Trading the Fed’s Plan to Raise Interest Rates

The U.S. Federal Reserve is set to raise benchmark interest rates in 2022, effectively signaling the end of the accommodative monetary policy that was deployed to assist the economy in early 2020.

For traders and investors, interest rates represent a lot more than the percentage one pays on a home loan. In terms of the global financial markets, interest rates serve as an important barometer of the economy.

For example, falling interest rates are typically a sign of a weak (or weakening) economy, because central bankers often lower benchmark interest rates to help stimulate the economy during periods of recession or depression.

Alternatively, a rising rates environment—as expected in the U.S. during 2022—is typically a sign of economic strength, or at minimum that economic fundamentals are strengthening.

As most market participants are aware, the U.S. Federal Reserve dropped benchmark interest rates (i.e. the federal funds rate) to zero in response to the economic headwinds presented by the COVID-19 pandemic.

And while the pandemic is still raging amidst a surge in cases linked to the new Omicron variant, the underlying economy has undoubtedly strengthened since those dark days in early 2020. Today, the unemployment rate has dropped back down toward its historical average, and gross domestic product (GDP) in the U.S. has also rebounded back toward “normal” levels.

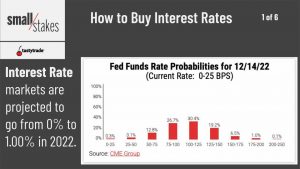

Due to strengthening economic fundamentals, the U.S. central bank has signaled its intent to raise benchmark interest rates at some point in 2022. In fact, many expect that the Fed could raise rates a quarter-point (0.25%) as soon as March—with one or two more similar increases set to occur later this year.

Whenever the first increase does occur, that will represent the first time the Fed has tightened monetary policy since the pandemic began.

And like anything in the markets, investors and traders are currently placing their bets on when that first rate hike will occur. Like most things in the financial markets, interest rates can be traded and invested in—across a wide spectrum of products.

For example, bonds (government, corporate or municipal) are popular interest rate investment vehicles. On the other hand, the yields on government bonds are popular for trading and hedging.

Yield is another way of expressing the concept of an interest rate, although it refers to the return side of a debt investment.

For example, a person borrowing money thinks about their obligation in terms of the associated interest rate, but the person or entity buying that debt and receiving the interest payments usually thinks about that income in terms of yield (i.e. return on investment).

One of the most closely followed yields on earth is the U.S. 10-year Treasury bond. The yield on the 10-year Treasury represents the percent of interest paid on a U.S. government bond with 10 years to maturity.

As referenced earlier, yields (aka interest rates) fluctuate based on relative strength in the economy. So when the economy is in recession/depression, they generally move lower. And during periods of economic strength (or an economic rebound) yields generally move higher.

In March of 2020, the U.S. 10-Year Treasury yield dropped to its lowest level in history—down to 0.54%—on fears relating to COVID-19 pandemic and its potential impact on the global economy. As those fears have abated (somewhat), the 10-year yield has rebounded.

And it might be more accurate to refer to the recent move in the 10-year Treasury yield as a “spike.”

In anticipation of the U.S. central bank’s move to raise benchmark interest rates in 2022, the yield on the 10-year Treasury jumped from about 1.33% in early December 2021, all the way to 1.80% as of mid-January 2022. As illustrated below, that’s the highest level in the 10-year Treasury yield since January of 2020.

Of course, the big question going forward is where yields go from here.

If the U.S. Federal Reserve follows through with its plan to raise rates, as most expect, it’s entirely possible the 10-year Treasury yield could climb even higher during H1 2022.

However, that’s not the only scenario that could play out from here. Alternatively, it’s possible that the Omicron variant (or another as yet undiscovered variant) could wreak further havoc on the global economy.

If the global economy does experience a serious setback—for whatever reason—it’s entirely possible that leaders at the Fed might elect to delay any further hikes in rates. That type of decision would almost certainly push yields back down.

And there’s a third scenario that also must be considered. If the global economy remains strong, and the U.S. Federal Reserve continues to raise rates, one could see another headwind developing.

Back in summer of 2018, the U.S. 10-year Treasury yield started tracking higher, and climbed from 2.5% all the way above 3%. At that time, the stock market pulled back because rising rates at that time were viewed as a serious headwind for the economy.

Fast-forwarding to 2022, one could see the same story unfolding this year if the 10-year yield spikes above 2.5%, or even worse, makes a move toward 3.0%. Under this scenario, it’s almost assured that the U.S. economy would start to labor, due to the mounting stress of higher financing costs.

The thing is, interest rates usually have a sweet spot—if they increase too quickly, rates can represent a significant barrier to economic growth.

The above suggests that yields (aka interest rates) will be a big x-factor during the 2022 trading year, and that investors and traders would be wise to monitor this niche of the financial markets during the coming months.

Readers seeking to learn more about trading interest rates (via yields) are encouraged to review this new installment of Small Stakes on the tastytrade financial network.

To follow everything moving the financial markets on a daily basis, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.