Trading the Midwest Drought

If the Great Plains and Midwest drought persists, it could push up prices of agricultural commodities and grocery prices in the United States.

The western half of the United States has been battling a severe drought since the turn of the century. The ongoing drought has created some of the most extreme conditions observed in the last 1,200 years, according to research published by the journal Nature Climate Change.

Unfortunately, drought-like conditions have also spread further east, with the Great Plains and Midwest suffering from unusually dry conditions since summer of last year.

Droughts can be catastrophic for the agricultural industry, but it isn’t limited to rural America. Droughts throttle agricultural production and contribute to shortages, which in turn pushes up the prices of agricultural commodities.

Ultimately that leads to higher food prices, which is the last thing most Americans want to deal with in 2023. Especially considering the country’s ongoing battle with record inflation.

Drought-like conditions from 2022 persist in 2023

Last fall, the National Integrated Drought Information System (NIDIS) estimated that 60% of the North Central United States was in moderate to exceptional drought, while 30% of the region was in severe drought.

Then, in January of this year, NIDIS estimated that 49% of the Midwest was abnormally dry. Today, drought.gov estimates that 27% of the Midwest remains abnormally dry, while 9% of the region is already officially in drought.

According to the United States Department of Agriculture (USDA), the conditions have created dry topsoil, poor pasture conditions and limited moisture for newly planted crops. Moreover, the current weather forecast calls for above-average temperatures and below-average precipitation.

As a result, it’s expected that an increased percentage of the Great Plains and Midwest will face drought conditions because even more moisture will be extracted from the earth’s surface during this period, assuming the continued absence of rainfall.

Potential impact on the agricultural sector

The biggest threat from drought relates to crop yield, which is a measurement of the amount of crop grown per unit of land area.

High crop yields (i.e. bountiful harvests) are characteristic of optimal growing conditions.

However, when precipitation is insufficient, or temperatures are above average, crop yields typically plummet. Lower-than-average crop yields can also develop as a result of insufficient sunlight and fertilization, and damage from pests.

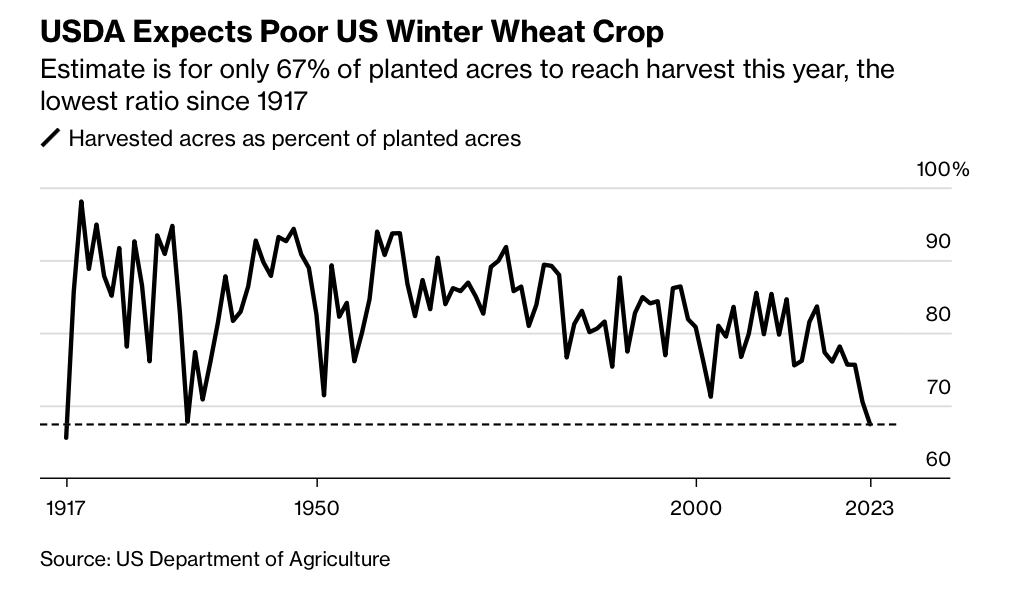

Illustrating the extent of the current drought, the USDA recently projected that in 2023 wheat farmers are expected to harvest just 67% of their planted acres, which would be the weakest yield observed since 1917.

Source: farmpolicynews.illinois.edu

Moreover, current estimates suggest that some 26% of corn-growing areas in the U.S. are experiencing moderate (or worse) drought. That’s the second-driest conditions for corn-growing areas in the U.S. over the last decade. In 2013, drought-like conditions affected 29% of corn-growing acreage in the U.S.

However, the situation in the hay market is even more critical. Hay is a nickname for alfalfa, which is typically harvested, dried and then fed to horses, beef cattle, dairy cattle and other livestock during the winter and the driest parts of the summer.

The current drought has been especially hard on the hay market, and as a result, supplies are currently running at historically low levels in the Great Plains and Midwest. According to the USDA, hay inventories in the U.S. were at their lowest levels in roughly 70 years at the end of 2022.

That reality has also impacted prices in the hay market. Last fall, hay prices surged to record levels, and have only pulled back marginally as of May 2023. The all-time monthly high for hay was set in October 2022, at $250/ton. Today, a ton of hay is trading for about $235/ton.

Last summer, the drought contributed to deteriorated pastureland, which meant there wasn’t enough grass for livestock to eat. As a result of record-high hay prices, it wasn’t economically feasible for many farmers and ranchers to substitute grass with hay.

As a result, many farmers and ranchers were forced to cull their herds. If the drought persists, or intensifies, that will undoubtedly be the case again in 2023.

According to a 2022 report by Reuters, about 75% of the cattle sent to auction last fall were sent directly to the slaughterhouse as a result of insufficient feed. Normally, that figure would be closer to 50%.

Unlike other crops, hay is usually planted very early in the spring season, which is why there’s already some visibility into the dynamics of the hay market in 2023. Along those lines, wheat is usually planted in the fall and then harvested in mid-summer, which is why the USDA is already able to gauge the relative health of the 2023 harvest.

On the other hand, corn and soybeans—two of the other large-volume crops grown in the U.S.—aren’t planted until late spring or early summer. That means 2023 forecasts for corn and soybean yields aren’t yet clear, and will depend heavily on growing conditions observed in the coming weeks.

But if the drought persists, it’s almost certain that projections for the fall harvest of corn and soybeans will suffer, which will undoubtedly lead to higher prices at the grocery store.

Currently, corn is trading about $6/bushel, and has ranged between roughly $5.60/bushel and $6.80/bushel during the last six months. Soybeans, on the other hand, are currently trading for $13.30/bushel, and have ranged between about $13/bushel and $15.40/bushel during the last six months.

Going forward, the intensity of the 2023 drought will influence prices in the agricultural sector, as well as the grocery store. For this reason, investors and traders may want to monitor this niche of the financial markets closely in the coming weeks.

To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.