NFG Could Be Your Best Bet in the Energy Sector

Think oil's the only game in town? National Fuel Gas begs to differ.

- Oil prices have dropped from $80 per barrel to around $65 in recent weeks, but natural gas prices have soared.

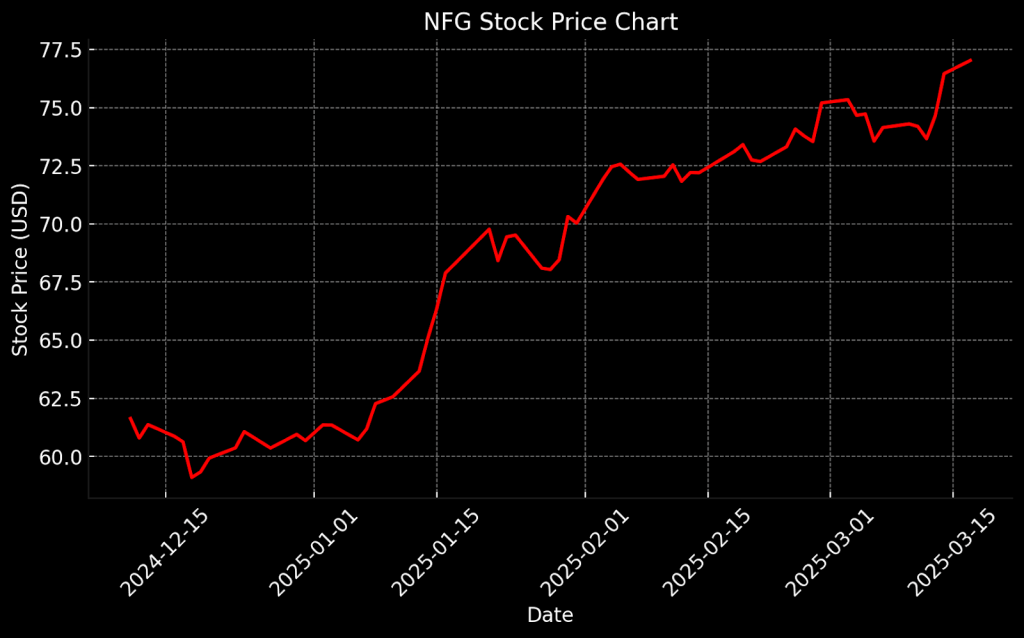

- National Fuel Gas has been a standout, rising 25% year-to-date and 50% over the past 52 weeks.

- Despite those strong returns, NFG’s valuation still looks reasonable, making it an attractive choice for investors.

National Fuel Gas (NFG) is proving fortune favors the resilient in the world of energy. While the oil market has spiraled downward, natural gas prices have surged and NFG is capitalizing on the shift. With a diversified business model spanning production, storage and utility services, the company is positioned to thrive—even amid volatility.

But with its stock already up more than 25% in 2025, the real question is whether NFG is still a buy or has reached its peak. Let’s explore why its recent performance is more than just a fluke and how its strategic moves—combined with the rally in natural gas—could signal continued growth.

Natural gas shines, while oil falters

The natural gas market has seen a dramatic rally in 2025, with prices nearly doubling after sinking last August to a low of below $2.00 per million British thermal units (MMBtu). Of late, natural gas has consistently traded above $4.00/MMBtu, with prices even nearing $5.00. This sharp rise contrasts with the crude oil prices which have fallen from $80 per barrel, down to $65-$70. The oil slump can be attributed to a combination of deteriorating economic expectations in Europe and the easing of geopolitical risk, such as the Israel-Hamas ceasefire.

Historically, crude oil and natural gas prices have often moved in tandem because of their roles as energy substitutes in some sectors. However, recent trends show a rare divergence between the two commodities. Oil prices have been driven down by macroeconomic factors, while natural gas prices have surged because of tightening inventories. The disconnect between oil and natural gas pricing has created some unusual market opportunities, with natural gas-focused companies seeing notable gains despite broader weakness in the energy sector.

In the midst of this disconnect, Natural Fuel Gas has been a standout performer. The company has risen more than 25% in 2025 alone, and its stock is up nearly 50% over the past year. While many oil stocks have struggled with the recent price slump, NFG has capitalized on the rally in natural gas prices, demonstrating resilience in a difficult market. The big question now is whether the rally can continue, or whether the stock has reached a lofty enough valuation that it’s no longer attractive.

Why NFG is thriving in 2025

National Fuel Gas, or NFG, is a diversified energy company with operations spanning exploration, production, pipeline and utility services. The company, based in Williamsville, New York, is heavily levered to the natural gas sector, with a strong presence in the Marcellus and Utica Shales.

