Trading the Next Phase of the US-China Trade War

In early May 2022, the Office of the U.S. Trade Representative announced it would be conducting a review focused on the effectiveness of tariffs levied on imported goods from China—a process that could ultimately end in the removal (or reduction) of existing import taxes.

There was a time when the U.S.-China trade war was one of the biggest stories in the financial markets.

Then, the COVID-19 pandemic arrived. After that, the outbreak of a full-scale war in Eastern Europe. As a result, the trade war has effectively been pushed to the back of the market’s collective consciousness.

In the coming weeks, the trade war could fade even further from relevance as the U.S. government indicated recently that import tariffs levied against China could be rolled back all together at some point soon.

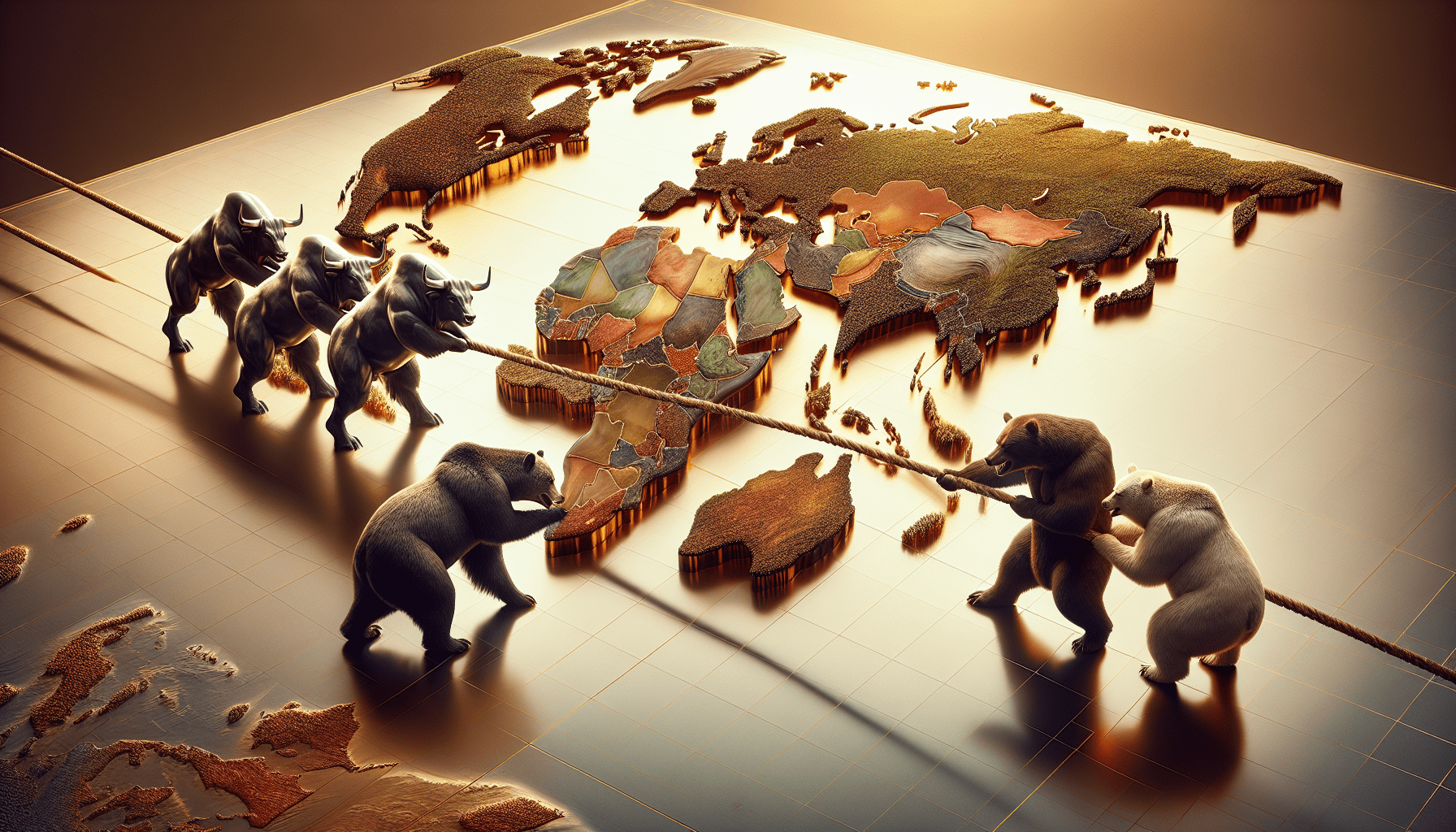

As shown below, tariffs in both countries skyrocketed during the trade war and have remained at elevated levels, despite the fact that the two countries agreed to the Phase I trade deal in early 2020.

