.5 billion.

Along with Nvidia and Intel (INTC), Advanced Micro Devices is a goliath when it comes to GPUs geared toward the gaming industry. But Advanced Micro Devices and Intel are both well behind Nvidia in the artificial intelligence sector. However, things could change in the not-too-distant future.

Much like Nvidia, Advanced Micro Devices has been one of the stock market’s top performers in 2023. Shares are up +69% year-to-date, and are expected to rally further as a result of the positive spillover from Nvidia’s bullish earnings report.

Investors and traders are likely piling into Advanced Micro Devices because of the company’s forthcoming offering in the AI chip market—the Instinct MI3000—which is expected to launch at some point in 2023.

Notably, Intel is by far the laggard when it comes to AI-focused chips. Intel isn’t expected to enter the AI chip market until 2025, when its “Falcon Shores” chip is expected to be released.

Based on the aforementioned information, it’s clear that Nvidia currently enjoys a virtual monopoly in the AI chip sector.

However, leaders at Nvidia are well aware that its dominance may soon be coming to an end. Providing further context on the company’s recent earnings report, Nvidia’s CEO Jensen Huang indicated that competition in the AI chip niche is heating up, adding that “we have competition from every direction.”

Going forward, it will be interesting to see how Advanced Micro Devices’s new chip impacts the AI chip sector. When the date of that launch is finally known, it will undoubtedly become a key event on the 2023 calendar.

Stay tuned for Luckbox‘s upcoming May/June 2023 issue for more on Nvidia. Subscribe for free at getluckbox.com.

To follow everything moving the markets in 2023, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.