NFG’s business is divided into four main segments: exploration and production (Seneca Resources), pipeline and storage (National Fuel Gas Supply), utility (National Fuel Gas Distribution) and energy marketing (National Fuel Resources). As one of the oldest utility companies in the U.S., founded in 1902, it has a long history of innovation and growth. It serves more than 750,000 customers in New York and Pennsylvania, making it a significant player in the Eastern United States.

In recent months, NFG has emerged as a standout in the energy sector amid continuing volatility in the oil market. While crude oil prices have slipped, natural gas prices have surged—helped in part by colder U.S. winter weather and tighter supplies. The company has capitalized on the rally in natural gas prices, and its growth reflects its diversified portfolio and its ability to adapt to shifting market dynamics.

NFG’s performance has been bolstered by the approval of a rate case in New York, which granted the first base delivery rate increase since 2017. Effective Jan. 1, 2025, the three-year settlement permits annual increases in revenue totaling $86 million. These funds are earmarked for enhancing pipeline infrastructure, addressing operational costs and advancing decarbonization initiatives to meet state climate objectives. Residential customers can anticipate average monthly bill increases of approximately $5.97 (5.6%) in January 2025, followed by $6.06 (7.2%) in October 2025 and $5.18 (5.8%) in October 2026.

In its latest earnings report for Q1 FY2025, NFG posted a 14% year-over-year increase in adjusted earnings per share, surpassing analyst expectations. The company’s adjusted earning per share (EPS) also reached $1.66, driven by strong performance in its rate-regulated segments, which saw approximately 30% growth in earnings per share.

Despite the overall positive results, NFG did miss revenue expectations, with total revenue of $550 million, which came in 7.5% below expectations. Nonetheless, NFG has raised its fiscal 2025 earnings guidance to a range of $6.50 to $7.00 per share, reflecting optimism in the natural gas market and improved operational performance. With production up 6% sequentially and an expected increase in capital expenditures, the company is positioned for continued growth.

Shares of NFG still look attractive

Stock in National Fuel Gas has shown remarkable resilience in 2025, outperforming many energy sector peers. But the company’s valuation remains attractive compared to industry averages. It is trading at a non-GAAP price-to-earnings (P/E) ratio of roughly 15, which is below the sector median of 20. That signals the stock is priced conservatively despite its robust growth potential. This lower multiple might indicate caution or potential undervaluation in the face of rising natural gas prices and an expanding business model.

Similarly, the company’s price-to-sales (P/S) ratio stands at 3.5, higher than the sector’s average of 2.5, reflecting the growth and stability it has achieved in its diversified operations. Its price-to-book (P/B) ratio of 2.5 is also above the industry median of 1.8, but this is typical for energy companies with significant asset bases in production and infrastructure. These metrics suggest NFG is not trading at a steep discount, but the stock is far from being overvalued, especially when factoring in its well-rounded performance in its various business segments.

Recent performance of the shares has drawn the attention of analysts. Six cover NFG, with two rating it a “buy” and three maintaining a “hold” rating. Their average price target is around $78 per share, almost exactly where the stock trades today. That suggests the market sees the stock as fairly priced. However, the recent approval of a rate case in New York, combined with continuing investments in production and infrastructure, arguably makes it appealing, especially considering the company’s projected earnings growth and favorable outlook for natural gas.

Despite NFG’s solid position in the energy sector, some risks remain, including commodity price volatility and the effect of future regulatory changes. However, with its vertically integrated business model and diverse revenue streams, the company looks well-positioned for continued growth.

Investment takeaways

National Fuel Gas is thriving while many of its energy sector peers are faltering. Oil prices are sliding downward, but the natural gas market has been rising, and NFG is reaping the benefits. With natural gas prices nearly doubling since August, the company’s stock has surged by more than 50% over the last 52 weeks. But it’s not just bullish sentiment that’s fueling this performance—its strategic moves, from securing a rate case approval in New York to ramping up its production and infrastructure investments, are setting the stage for continued success.

In addition, NFG’s stock remains somewhat undervalued relative to industry standards. Its P/E ratio of 15 is below the sector’s median, suggesting room for an upward revision of its valuation. Taking into account the reasonable P/B and P/S ratios, NFG presents a balanced opportunity—one that’s not overly priced, yet positioned for further upside. Strong fundamentals, coupled with the favorable natural gas market, point to a stock ripe for further gains. For investors who can stomach the inherent risk of commodity price fluctuations, NFG looks like a compelling choice.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.