Source: piie.com

On May 3 2022, the Office of the U.S. Trade Representative announced it began a statutory process that could end with the removal of tariffs on imported goods from China, or at least lower them to pre-trade war levels. And it’s expected that China would likely follow-up by doing the same.

Such a move would essentially bring the now infamous trade war to a close, because tariffs are one of the primary tools the U.S. government has been using to try and win trade concessions from China.

It should be noted that this month’s bureaucratic review of the tariffs’ impact and effectiveness was actually put on the calendar four years ago, when the tariffs were first put in place. The forthcoming process will provide American businesses with the opportunity to express their satisfaction, or dissatisfaction, with the current import tax regime.

But no matter the feedback from the business community, there are other indications that suggest the tariffs won’t be in place for much longer.

Tariffs—at their core—make imported goods more expensive. And during a period of rampant inflation, it’s easy to see why the U.S. government might view the removal of those tariffs as a quick and easy way to effectively cut prices, and ease the burden on American consumers.

Whether intended or not, the institution of the tariffs back in 2018 served to disrupt the global supply chain, because the broader trade war injected uncertainty into the global economy. In hindsight, that timing was extremely unfortunate because it put the U.S. supply chain on fragile footing leading up to the pandemic.

The COVID-19 crisis has only served to exacerbate the problem—making it even harder for goods to efficiently flow through the global economy.

The other hard truth is that the tariffs haven’t been effective.

The U.S. has won few concessions from China since the onset of the trade war. Worse, Chinese purchases of American-made goods are actually lower now than they were before the start of the trade war.

During 2020 and 2021, China bought only 57% of the total goods and services outlined in the Phase I trade agreement that was put in place in early 2020. Moreover, the sum of China’s annual purchases from the United States has actually declined in the last couple of years—meaning Chinese purchases of American goods and services actually took a step back since the tariffs were first introduced.

Considering that China failed to hold up its end of the Phase I bargain, it’s virtually impossible to think that the U.S. will stick to the current roadmap. And by repealing the tariffs, the U.S. would rearm itself with one of its most important bargaining chips.

Using a carrot-and-stick approach, American trade negotiators could offer an olive branch to the Chinese by removing the tariffs, and then use the implied threat of fresh tariffs to try and leverage China into adopting some of the other American trade-related demands.

Beyond increasing purchases of American-made goods and services, the U.S. has also been pressing China to remove barriers for U.S. farm exports to China, adhere to global intellectual property laws, and open up the Chinese financial services sector to American firms—among other things.

By softening its approach, and working more collaboratively with China—instead of contentiously—the American government may also find a more sympathetic ear in the Middle Kingdom.

Moreover, the removal of the tariffs could help offset some of the pain that’s been inflicted on the U.S. economy through rising gas prices. Cutting the tariffs will effectively make Chinese-made goods less expensive in the United States. A development that would likely provide some degree of relief to consumers.

Removing the tariffs wouldn’t necessarily represent a “silver bullet” when it comes to reigning in inflation, but coupled with rising interest rates, it could serve to help slowdown what’s effectively been a runaway train.

Joseph Glauber, a senior research fellow at the International Food Policy Research Institute and former chief economist at the USDA told CNN that he thinks it’s a “no-brainer” for the U.S. to lift the tariffs. Mr. Glauber added that, “It would help normalize trade” if the tariffs were removed.

None of the above guarantees that the current administration will actually remove the tariffs, but the forthcoming review by the Office of the U.S. Trade Representative should provide important insight into their net impact on the economy.

For more on what’s moving the financial markets, readers are encouraged to tune into TASTYTRADE LIVE.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.