Trading China’s Coronavirus (Part 5)

Markets Reopen, Crude Oil Tanks

Key Coronavirus Updates:

- The estimated number of global coronavirus infections has risen to more than 24,500 with at least 493 associated fatalities

- The second death outside of mainland China linked to the novel coronavirus was reported in Hong Kong (the first occurred in the Philippines)

- The Hong Kong citizen who passed away had visited Wuhan in the last 30 days and had a pre-existing condition

- Trial treatments of Gilead (GILD) coronavirus drug, Remdesivir, could start in China next week

- The Shanghai and Shenzhen Composite indexes both opened down more than 9% after the Lunar New Year holiday

- The Chinese central bank injected nearly $200 billion of liquidity into the financial system on Monday to mitigate economic instability

- The Foreign Secretary of the United Kingdom has advised all British citizens to leave China

- Hyundai Motor Company has suspended production at its plants in South Korea due to supply chain disruptions associated with the coronavirus outbreak in mainland China

- Nike has closed half its stores in China and now expects a “material impact” on operations there

- Disney expects to take a $175 million hit if its theme parks in Shanghai and Hong Kong remain closed for two months

- Former Federal Reserve Chairwoman Janet Yellen said the coronavirus poses a serious risk to the global economy

Amid the tragic coronavirus outbreak, trading opportunities continue to multiply.

And while limiting the impact on the health and security of human civilization remains the top priority, investors and traders need to continue to monitor and risk manage their portfolios, no matter the prevailing headlines.

Aside from a parabolic move in Tesla (TSLA), two other big narratives playing out in recent days have been the reopening of equity markets in China, as well as the continued decimation of crude oil.

Chinese markets were center stage Feb. 3 after equity markets in the country reopened following the Lunar New Year holiday. Given that the coronavirus outbreak gained considerable momentum during the holiday, it wasn’t too much of a surprise to see the major Chinese indexes suffer severe losses on Monday.

The Shanghai Composite and Shenzhen Composite, the two primary stock market indexes in the mainland, were down 7.7% and 8.4%, respectively. It was the biggest single-day down move in the Shanghai Composite since 2015.

The Chinese central bank moved quickly Monday evening to inject liquidity into the financial system, which helped ease worries overnight—both indexes recovered just under 2% on Tuesday.

Alongside the chaos in Chinese equities, heightened volatility in crude oil has also continued. Crude oil prices are down roughly 20% since the start of 2020.

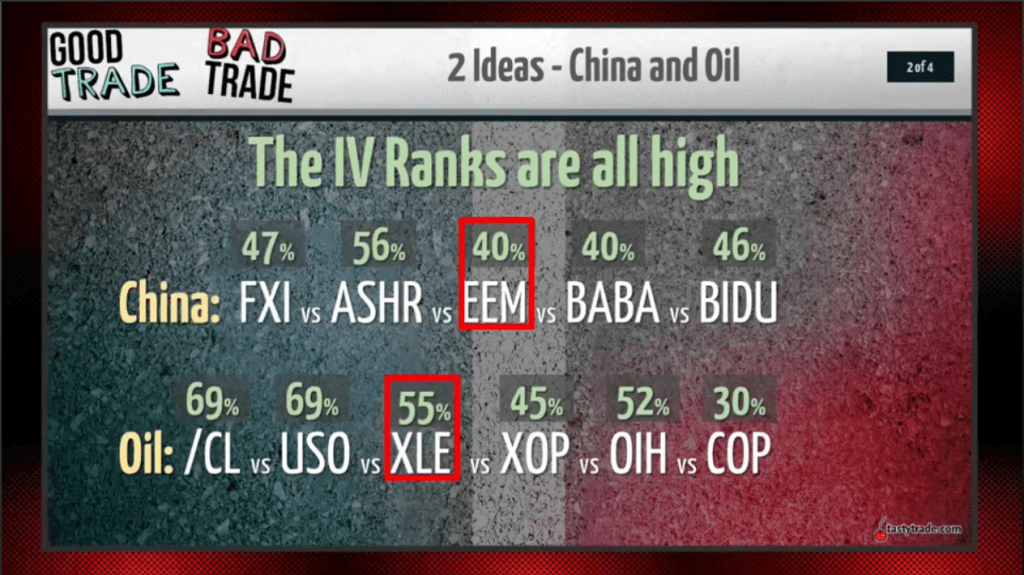

Given that intense market action, it shouldn’t come as much of a surprise that implied volatility in China and crude-focused ETFs has spiked. For contrarian traders, that means both directional and volatility-based trading ideas abound.

The slide below, excerpted from a new episode of Good Trade Bad Trade on the tastytrade financial network, highlights how Implied Volatility Rank (IVR) has increased dramatically across some of the highest volume China and oil-focused ETFs:

As a reminder, the purpose of Implied Volatility Rank is to report how current levels of implied volatility stack up against the previous 52 weeks of data in a given underlying.

For example, if hypothetical stock XYZ has had an implied volatility range of between 30 and 60 over the past year, and implied volatility is currently trading at 45, XYZ would have a current IV Rank of 50%.

If implied volatility were currently trading 60 in XYZ, then IV Rank would be 100%, indicating that implied volatility in XYZ was trading at a level equal to the richest observed in the last 52 weeks. And if implied volatility dropped all the way to 30, then IVR would be 0%.

Circling back to Good Trade Bad Trade, Dr. Michael Rechenthin (aka “Dr. Data”) walks viewers through his thinking on potential trading ideas in both groups of ETFs on this installment of the show. Traders may want to review the complete episode to learn more about current opportunities in ETFs with significant exposure to China and crude oil. Additional information about using IV Rank when trading options can also be reviewed on a previous installment of Best Practices.

Click here to catch up on the entire “Trading the Coronavirus” series.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.