NVDA Q2 Earnings: These Stocks Made the Biggest Moves the Last Time Nvidia Reported Earnings

After a blockbuster Q1 earnings report on May 24, Nvidia is scheduled to release its Q2 earnings report on Aug. 23

- Nvidia released blockbuster earnings in Q1 that triggered a huge one-day move in the underlying shares of NVDA and many of its competitors.

- Nvidia is scheduled to release its Q2 earnings report on Aug. 23.

- If Nvidia makes another big move in the wake of earnings, that same group of associated stocks could do so, as well.

One of the biggest events of the Q2 earnings season is slated for Aug. 23, which is when Nvidia (NVDA) is scheduled to release its latest earnings report.

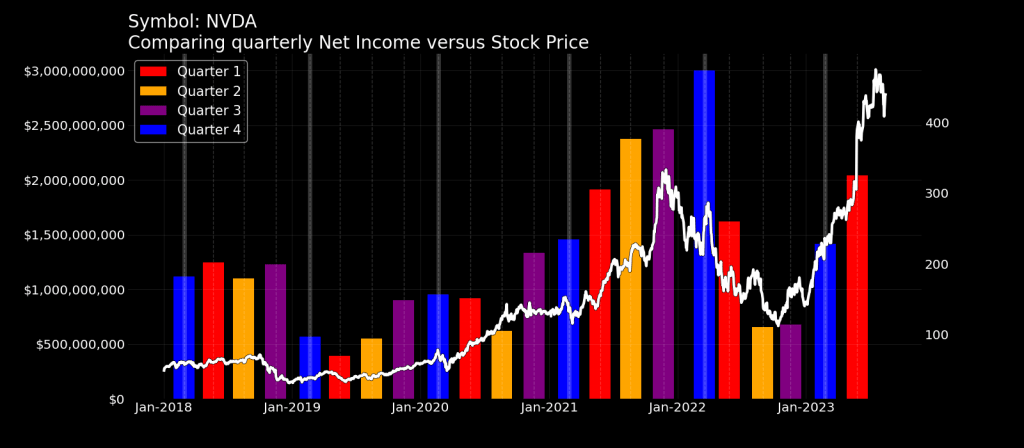

On May 24, Nvidia released a blockbuster Q1 earnings report that triggered a stunning 24% one-day rally in the company’s underlying shares. Year-to-date, Nvidia’s stock is up more than 200%, making it one of the top performers in the stock market—especially of the large-cap variety.

Back in Q1, one of the biggest surprises was Nvidia’s ongoing revenue guidance. On May 24, Nvidia raised its Q2 revenue projection to $11 billion, which was substantially higher than Wall Street’s existing expectation of $7 billion.

The company also indicated that it was experiencing a surge in demand related to artificial intelligence (AI). Nvidia’s AI chips are considered some of the most advanced in the industry, and are commonly used in the systems that train and operate generative AI applications like ChatGPT.

Excitement over AI had already been growing due to the lightning-fast adoption of ChatGPT, and Nvidia’s Q1 earnings report in many ways confirmed the potential of the AI revolution.

AI will not only change how humans live and work, but it also appears poised to provide some technology companies with a license to print money—or so it seems.

In that regard, the Nvidia earnings release triggered an AI-driven frenzy, and any company with even the slightest link to AI saw its shares move higher on May 25, the trading session immediately following Nvidia’s May 24 earnings release.

The list below highlights the stocks that made the biggest single-day moves in the wake of Nvidia’s Q1 earnings release:

- Nvidia (NVDA), +24%

- Monolithic Power Systems (MPWR), +17%

- Advanced Micro Devices (AMD), +11%

- Arista Networks (ANET), 11%

- Cadence Design Systems (CDNS), +10%

- Synopsys (SNPS), +10%

- Broadcom (AVGO), +7%

- Adobe (ADBE), +7%

- Applied Materials (AMAT), +7%

- Dish Network (DISH), +7%

- Digital Realty Trust (DLR), +7%

- Lam Research (LRCX), +6%

- KLA Corp (KLAC), +6%

- Oracle Corp (ORCL), +6%

- ServiceNow (NOW), +6%

- Micron Technology (MU), +5%

Many of the stocks listed above share a strong, positive correlation with Nvidia. For example, the stocks exhibiting the highest correlation with NVDA over the last three months include MPWR (0.78), CDNS (0.76), SNPS (0.75), AMD (0.69), AMAT (0.64) and NOW (0.61).

Past performance is certainly no guarantee of future returns, but the stocks listed will likely move in tandem with Nvidia on Aug. 24, especially if Nvidia makes a big move in one direction or the other.

Nvidia’s Q2 Earnings Expectations and Q3 Guidance

Back in Q1, it was Nvidia’s revised guidance that really took the market by surprise and triggered the huge rally on May 25.

This quarter, revenue is expected to clock in at $11 billion, which would be a 64% increase from Q2 of last year. Considering that Nvidia just released that guidance in late May, it’s likely the company will meet those expectations.

However, the big focus on Aug. 23 will be Nvidia’s ongoing revenue guidance, particularly for Q3. At this time, the market is currently forecasting Q3 revenues of about $12 billion.

If Nvidia guides Q3 revenues significantly higher—for example, $15 billion and above—that could trigger another substantial rally in the underlying stock, as well as the aforementioned stocks that moved big after Nvidia’s Q1 earnings release.

On Aug. 9, the Financial Times reported that several large-cap Chinese tech companies had recently submitted new orders with Nvidia in hopes of getting ahead of any potential restrictions instituted by the U.S. government.

According to the Financial Times, companies such as Alibaba (BABA), Baidu (BIDU), ByteDance (BDNCE) and Tencent (TCEHY) ordered around $1 billion worth of the A800s to be delivered this year, and another $4 billion worth of Nvidia products to be delivered next year.

Those new orders could provide a boost to Nvidia’s ongoing revenue and earnings projections, and may therefore be an important x-factor in the upcoming report.

However, one can’t overlook the fact that Nvidia has other divisions within its company, and in Q1, one of those divisions was a significant underperformer.

In Q1, Nvidia’s gaming division—which includes graphics cards for PCs—reported a 38% year-over-year decline in revenue. However, that shortfall was offset by sharp growth in the company’s data center division, as highlighted below.

The overhang of a recession, which clearly impacted Nvidia’s gaming revenue in Q1, represents another x-factor for Nvidia’s upcoming earnings release.

Previously, some other well-known semiconductor companies—such as Texas Instruments (TXN) and the Semiconductor Manufacturing International Corp (SMIC)—indicated they were expecting a slowdown in sales during H2 2023, as a result of subdued global economic conditions. However, those companies aren’t well-positioned in the AI niche, which appears to be a clear differentiator in the semiconductor industry so far this year.

On Aug. 14 and 15, several banks upgraded their price targets for Nvidia, projecting strong Q2 earnings and strong guidance for Q3. Baird, for example, raised its price target from $475 to $570, and maintained its current “outperform” rating on the stock.

Along those lines, Morgan Stanley (MS) reiterated Nvidia as its “top pick,” noting that the company is benefiting from “a backdrop of the massive shift in spending towards AI, and a fairly exceptional supply-demand imbalance that should persist for the next several quarters.”

Click here to read Part 2 of this series: Q2 NVDA Earnings Preview: Why Nvidia Dominates in Artificial Intelligence.

To learn more about trading an earnings event, check out this recent episode of Market Measures on the tastylive financial network. To follow everything moving the markets on a daily basis, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive(for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Also, check out the recent article, “Can Nvidia Beat Earnings Expectations for the Third Time?” via tastylive.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor for Luckbox magazine.